Professional services firms lose thousands of dollars annually through poor work in progress management. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how accounting for WIP in professional services can make or break your bottom line.

This guide walks you through the methods, best practices, and pitfalls that matter most to your firm’s financial health.

WIP represents the dollar value of work your firm has completed but hasn’t yet invoiced to clients. If you bill monthly but your projects run across multiple months, WIP sits on your balance sheet as an asset until you recognize it as revenue. This timing matters enormously because it separates the moment you earn revenue from the moment cash hits your account. Without accurate WIP accounting, your financial statements will misrepresent profitability in any given month, making it impossible to spot which engagements are truly profitable and which ones drain resources.

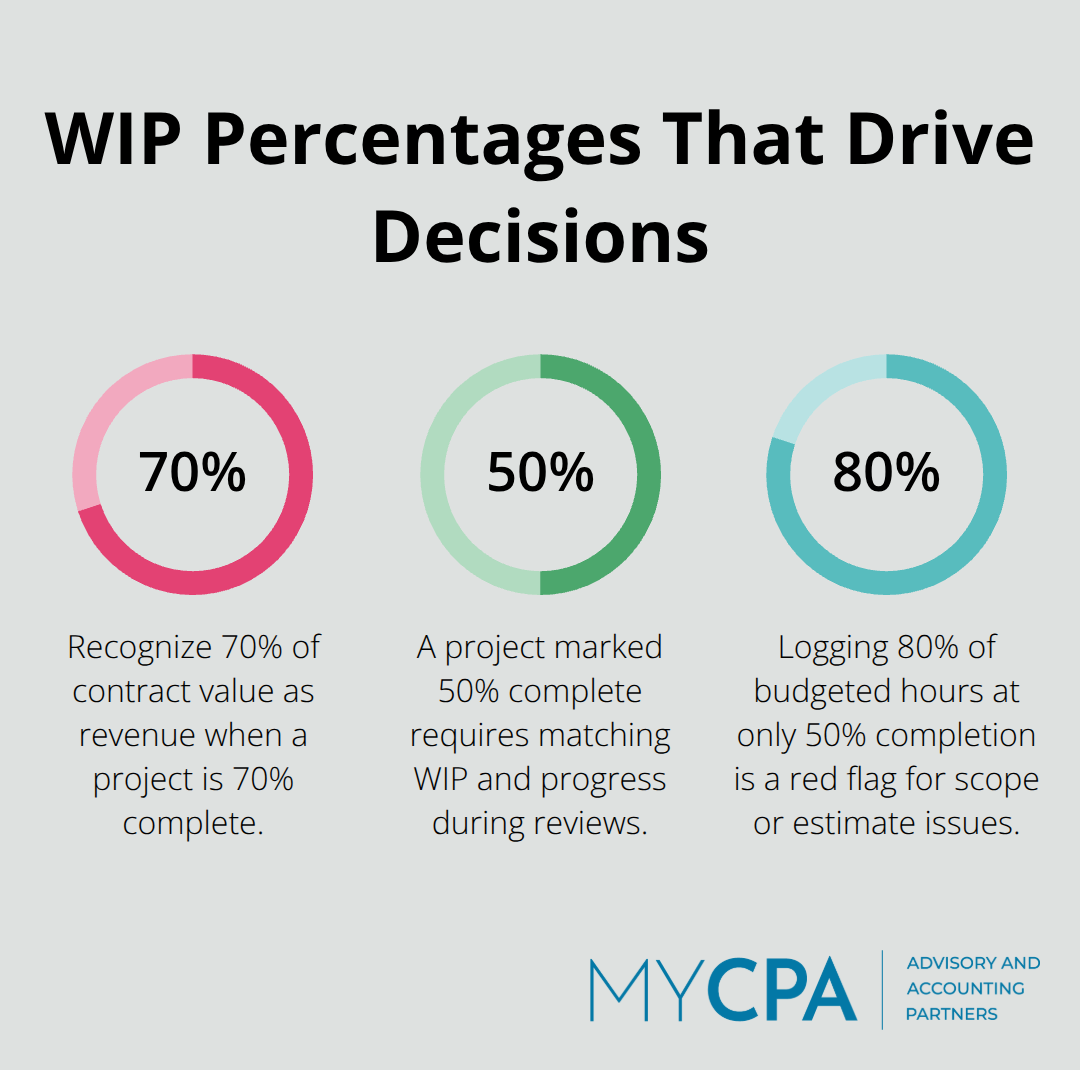

The percentage-of-completion method dominates professional services because it matches revenue to the actual work delivered each period. A project that is 70% complete gets 70% of its total contract value recognized as revenue, regardless of when you send the invoice. The completed-contract method exists as an alternative, but it defers all revenue until final delivery, which can hide losses on troubled projects for months and create misleading cash flow forecasts.

