Small business owners face complex financial decisions that directly impact their bottom line. The IRS reports that 40% of small businesses pay penalties due to tax filing errors.

We at My CPA Advisory and Accounting Partners see how the right small business tax and accounting services transform operations. Professional support reduces compliance risks while freeing owners to focus on growth strategies.

Professional tax and accounting services extend far beyond annual tax returns. Tax preparation and filing services form the foundation, where certified professionals navigate federal, state, and local requirements while they identify deductions that average business owners miss.

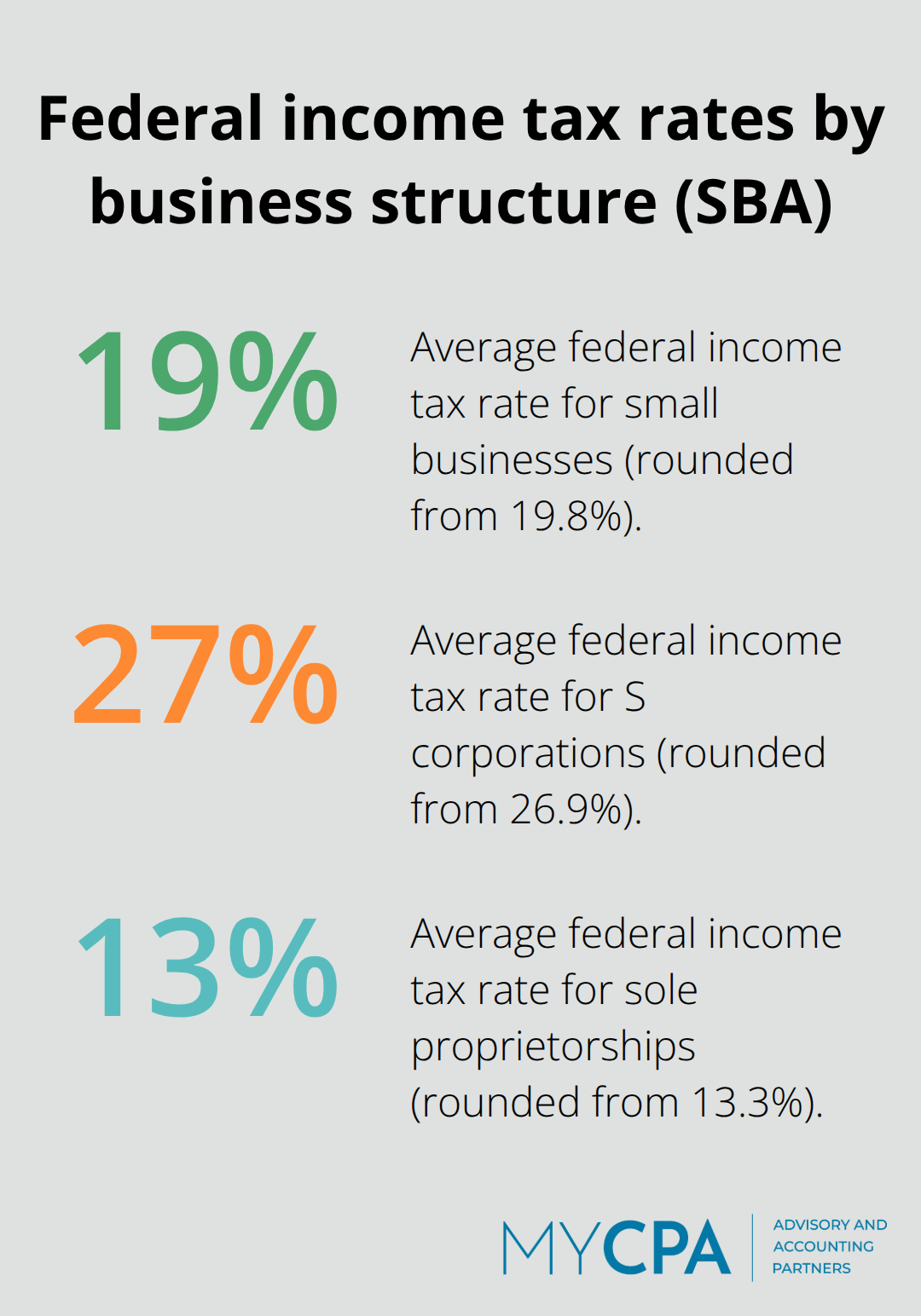

According to the SBA, small businesses typically pay 19.8% in federal income taxes, but this varies dramatically by structure: S corporations pay 26.9% while sole proprietorships pay just 13.3%. Professional preparers understand these nuances and structure filings to minimize liability. They handle quarterly estimated payments, employment tax compliance, and multi-state filing requirements that trip up 40% of small businesses (according to IRS data).

