Managing your business finances shouldn’t feel overwhelming. Many companies struggle with scattered accounting tasks across multiple providers, leading to inconsistencies and higher costs.

We at My CPA Advisory and Accounting Partners see businesses transform when they switch to comprehensive accounting services. This integrated approach combines bookkeeping, tax planning, payroll, and financial analysis under one roof.

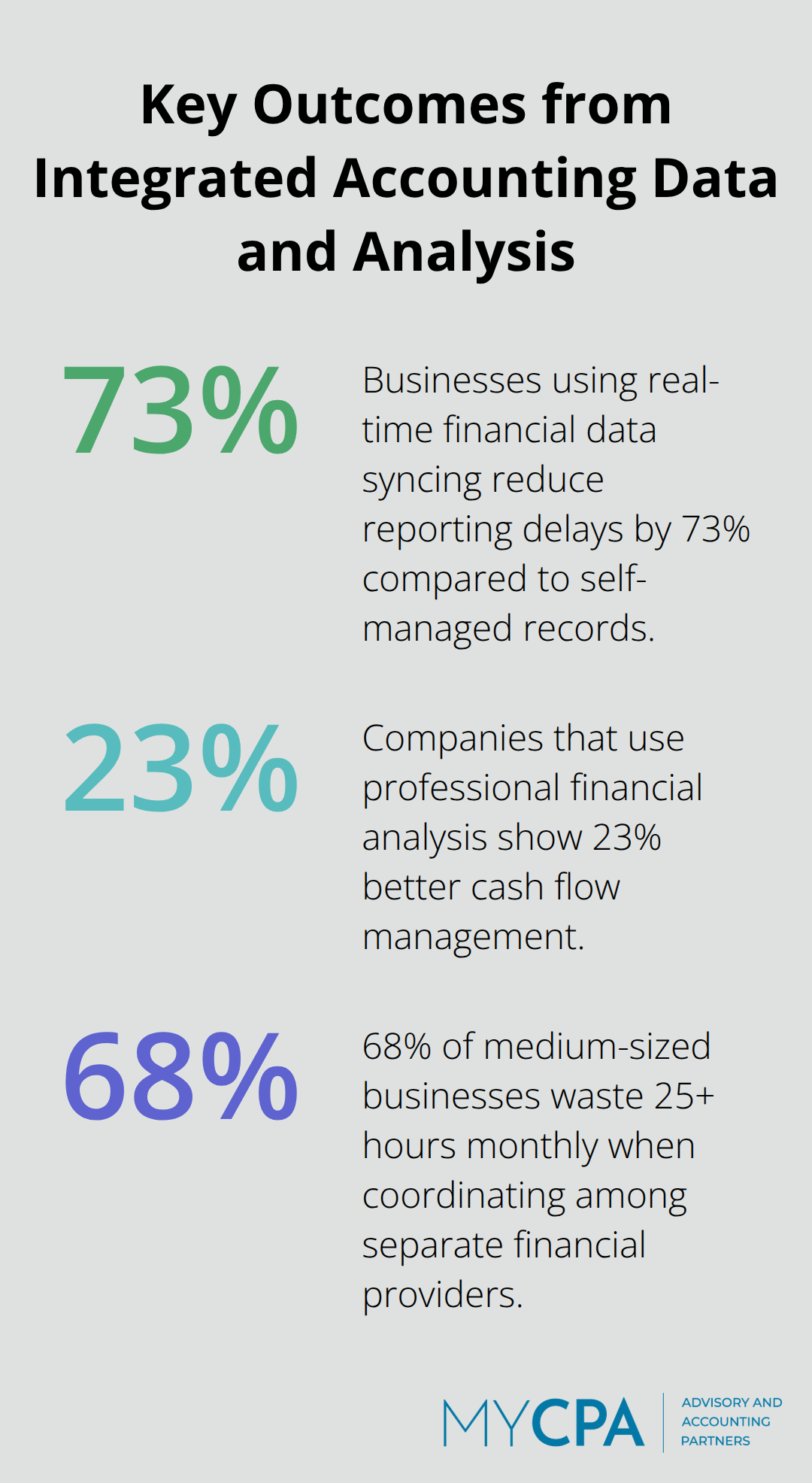

Professional bookkeeping forms the foundation of comprehensive accounting services. This approach extends far beyond basic transaction recording. Modern firms handle daily transaction categorization, bank reconciliations, accounts payable and receivable management, and monthly financial statement preparation. According to industry data, businesses using real-time financial data syncing reduce reporting delays by 73% compared to self-managed records. The best providers use cloud-based platforms like QuickBooks Online or Xero, which give you real-time access to your financial data from anywhere.

