Real Estate Investment Trusts (REITs) have become a popular option for investors seeking exposure to real estate markets. However, understanding their tax implications is essential for making informed investment decisions.

At My CPA Advisory and Accounting Partners, we often field questions about REITs’ tax efficiency. This post will explore the tax structure of REITs, their impact on different types of investment accounts, and how they compare to other real estate investments from a tax perspective.

Real Estate Investment Trusts (REITs) allow investors to participate in real estate markets without direct property ownership. These investments allow you to earn income from real estate without having to buy, manage, or finance properties themselves.

REITs come in three main types:

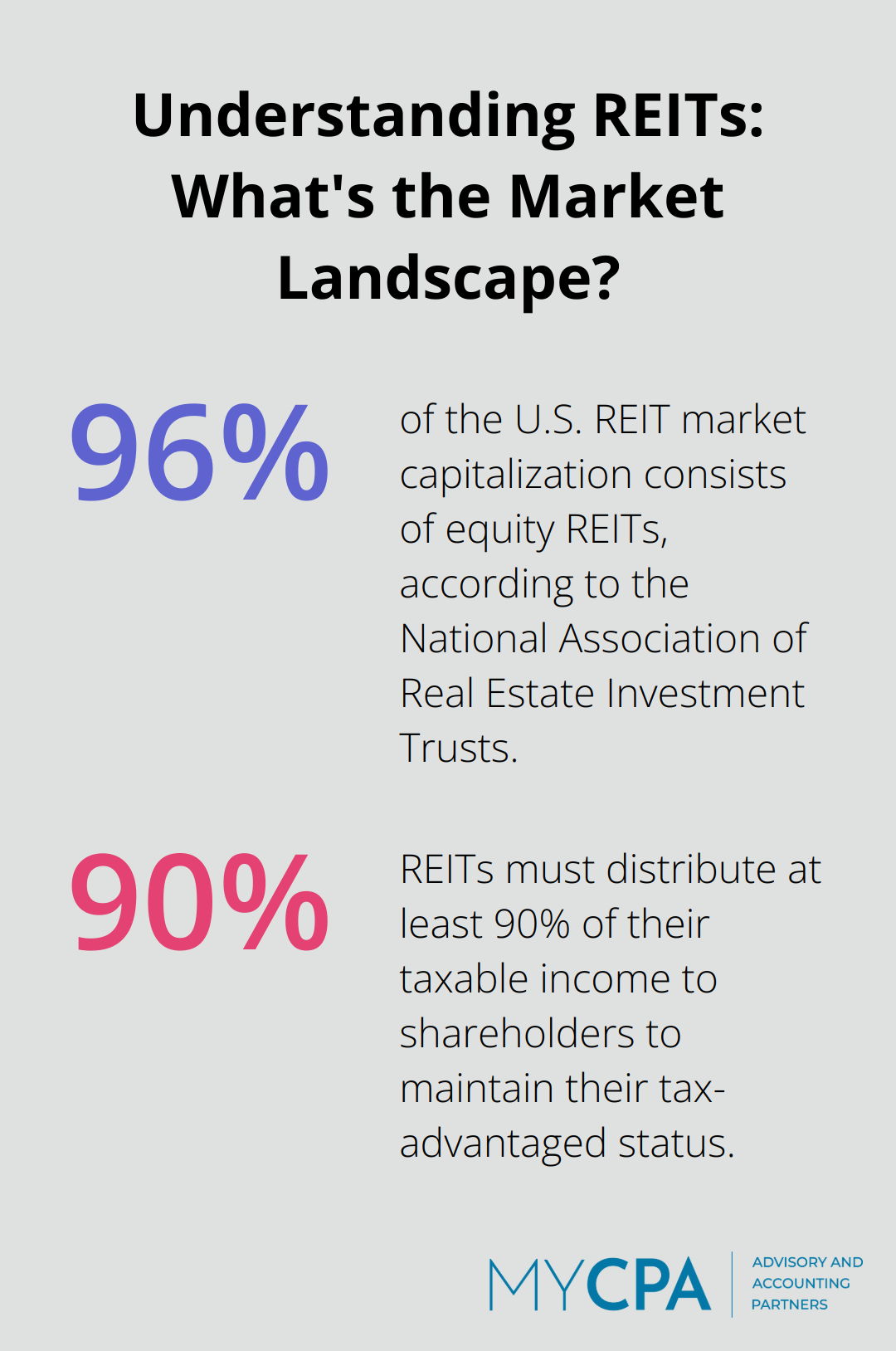

The National Association of Real Estate Investment Trusts (Nareit) reports that equity REITs constitute approximately 96% of the U.S. REIT market capitalization.

