Retirement brings new financial challenges that require smart tax planning strategies for retirees. The average retiree pays 13.5% of their income in taxes, yet many miss opportunities to reduce this burden.

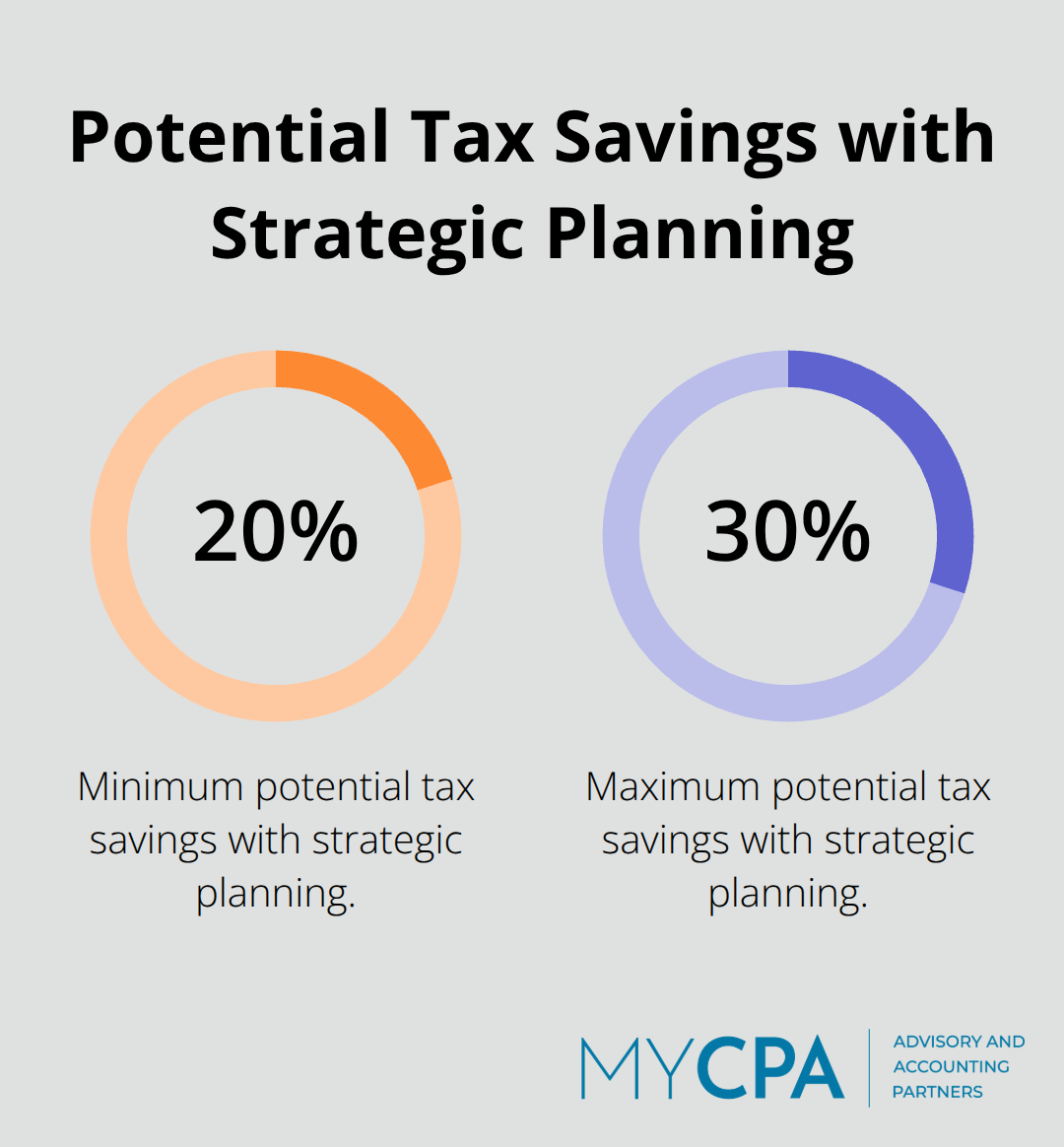

We at My CPA Advisory and Accounting Partners see retirees lose thousands annually through poor withdrawal timing and overlooked deductions. Strategic planning can save 20-30% on your tax bill.

The IRS mandates withdrawals from traditional retirement accounts starting at age 73, and the penalty for missed Required Minimum Distributions hits hard at 25% of the amount you should have withdrawn. The SECURE Act 2.0 reduced this penalty to 10% if you correct it quickly, but complete avoidance saves more money. Your RMD amount increases each year based on IRS life expectancy tables, and many retirees withdraw exactly the minimum without tax consideration.

Smart retirees take larger distributions in low-income years to smooth out their tax burden over time. This strategy prevents massive tax spikes when RMDs force larger withdrawals later. The key lies in proactive distribution planning rather than reactive compliance.

