Small businesses face mounting pressure to manage finances efficiently while controlling costs. The advantages of outsourcing accounting services have become increasingly clear as companies seek professional expertise without the overhead of full-time staff.

We at My CPA Advisory and Accounting Partners see businesses transform their operations by partnering with external accounting professionals. This strategic move frees up resources and provides access to specialized knowledge that drives growth.

Outsourced accounting removes the need for full-time salaries. The median annual wage for bookkeeping, accounting, and auditing clerks was $49,210 in May 2024. Payroll taxes add 7.65%, health insurance averages $6,000 per employee, and workers’ compensation costs push total expenses to $70,000 to $95,000 per position. Small businesses typically save 40-60% when they outsource these functions to professional firms that spread costs across multiple clients.

Professional accounting software like QuickBooks Enterprise costs $1,340 annually per user, while advanced systems reach $15,000 yearly. New accounting staff need 3-6 months of training at reduced productivity, which costs businesses an additional $8,000 to $12,000 per hire. Outsourced accounting firms absorb these technology investments and maintain staff expertise without full cost transfer to individual clients. However, many small businesses remain cautious about outsourcing, with research showing that most prefer to keep business processes in-house.

Outsourced firms invest in enterprise-level software, automated workflows, and cloud-based systems that would cost small businesses $20,000 to $50,000 annually. These platforms include advanced reporting tools, real-time dashboards, and integration capabilities that most businesses cannot justify as independent purchases. Professional firms also maintain cybersecurity measures and data backup systems that would require additional IT investment of $5,000 to $15,000 yearly for proper implementation and maintenance.

Professional accounting firms provide access to specialized knowledge that goes far beyond basic bookkeeping. These teams stay current with tax law changes, industry regulations, and best practices that would require significant time investment for business owners to master independently. The expertise advantage becomes even more valuable as businesses grow and face complex financial decisions that require professional insight. Comprehensive accounting services save sole traders an average of 4.7 hours per week, while mid-sized businesses save 11.6 hours per week, allowing owners to focus on core business activities that drive revenue growth.

Professional accounting firms maintain specialized teams across multiple industries. CPA firms report steady growth in revenue through specialized services. Manufacturing businesses that work with industry-specific accountants save an average of $18,000 annually through proper inventory valuation methods. Retail companies benefit from specialized sales tax management that prevents costly audit penalties.

Healthcare practices require knowledge of HIPAA compliance and medical billing regulations that general bookkeepers cannot provide. Construction companies need expertise in percentage-of-completion accounting and prevailing wage requirements. Standard accounting software cannot handle these requirements automatically, making specialized knowledge essential for compliance and profitability.

Tax law changes occur frequently. The IRS postponed the $600 Form 1099-K threshold implementation, demonstrating how regulatory changes affect business operations. Professional accounting firms dedicate staff specifically to regulatory updates, while small business owners typically learn about changes after penalties occur.

The average small business penalty for late tax filings reaches $1,500. Improper payroll tax handling can result in penalties that exceed $15,000. State and local regulations add complexity, with sales tax requirements that vary across 13,000 jurisdictions nationwide (making compliance particularly challenging for multi-state operations).

Professional firms maintain current knowledge of these requirements and implement systems that prevent violations before they occur. This protection shields businesses from both financial penalties and time-consuming audit processes.

Professional accounting teams provide financial analysis that extends far beyond standard profit and loss statements. Cash flow forecasts help businesses plan for seasonal variations and growth investments. Ratio analysis identifies operational inefficiencies that owners often miss during day-to-day operations.

Advanced reports include budget variance analysis, cost center profitability, and trend identification that supports strategic decisions. These insights help businesses identify which products or services generate the highest margins and which operational areas need improvement to maximize profitability.

This level of expertise becomes even more valuable when businesses need to focus their energy on core operations that drive growth and customer satisfaction. Cross-disciplinary tax and business experts provide proactive guidance that increases business net worth through strategic planning and implementation.

Business owners spend significant time on administrative tasks, with accounting activities consuming the largest portion of this time burden. Small business owners who outsource accounting functions report they save 15-20 hours weekly that they redirect toward sales, product development, and customer relationships. Manufacturing companies see the highest time savings, with owners who report 23 hours weekly recovered after they outsource financial management.

