Most business owners leave money on the table every year simply because they don’t understand tax planning meaning or how it works. The difference between a reactive approach and a strategic one can amount to thousands of dollars in unnecessary taxes.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how proper tax planning transforms a business’s bottom line. This guide walks you through what tax planning actually is, why it matters, and the strategies that deliver real results.

Tax planning means organizing your finances throughout the year to minimize what you owe in taxes. It’s not something you do once a year when filing your return. Instead, it runs parallel to how you operate your business all twelve months. The core objective is straightforward: reduce your overall tax liability while still meeting all legal obligations. This means identifying deductions and credits you’re entitled to, timing income strategically, and structuring your business in ways that favor lower tax rates. Without a plan, you pay whatever the tax code calculates without taking advantage of legitimate strategies available to you.

Tax preparation happens after the fact-you gather documents in April and hand them to someone who files your return based on what already occurred. Tax planning happens before the fact, sometimes months in advance. A tax preparer looks backward; a tax planner looks forward and sideways, anticipating changes and adjusting your approach accordingly. When you run a business, waiting until tax season means you’ve already lost hundreds or thousands of dollars in planning opportunities. The gap between these two approaches directly impacts your bottom line.

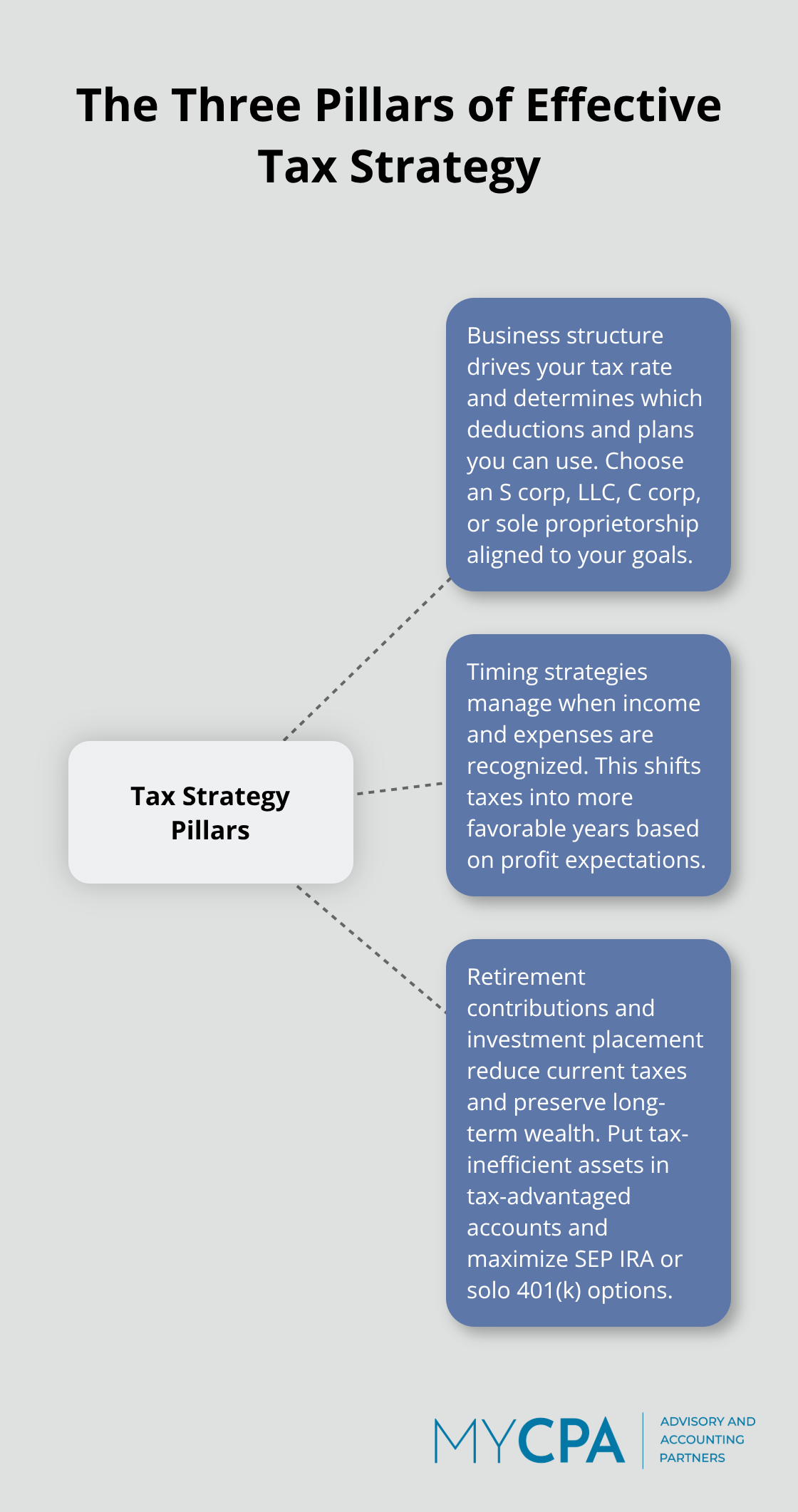