REITs enjoy a unique tax status that sets them apart from most corporations. They can avoid corporate income tax if they meet specific Internal Revenue Service (IRS) requirements:

The cornerstone of REIT status lies in the dividend distribution rule. By law, REITs must distribute at least 90% of their taxable income to shareholders. This high payout requirement attracts income-focused investors.

For instance, a REIT with $100 million in taxable income must distribute at least $90 million to shareholders to maintain its tax-advantaged status. This requirement ensures a consistent income stream for investors.

While REITs benefit from tax advantages at the corporate level, the taxation of REIT dividends for individual investors can be complex. REIT dividends typically face taxation as ordinary income, subjecting them to the investor’s marginal tax rate. This differs from qualified dividends from regular stocks, which often receive preferential tax treatment.

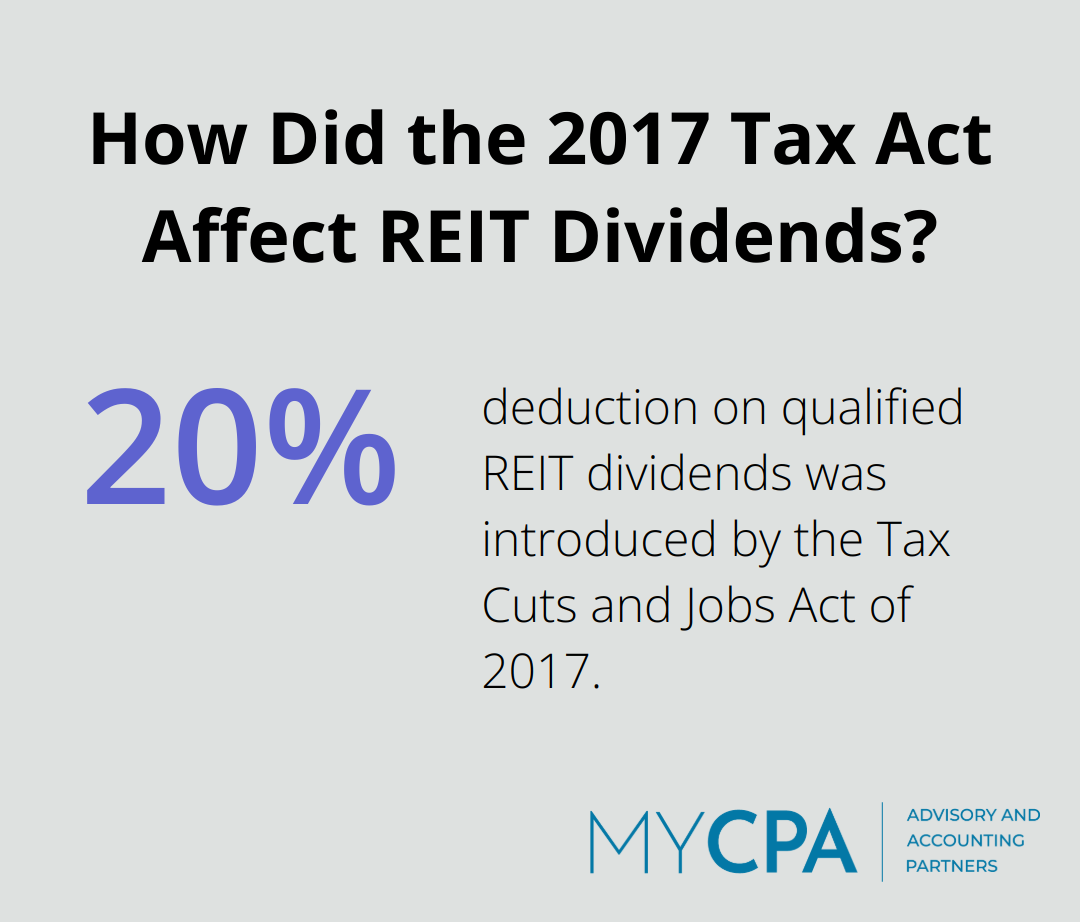

The Tax Cuts and Jobs Act of 2017 introduced a 20% deduction on qualified REIT dividends for individual taxpayers. This deduction effectively reduces the maximum tax rate on REIT dividends from 37% to 29.6% for those in the highest tax bracket. (Note: This deduction is set to expire at the end of 2025 unless Congress extends it.)

