Tax season doesn’t have to be a stressful scramble through boxes of receipts and forgotten documents. Smart tax preparation planning throughout the year can save you hours of work and potentially thousands of dollars.

We at My CPA Advisory and Accounting Partners see too many business owners miss valuable deductions simply because they lack an organized system. The right approach transforms tax time from chaos into a streamlined process that actually benefits your bottom line.

The average small business owner spends 120 hours annually on tax preparation, but this drops significantly with proper organization systems in place.

Create three dedicated folders: one for income documents like 1099s and invoices, another for expense receipts, and a third for tax-related correspondence.

Set up automatic monthly transfers of bank statements and credit card records to these folders. The IRS recommends that you keep tax records for at least three years, but business owners should maintain documentation for seven years to handle potential audits. Create a simple spreadsheet that tracks monthly income and expenses by category, and update it every time you pay bills or receive payments.

FreeTaxUSA and similar platforms report that users who maintain digital records throughout the year file their returns 60% faster than those who use paper systems. Scan receipts immediately with apps like Receipt Bank or simply your phone camera, then store them in cloud-based folders that you organize by month and expense type.

Connect your business bank accounts to accounting software like QuickBooks, which automatically categorizes 80% of transactions correctly. Set up recurring calendar reminders every month to review and organize your digital files. Small business owners who use integrated tax planning software save an average of $600 in professional preparation fees compared to those who hand over shoe boxes of receipts to their accountant.

Business owners frequently miss legitimate deductions due to poor expense tracking. Create separate tracking categories for office supplies, travel expenses, professional development, and equipment purchases.

Use the actual expense method for vehicle deductions if you drive more than 14,000 business miles per year, as this typically yields higher deductions than the standard mileage rate. Set up automatic expense categorization rules in your accounting software to capture recurring costs like software subscriptions and utility bills.

Review your expense categories quarterly to identify patterns and potential new deduction opportunities you might have overlooked. This systematic approach to expense tracking sets the foundation for strategic tax planning that can significantly reduce your overall tax burden.

Smart business owners treat tax planning like a chess game and think several moves ahead to maximize every available advantage. The Section 199A deduction alone can save pass-through entity owners up to 20% on qualified business income, but only if you structure your business activities correctly throughout the year. Most small business owners leave thousands on the table because they focus on tax preparation rather than strategic tax positioning.

You can dramatically shift your tax burden between years when you time your income and expenses strategically. Accelerate equipment purchases before December 31st to claim Section 179 deductions worth up to $1,220,000 for 2024, rather than depreciate assets over several years. Defer client invoices until January if you expect lower tax rates next year, or accelerate collections in December to offset current-year losses.

Medical practices and consultants who bill quarterly should strategically time their December invoices based on projected annual income. The IRS allows cash-basis taxpayers significant flexibility in their approach to income recognition (though C-corporations face stricter rules that require advance planning).