An effective tax strategy rests on three foundational components working together. First, you need the right business structure. Whether you operate as an S corporation, LLC, C corporation, or sole proprietorship dramatically affects your tax rate. The IRS allows bonus depreciation for equipment placed in service after September 27, 2024, which means if you’re still structured as a sole proprietor when you purchase equipment, you may miss this deduction entirely.

Second, you must manage timing strategically. For cash-basis businesses especially, deferring revenue in strong profit years and accelerating deductible expenses when profits are expected to be lower can shift your tax burden to years when it’s more favorable. Third, retirement contributions and investment placement matter far more than most owners realize. Contributing to a SEP IRA or solo 401(k) reduces your taxable income dollar-for-dollar, while placing tax-inefficient investments like bonds in retirement accounts and tax-efficient investments in taxable accounts preserves more wealth long-term.

These three components aren’t isolated; they work together to create real tax savings. Your business structure determines which retirement plans you can access, timing strategies depend on your structure and profit expectations, and investment placement decisions depend on what accounts are available to you. Understanding how each piece connects reveals why a fragmented approach fails. When you address all three areas simultaneously, you unlock opportunities that a piecemeal strategy misses entirely. This interconnected approach is what separates owners who pay their fair share from those who pay far more than necessary.

The strategies that actually work require knowing your specific situation and staying ahead of tax law changes. This is where professional guidance becomes invaluable for business owners juggling multiple priorities.

