Tax planning for high-salaried employees can significantly impact your financial future. As income rises, so does the complexity of managing your tax obligations effectively.

At My CPA Advisory and Accounting Partners, we understand the unique challenges faced by high earners in optimizing their tax strategies. This guide will explore key tactics to help you minimize your tax burden and maximize your wealth-building potential.

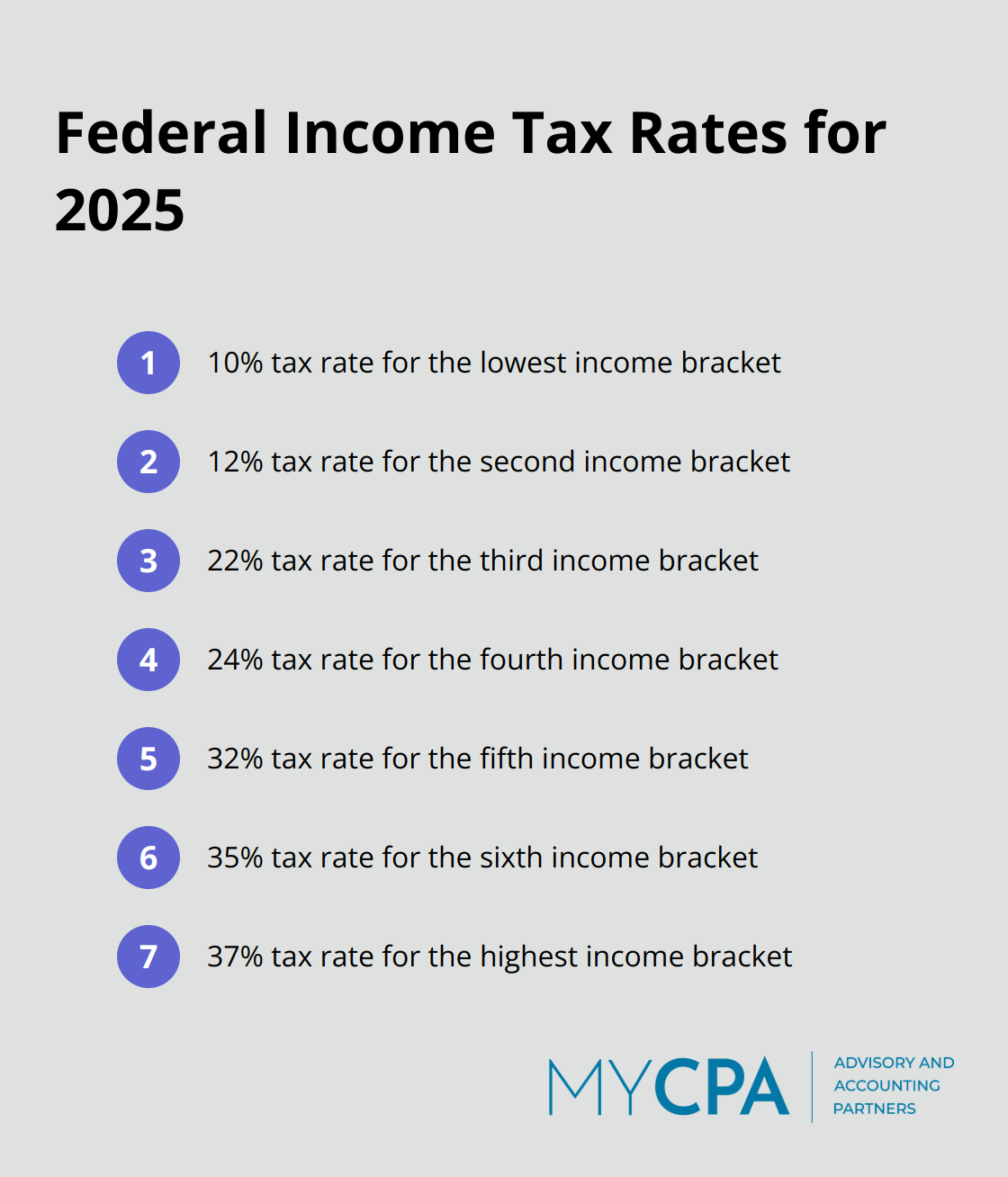

The U.S. employs a progressive tax system that taxes income at different rates as it increases. This system significantly affects your overall tax liability and financial planning strategies. In 2025, the federal income tax system consists of seven tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. As your income rises, it’s taxed at progressively higher rates.