The withdrawal sequence from your retirement accounts directly impacts your lifetime tax bill. Financial research consistently shows that withdrawals from taxable accounts first, then tax-deferred accounts, and finally Roth accounts maximize after-tax income. However, this traditional approach fails when you consider Medicare premiums and Social Security taxation.

Proportional withdrawals from multiple account types often work better, as they keep your annual income steady and avoid tax bracket jumps. Single filers with taxable income up to $48,350 in 2025 pay zero percent on long-term capital gains (making taxable account withdrawals particularly attractive for lower-income retirees).

Up to 85% of your Social Security benefits become taxable when your provisional income exceeds certain thresholds. Provisional income includes half your Social Security benefits plus all other income sources including tax-exempt interest. This creates a double taxation effect where retirement account withdrawals trigger taxes on both the withdrawal and your Social Security benefits.

Strategic Roth IRA conversions before you claim Social Security can reduce this impact significantly. Keep provisional income just below these thresholds through careful withdrawal planning to potentially save thousands in combined taxes and Medicare premium increases.

These foundational strategies set the stage for retirement success, but many retirees still fall into costly traps that drain their savings unnecessarily.

Healthcare expenses represent the largest overlooked deduction area for retirees. The average 65-year-old couple needs $315,000 for medical costs throughout retirement according to Fidelity research. Medical expenses that exceed 7.5% of adjusted gross income qualify for itemized deductions, yet most retirees miss this threshold when they fail to bunch medical expenses strategically.

Schedule elective procedures, dental work, and prescription refills in the same tax year to maximize deductions. Health Savings Accounts provide triple tax benefits for retirees over 65 (tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses). After age 65, HSAs allow penalty-free withdrawals for any purpose, not just medical expenses.

Moves to tax-friendly states during retirement backfire when retirees maintain ties to their previous high-tax state. States like California and New York aggressively pursue former residents who haven’t properly severed domicile connections. Change your voter registration, driver’s license, bank accounts, and establish a new primary care physician within 90 days of your move.

Spend more than 183 days annually in your new state to avoid dual taxation. Florida residents save an average of $3,000 annually compared to New York residents on the same income, but incomplete moves trigger audits that cost more than the savings. Document your relocation thoroughly with receipts, utility bills, and residence records.

Tax-loss harvesting opportunities disappear permanently when retirees fail to rebalance portfolios strategically. Sell losing investments to offset gains and reduce taxable income, yet many retirees hold declining positions while they hope for recovery. Harvest losses annually before year-end, but avoid wash sale rules (wait 31 days before you repurchase identical securities).

Asset location matters more in retirement when income needs increase. Keep tax-inefficient investments like REITs and bonds in tax-deferred accounts while you hold growth stocks in taxable accounts to capture preferential capital gains rates. This positioning can save thousands annually in unnecessary taxes.

These common mistakes cost retirees significant money each year, but advanced optimization techniques can recover these losses and create additional tax savings opportunities.

