Tax efficiency loss is a critical issue that affects economies worldwide. The efficiency loss of a tax is the idea that taxation can create distortions in economic behavior, leading to reduced productivity and growth.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how tax inefficiencies can impact businesses and individuals. This blog post explores the economic consequences of tax efficiency loss and offers strategies to improve tax efficiency for a stronger, more prosperous economy.

Tax efficiency loss represents a major economic challenge that impacts businesses and individuals alike. This phenomenon occurs when tax policies create distortions in economic behavior, which results in reduced productivity and overall economic growth. A 2014 report from the Government Accountability Office (GAO) estimated that over $3 billion was spent on administrative leave costs over a certain period.

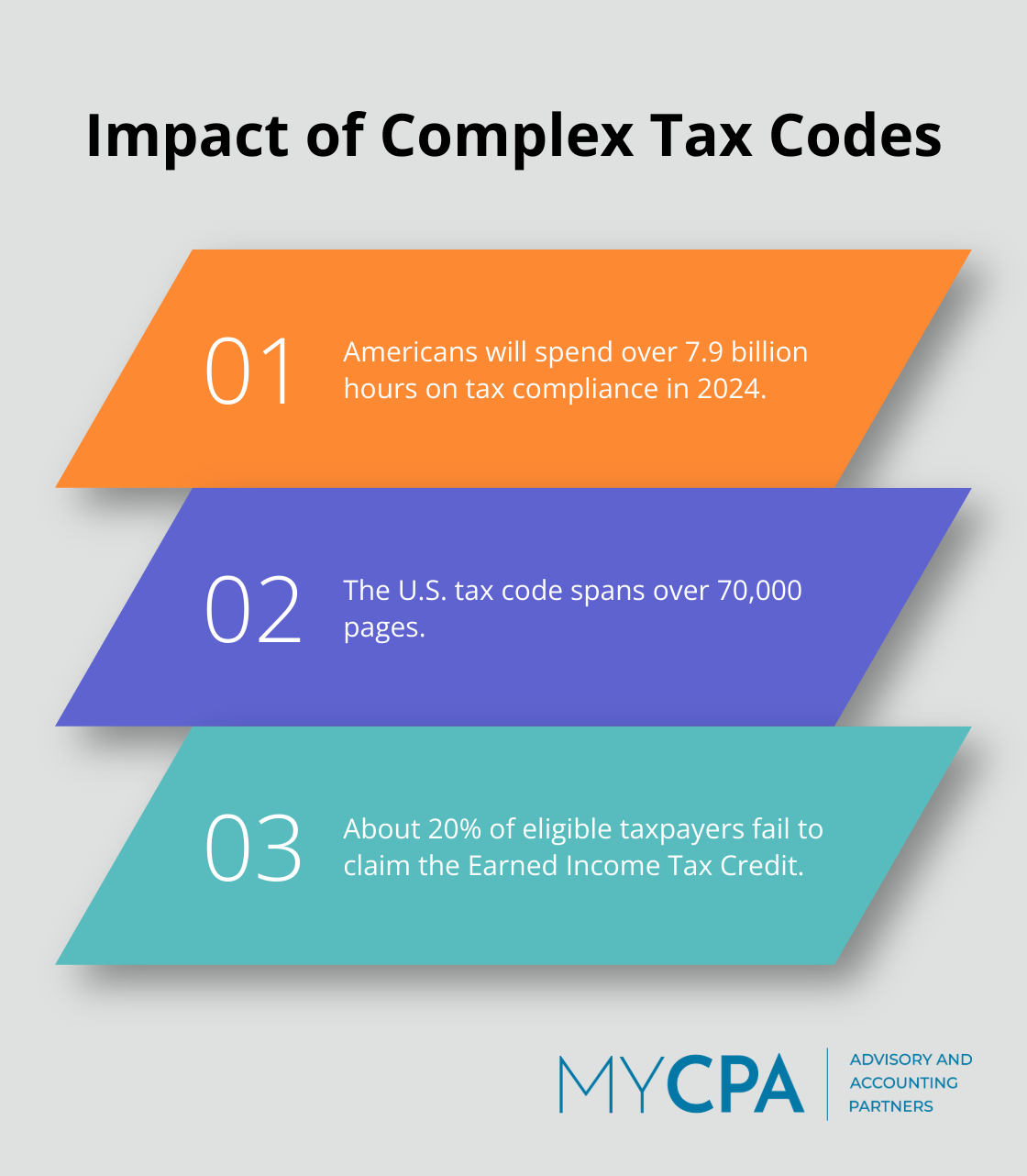

The U.S. tax code spans over 70,000 pages, which makes compliance a daunting and time-consuming task. This complexity increases administrative costs for both taxpayers and the government. According to the Internal Revenue Service (IRS), Americans will spend over 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024.

Tax laws often contain loopholes and special provisions that create unintended incentives. These can prompt taxpayers to structure their finances in ways that may not be economically optimal. For example, economists have criticized the mortgage interest deduction (while popular) for potentially distorting the housing market and encouraging excessive debt.