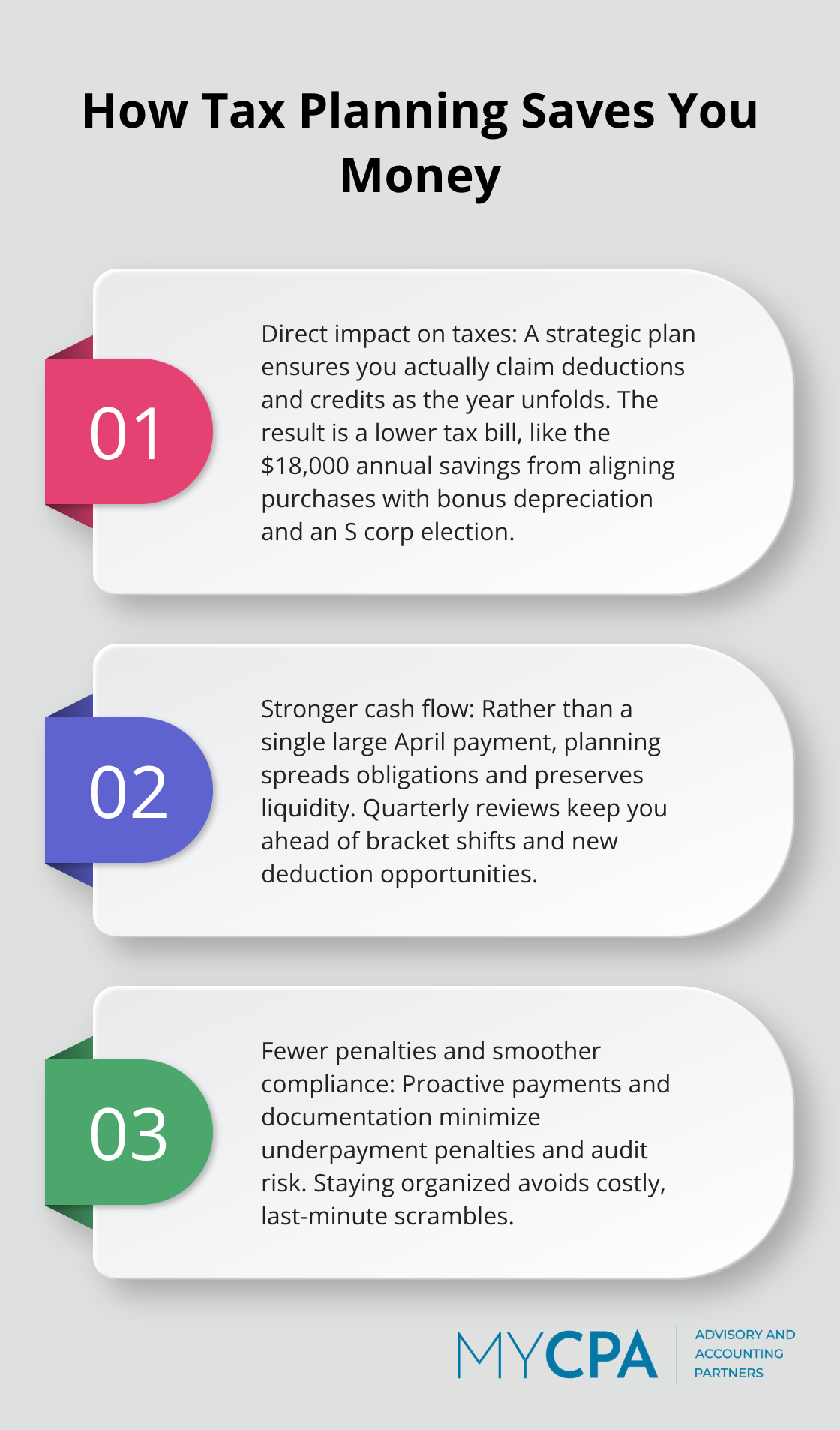

Most business owners pay thousands more in taxes than they legally owe because they never formulated a deliberate plan. The IRS doesn’t volunteer refunds or point out deductions you missed. If you don’t claim them, that money vanishes. A strategic tax plan changes this equation entirely. When you organize your finances to take advantage of legitimate deductions and credits throughout the year, you keep more cash in your business where it can fund growth, equipment purchases, or payroll increases. One construction company owner reduced their annual tax bill by $18,000 simply by timing equipment purchases to align with bonus depreciation rules and switching to an S corporation structure. That $18,000 flows directly to the bottom line every single year.

Cash flow matters far more than most owners realize, especially during slower business months or when you need working capital for seasonal operations. Tax planning directly addresses this reality. Rather than writing a large check to the IRS in April, a deliberate plan spreads your tax obligation across the year through strategic timing and structure decisions. This approach preserves liquidity when your business needs it most. Business owners who implement quarterly tax reviews catch shifting tax brackets before they happen, identify new deduction opportunities as the year unfolds, and stay compliant with state and federal requirements without scrambling.

Penalties and missed deadlines create a secondary drain that tax planning prevents entirely. The IRS assesses penalties for underpayment penalties, missed quarterly filing deadlines for certain entities, and failure to maintain required documentation. These penalties can add significantly to your tax bill if you haven’t paid enough throughout the year. Worse, poor record-keeping creates audit risk. When the IRS questions deductions or income, a disorganized file becomes expensive to reconstruct and defend.

