Receiving a substantial bonus can feel exciting, but it often comes with unexpected tax consequences that catch many employees off guard. The IRS treats bonuses as supplemental income, subjecting them to different withholding rates than regular paychecks.

At My CPA Advisory and Accounting Partners, we see clients lose thousands of dollars annually due to poor large bonus tax planning. Smart preparation can help you keep more of your hard-earned money.

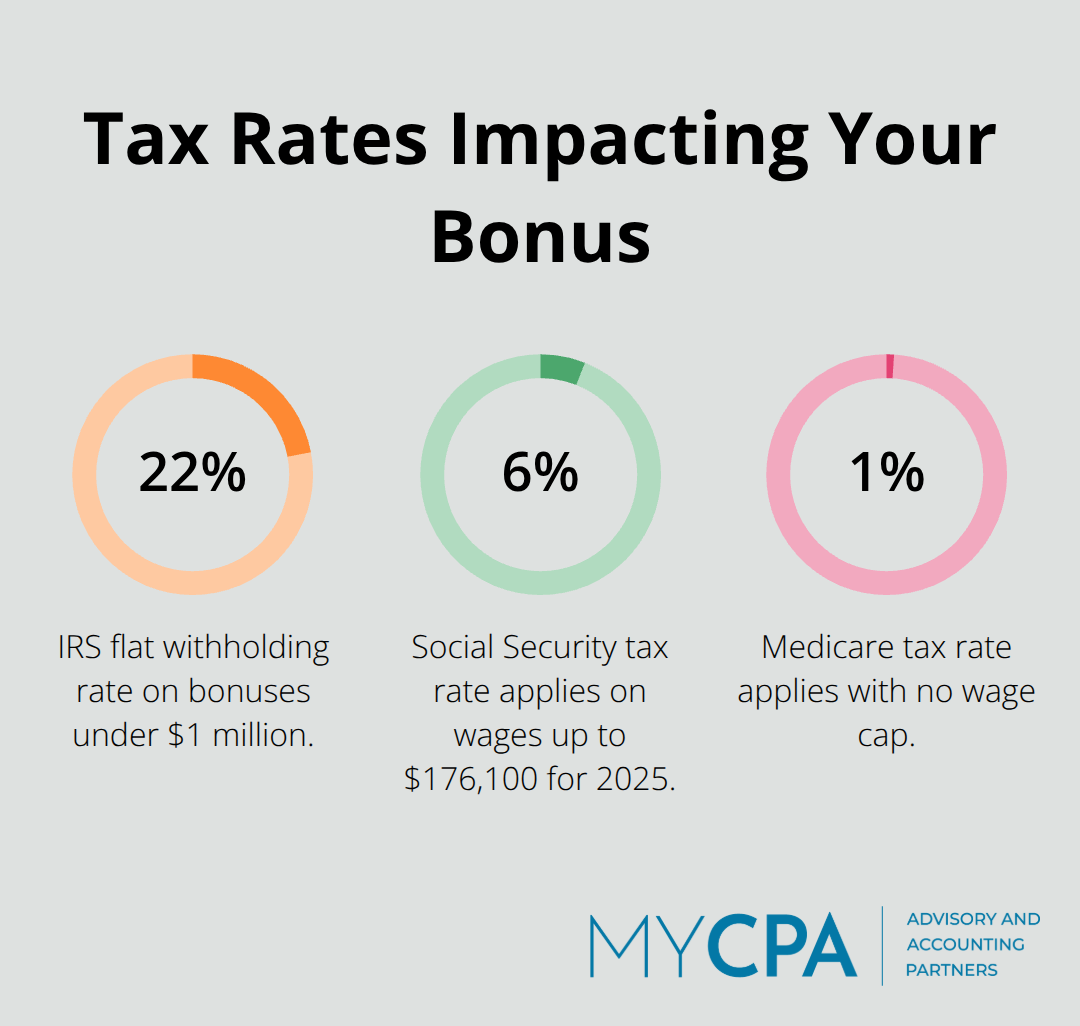

The IRS mandates a flat 22% withholding rate on bonuses under $1 million, but this creates a dangerous misconception. Your actual tax liability depends on your total annual income, not just the withholding rate. If you earn $80,000 annually and receive a $30,000 bonus, that bonus pushes your total income to $110,000, potentially moving you into the 24% tax bracket. The 22% withholding becomes insufficient, leaving you with a tax bill in April. For bonuses exceeding $1 million, the withholding jumps to 37% on the excess amount, but again, this withholding may not cover your actual obligation.