High-income earners fall into the top three brackets for 2025. For single filers, taxable income over $197,300 enters the 32% bracket, over $518,400 falls into the 35% bracket, and income exceeding $626,350 is taxed at 37%. Married couples filing jointly face higher thresholds: $394,600 for the 32% bracket, $622,050 for 35%, and $751,600 for 37%.

Your marginal tax rate is the rate applied to your last dollar of income. This rate plays a critical role in tax planning because it affects the value of deductions and credits. For example, a $1,000 deduction saves $370 in taxes for someone in the 37% bracket, while the same deduction only saves $240 for someone in the 24% bracket.

The value of tax deductions and credits increases as your marginal tax rate rises. High-income earners (those in the top tax brackets) benefit more from deductions in absolute dollar terms. This makes strategies like charitable giving and mortgage interest deductions particularly attractive for those in higher tax brackets.

Tax bracket management involves careful planning to control when and how you recognize income. Strategies may include:

These strategies can potentially lower your taxable income and keep you in a lower tax bracket.

Understanding tax brackets and marginal rates forms the foundation of effective tax planning. This knowledge allows you to make informed decisions about income timing, deductions, and investment strategies. In the next section, we’ll explore how to maximize pre-tax contributions to further reduce your taxable income.

Pre-tax contributions offer high-salaried employees powerful tools to reduce their taxable income. This chapter explores the most effective pre-tax contribution options available to you.