A deliberate tax plan includes a documentation system that keeps receipts, invoices, and transaction records organized from day one, making compliance effortless and audit defense straightforward. This organization also enables you to make informed financial decisions year-round rather than stumbling through tax season with incomplete information. When you track income, expenses, and tax implications monthly, you spot problems early and adjust strategy mid-year if profit forecasts change. This forward-looking approach transforms tax management from a painful annual event into a manageable part of running your business efficiently, setting the stage for the specific strategies that actually deliver results.

Your business structure determines your tax rate more than almost any other factor. An S corporation saves you 15-25% in self-employment taxes compared to a sole proprietorship earning the same income, since S corp owners only pay self-employment tax on W-2 wages, not on all business profits. The IRS allows 100% bonus depreciation for equipment placed in service after January 19, 2025, which means choosing the right structure before you purchase equipment determines whether you capture this deduction or lose it entirely.

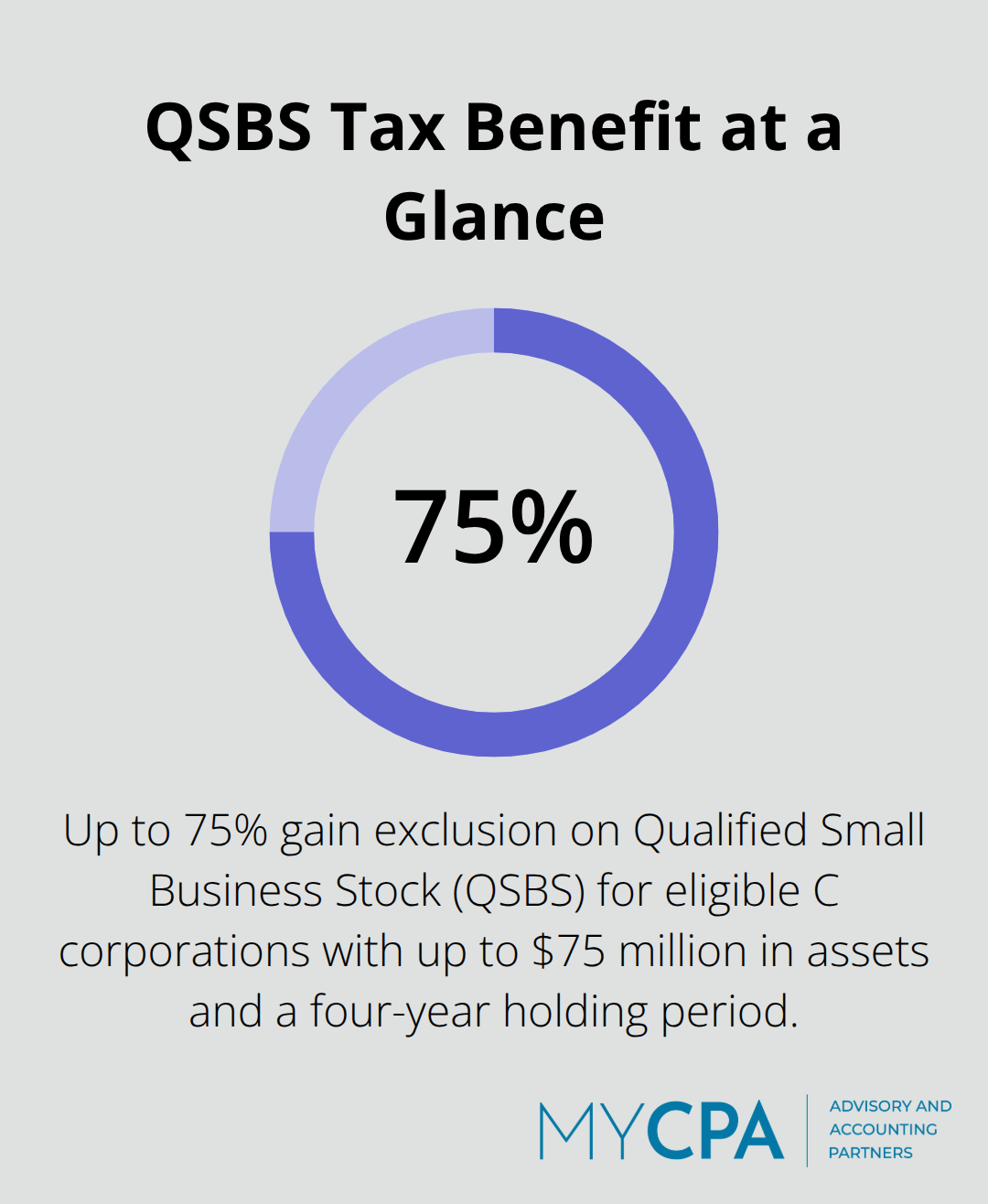

A manufacturing business that invests $500,000 in new equipment can deduct the full amount immediately under current rules if structured correctly, versus spreading depreciation over years under older rules. LLCs taxed as S corporations work well for service businesses, while C corporations make sense if you plan to sell within three to five years and qualify for Qualified Small Business Stock benefits, which apply to businesses with up to $75 million in assets and offer up to 75% gain exclusion for a four-year holding period.

Timing decisions create the second major lever for tax savings. For cash-basis businesses, deferring revenue in years when profits already exceed your target and accelerating deductible expenses when profits are expected to be lower shifts your tax burden to more favorable years. A consulting firm that expects $200,000 in profit can defer client invoicing by two weeks in December and accelerate vendor payments, moving $30,000 of income to the following year and reducing current-year taxes substantially.

Investment placement matters equally. Tax-efficient index funds belong in taxable accounts while tax-inefficient investments like bonds and dividend-paying stocks belong in 401(k)s and IRAs where growth compounds tax-free. This strategic placement preserves more wealth over time than a scattered approach.