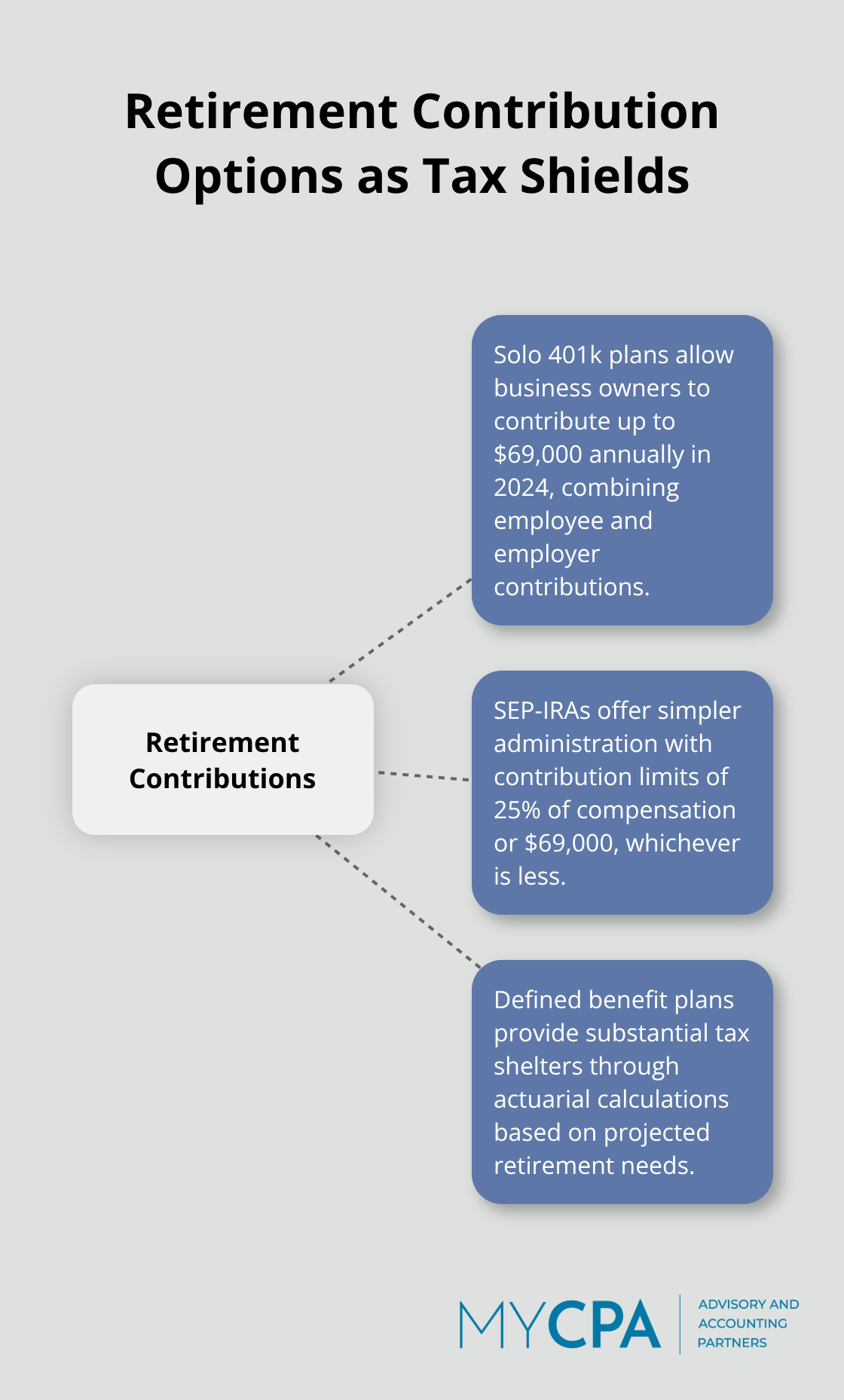

Solo 401k plans allow business owners to contribute up to $69,000 annually in 2024, which combines employee and employer contributions that directly reduce taxable income. SEP-IRAs offer simpler administration with contribution limits of 25% of compensation or $69,000, whichever is less.

High-income earners should establish defined benefit plans that can provide substantial tax shelters through actuarial calculations based on projected retirement needs. Fund these accounts by December 31st for current-year deductions (though SEP-IRAs and solo 401ks accept contributions until the tax deadline). Business owners who consistently maximize retirement contributions while they maintain cash flow create compound tax savings that often exceed the immediate deduction benefits.

Tax-loss harvesting allows you to offset capital gains with investment losses, potentially saving thousands in taxes on profitable investments. Hold investments for more than one year to qualify for long-term capital gains rates, which max out at 20% compared to ordinary income rates that can reach 37%.

However, even the most sophisticated tax strategies can backfire without proper execution and documentation, which leads us to examine the most common mistakes that cost business owners money every year.

The IRS reports that math errors alone affect 2.4 million tax returns annually, but the costliest mistakes happen long before you sit down to calculate numbers. Business owners who miss quarterly estimated tax deadlines face penalties if they owe $1,000 or more in tax after subtracting their withholdings and credits, while those who fail to file by the annual deadline trigger penalties that start at 5% of unpaid taxes per month. The Electronic Federal Tax Payment System shows that 40% of small business owners pay estimated taxes late, which compounds into thousands in avoidable penalties over multiple years.

