Small businesses lose an average of $40,000 annually due to poor financial management, according to recent QuickBooks research. The right accounting partner can prevent these costly mistakes.

We at My CPA Advisory and Accounting Partners see too many business owners struggle with choosing the best accounting services for small business needs. The wrong choice leads to compliance issues, missed tax deductions, and financial chaos that stunts growth.

Small businesses require three core accounting services that directly impact their bottom line and compliance status. Bookkeeping forms the foundation, with cloud-based software like QuickBooks or Xero for daily transaction recording. This service tracks every dollar that flows in and out, maintains accounts receivable and payable, and reconciles bank statements. The National Federation of Independent Business reports that businesses with accurate daily bookkeeping are 40% more likely to secure funding when needed.

Professional bookkeepers handle transaction categorization, invoice management, and expense tracking that business owners often struggle to maintain consistently. They process vendor payments, customer receipts, and payroll entries while maintaining detailed audit trails. Modern bookkeeping services integrate with banking systems to automatically import transactions, reducing manual data entry errors by up to 85% according to Intuit research.

Tax services extend beyond annual filing to year-round planning that saves substantial money. The IRS estimates that small businesses miss an average of $3,000 in deductions annually due to poor record-keeping and lack of strategic planning. Professional tax preparers identify business meal deductions, home office expenses, and equipment depreciation that business owners typically overlook. Strategic tax planning involves quarterly estimated payments, entity structure optimization, and timing income and expenses to minimize tax burden.

Financial reporting transforms raw data into actionable insights through profit and loss statements, balance sheets, and cash flow projections. These reports reveal profit margins by product line, seasonal trends, and cash flow patterns that inform pricing decisions and expansion timing (critical for growth planning). Real-time financial analysis helps identify problems before they become catastrophic, such as detecting declining gross margins or excessive inventory levels that tie up working capital.

The quality of these services varies dramatically between providers, which makes the selection process vital for your business success.