Bookkeeping and financial record management provide the data foundation for smart business decisions. Modern accounting firms use cloud-based platforms like QuickBooks to automate transaction categorization and generate real-time financial reports. 64.4% of small businesses now use accounting software, but many still struggle with proper implementation. Professional bookkeepers maintain accurate records year-round, track deductible expenses, and prepare monthly financial statements that reveal profit trends and cash flow patterns. Payroll processing eliminates the complexity of wage calculations, withholdings, and employment taxes while it maintains compliance with changing regulations. The IRS requires businesses with self-employment income over $400 to file returns, and payroll mistakes can trigger costly penalties.

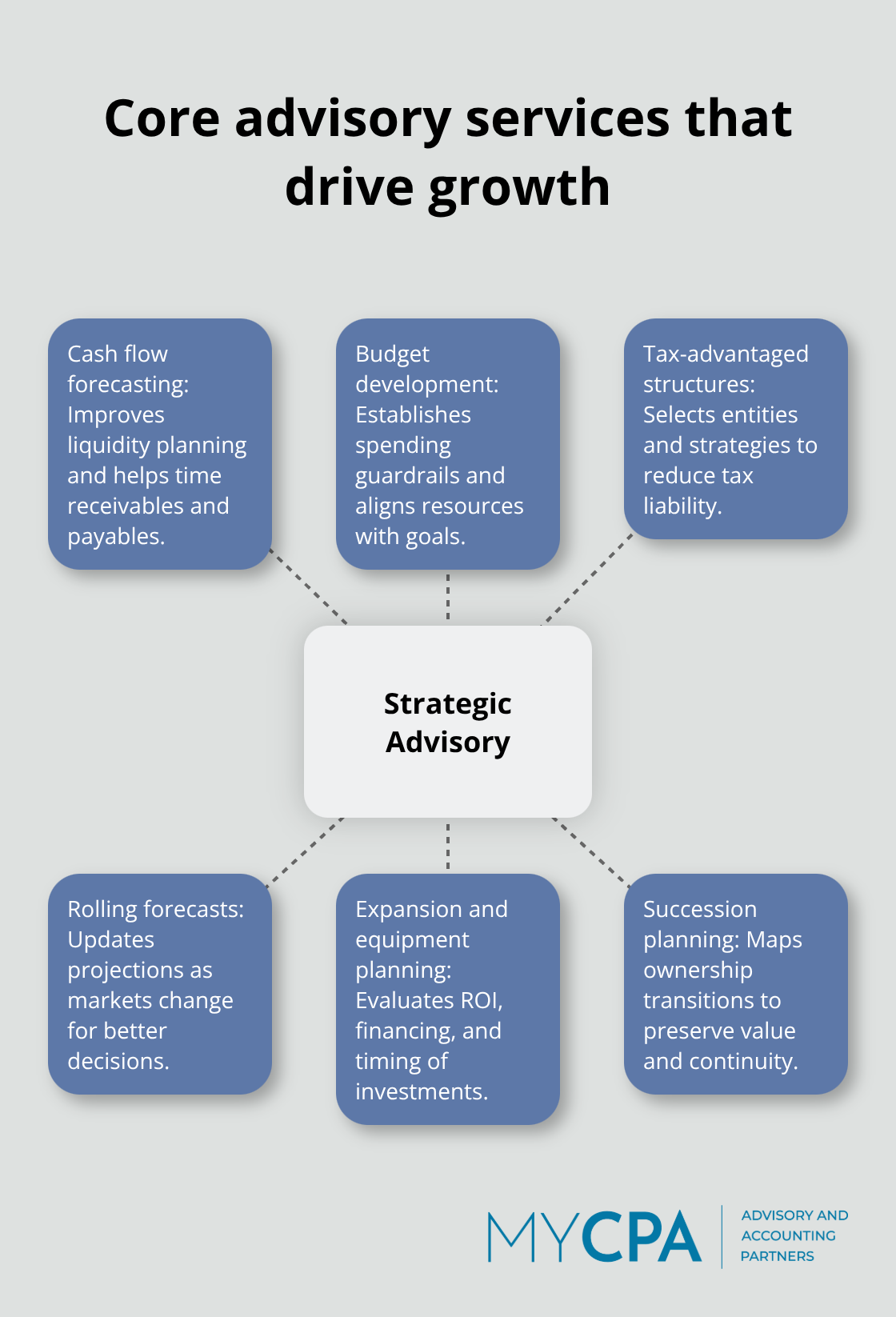

Business advisory and financial planning services transform accountants from number processors into strategic partners. These professionals analyze financial data to identify growth opportunities, recommend tax-advantaged business structures, and create rolling forecasts that adapt to changing market conditions. According to Sage, 91% of accounting professionals report that technology enhances their ability to focus on client advisory services rather than routine data entry. Advisory services include cash flow forecasting, budget development, and strategic planning that helps businesses navigate expansion, equipment purchases, and succession planning decisions.