Monthly reconciliations catch discrepancies early and prevent costly mistakes during tax season.

Tax services extend well beyond annual preparation. Comprehensive providers offer quarterly tax planning sessions, estimated payment calculations, and year-round strategy adjustments. Professional tax planning services can range from $800 to $10,000+ depending on your situation and complexity. These services include entity structure analysis, retirement plan contributions, equipment purchase timing, and income deferral strategies. Professional tax planning also includes multi-year forecasting to minimize tax burdens as your business grows.

Financial reporting transforms raw data into actionable business intelligence. Comprehensive services include monthly profit and loss statements, balance sheets, cash flow analysis, and key performance indicator tracking. Modern accounting firms provide dashboard reporting that updates in real-time and shows metrics like gross profit margins, customer acquisition costs, and inventory turnover rates (all accessible through secure client portals). This analysis helps identify trends before they become problems. Businesses that use professional financial analysis show 23% better cash flow management according to recent studies.

These integrated services work together to create a complete financial management system that supports your business growth and strategic decision-making.

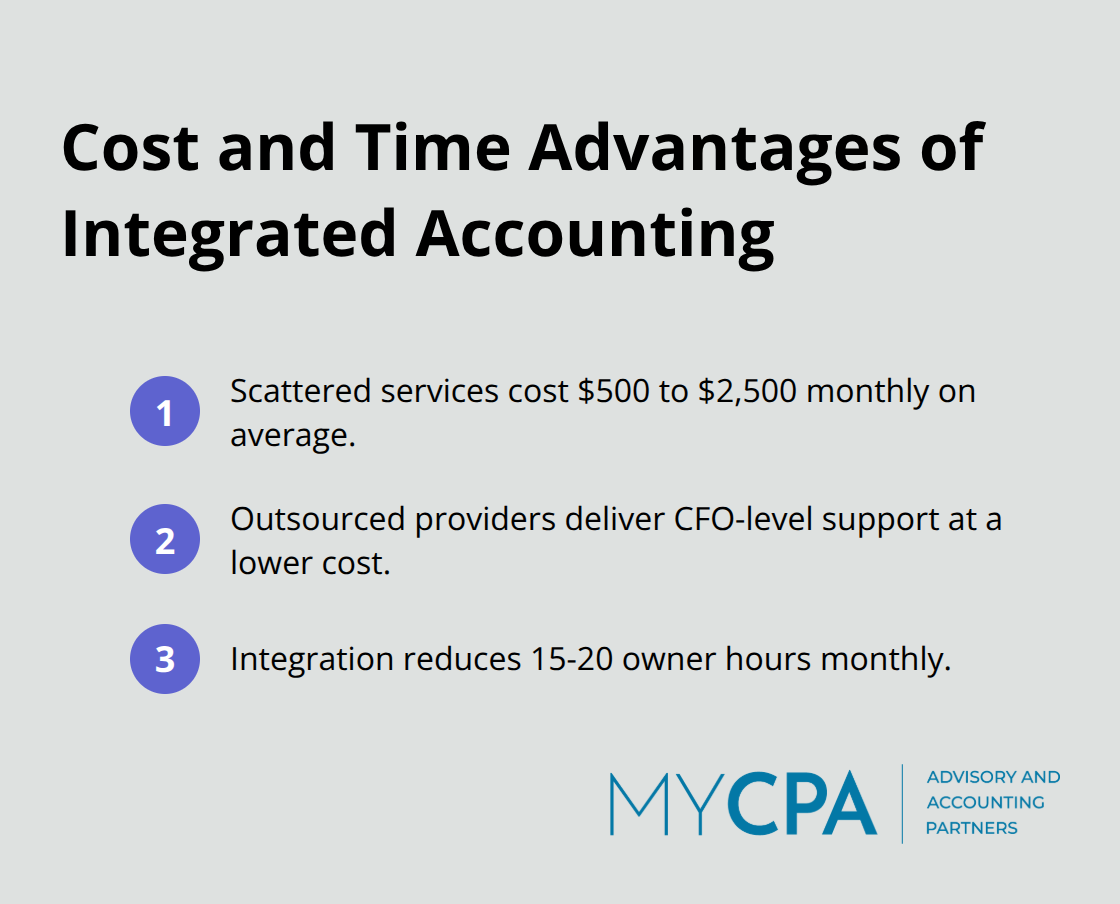

Businesses typically spend significantly more when they use separate providers for bookkeeping, tax preparation, and payroll services compared to comprehensive packages. The average small business pays $500 to $2,500 monthly for scattered accounting services versus integrated solutions according to recent industry surveys. Outsourced providers cost significantly less while delivering high-quality CFO accounting support compared to hiring separate specialists. Integration also reduces the 15-20 hours monthly that business owners spend to manage multiple vendor relationships and reconcile conflicting advice.