Time-and-material contracts add another layer of complexity because revenue recognition depends on hours worked and expenses incurred, which means your WIP grows incrementally as timesheets are logged and materials are purchased.

The real danger lies in inflated hour estimates or optimistic milestone assumptions that pad WIP without reflecting actual progress, leading to overstated earnings and eventual write-downs that damage credibility. Your assets look stronger than they are when WIP is overstated, and you miss early warning signs that projects are underperforming when it’s understated.

WIP appears as a current asset, and it lives alongside unbilled revenue, which tracks earnings for services delivered but not yet invoiced. These are distinct concepts that many firms conflate, causing confusion in cash flow forecasting. Deferred revenue, the flip side, represents cash you’ve already received before delivering the work, and it must be monitored separately to avoid recognizing it prematurely when scope changes occur.

Direct labor costs represent the largest variable in WIP calculations because billable hours and rates fluctuate based on staffing levels and project demands. A firm that fails to reconcile WIP monthly against time-tracking records and project status will accumulate errors that compound across quarters, making year-end adjustments painful and unreliable. Automating this reconciliation by integrating your time-tracking system directly with your accounting software allows billable hours to flow into WIP calculations without manual intervention. This integration cuts errors dramatically and provides real-time visibility into how much revenue you’ve earned but not yet billed. Without this discipline, you’re essentially flying blind on your largest asset and your most important source of profitability signals.

The methods you select and the systems you put in place to track them will determine whether your WIP accounting reveals true project performance or masks it. Next, we’ll examine the specific best practices that separate firms with tight financial control from those that struggle with WIP surprises.

The gap between knowing you need accurate WIP accounting and actually executing it consistently is where most professional services firms stumble. Time tracking that doesn’t connect to billing, WIP reviews that happen sporadically, and accounting software that doesn’t talk to your project management platform create expensive disconnects. Firms hemorrhage thousands monthly because their data sits in silos, forcing manual reconciliations that introduce errors and delay recognition of real profitability problems until it’s too late to adjust staffing or project scope.