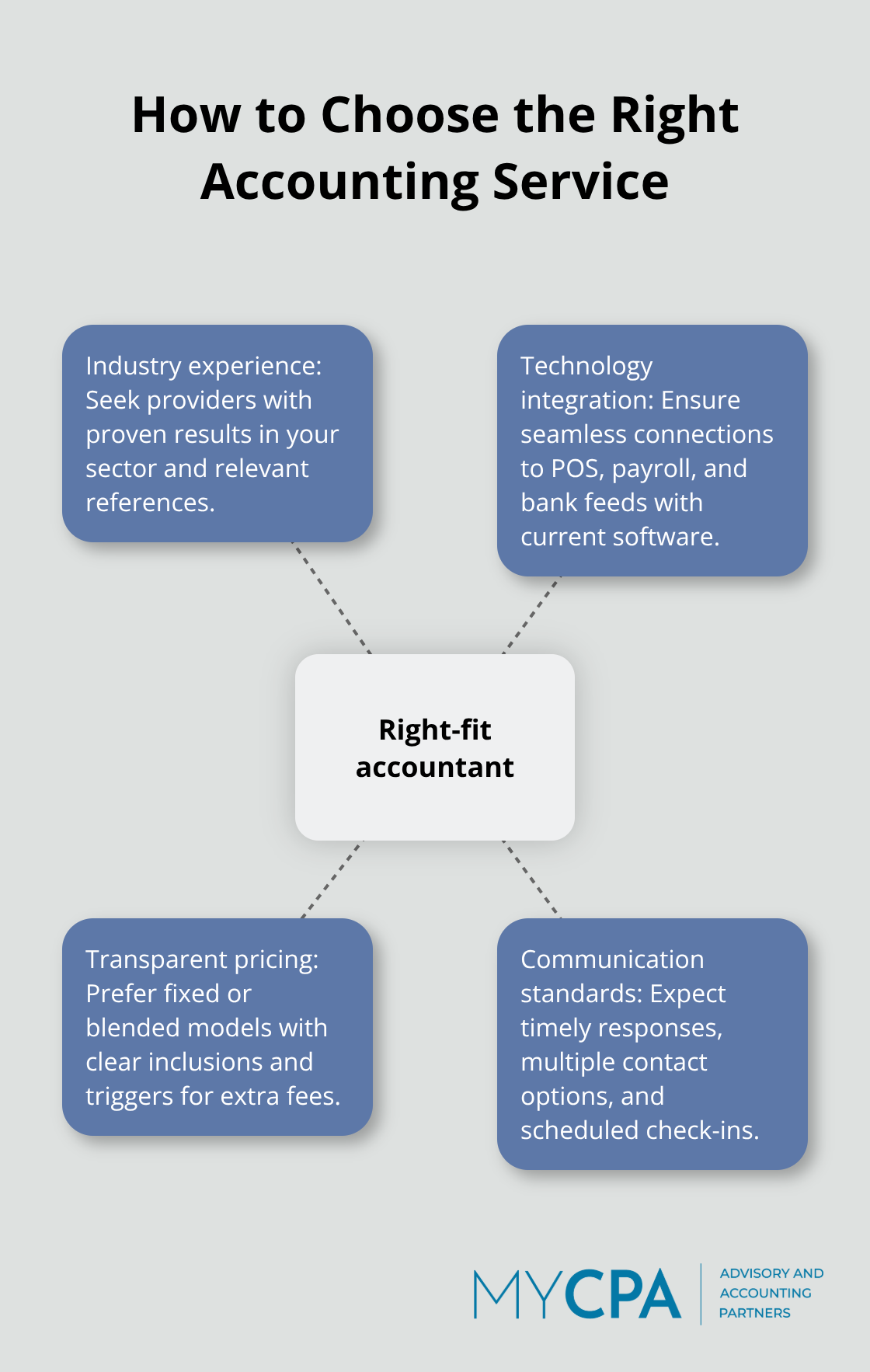

Industry experience separates competent accountants from exceptional ones. Businesses that work with industry-specific accountants often report better financial outcomes compared to those that use generalist services. Restaurant owners need accountants who understand inventory methods and tip compliance, while construction companies require expertise in job cost allocation and equipment depreciation schedules. Manufacturing businesses benefit from accountants familiar with work-in-process inventory and cost allocation methods. Ask potential providers for client references in your specific industry and request examples of challenges they solved for similar businesses.

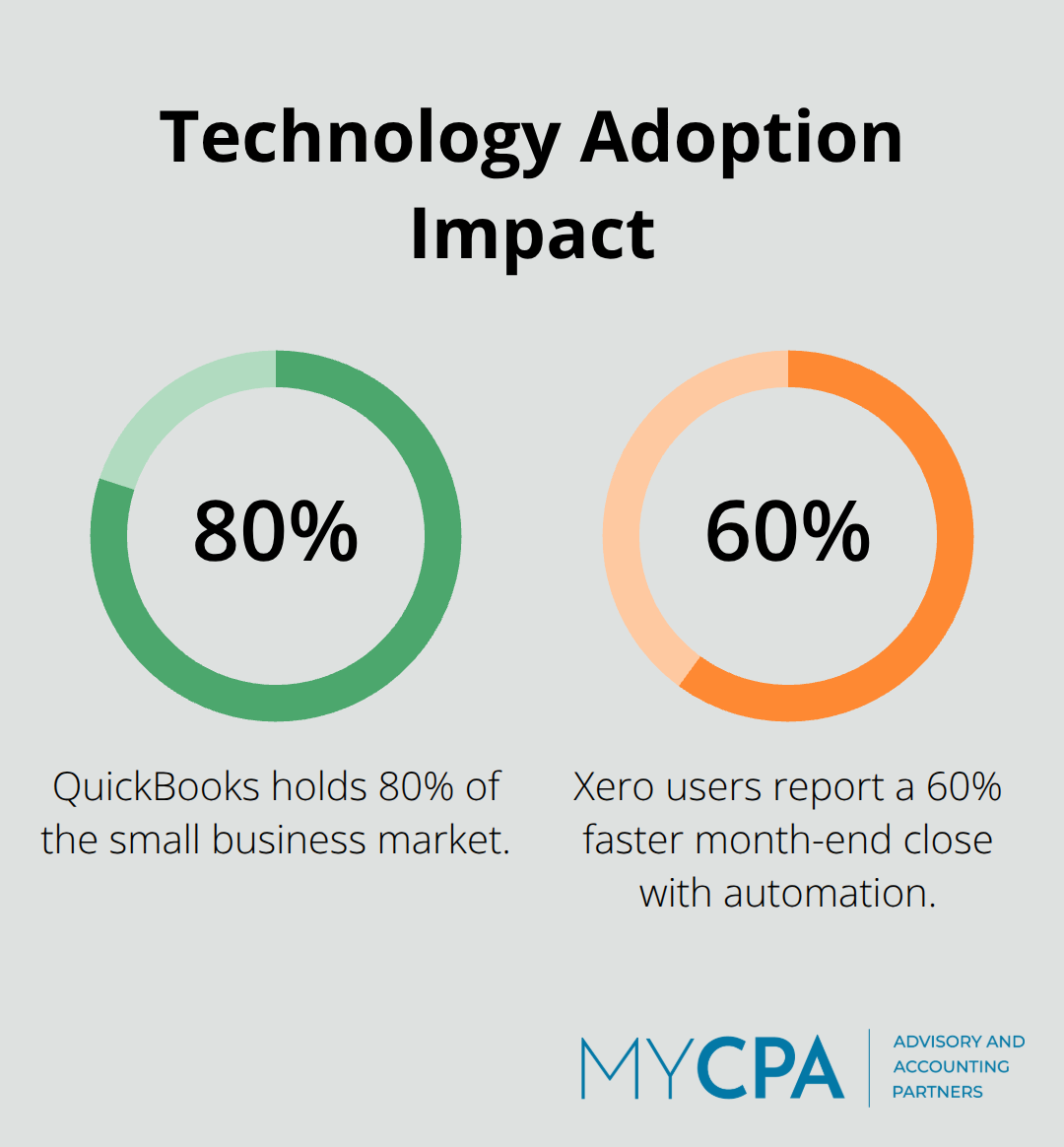

Modern accounting demands seamless software integration across multiple platforms. QuickBooks dominates 80% of the small business market, but your accountant must also integrate with your point-of-sale system, payroll platform, and bank feeds. Xero users report 60% faster month-end close when their accountant uses advanced automation features.