Retirement contributions remain the simplest tax reduction available: a solo 401(k) allows you to contribute up to $69,000 in 2024 as both employer and employee, reducing taxable income dollar-for-dollar. SEP IRAs work better for businesses with inconsistent income since contributions are optional each year. Pass-through entity tax elections also merit consideration, allowing you to pay tax at the entity level and generate a federal deduction for owners, potentially reducing overall federal liability while maintaining neutral state impact.

The right combination of these strategies depends on your profit level, growth plans, and whether you anticipate a sale. My CPA Advisory and Accounting Partners helps business owners identify which strategies fit their specific situation, since the optimal choice varies significantly based on individual circumstances.

Tax planning meaning extends far beyond filing a return once a year-it’s the deliberate process of organizing your finances throughout the year to keep more money in your business where it drives growth. The strategies covered here (structuring your business correctly, timing income and expenses strategically, and maximizing retirement contributions) deliver measurable results when you implement them together. Business owners who plan ahead reduce their tax liability, preserve cash flow for operations and growth, and avoid penalties that drain profits.

You don’t need to overhaul your entire business to start a tax plan. Review your current structure and identify which retirement accounts you’re using, then track your income and expenses monthly rather than scrambling to organize them in March. Assess whether your current approach aligns with your profit forecasts for the year, since these steps alone reveal opportunities most owners miss.

The complexity lies in knowing which strategies fit your specific situation, since an S corporation structure works brilliantly for some businesses but creates unnecessary complications for others. We at My CPA Advisory and Accounting Partners help business owners implement tax planning strategies tailored to their actual circumstances, and our tax services, accounting expertise, and business advisory work together to minimize your tax liability while keeping your financial management stress-free. Contact us to discuss how a formal tax plan can transform your bottom line.

Privacy Policy | Terms & Conditions | Powered by Cajabra