Income tax planning can save you thousands of dollars annually when executed properly. The average American overpays their taxes by $1,200 each year due to missed opportunities and poor timing.

We at My CPA Advisory and Accounting Partners see clients reduce their tax burden by 15-30% through strategic planning. The key lies in understanding advanced techniques, avoiding common pitfalls, and implementing the right strategies before year-end.

The 2025 401(k) contribution limit reaches $23,500, with catch-up contributions of $7,500 for those 50 and older. Workers who maximize these contributions reduce their taxable income by up to $31,000 annually. Traditional IRA contributions cap at $7,000, but backdoor Roth conversions provide real power for high earners who exceed income limits.

Health Savings Accounts offer triple tax benefits with $4,300 individual limits ($5,300 for those 55 and older). These accounts allow tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Tax-loss harvesting allows investors to offset capital gains through the sale of underperforming securities. The IRS permits up to $3,000 in excess losses to offset ordinary income annually, with remaining losses that carry forward indefinitely.

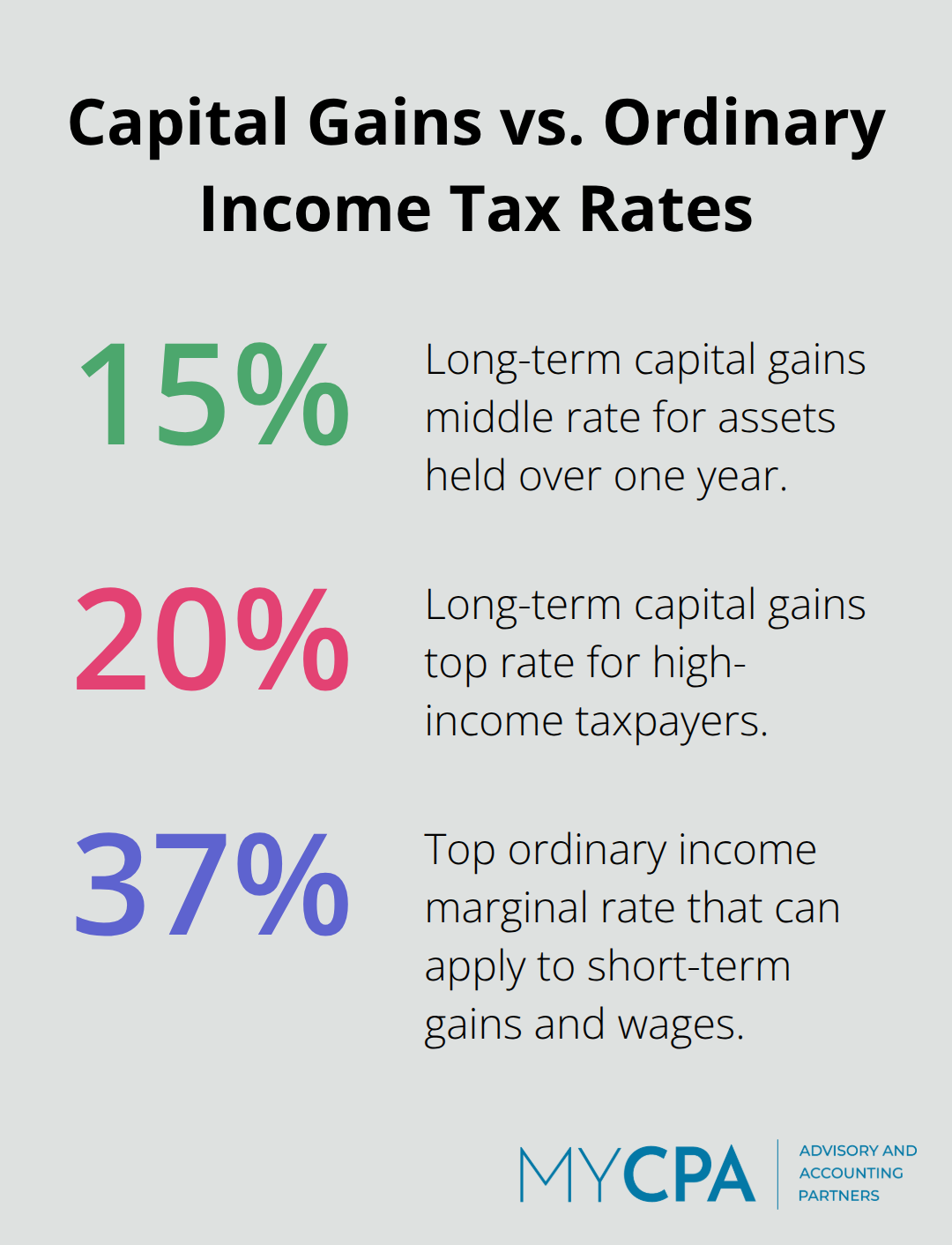

Smart investors harvest losses in December while they avoid the wash-sale rule through a 31-day waiting period before repurchase of identical securities. Investment timing matters significantly: assets held longer than one year qualify for preferential long-term capital gains rates of 0%, 15%, or 20% versus ordinary income rates up to 37%.