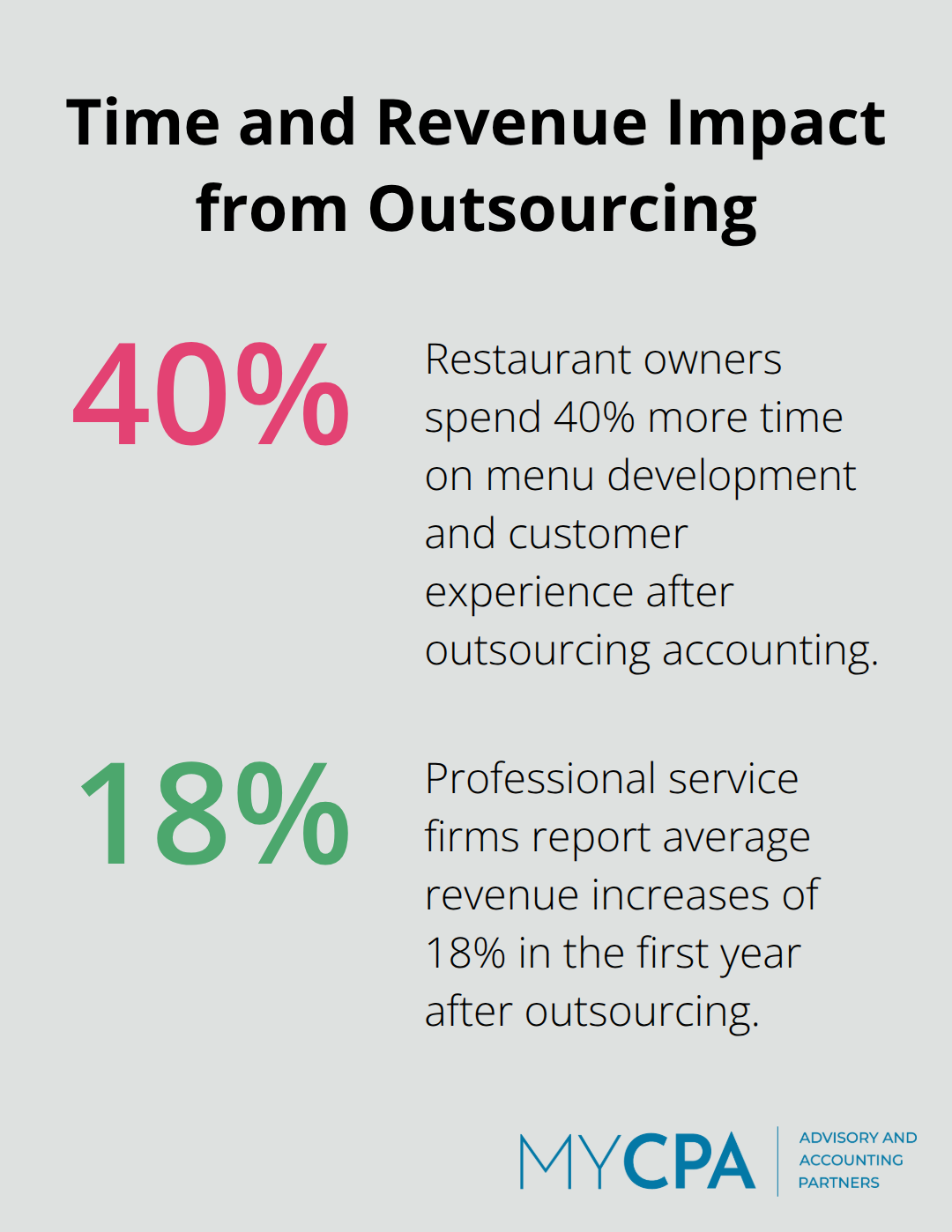

The time savings compound when you eliminate interruptions from tax deadlines, payroll processing, and monthly procedures. Restaurant owners who outsource accounting spend 40% more time on menu development and customer experience improvements. Professional service firms redirect saved time toward client acquisition and generate average revenue increases of 18% within the first year after they outsource.

Payroll processing takes small businesses an average of 5 hours per pay period when they handle it internally. Monthly financial reports require 8-12 hours for accurate completion. Tax preparation consumes 40-60 hours annually for businesses with multiple revenue streams. These tasks interrupt core business operations and prevent strategic thought that drives growth.

Internal accounting management creates constant decision fatigue from vendor payments, invoice processing, and compliance deadlines. Business owners report they feel overwhelmed during tax seasons and month-end periods. Outsourced services eliminate these interruptions and provide predictable monthly costs instead of seasonal workload spikes that disrupt business operations.

Rapidly growing businesses face accounting bottlenecks that limit expansion. New accounting staff requires 6-8 weeks for recruitment, 3 months for training, and significant salary commitments that strain cash flow during growth periods (particularly for companies with seasonal revenue patterns). Outsourced accounting scales immediately with business volume increases without delays or training costs. Technology companies report seamless expansion from 10 to 100 employees when they use outsourced accounting without adding internal financial staff.

The advantages of outsourcing accounting services extend beyond simple cost reduction. Businesses save 40-60% on labor costs while they gain access to enterprise-level technology and specialized expertise that would otherwise require substantial investment. Professional firms provide industry-specific knowledge, regulatory compliance, and advanced financial analysis that prevents costly mistakes and drives strategic growth.

The decision to outsource depends on your current resources, growth trajectory, and internal capabilities. Companies that experience rapid expansion, seasonal fluctuations, or complex compliance requirements benefit most from external partnerships. Businesses that spend more than 15 hours weekly on financial tasks should evaluate their options (particularly those facing regulatory complexity or growth constraints).

We at My CPA Advisory and Accounting Partners offer tailored financial services that include tax optimization, accurate bookkeeping, QuickBooks management, and business advisory consultation. The time you save from outsourced accounting creates opportunities for revenue generation, customer relationship development, and strategic planning. This approach drives long-term business success while professional teams handle your financial operations with expertise and precision.

Privacy Policy | Terms & Conditions | Powered by Cajabra