Fragmented accounting creates dangerous information gaps that cost businesses an average of $4,800 per error according to QuickBooks research data. Single-provider systems maintain consistent chart of accounts, unified reporting standards, and seamless data flow between tax planning and daily bookkeeping. This consistency prevents the costly mistakes that occur when your tax preparer uses different account classifications than your bookkeeper. Professional accounting services also provide real-time visibility into cash flow patterns, which allows businesses to make informed decisions about equipment purchases, hiring, and expansion timing.

Comprehensive providers offer deep expertise across interconnected financial areas that individual specialists often miss. This cross-functional knowledge helps identify tax-saving opportunities during routine bookkeeping and spot cash flow issues before they impact operations. Outsourced accounting services deliver key differences in cost, efficiency, and scalability compared to managing multiple provider relationships. The integrated approach means your tax strategy directly informs your bookkeeping practices, which creates a cohesive financial management system that supports growth rather than creates obstacles.

These advantages become particularly valuable for specific types of businesses that face unique financial challenges and growth pressures.

Companies that generate $500,000 to $5 million annually face the biggest financial management challenges that comprehensive accounting services solve directly. These businesses outgrow simple bookkeeping but lack resources for full accounting departments. Research from the Association of Chartered Certified Accountants shows that 68% of medium-sized businesses waste 25+ hours monthly when they coordinate between separate financial providers.

Manufacturing companies with inventory tracking, service businesses that manage project profitability, and retail operations that handle multiple revenue streams benefit most from unified financial oversight. Professional services firms like law practices and consulting agencies need integrated time tracking, billing, and tax planning that scattered providers cannot deliver effectively.

Businesses that expand rapidly need accounting systems that adapt without constant vendor changes. Companies that add employees, open locations, or launch products cannot afford financial reporting gaps during critical growth phases. The Small Business Administration reports that nearly 20% of startups fail due to team problems and other human resource-related issues. These businesses need monthly financial analysis, quarterly tax planning, and real-time cash flow monitoring that only comprehensive providers deliver consistently. Technology startups, franchises, and businesses that secure investment capital particularly need the credible financial reporting that integrated accounting services provide to investors and lenders.

Entrepreneurs from non-financial backgrounds waste significant time and money when they try to manage accounting tasks themselves or coordinate multiple specialists. The National Federation of Independent Business found that business owners spend an average of 120 hours annually on financial management tasks they could outsource. Restaurant owners, contractors, healthcare practitioners, and creative professionals typically lack accounting expertise but need sophisticated financial management for tax optimization and business growth (which comprehensive services provide). These business owners benefit most from comprehensive services because they gain expert knowledge across all financial areas while they focus their time on revenue activities that actually grow their businesses.

Comprehensive accounting services deliver measurable value through integrated financial management that reduces costs, improves accuracy, and provides strategic insights. Businesses that consolidate bookkeeping, tax planning, payroll, and financial analysis under one provider typically save 30-40% compared to separate vendors. This approach provides real-time visibility into financial performance while eliminating costly coordination between multiple service providers.

Professional accounting transforms business operations through the elimination of information gaps and reduction of administrative burden. Expert guidance across all financial areas allows business owners to focus on growth activities while they maintain compliance and optimize tax strategies. The integrated approach creates consistency that prevents expensive errors and provides strategic advice that scattered providers cannot match.

Assessment of your current financial management costs, time investment, and service gaps reveals whether you need comprehensive solutions. Consider whether scattered providers create inefficiencies or limit your access to strategic financial advice (which comprehensive services eliminate). We at My CPA Advisory and Accounting Partners offer tailored comprehensive accounting services that combine tax optimization, accurate reporting, and proactive business advisory to support your financial goals.

Privacy Policy | Terms & Conditions | Powered by Cajabra