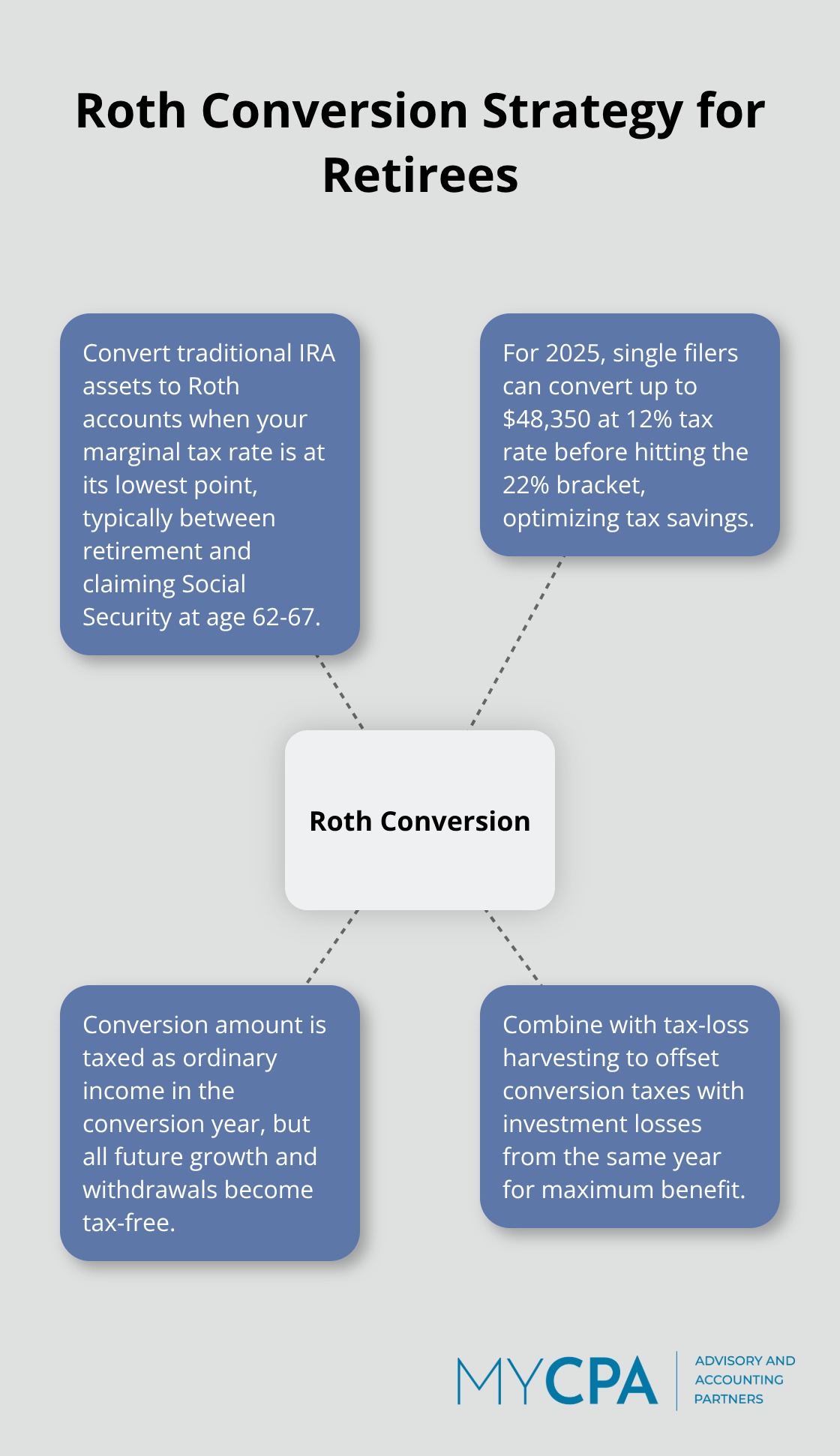

Roth IRA conversions work best during market downturns when account values drop temporarily or in years with unusually low income. Convert traditional IRA assets to Roth accounts when your marginal tax rate hits its lowest point, typically between retirement and Social Security claims at age 62-67. The conversion amount gets taxed as ordinary income in the conversion year, but all future growth and withdrawals become tax-free.

Target conversions that keep you within your current tax bracket to avoid higher rates unnecessarily. For 2025, single filers can convert up to $48,350 at 12% before they hit the 22% bracket. This strategy becomes powerful when you combine it with tax-loss harvesting to offset conversion taxes with investment losses from the same year.

Qualified Charitable Distributions from IRAs after age 70½ count toward your RMD requirement while they avoid taxable income entirely. This strategy beats standard charitable deductions because the distribution never appears as income on your tax return. The annual limit reaches $105,000 per person for 2025 (married couples can donate up to $210,000 tax-free from their IRAs).

Donate appreciated securities instead of cash to charities for double tax benefits. You avoid capital gains taxes on the appreciation while you claim the full fair market value as a charitable deduction. A $10,000 stock position purchased for $3,000 generates a $10,000 deduction while you avoid $1,050 in capital gains taxes at the 15% rate. Bunch charitable contributions into alternating years to exceed the standard deduction threshold when itemization makes sense.

Hold dividend-paying stocks and bonds in tax-deferred accounts like traditional IRAs while you keep growth stocks in taxable accounts. This asset location strategy captures preferential capital gains rates on growth investments while it shelters high-tax ordinary income from dividends and interest. Municipal bonds belong in taxable accounts for high-income retirees since their tax-free status provides no benefit inside already tax-sheltered retirement accounts.

Time capital gains realizations to stay within the 0% capital gains bracket when possible. Harvest gains annually up to the threshold to reset your cost basis higher without taxes. This technique works particularly well for retirees with modest income who can realize substantial gains tax-free each year. For deeper insights into advanced tax strategies, consider specialized resources that cover sophisticated planning techniques.

Effective retirement tax planning requires a comprehensive approach that addresses RMD management, strategic withdrawals, and Social Security optimization. The most successful tax planning strategies for retirees combine proactive distribution timing with advanced techniques like Roth conversions and charitable contributions. Professional guidance becomes essential when you navigate complex retirement tax scenarios.

We at My CPA Advisory and Accounting Partners help retirees minimize tax liabilities through personalized tax services and proactive advisory consulting. Our expertise helps clients implement sophisticated strategies while they avoid costly mistakes. Start with a review of your current withdrawal strategy and RMD projections (calculate your provisional income to understand Social Security tax implications).

Consider Roth conversions during low-income years and explore tax-loss harvesting opportunities before year-end. Document any state relocation plans thoroughly and maximize healthcare deductions through strategic timing. The difference between reactive tax compliance and proactive tax optimization can save thousands annually, and professional tax planning services provide the expertise needed to implement these strategies effectively.

Privacy Policy | Terms & Conditions | Powered by Cajabra