Tax efficiency loss affects businesses in several ways. It can lead to decreased investment and innovation. A study by the National Bureau of Economic Research found that high corporate tax rates can reduce business investment by up to 10%. This reduction in investment slows economic growth and job creation.

Individuals also feel the impact of tax inefficiency. Complex tax rules can result in filing errors, which potentially lead to penalties or missed deductions. The IRS estimates that about 20% of eligible taxpayers fail to claim the Earned Income Tax Credit due to its complexity, which leaves billions of dollars unclaimed each year.

Tax professionals play a critical role in helping businesses and individuals navigate these complexities. Companies like MyCPA Advisory and Accounting Partners offer expertise in tax planning and compliance, which can help mitigate the effects of tax inefficiency.

The next chapter will explore the broader economic consequences of tax efficiency loss, including its impact on government revenue, public services, and wealth distribution.

Tax inefficiency creates significant barriers to investment and innovation. Making the Tax Cuts and Jobs Act permanent would boost long-run economic output by 1.1 percent, but would increase the budget deficit. This translates to billions of dollars in potential economic output and thousands of potential jobs.

Small businesses (often considered the engines of economic growth) face particularly severe impacts. A National Small Business Association survey found that 40% of small business owners dedicate over 80 hours per year to federal tax compliance. This represents time and resources that could otherwise fuel business growth and job creation.

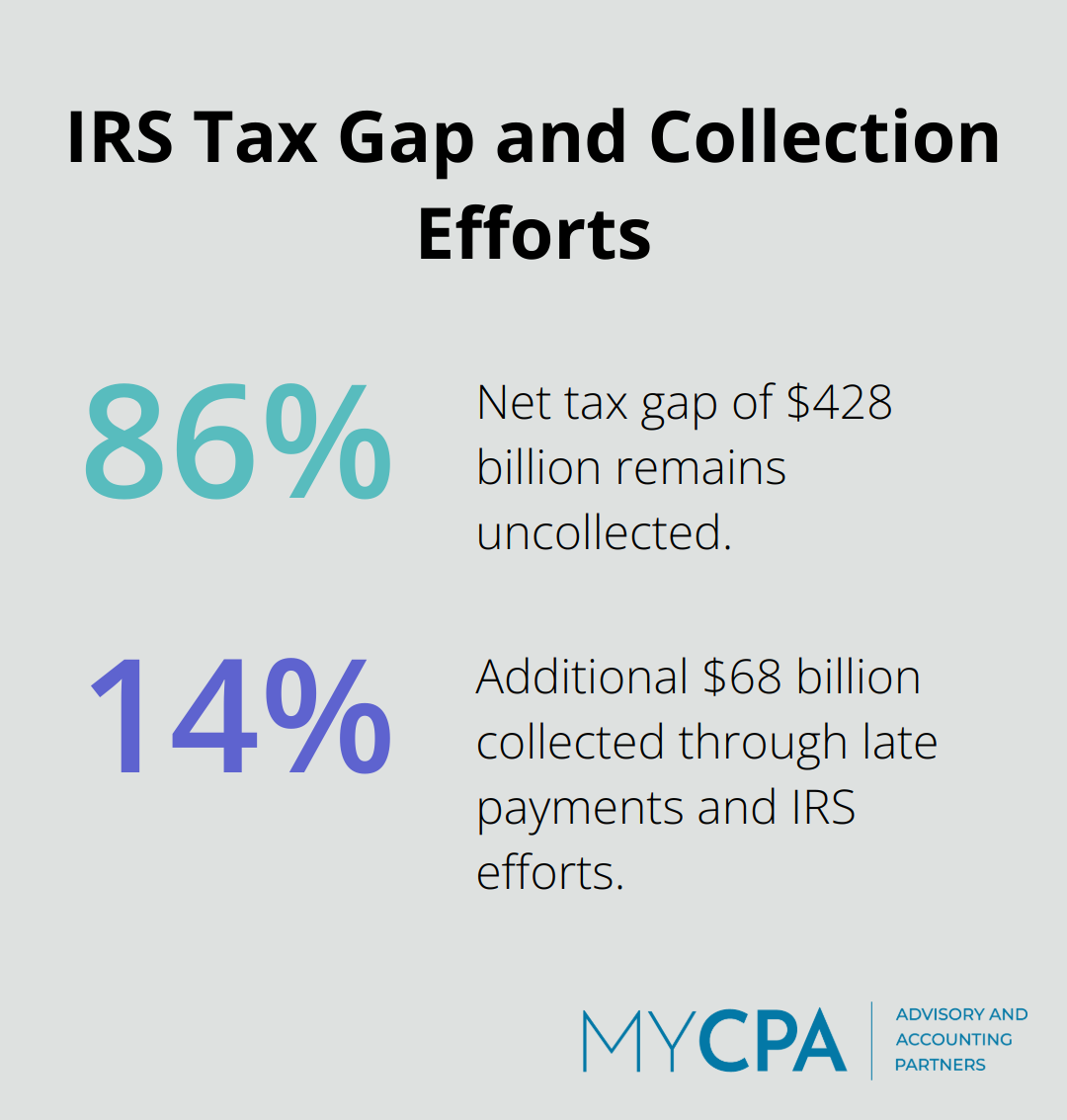

Inefficient tax systems not only slow economic growth but also impair the government’s ability to fund essential public services. The IRS estimated the net tax gap was $428 billion after late payments and IRS efforts collected an additional $68 billion. This massive shortfall reduces funding for education, infrastructure, and social programs.