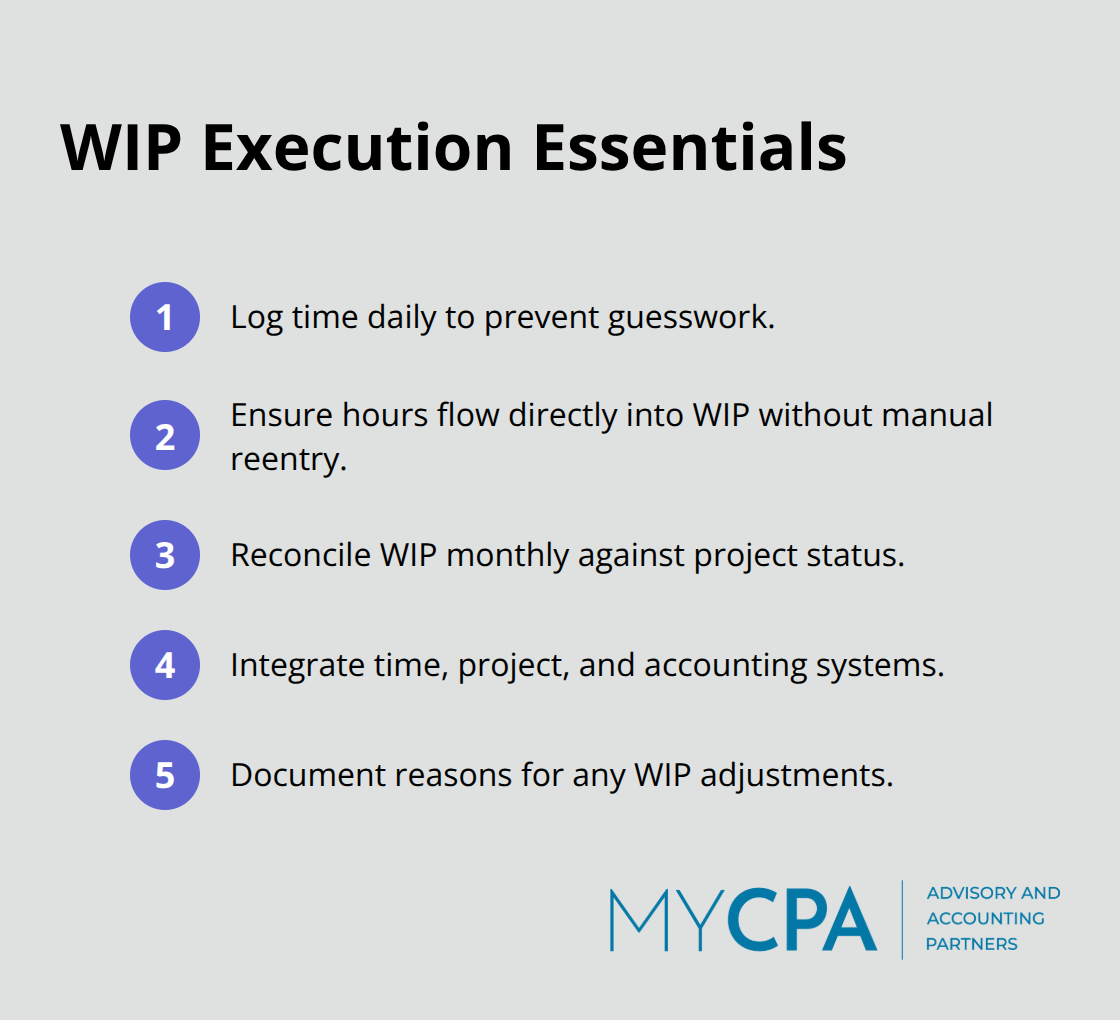

Your time-tracking system forms the foundation of WIP accuracy, and it must be non-negotiable. Every billable hour logged should flow directly into your WIP calculation without manual reentry. Your team records time daily, not weekly or monthly, because memory fades and estimates become guesses. Require timestamps and project codes so hours land in the right engagement from the moment they’re logged.

For small firms using spreadsheets temporarily, that approach works, but the moment you manage more than two simultaneous projects, spreadsheets become a liability. Switch to dedicated time-tracking tools that integrate with your accounting software. Tools like Toggl, Harvest, or Clockify cost under fifty dollars monthly per user and eliminate the manual work that introduces errors. The integration matters most. When hours flow directly from your time-tracking tool into your accounting platform, WIP calculations update automatically, and you spot billing lags or underutilized staff immediately rather than discovering them during year-end reconciliation.

Monthly WIP reviews must involve both your finance team and your project managers or delivery leads, not just accountants sitting alone with spreadsheets. During these reviews, compare recorded hours against project status and actual progress. If a project is marked 50% complete but your team has logged 80% of budgeted hours, that’s a red flag that either your initial estimate was too low or scope creep is eating your margin.

Adjust WIP entries monthly based on this reality, not on optimistic assumptions. If a project that should have been billed two weeks ago is still waiting for client sign-off, your WIP doesn’t move to revenue until that sign-off arrives. Similarly, if a client dispute delays billing, WIP sits on your balance sheet longer, and you need visibility into that timing so cash flow forecasts account for it. Document the rationale for any WIP adjustments so when partners or auditors ask why a number changed, you have a clear trail. This discipline also surfaces projects that are underwater early enough to renegotiate scope or staffing before losses mount.

Your project management system, time-tracking platform, and accounting software must share data automatically. If they don’t, you manually copy numbers between systems, and that’s where errors breed. Cloud-based ERPs like NetSuite, Deltek Vantagepoint, or even QuickBooks Online with integrated project accounting modules handle this synchronization. The cost is higher upfront, but the payoff is massive: real-time WIP dashboards that show revenue per consultant, project profitability trends, and cash conversion cycles without waiting for month-end close.

