Choosing the right small business consultant can make or break your company’s growth trajectory. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how expert guidance can transform struggling businesses into thriving enterprises.

Small business consulting is a powerful tool, but finding the perfect match for your unique needs requires careful consideration. This guide will walk you through the essential steps to select a consultant who can propel your business forward.

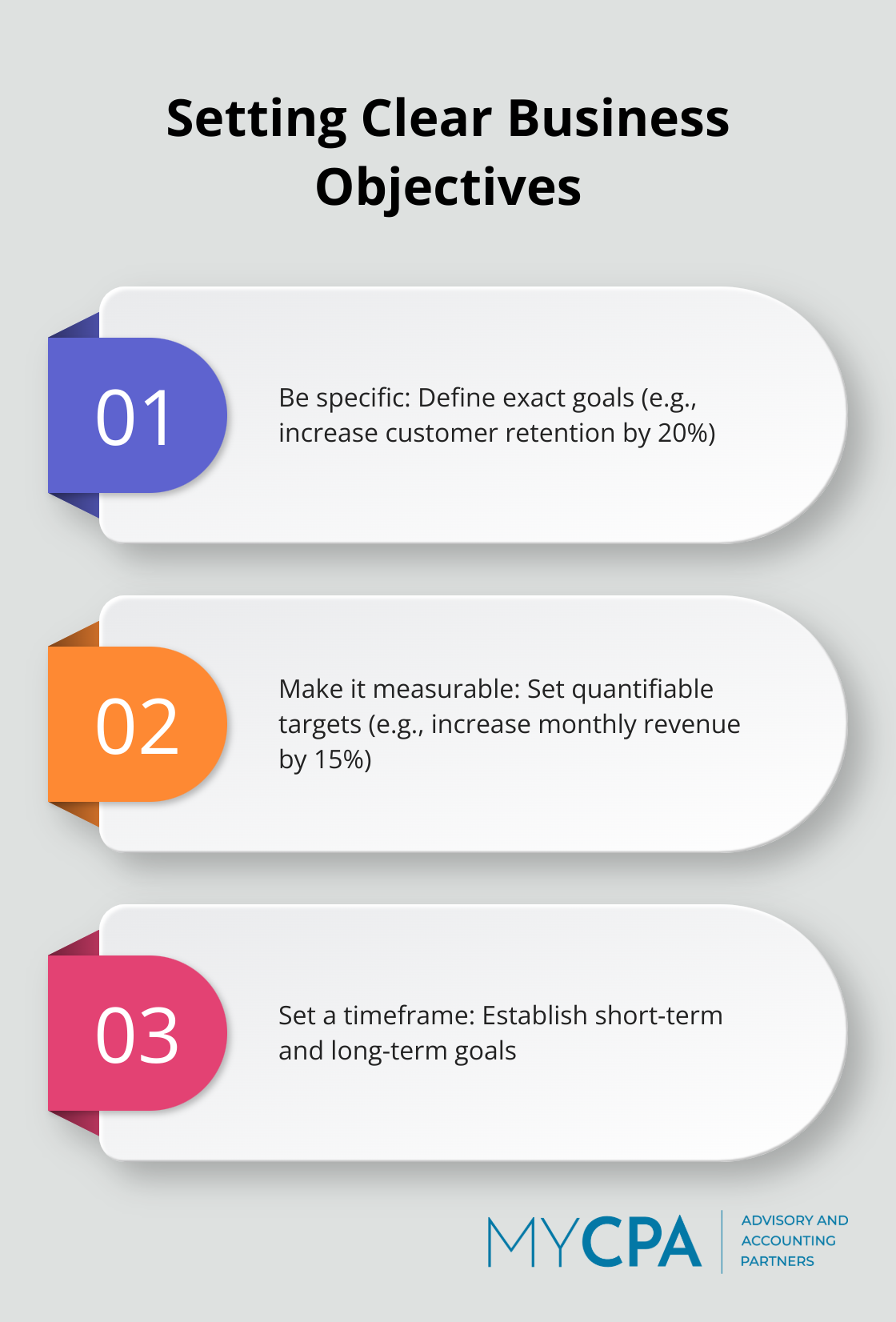

The first step in finding the right small business consultant is to pinpoint your business needs. List the specific challenges your business faces. Don’t settle for vague statements like “we need to improve sales.” Instead, specify “we need to increase our customer retention rate by 20%.” This precision will help you find a consultant who can address your exact needs.

After identifying your challenges, establish clear, measurable goals. Short-term objectives might include increasing monthly revenue by 15% or reducing operational costs by 10%. Long-term goals could involve expanding into new markets or doubling your customer base within two years. These concrete targets will guide your search for the right consultant.