S-Corporation election saves self-employed individuals thousands in self-employment taxes. While sole proprietors pay 15.3% self-employment tax on all profits, S-Corp owners pay this tax only on reasonable salary, not distributions.

Limited Liability Companies provide flexibility with pass-through taxation while they allow multiple tax elections. Business owners should track every deductible expense: home office costs, vehicle usage, professional development, and equipment purchases. The Section 179 deduction allows immediate expensing of qualifying business equipment, rather than depreciation over years.

These foundational strategies create the framework for more sophisticated tax planning strategies that can further reduce your overall tax burden.

Income timing strategies deliver immediate tax savings through careful year-end planning. High earners should defer bonuses and consulting payments into the following tax year when they expect lower income. The opposite approach works for those who anticipate higher earnings: accelerate income recognition to capture current lower tax rates. Self-employed professionals can delay December invoices or prepay January expenses to shift income between tax years.

Tax bracket management becomes powerful when you combine it with retirement account conversions. Convert traditional IRA funds to Roth accounts during low-income years to minimize the tax hit while you build tax-free retirement wealth. The IRS allows partial conversions, so you can convert exactly enough to reach the top of your current tax bracket without you jump to the next level.

Tax credits reduce your tax bill dollar-for-dollar, which makes them more valuable than deductions. The Earned Income Tax Credit provides up to $7,430 for families with three or more children in 2024. The Child Tax Credit offers $2,000 per qualifying child, while the American Opportunity Credit provides up to $2,500 for college expenses.

Business owners should claim the Research and Development Credit for software development, product testing, and process improvements. The Work Opportunity Tax Credit provides up to $9,600 when you hire from targeted groups (including veterans and ex-felons). Energy-efficient business equipment qualifies for substantial credits under Section 48C, often covering 30% of installation costs.

Gift tax exclusions allow wealthy families to transfer $18,000 per recipient annually without tax consequences. Married couples can combine their exclusions to gift $36,000 per person. Strategic gifts of appreciating assets remove future growth from your taxable estate while they maximize the annual exclusion benefit.

Qualified Personal Residence Trusts allow homeowners to transfer their residence at discounted values while they retain occupancy rights. This technique works particularly well for vacation homes expected to appreciate significantly. Generation-skipping trusts apply when you transfer assets to recipients two or more generations below and are separate from the estate tax, directly benefiting grandchildren while preserving wealth across multiple generations.

These advanced techniques work best when you coordinate them with proper documentation and avoid the common mistakes that can derail even the most sophisticated tax strategies.

Tax mistakes destroy wealth faster than market crashes. The IRS has identified numerous taxpayer problems requiring congressional attention, with preventable errors that proper planning eliminates. Self-employed taxpayers face the highest penalty rates because quarterly payment requirements catch them unprepared, while poor documentation leads to disallowed deductions during audits.

Self-employed individuals must pay estimated taxes quarterly to avoid underpayment penalties. The IRS charges 8% annually on missed payments, which compounds throughout the year. Taxpayers who owe $1,000 or more face automatic penalties unless they pay 90% of current year taxes or 100% of prior year liability through quarterly payments.

The number 100% seems to be not appropriate for this chart. Please use a different chart type.

High earners with prior year AGI above $150,000 must pay 110% of last year’s tax to avoid penalties. The September 15 third quarter deadline trips up most taxpayers because it falls only four months after the June payment, not three like other quarters.