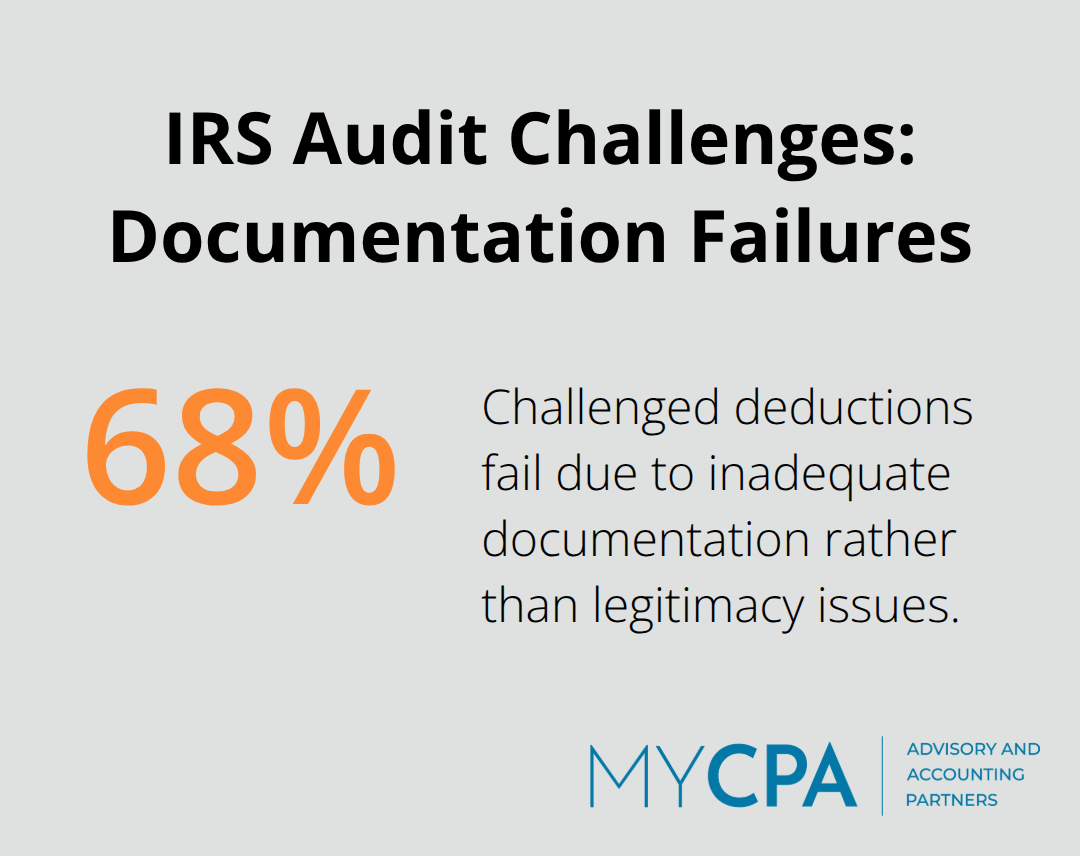

Poor record maintenance ranks as the number one reason the IRS rejects business deductions during audits, with 68% of challenged deductions that fail due to inadequate documentation rather than legitimacy issues.

Business owners must store receipts digitally within 24 hours of purchase, because thermal paper receipts fade completely within two years and cash register ink often becomes illegible after 18 months.

The IRS requires contemporaneous records for meal and entertainment deductions, which means you must document the business purpose, attendees, and discussion topics at the time of the expense, not months later during tax preparation. This strict documentation standard protects legitimate business expenses from audit challenges.

TaxAct research indicates that 43% of small business owners overlook the Section 199A qualified business income deduction that allows eligible taxpayers to deduct up to 20 percent of their qualified business income, simply because they lack proper income categorization throughout the year. The Research and Development Tax Credit applies to software development, product testing, and process improvements that most business owners never claim because they assume it only covers laboratory research.

Monthly expense reviews help identify overlooked deductions like professional development courses, business insurance premiums, and home office expenses that many entrepreneurs treat as personal costs instead of legitimate business deductions. These systematic reviews often uncover thousands in missed opportunities.

Business owners who file estimated taxes late face compound penalties that grow each quarter, turning a $200 shortfall into a $2,000 problem over four quarters. The IRS charges interest on unpaid balances from the original due date, not from when you finally submit payment.

Cash-basis taxpayers who accelerate income without planning face higher tax brackets that cost more than the cash flow benefits they gained. Strategic income timing requires advance planning to avoid these expensive miscalculations.

Proactive tax preparation planning transforms your annual tax burden from a reactive scramble into a strategic advantage that compounds year after year. Business owners who implement systematic record-keeping and strategic decisions typically reduce their effective tax rates by 15-25% compared to those who treat taxes as an annual afterthought. The financial impact extends far beyond immediate savings.

Consistent tax optimization frees up capital for business reinvestment, retirement contributions, and emergency reserves that strengthen your long-term financial position. Small businesses that maintain organized systems and strategic plans often reinvest their tax savings into growth opportunities that generate returns for decades. These systematic approaches create competitive advantages that separate thriving businesses from those that merely survive.

Complex tax situations require professional expertise to navigate changing regulations and identify optimization opportunities that software cannot detect. We at My CPA Advisory and Accounting Partners help business owners minimize tax liabilities while enhancing overall financial health through personalized strategies and accurate accounting services (visit our comprehensive financial services to learn more). Strategic tax management often determines whether your business thrives or merely survives in competitive markets.

Privacy Policy | Terms & Conditions | Powered by Cajabra