The tax implications of REITs can significantly impact an investor’s overall returns. Factors such as the type of REIT, the nature of its distributions, and the investor’s tax bracket all play a role in determining the tax efficiency of REIT investments.

As we move forward, we’ll explore how these tax considerations affect different types of investment accounts and compare REITs to other real estate investment options from a tax perspective.

Real Estate Investment Trusts (REITs) offer a distinct tax profile compared to traditional stocks. Most REIT dividends face taxation as ordinary income, subjecting them to your marginal tax rate (which can reach up to 37% for high-income earners). The Tax Cuts and Jobs Act of 2017 introduced a 20% deduction on qualified REIT dividends, effectively reducing the maximum tax rate to 29.6% for those in the highest bracket. (This deduction is set to expire at the end of 2025 unless Congress extends it.)

When you sell REIT shares, you may trigger capital gains taxes. The tax rate depends on your holding period:

Holding REITs in taxable accounts subjects dividends to immediate taxation. This approach may suit investors who:

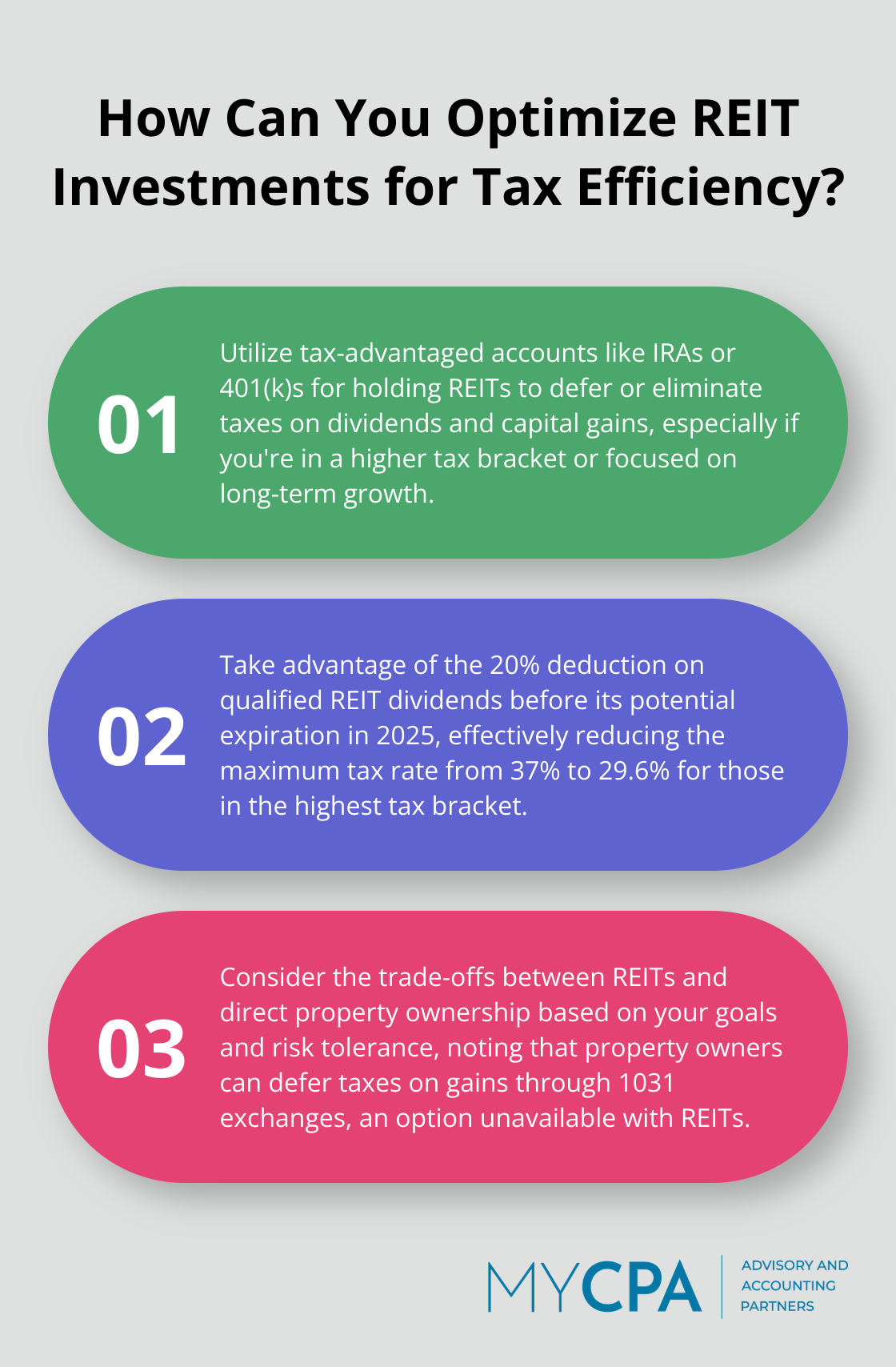

Placing REITs in tax-advantaged accounts like IRAs or 401(k)s can defer or eliminate taxes on dividends and capital gains:

This strategy often appeals to investors in higher tax brackets or those focused on long-term growth.

The decision to hold REITs in taxable or tax-advantaged accounts should align with your overall investment strategy and tax situation. Factors to consider include:

As we move forward, we’ll explore how REITs compare to other real estate investments from a tax perspective, helping you make informed decisions about incorporating these assets into your portfolio.