Consulting fees vary widely based on experience and project scope. When setting your budget, consider the potential return on investment.

Consider your timeline for achieving your objectives. Do you need immediate results, or are you planning for long-term growth? Some consultants specialize in quick turnarounds, while others excel at developing and implementing comprehensive strategies over time. Your timeline will influence the type of consultant you should seek.

Take stock of your internal resources. Do you have team members who can dedicate time to work with a consultant? Will you need additional support to implement the consultant’s recommendations? Understanding your internal capabilities will help you choose a consultant who can complement your existing resources and fill any gaps.

As you define your business needs, you’ll create a clear picture of the ideal consultant for your situation. This clarity will prove invaluable as you move on to the next step: identifying the key qualities to look for in a small business consultant.

A consultant with deep knowledge of your industry can provide immediate value. They understand the nuances, challenges, and opportunities specific to your field. For example, a consultant who has worked with numerous retail businesses will likely have insights into inventory management, customer retention strategies, and point-of-sale systems that a generalist might lack.

Top-tier consultants base their recommendations on solid data and analytics. They should interpret complex financial statements, market trends, and operational metrics to provide actionable insights. Data-driven decision making improves understanding through analytics that are more proactive, predictive, and able to see patterns in increasingly complex sources.

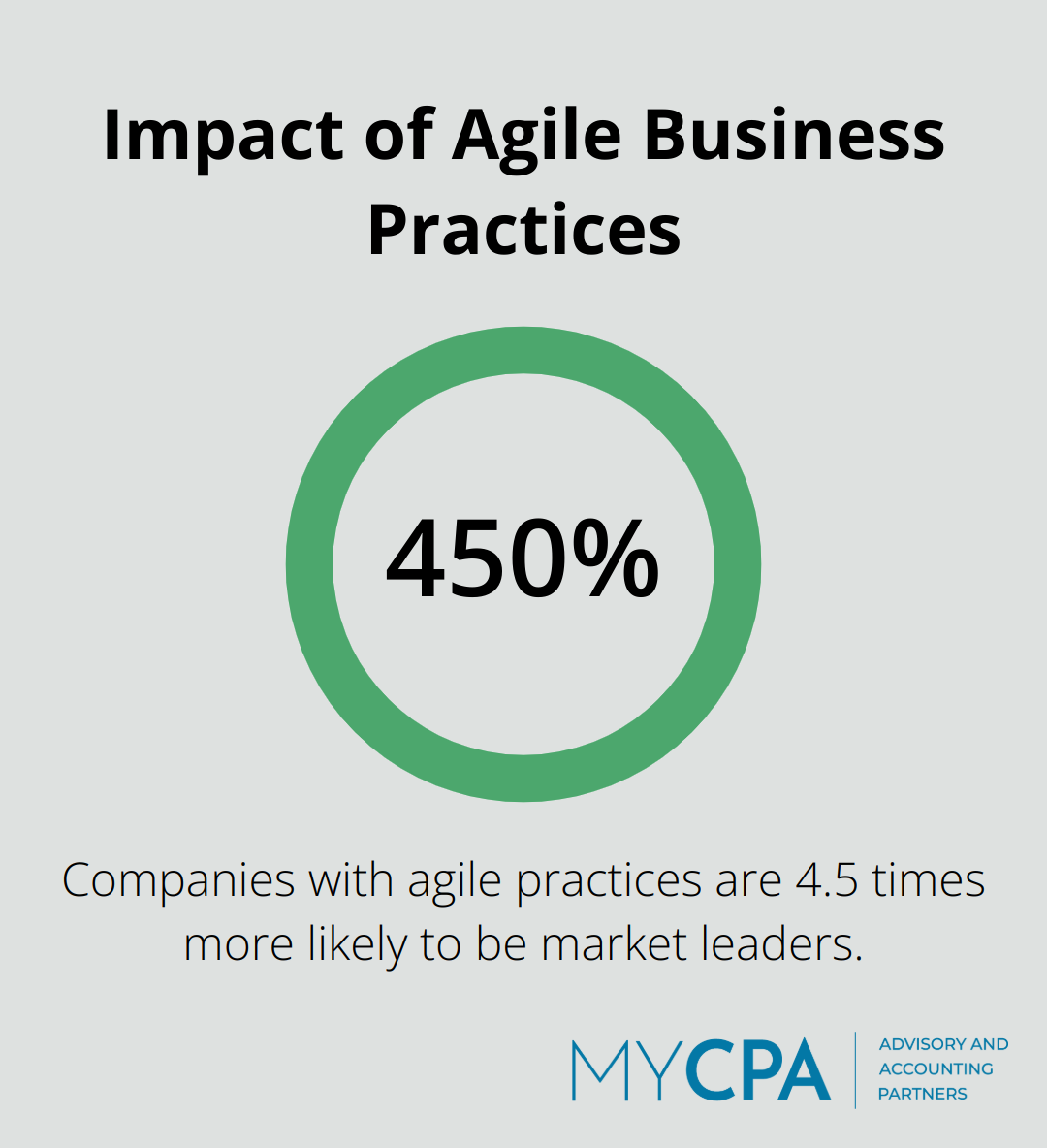

The business landscape constantly evolves, and a great consultant must adapt their strategies accordingly. Look for someone who stays current with industry trends and proposes innovative solutions. A survey by McKinsey found that companies with agile business practices are 4.5 times more likely to be market leaders.

Past performance often indicates future success. Ask potential consultants for case studies or references from businesses similar to yours. A consultant who has helped a company in your industry increase revenue by 30% (or cut operational costs by 20%) is likely to bring valuable insights to your business.

The ability to articulate complex ideas clearly is essential. Your consultant should explain their strategies in a way that resonates with you and your team. They should also listen well, taking the time to understand your unique business challenges before proposing solutions.

A great consultant doesn’t just solve immediate problems; they help you plan for the future. They should see the big picture and develop strategies that align with your long-term business goals. A Harvard Business Review study found that companies with clearly defined and well-communicated strategies are 2.5 times more likely to be top performers in their industries.

While often overlooked, the consultant’s ability to mesh with your company culture is vital for a successful engagement. They should work effectively with your team and understand your company’s values and work style.

Now that you understand what makes a great small business consultant, it’s time to learn how to evaluate potential candidates effectively. The next section will guide you through the process of assessing consultants to ensure you find the perfect match for your business finances needs.

Start your evaluation by examining the consultant’s professional background. Look for relevant certifications (such as Certified Management Consultant) or industry-specific qualifications. While educational background matters, practical experience often outweighs academic credentials. To become a Certified Management Consultant, one typically needs at least three years of full-time consulting experience and five satisfactory client evaluations.