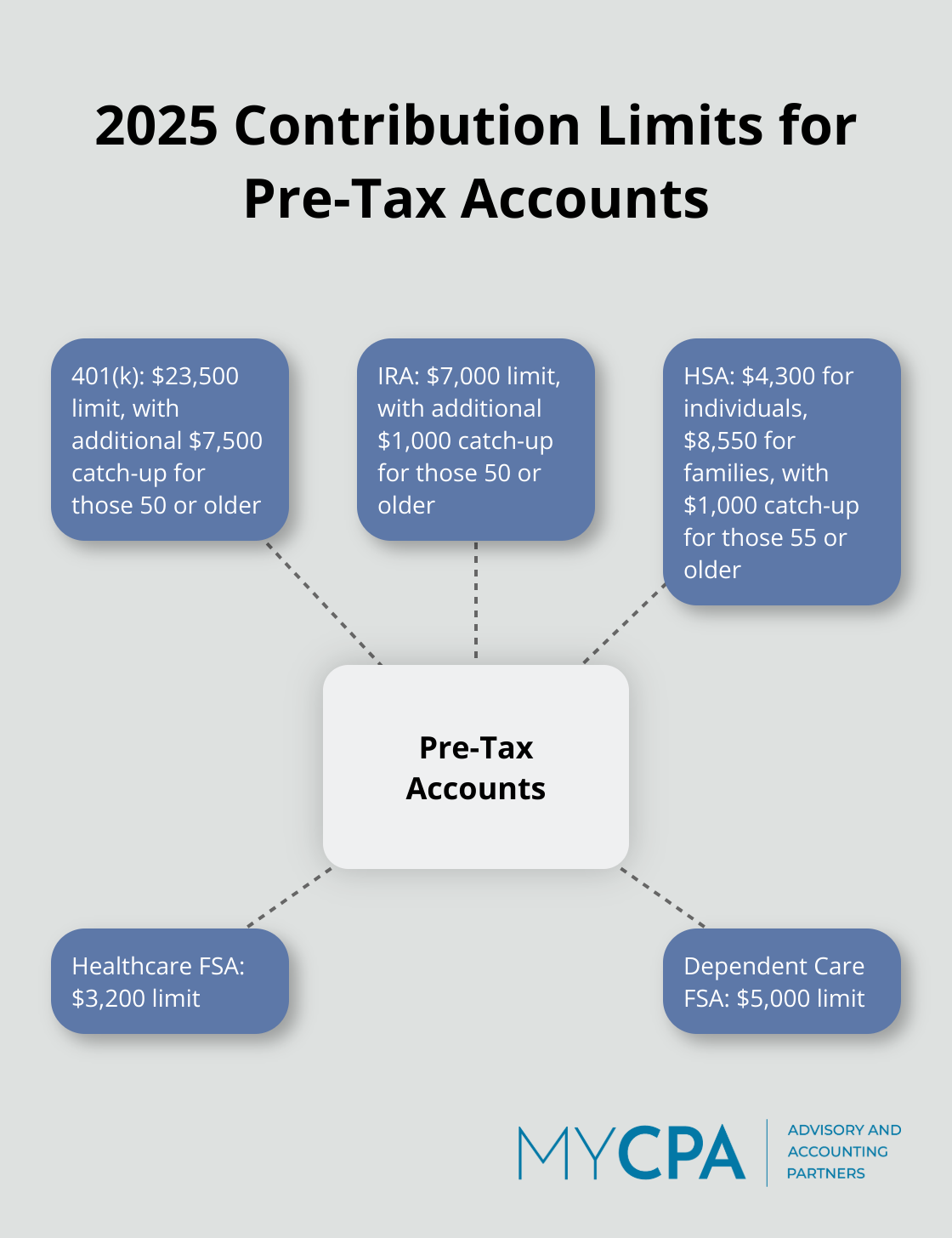

The 2025 contribution limit for 401(k) plans stands at $23,500. Employees aged 50 or older can make an additional catch-up contribution of $7,500. This means you could potentially reduce your taxable income by up to $31,000 through 401(k) contributions alone.

We recommend contributing at least enough to receive the full employer match (if offered). This strategy not only reduces your taxable income but also secures additional funds for your retirement.

For those eligible, traditional IRA contributions can further reduce taxable income. In 2025, you can contribute up to $7,000 to an IRA, with an additional $1,000 catch-up contribution for those 50 or older.

HSAs provide a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For 2025, individuals can contribute up to $4,300, while families can contribute up to $8,550. Those 55 and older can make an additional $1,000 catch-up contribution.

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, making them an excellent long-term savings vehicle for healthcare expenses. Some employers even offer HSA contribution matches, which further enhances their value.

FSAs allow you to set aside pre-tax dollars for healthcare and dependent care expenses. For 2025, you can contribute up to $3,200 to a healthcare FSA and up to $5,000 to a dependent care FSA.

While FSAs typically have a “use it or lose it” policy, some plans allow a grace period or a limited rollover. Try to estimate your expenses carefully to maximize the tax benefits without risking unused funds.

The key to effective pre-tax contribution strategies lies in balancing current tax savings with long-term financial goals. Consider your overall financial picture, including retirement plans, healthcare needs, and family obligations, when deciding how to allocate your pre-tax contributions.

Pre-tax contributions serve as a powerful tool for reducing your taxable income, but they represent just one aspect of comprehensive tax planning. The next chapter will explore additional strategies to further optimize your tax situation through deductions and credits.