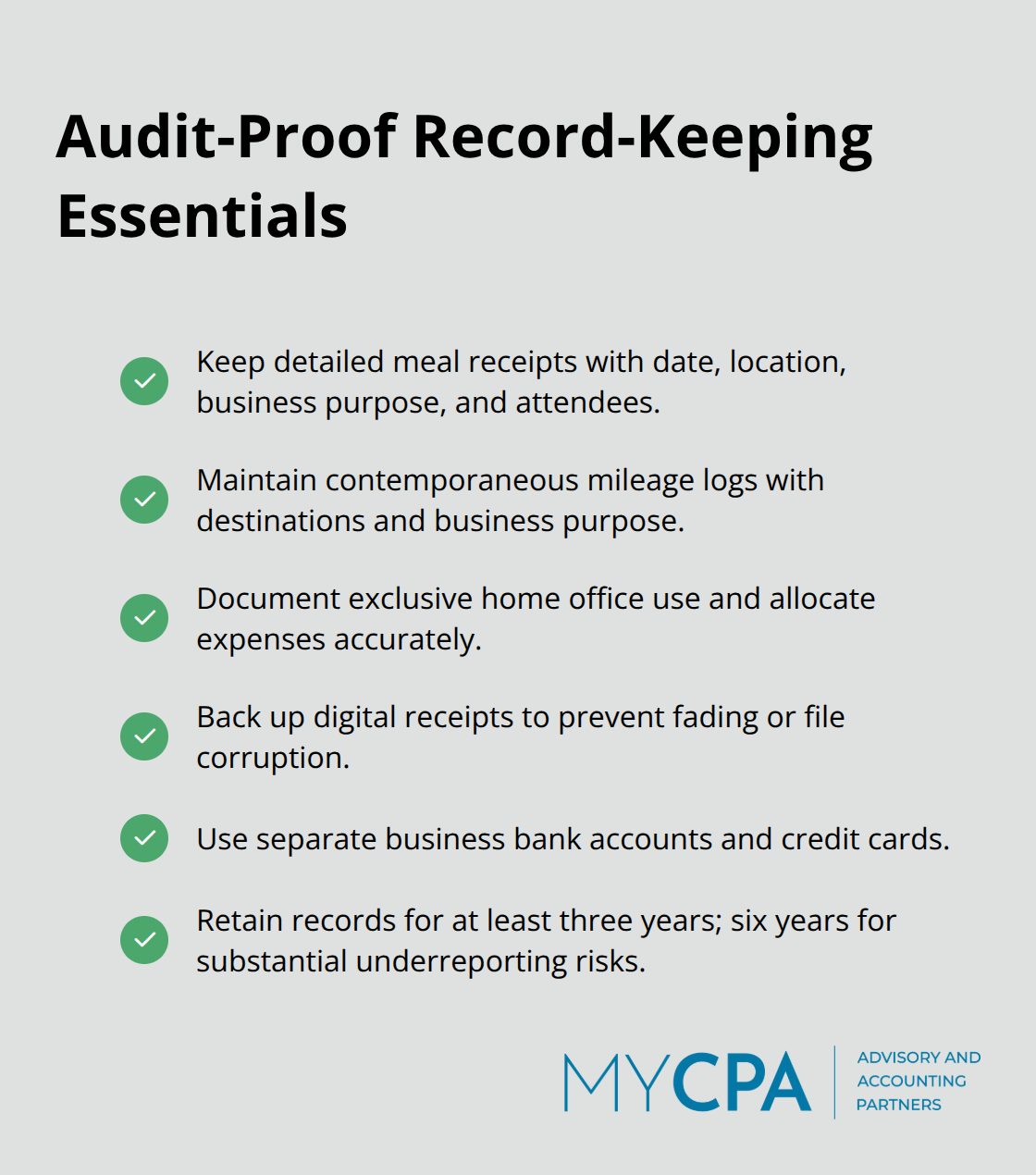

The IRS audit rate jumps to 2.4% for taxpayers who claim business deductions without proper documentation. Reconstructed records during audits typically result in 40-60% disallowance rates because the IRS requires contemporaneous documentation, not retroactive summaries.

Business meal deductions demand receipts that show date, location, business purpose, and attendees. Vehicle deduction claims need mileage logs with specific business destinations, not estimated percentages. Home office deductions require exclusive business use documentation and detailed expense allocation between personal and business portions.

Multi-state taxpayers face conflicting residency rules that create double taxation without proper planning. States like California pursue residents aggressively and claim tax obligations even after relocation if significant ties remain. New York’s 184-day rule counts partial days as full days for residency determination (which catches taxpayers who underestimate their presence).

State-specific deduction limits vary dramatically: New Jersey caps property tax deductions at $10,000 while Pennsylvania allows unlimited deductions. Reciprocal agreements between states reduce filing requirements, but only 16 states participate in these programs, which leaves most taxpayers with multiple filing obligations.

Poor record organization costs taxpayers thousands in missed deductions and penalty fees. The IRS requires taxpayers to maintain records for three years after filing, but audit protection extends to six years for substantial underreporting cases. Digital receipts fade or become corrupted without proper backup systems.

Business owners who mix personal and business expenses face automatic red flags during IRS reviews. Separate bank accounts and credit cards provide clear audit trails that protect legitimate deductions (and reduce examination time significantly).

Effective income tax planning requires a systematic approach that combines retirement account maximization, strategic investment timing, and proper business structure optimization. The techniques outlined above can reduce your tax burden by 15-30% annually when you implement them correctly. Professional guidance becomes indispensable when you navigate complex tax regulations and avoid costly mistakes.

Self-prepared returns miss an average of $1,200 in potential savings, while professional oversight prevents quarterly payment penalties and documentation failures that trigger audits. We at My CPA Advisory and Accounting Partners specialize in comprehensive tax services that minimize tax liabilities while we enhance your overall financial health. Our expertise covers tax services, accounting, QuickBooks management, and business advisory consulting to provide complete financial solutions.

Start your tax optimization plan immediately. Review your current retirement contributions, assess potential tax-loss harvesting opportunities, and organize your documentation systems. The most successful taxpayers begin their income tax planning in January (not December), which gives them full-year flexibility to execute sophisticated strategies that maximize savings and build long-term wealth.

Privacy Policy | Terms & Conditions | Powered by Cajabra