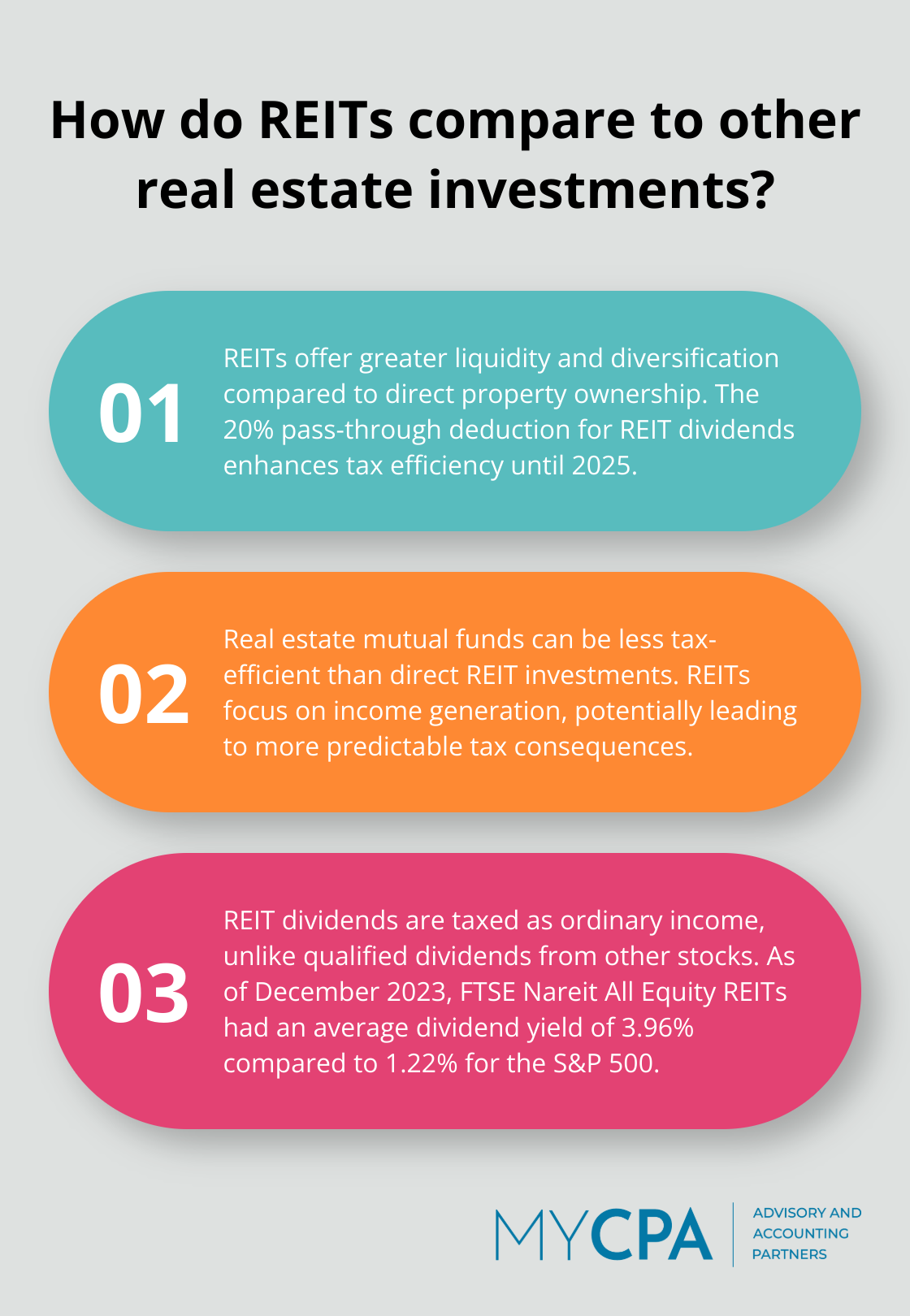

Direct property ownership and REITs offer different approaches to real estate investing. Property owners benefit from depreciation deductions but face complex tax reporting and potential liability issues. REITs provide a hands-off approach with greater liquidity and diversification.

The 20% pass-through deduction for REIT dividends (expiring in 2025 unless extended) enhances their tax efficiency for some investors. However, property owners can defer taxes on gains through 1031 exchanges, an option unavailable with REITs.

Direct ownership allows more control over investment decisions and potential for higher returns in certain markets. The choice between REITs and direct ownership depends on an investor’s goals, risk tolerance, and tax situation.

Real estate mutual funds invest in real estate companies, including REITs, offering another way to access the sector. From a tax perspective, these funds can prove less efficient than direct REIT investments.

Mutual funds must distribute capital gains to shareholders, which can result in unexpected tax bills. REITs typically focus on income generation rather than capital gains, potentially leading to more predictable tax consequences.

The 20% deduction on qualified REIT dividends applies to direct REIT investments but not necessarily to REIT dividends received through a mutual fund. This distinction can significantly impact after-tax returns, especially for investors in higher tax brackets.

The tax treatment of dividends marks a key difference between REITs and other dividend-paying stocks. Most stock dividends qualify for lower tax rates (0%, 15%, or 20% depending on income), while REIT dividends face taxation as ordinary income.

The 20% deduction on qualified REIT dividends narrows this gap, particularly for high-income investors. For example, an investor in the 37% tax bracket would effectively pay 29.6% on REIT dividends, compared to 23.8% (20% plus the 3.8% Net Investment Income Tax) on qualified dividends from other stocks.