State tax treatment varies dramatically across the country. California imposes its highest marginal rate of 13.3% on supplemental wages, while states like Texas and Florida impose no state income tax on bonuses. New York taxes bonuses at regular income rates, which can reach 10.9% for high earners. Calculate your combined federal and state effective rate before your bonus arrives. This preparation prevents the shock of owing $15,000 or more on a $50,000 bonus.

Social Security tax applies at 6.2% on wages up to $176,100 for 2025, and Medicare tax hits at 1.45% with no wage cap. High earners face an additional 0.9% Medicare surtax on wages exceeding $200,000. These payroll taxes cannot be reduced through deductions or retirement contributions, making them unavoidable costs that reduce your bonus by at least 7.65%. For a $40,000 bonus, expect to lose at least $3,060 to payroll taxes alone (before considering income taxes).

When you combine federal income tax, state tax, and payroll taxes, your effective rate on bonus income frequently exceeds 40%. A $50,000 bonus in California could result in $22,000 in total taxes. This reality makes strategic tax planning essential rather than optional. The next step involves implementing specific strategies to reduce this tax burden before you receive your bonus payment.

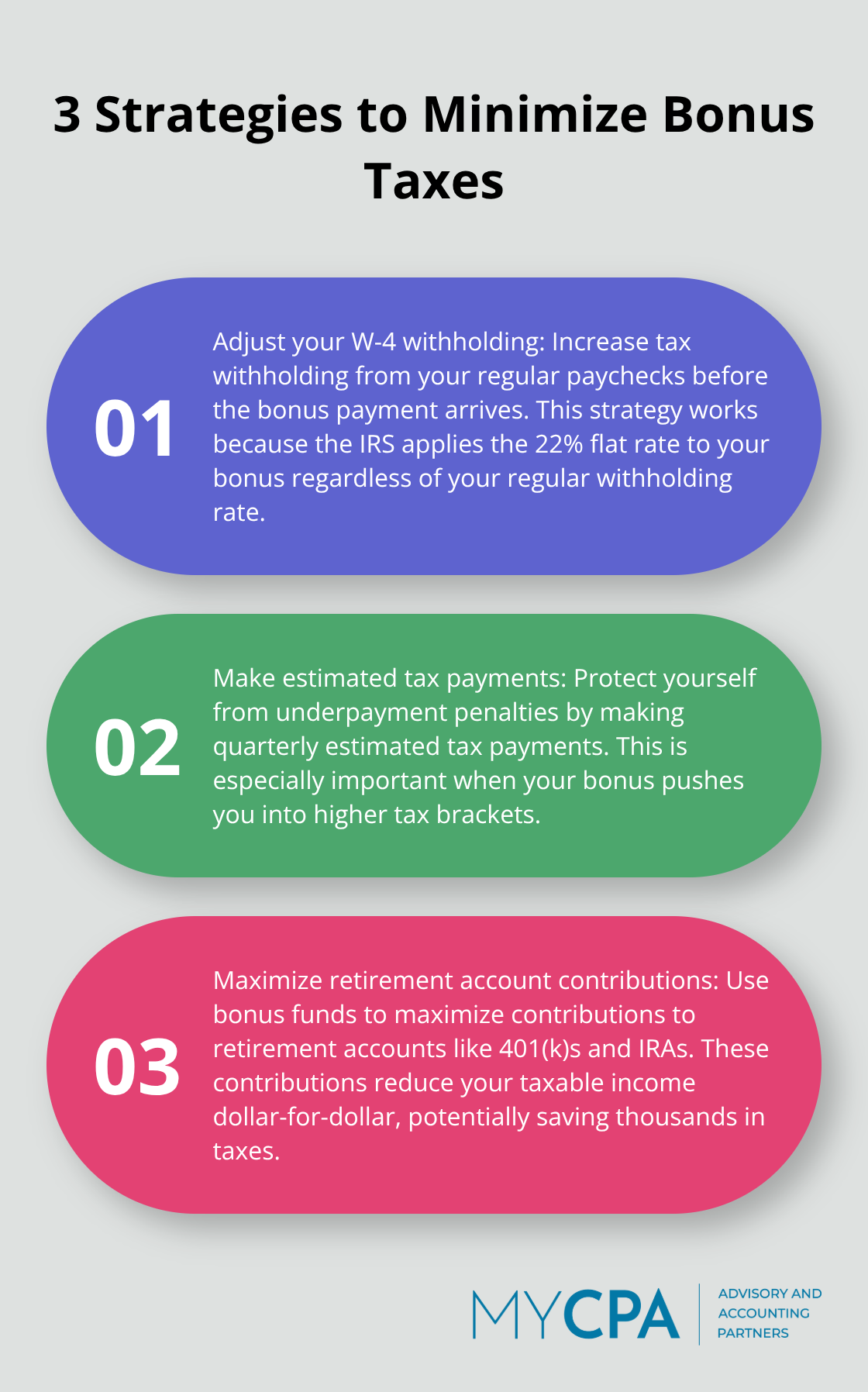

The window between learning about your bonus and receiving it represents your most powerful opportunity to reduce the tax impact. You should adjust your W-4 withholding allowances to increase tax withholding from your regular paychecks before the bonus payment arrives. This strategy works because the IRS applies the 22% flat rate to your bonus regardless of your regular withholding rate.