The quality of these services depends heavily on the expertise and approach of your chosen accounting partner. Different firms offer varying levels of specialization and technology integration (which affects both service quality and pricing).

Industry expertise separates competent accountants from exceptional ones. Retail businesses need professionals who understand sales tax compliance across multiple jurisdictions and inventory valuation methods. Construction companies require expertise in project cost accounting and contract management. Manufacturing firms benefit from accountants familiar with depreciation schedules for equipment and work-in-progress inventory tracking. According to Onpay, 39% of small business owners find new accountants through recommendations from other professional advisors in their industry. This statistic reveals why industry connections matter: professionals who work within your sector understand the specific deductions, compliance requirements, and cash flow patterns that generic accountants miss.

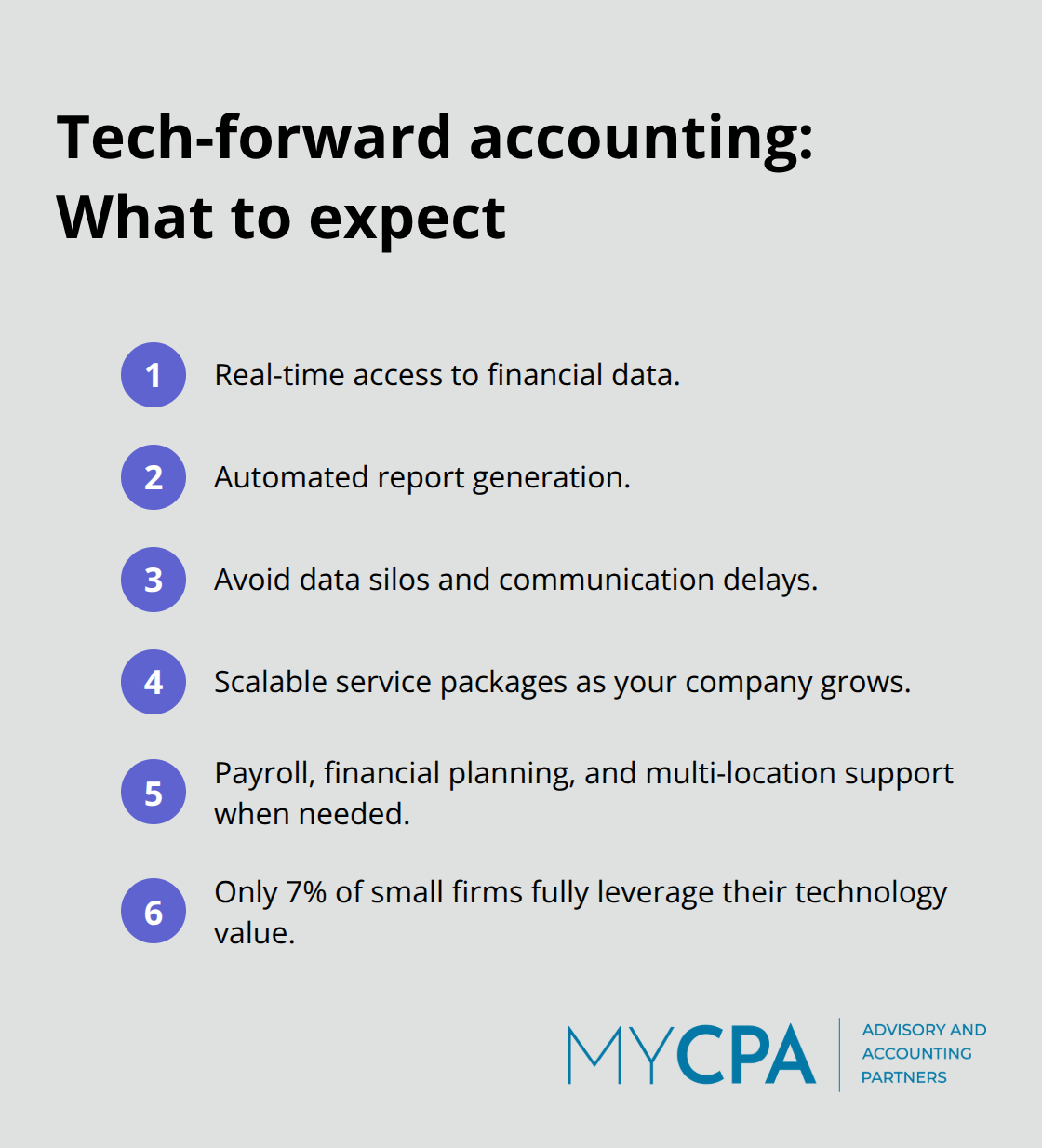

Modern accounting firms must offer integrated technology solutions that connect with your existing business systems. Cloud-based platforms allow real-time access to financial data and automated report generation. Firms that use outdated desktop software create data silos and communication delays.

The best accounting partners provide comprehensive service packages that scale with your business growth. Start-ups might need basic bookkeeping and tax preparation, but companies that expand require payroll processing, financial planning, and multi-location accounting support. Wolters Kluwer reports that only 7% of small firms fully leverage their technology value (which makes tech-savvy partners essential for competitive advantage).

Responsive communication distinguishes professional accounting firms from overwhelmed practices. Your accountant should return calls within 24 hours during business periods and provide clear explanations without technical jargon. Test communication style during initial consultations when you ask specific questions about your business situation. Firms that provide vague answers or push standardized solutions lack the personalized approach successful businesses need. 51% of firms struggle to keep up with regulatory changes, which makes proactive communication about new requirements a critical selection factor.

Professional accounting services deliver measurable value that extends far beyond basic compliance. The financial benefits and operational improvements these partnerships create often surprise business owners who previously handled their own books.

Professional tax and accounting services generate measurable returns that far exceed their costs through strategic deduction optimization and compliance accuracy. Certified professionals identify deduction opportunities that business owners miss, spotting overlooked expenses like home office costs, vehicle depreciation, and professional development investments. The Journal of Accountancy reports that 80% of accounting executives believe AI-enhanced services create competitive advantages through better deduction tracking and compliance monitoring. Professional preparers also eliminate costly penalties: the IRS assesses $7 billion annually in small business penalties, with 60% stemming from filing errors that professionals prevent through systematic review processes.