REITs often offer higher dividend yields than many other stocks. As of December 2023, FTSE Nareit All Equity REITs had an average dividend yield of 3.96%, compared to 1.22% for the S&P 500.

The choice between REITs and other investment options hinges on your overall investment strategy, income needs, and tax situation. Each option presents unique tax implications that can significantly impact your returns.

At My CPA Advisory and Accounting Partners, we specialize in analyzing these factors to determine the most suitable approach for your portfolio. Our expertise can help you navigate the complex tax landscape of real estate investments and make informed decisions that align with your financial goals.

REITs offer a unique blend of real estate exposure and potential tax advantages. Their tax efficiency stems from their special status, which allows them to avoid corporate-level taxation by distributing most of their income to shareholders. The 20% deduction on qualified REIT dividends (set to expire in 2025) enhances their appeal, especially for high-income investors.

The tax implications of REITs are complex and multifaceted. While they can provide tax benefits in certain scenarios, their dividends are generally taxed as ordinary income, which may result in higher tax bills compared to qualified dividends from other stocks. The placement of REITs within your portfolio can significantly impact your overall tax situation.

Given the intricacies of REIT taxation and the ever-changing landscape of tax laws, seeking professional guidance is important. My CPA Advisory and Accounting Partners can provide personalized advice tailored to your unique financial situation, helping you make informed decisions about incorporating REITs into your investment strategy. Our team specializes in navigating the complexities of investment taxation, including the nuances of REITs’ tax efficiency.

Privacy Policy | Terms & Conditions | Powered by Cajabra