When data flows automatically, your team spends time analyzing WIP trends and making decisions rather than hunting down missing hours or reconciling conflicting numbers across three different systems. This integration also prevents the scenario where your project management tool shows a milestone complete, but your accounting software hasn’t recognized the corresponding revenue yet, creating confusion about what you’ve actually earned.

Most professional services firms treat WIP as a month-end accounting exercise, but that approach leaves money on the table. Real-time WIP dashboards reveal which engagements are profitable as work progresses, not after the fact. You can spot a project trending toward a loss weeks before completion and take corrective action. You can also identify which consultants or service lines generate the highest margins, allowing you to staff future projects more strategically. This visibility transforms WIP from a compliance requirement into a management tool that drives better decisions about pricing, staffing, and scope management.

The moment you stop questioning your WIP assumptions is the moment your financial statements become fiction. Professional services firms make three critical errors repeatedly, and each one costs them thousands in misstated earnings and delayed cash collection.

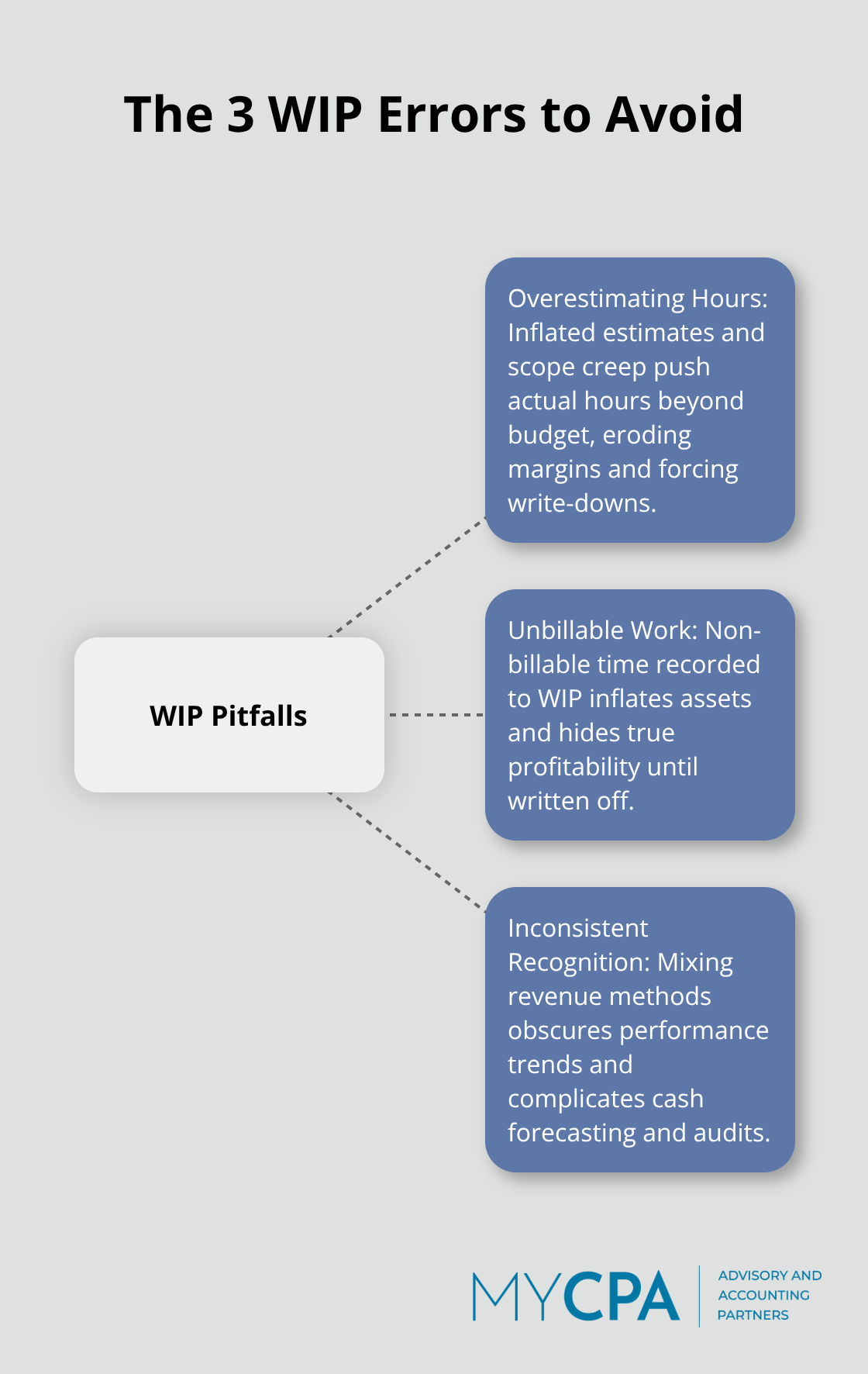

Your team estimates a client engagement will require 200 hours, so you record WIP based on that figure. Scope creep, client delays, and rework push actual hours to 280. Your WIP now reflects a revenue number that won’t materialize because your billing rate covers the original 200-hour estimate, not the inflated reality. The damage compounds when you fail to reconcile estimated hours against actual logged time monthly. Projects that should trigger immediate scope renegotiations instead sit on your books at inflated values until year-end reconciliation forces painful write-downs.

The fix demands brutal honesty during your monthly WIP reviews. If a project has consumed 70% of budgeted hours but is only 40% complete, adjust your WIP downward immediately and flag the engagement for scope discussion with the client. Don’t wait for completion to discover you’ve been underbilling for months. This monthly discipline prevents the scenario where your team realizes too late that a project will lose money no matter how much additional work they pour into it.

Your team spends time on internal training, process improvements, or client relationship management that doesn’t get billed. That work still consumes labor costs, but it has zero revenue attached. Many firms record these hours into WIP anyway, hoping to absorb them through billable projects later. They don’t. Unbillable hours accumulate, inflate your WIP asset, and create a false sense of profitability that evaporates when you finally acknowledge those costs belong in overhead, not WIP.