When you increase withholding on regular pay by $500 per month for three months before your December bonus, you create a $1,500 tax credit that reduces your April tax bill. The IRS requires employers to implement W-4 changes within 30 days, so you must act quickly once you know about your bonus.

Quarterly estimated tax payments protect you from underpayment penalties when your bonus pushes you into higher tax brackets. The IRS imposes penalties when you owe more than $1,000 at tax time and have not paid at least 90% of the current year’s tax or 100% of last year’s tax (110% for high earners).

Calculate your projected tax liability with the bonus included, then make estimated payments with Form 1040ES. For a $60,000 bonus that pushes your income from $100,000 to $160,000, you might owe an additional $18,000 in federal taxes. A $15,000 estimated payment in the quarter you receive the bonus prevents the 6% annual penalty on the underpayment.

Retirement account contributions with bonus funds deliver immediate tax reductions dollar-for-dollar. The 2025 401k contribution limit reaches $23,500, with an additional $7,500 catch-up contribution for those over 50. A $30,000 bonus contribution to your 401k reduces your taxable income by the full amount, potentially saving $7,200 in federal taxes at the 24% bracket.

Traditional IRA contributions provide similar benefits up to $7,000 annually, with catch-up contributions adding another $1,000 for older workers. These contributions must occur before the tax deadline to count for the current tax year. This flexibility allows you to time the tax benefit strategically while you prepare for the cash flow management challenges that come with large bonus payments.

The moment your bonus arrives, transfer your calculated tax obligation into a separate high-yield savings account. This prevents you from accidentally spending money that belongs to the IRS. Based on our earlier calculations, a $50,000 bonus requires you to set aside $20,000 to $22,000 for taxes.