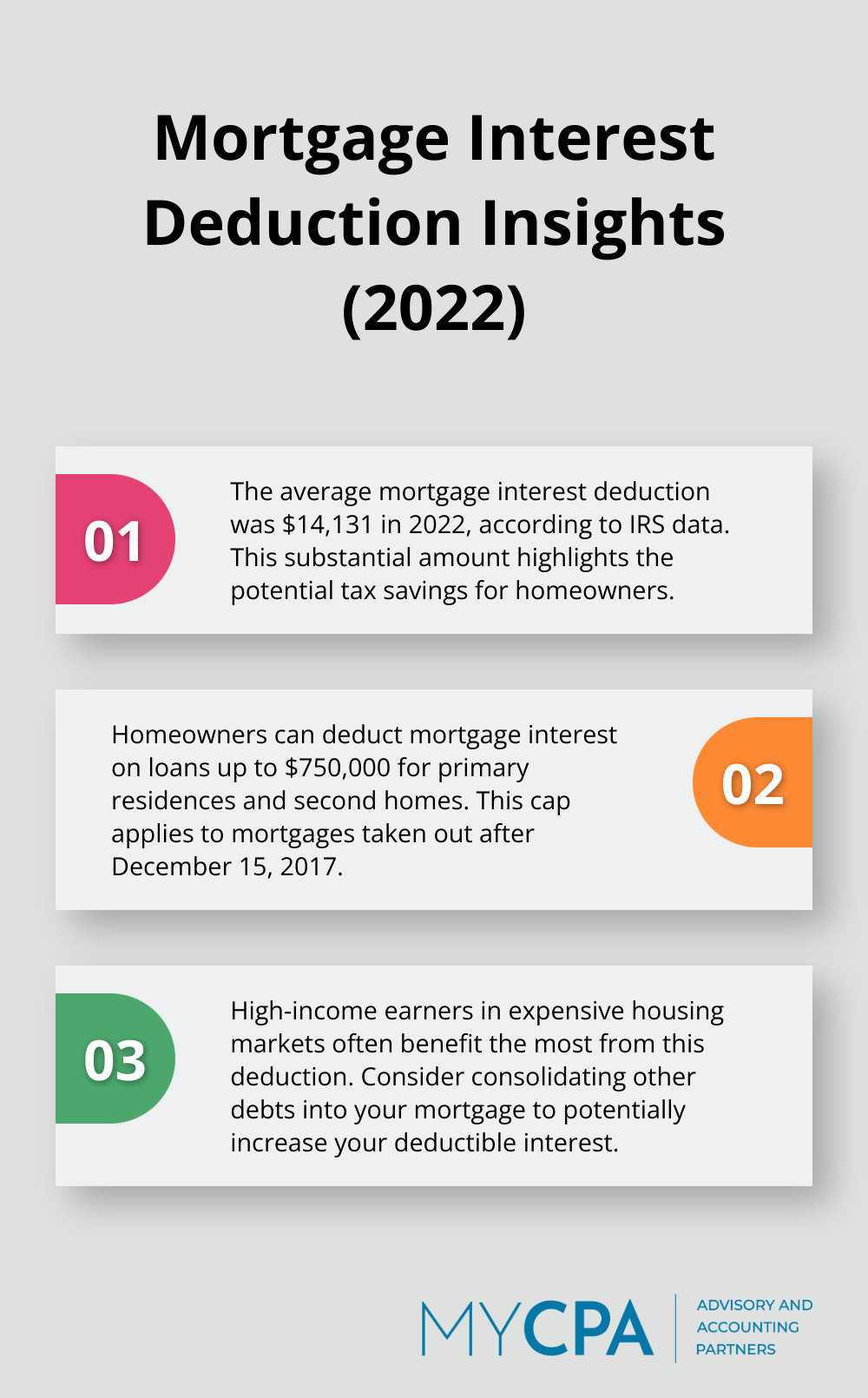

Homeowners can deduct mortgage interest on loans up to $750,000 for primary residences and second homes. This deduction benefits high-income earners in expensive housing markets. In 2022, the average mortgage interest deduction was $14,131 (according to IRS data). To maximize this benefit, consider consolidating other debts into your mortgage, as the interest may become deductible.

Charitable giving supports causes and provides tax benefits. The IRS allows deductions for donations to qualified organizations up to 60% of your adjusted gross income for cash contributions. For qualified farmers or ranchers, there’s an exception to the “for the use of” contribution limit based on 50% of AGI. High-income earners should consider donating appreciated stocks or real estate to maximize tax savings.

High-income earners can benefit from education tax credits. The Lifetime Learning Credit offers up to $2,000 per tax return for qualified education expenses. However, you cannot claim this credit if you are single with a MAGI above $90,000 or married filing jointly with a MAGI above $180,000. This credit holds value for those pursuing graduate degrees or professional development courses.

The SALT deduction allows you to deduct state and local taxes (including property taxes) from your federal taxable income. The IRS caps this deduction at $10,000 for both single filers and married couples filing jointly. To maximize this deduction, try timing your property tax payments. If you’re close to the $10,000 limit, you might pay your property taxes for the following year in December to claim the deduction in the current tax year.

Tax laws change frequently, and optimal strategies depend on your specific financial situation. Work with a tax professional to develop a personalized strategy that maximizes your deductions and credits while ensuring compliance with current tax laws. My CPA Advisory and Accounting Partners offers expertise in this area, helping clients navigate complex tax situations and identify opportunities for significant savings.

Tax planning for high-salaried employees requires a comprehensive approach that combines understanding tax brackets, maximizing pre-tax contributions, and leveraging deductions and credits. These strategies can significantly reduce your tax burden and enhance your overall financial well-being. Effective tax planning involves long-term strategizing to align your financial decisions with your career trajectory and life goals.

As your income grows, so does the complexity of your tax situation, making it essential to stay informed about changes in tax laws and regulations. Every individual’s financial situation is unique, and what works for one high-income earner may not be the optimal solution for another. This is where professional tax advice becomes invaluable.

At My CPA Advisory and Accounting Partners, we specialize in providing tailored financial services for high-income individuals. Our team of experts can help you navigate the complexities of tax planning (ensuring you make informed decisions that align with your financial goals). We offer personalized tax strategies, accounting services, and business advisory to help you minimize tax liabilities and maximize your financial health.

Privacy Policy | Terms & Conditions | Powered by Cajabra