Write off non-billable WIP monthly, and track the percentage of your team’s time that doesn’t generate revenue. If that number exceeds 15% to 20%, your pricing strategy or resource allocation is broken. This metric reveals whether your firm is staffed appropriately for the work you actually bill. High unbillable percentages signal that you’re either underpricing engagements, overstaffing projects, or spending too much time on activities that don’t directly serve clients.

You use percentage-of-completion for one client and completed-contract for another, making it impossible to compare project profitability or forecast cash flow accurately. GAAP compliance requires consistent application unless contract structure genuinely demands different treatment, and you must document that rationale. Standardize on one primary method across your firm unless a contract explicitly requires an alternative, then create a written exception log explaining the deviation.

This consistency lets you spot real performance trends instead of chasing accounting noise. When every project uses the same revenue recognition approach, you can identify which service lines, client types, or engagement structures actually generate profit. You also simplify your month-end close process because your team applies the same logic to every engagement rather than making judgment calls about which method applies to which project. The result is faster closes, fewer audit questions, and better data for staffing and pricing decisions.

Accurate WIP accounting separates professional services firms that understand their true profitability from those operating without visibility into their largest asset. The three practices we’ve covered-ruthless time tracking, monthly WIP reviews with your delivery team, and integrated systems that eliminate manual data entry-form the foundation of financial control. Without them, your balance sheet misrepresents earnings, your cash flow forecasts miss reality, and your team makes staffing and pricing decisions based on incomplete information.

Firms that master accounting for WIP in professional services spot unprofitable engagements weeks before completion, adjust staffing based on real utilization data, and recognize revenue that actually reflects the work delivered. They also catch billing lags immediately rather than discovering them during year-end close, which accelerates cash conversion and improves working capital. More importantly, they build financial statements their leadership and auditors trust, eliminating the credibility damage that comes from large WIP write-downs or revenue restatements.

We at My CPA Advisory and Accounting Partners work with professional services firms to build WIP systems that actually work. Our accounting and business advisory services help you implement the discipline and tools that transform WIP from a compliance headache into a competitive advantage. If your current approach to accounting for WIP in professional services leaves you uncertain about project profitability or cash flow timing, contact us to discuss how we can strengthen your financial foundation.

Privacy Policy | Terms & Conditions | Powered by Cajabra