Cloud-based systems allow real-time collaboration and eliminate the email shuffle of spreadsheets that creates version control nightmares. Verify that your prospective accountant uses current software versions and offers mobile access for urgent financial questions.

Hourly rates create unpredictable expenses that strain small business budgets. Fixed monthly packages that range from $300 to $800 provide cost certainty and encourage proactive communication rather than rushed consultations. Blended pricing works best for growth-stage businesses (it combines base bookkeeping fees with project rates for tax preparation and advisory services). Avoid accountants who quote unrealistically low prices, as inadequate professional preparation can lead to audit complications. Request detailed pricing breakdowns that specify exactly which services are included and which trigger additional fees. Professional accounting services provide accurate financial reporting, minimize tax liabilities, and offer valuable insights for decision-making.

Response time expectations matter more than most business owners realize. Professional accounting firms establish clear communication protocols and respond to routine questions within 24 hours during normal business periods. Peak tax season may extend response times, but your accountant should communicate these delays proactively. Look for firms that offer multiple contact methods (email, phone, and secure client portals) and schedule regular check-ins rather than wait for problems to surface. The best accounting relationships involve monthly or quarterly reviews that keep your business on track financially.

However, even experienced accountants with great technology and fair pricing can derail your business if they exhibit certain warning signs that smart business owners learn to recognize early.

Professional credentials matter more than charismatic sales pitches when your business compliance depends on expert guidance. While unlicensed practitioners contribute to small business tax problems, many business owners overlook basic credential verification. Certified Public Accountants must complete 150 credit hours of education and pass rigorous examinations, while Enrolled Agents demonstrate specialized tax expertise through IRS tests. Request license numbers and verify active status through state board websites before you sign any contracts. Accountants who deflect credential questions or provide vague answers about their qualifications often lack proper training to handle complex business situations.

Response delays during tax season reveal how accountants prioritize client relationships under pressure. Professional firms establish clear communication timelines and stick to them, while unreliable providers disappear when you need them most. Test responsiveness during initial consultations by asking specific technical questions about your industry or business structure. Accountants who provide generic responses or schedule follow-up calls instead of answering directly often lack the expertise they claim. The National Association of Tax Professionals reports that 60% of small business penalties result from missed deadlines caused by poor accountant communication. Firms that use outdated email systems or refuse to adopt secure client portals typically struggle with modern compliance requirements.

Accountants who promise identical solutions for restaurants, construction companies, and retail businesses demonstrate dangerous inexperience with sector-specific requirements. Manufacturing businesses need cost accounting expertise that differs completely from service company needs, yet many generalist firms apply cookie-cutter approaches that miss important deductions and compliance requirements. Ask potential accountants to explain specific challenges in your industry and describe recent client situations they resolved. Vague responses about helping all types of businesses indicate insufficient specialization (this leads to missed opportunities and regulatory mistakes that cost money).

Accountants who guarantee specific tax savings percentages or promise to eliminate your tax burden completely operate outside professional standards. The IRS scrutinizes aggressive tax positions, and unrealistic promises often lead to audit flags and penalty assessments. Professional accountants discuss potential savings based on your specific situation rather than make blanket guarantees. They explain tax strategies clearly and warn about risks associated with aggressive positions that might trigger IRS attention.

Small businesses need the best accounting services for small business growth that combine industry expertise, modern technology, and clear pricing structures. Professional credentials like CPA certification and proven track records in your specific sector distinguish qualified providers from generic services that miss critical compliance requirements. The financial impact extends beyond basic bookkeeping to strategic growth support.

Businesses with professional accounting support report 40% better funding success rates and avoid the $40,000 average annual losses from poor financial management. Strategic tax planning, real-time financial reporting, and proactive advisory services drive growth while maintaining compliance with complex regulations. Start your search by requesting industry-specific references and testing communication responsiveness during initial consultations (verify credentials through state licensing boards and establish clear pricing expectations before contracts).

We at My CPA Advisory and Accounting Partners provide tailored financial services that combine tax efficiency with strategic business advisory support. Our expertise helps business owners achieve confident financial management through personalized approaches that address specific industry challenges and growth objectives.

Privacy Policy | Terms & Conditions | Powered by Cajabra