The tax code’s complexity also increases government administrative costs. The National Taxpayer Advocate reports that the IRS spends $2.8 billion annually on pre-filing taxpayer assistance alone. This money could support other critical government functions if the tax system operated more efficiently.

One of the most concerning consequences of tax inefficiency is its impact on income inequality. A National Bureau of Economic Research study found that tax expenditures (special deductions, exclusions, and credits in the tax code) disproportionately benefit high-income households. The top 20% of earners receive more than half of the benefits from major tax expenditures, while the bottom 20% receive less than 5%.

This uneven distribution of tax benefits exacerbates existing wealth gaps. The Federal Reserve reports that the wealthiest 10% of American families now hold 76% of the country’s wealth, up from 67% in 1989. An inefficient tax system that favors those who can afford sophisticated tax planning services only widens this divide.

The complexity of the tax code places a significant administrative burden on businesses of all sizes. Companies must allocate substantial resources to tax compliance, often at the expense of core business activities. This burden includes costs for tax preparation software, professional services, and employee time dedicated to tax-related tasks.

For multinational corporations, the challenge multiplies as they navigate different tax regimes across various jurisdictions. This complexity can lead to suboptimal business decisions driven by tax considerations rather than pure economic factors.

The next chapter will explore strategies to improve tax efficiency and mitigate these economic impacts.

The U.S. tax code’s complexity leads to high compliance costs and increased error chances. Simplifying tax codes and regulations can significantly improve tax efficiency. A study by the Mercatus Center at George Mason University found that tax code simplification could save the U.S. economy up to $1 trillion annually in compliance costs and lost productivity.

Policymakers should focus on:

For instance, a unified child credit could replace several existing family-related tax provisions. This simplification would reduce compliance costs for millions of families while maintaining support for households with children.

Technology advancements offer promising solutions for improving tax efficiency. The IRS has gradually modernized its systems, but significant room for improvement remains. Taxpayers increasingly use online services to perform a variety of tasks in their daily lives, including financial transactions.

Businesses and individuals can use tax preparation software and digital record-keeping tools to streamline their tax processes. These technologies reduce time spent on tax compliance and minimize errors. Cloud-based accounting software (which automatically categorizes expenses and generates tax reports) saves hours of manual work.

The IRS could improve efficiency by expanding its digital services. A comprehensive online portal for taxpayers to access information, submit documents, and communicate with IRS representatives would reduce processing times and improve accuracy.

Proactive tax planning remains one of the most effective ways for businesses and individuals to improve their tax efficiency. The Government Accountability Office reports that taxpayers who use paid preparers are more likely to receive larger refunds and pay lower taxes overall.

Year-round tax planning (rather than focusing on taxes only during filing season) can lead to significant savings. This approach allows for strategic decision-making that considers the tax implications of various financial moves.

For businesses, this might involve:

Individuals can benefit from strategies like:

While self-education about tax matters is valuable, seeking professional guidance often yields superior results. Tax professionals possess in-depth knowledge of tax laws and strategies that can significantly enhance tax efficiency.

These experts can:

The investment in professional tax services often pays for itself through reduced tax liabilities and improved financial planning. High income tax planning strategies can be particularly effective in managing wealth and securing your financial future. Additionally, comprehensive accounting services can boost profitability through more accurate financial reporting and expert financial advice tailored to your specific industry.

The efficiency loss of a tax is the idea that taxation can create distortions in economic behavior, leading to reduced productivity and overall economic output. These inefficiencies impact businesses, individuals, and the broader economy through reduced investment, strained public services, and widening wealth gaps. Addressing tax inefficiencies will foster a more robust and equitable economy through streamlined tax codes, technology-driven compliance, proactive tax planning, and professional guidance.

Tax efficiency loss poses a significant challenge to economic growth and prosperity. Individuals and businesses can mitigate negative impacts by implementing strategies that optimize their tax positions. These strategies not only benefit taxpayers but also contribute to a more efficient and productive economic system overall.

At My CPA Advisory and Accounting Partners, we understand the complexities of tax efficiency and its far-reaching implications. Our team of experts specializes in tailored financial services designed to optimize tax efficiency and enhance financial management for both businesses and individuals. We offer comprehensive tax services, accurate accounting, QuickBooks expertise, and personalized business advisory to ensure our clients navigate the tax landscape with confidence.

Privacy Policy | Terms & Conditions | Powered by Cajabra