Monthly financial reports and automated bookkeeping systems improve cash flow management by providing real-time visibility into receivables, payables, and expense trends. Businesses that use professional bookkeeping services report 23% better cash flow predictability compared to self-managed operations, according to Sage research. Cloud-based accounting platforms that professionals integrate generate instant profit and loss statements, balance sheets, and cash flow forecasts that reveal seasonal patterns and growth opportunities. Payroll automation through professional services eliminates calculation errors that affect 40% of businesses that manage payroll internally. Professional firms also implement rolling forecasts that adapt to changing business conditions (replacing static annual budgets with dynamic planning tools that support strategic decision-making throughout the year).

Professional accounting partnerships free business owners to concentrate on revenue-generating activities rather than administrative tasks. Small business owners spend more than 20 hours per month handling financial tasks when they manage finances internally. Professional services reduce this time investment to 20-30 hours through streamlined data collection and automated processing. McAfee found that 87% of companies experienced business acceleration after they implemented cloud accounting systems that professionals managed. This efficiency gain allows owners to focus on customer acquisition, product development, and market expansion strategies that drive growth rather than wrestle with compliance requirements and financial record maintenance (freeing up valuable time for core business activities).

Small business tax and accounting services deliver measurable value through strategic tax optimization, accurate financial reports, and operational efficiency gains. Professional partners who combine industry expertise with modern technology platforms provide specialized knowledge that generic solutions cannot match. The selection process requires you to evaluate credentials, communication standards, and service breadth that aligns with your business growth trajectory.

The long-term benefits extend beyond compliance and penalty prevention to create competitive advantages through better cash flow management, strategic advisory services, and automated systems. Professional accounting partnerships free owners to focus on revenue activities rather than administrative tasks. Businesses that invest in professional services report 23% better cash flow predictability and significant time savings compared to self-managed operations.

We at My CPA Advisory and Accounting Partners understand that you need careful evaluation of your specific needs and growth objectives when you select a financial partner. Our comprehensive accounting solutions combine tax efficiency strategies with accounting support and proactive business advisory services. The investment in professional small business tax and accounting services pays dividends through reduced liabilities, improved financial accuracy, and strategic guidance that supports sustainable growth.

Privacy Policy | Terms & Conditions | Powered by Cajabra