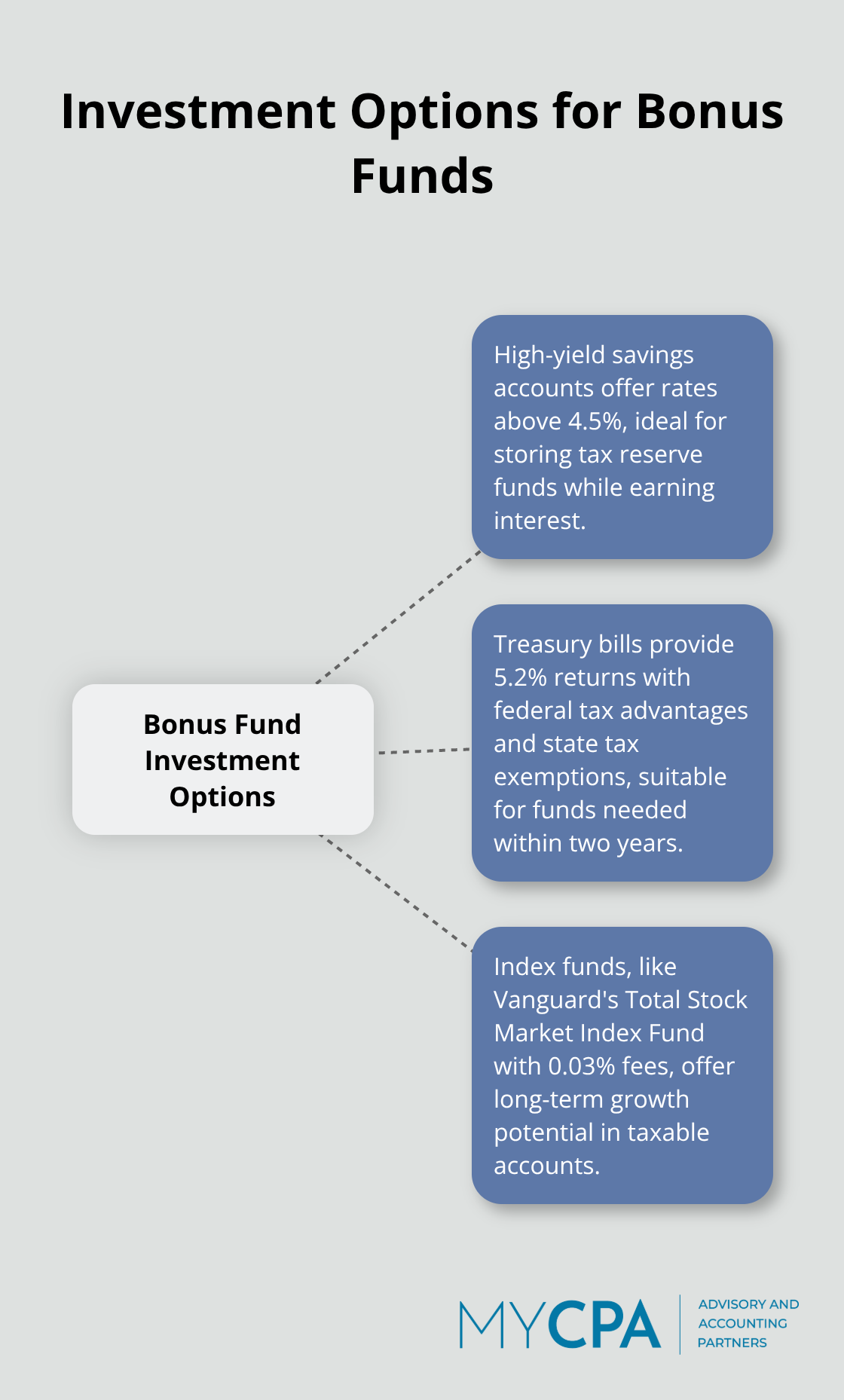

Marcus by Goldman Sachs and Ally Bank offer savings accounts with rates above 4.5%, which allows your tax reserve to earn interest while it waits for tax season. Calculate your exact tax liability with the IRS withholding calculator, then add 10% as a safety buffer. This approach prevents the panic of scrambling for tax money in April when you owe $15,000 but only have $3,000 available.

After you set aside tax obligations, invest remaining bonus funds in tax-efficient vehicles that align with your timeline. For money you need within two years, Treasury bills offer 5.2% returns with federal tax advantages and state tax exemptions.

For longer-term growth, index funds in taxable accounts provide flexibility without early withdrawal penalties. Vanguard’s Total Stock Market Index Fund charges just 0.03% in fees but does not have sufficient history to provide reliable long-term performance data. Avoid placing bonus funds into tax-deferred accounts if you’ve already maxed out contributions, as this creates unnecessary restrictions on access to your money.

Your large bonus affects next year’s estimated tax requirements and withholding strategy. The IRS safe harbor rule requires you to pay the lower of 90% of the current year’s tax or 100% of last year’s tax (110% if your previous year’s adjusted gross income exceeds $150,000).

A $60,000 bonus that increases your total tax from $25,000 to $40,000 means you must pay at least $44,000 in taxes next year to avoid penalties. Adjust your 2025 W-4 to increase withholding by $200 per month starting in January (this prevents underpayment penalties and spreads the tax burden across the entire year rather than creating a massive April payment).

You must act before your bonus arrives to keep more of your money and avoid unnecessary taxes. Adjust your W-4 withholding immediately after you learn about your bonus. Calculate your total tax liability and make estimated payments if the situation requires them. Max out retirement contributions to reduce taxable income dollar-for-dollar.

Transfer your calculated tax obligation to a separate savings account the moment your bonus hits your account. This step prevents you from accidentally spending money that belongs to the IRS. Invest any remaining funds in tax-efficient vehicles that match your timeline and risk tolerance.

Large bonus tax planning affects both the current year and the following tax year. Your bonus changes next year’s estimated tax requirements and withholding strategy completely. We at My CPA Advisory and Accounting Partners help clients navigate complex bonus tax situations through personalized tax services and business advisory consulting, especially when bonuses exceed $50,000 or push you into higher tax brackets.

Privacy Policy | Terms & Conditions | Powered by Cajabra