Review the consultant’s work history thoroughly. Consider how long they’ve been in business and the types of companies they’ve worked with. Ideally, they should have experience with businesses similar to yours in size and industry. For instance, a tech startup might not benefit as much from a consultant who has primarily worked with established manufacturing firms.

Request and carefully review case studies from the consultant. These should detail specific challenges they’ve addressed and quantifiable results they’ve achieved. A marketing consultant, for example, should demonstrate how they’ve increased lead generation or improved conversion rates for previous clients.

Don’t rely solely on the consultant’s word. Contact their past clients directly. Ask about the consultant’s strengths, weaknesses, and overall impact on the business. 84% of B2B decision makers start the buying process with a referral.

After narrowing down your options, conduct thorough interviews. Prepare specific questions about your business challenges and ask how they would approach these issues. Pay attention to their listening skills and how well they understand your unique situation.

During the interview, assess their communication style. A great consultant should explain complex concepts in simple terms. They should also ask probing questions about your business, showing genuine interest and insight.

Understanding a consultant’s methodology is essential. Ask about their structured approach to problem-solving and how they gather and analyze data. A consultant using outdated methods or relying solely on intuition might not deliver the results you need.

Inquire about their process for implementing recommendations. The best consultants don’t just provide advice; they help with execution. Consider their flexibility as well. While a structured approach is important, the consultant should adapt their methods to your specific needs and company culture.

Assess how well the consultant aligns with your company’s values and work style. A good cultural fit can significantly impact the success of the consulting engagement. Try to gauge their ability to work effectively with your team and understand your company’s unique dynamics.

When evaluating consultants for specific areas like QuickBooks consulting services, ensure they have the necessary expertise to optimize your business finances effectively.

Selecting the right small business consultant requires careful consideration and thorough research. The process demands a clear definition of your business needs, identification of key qualities in a consultant, and rigorous evaluation of potential candidates. This approach sets the stage for a productive and transformative partnership that can significantly impact your company’s success.

The ideal consultant for your business possesses the necessary expertise and aligns with your company’s culture and values. They demonstrate a proven track record of success, offer data-driven insights, and communicate effectively with your team. A thorough selection process includes in-depth interviews, reference checks, and case study reviews (this investment of time can save considerable resources in the long run).

Small business consulting can propel your company forward with the right guidance and expertise. My CPA Advisory and Accounting Partners offers comprehensive financial services, including tax optimization, accounting, and business advisory. Our experienced professionals can help you navigate financial management complexities and achieve your business goals.

Privacy Policy | Terms & Conditions | Powered by Cajabra