Staying on top of tax efficiency news is essential for businesses and individuals alike. The tax landscape is constantly evolving, with new regulations and strategies emerging regularly.

At My CPA Advisory and Accounting Partners, we understand the importance of keeping our clients informed about the latest developments in tax efficiency. This blog post will guide you through effective methods to stay updated and make the most of your tax planning efforts.

Staying informed about tax efficiency developments requires access to trustworthy and up-to-date information sources. The Internal Revenue Service (IRS) offers a wealth of resources for taxpayers and professionals alike. Their website features comprehensive guides, publications, and news releases on the latest tax laws and regulations.

We recommend you sign up for IRS e-News subscriptions. These deliver targeted updates straight to your inbox, keeping you informed about the latest IRS updates for the tax professional community. The weekly e-News for tax professionals provides a summary of important information generally issued on a weekly basis.

Several reputable tax news websites and publications provide in-depth analysis and commentary on tax efficiency strategies. The Journal of Accountancy (published by the American Institute of CPAs) offers authoritative insights into tax planning and compliance issues. Recently revised AICPA standards and other tax practice rules may apply to CPAs in unexpected circumstances. Tax Notes, another respected publication, delivers daily coverage of federal, state, and international tax news.

Joining professional associations for tax professionals opens doors to a network of experts and a wealth of educational resources. The National Association of Tax Professionals (NATP) and the National Society of Tax Professionals (NSTP) offer members access to tax research databases, continuing education courses, and forums for discussing complex tax issues.

Many tax software providers integrate news feeds and update notifications directly into their platforms. For instance, Thomson Reuters’ Checkpoint offers a daily email digest summarizing key tax developments. Similarly, CCH’s IntelliConnect platform provides real-time updates on tax law changes and their implications for various industries.

At MyCPA Advisory and Accounting Partners, we continuously monitor these resources to ensure our clients receive the most current and relevant tax advice. Our team synthesizes information from multiple sources, translating complex tax jargon into actionable strategies for businesses and individuals alike.

While these resources provide valuable information, interpreting and applying tax laws to your specific situation requires professional expertise. Always consult with a qualified tax advisor (such as those at MyCPA Advisory and Accounting Partners) before making significant financial decisions based on tax efficiency considerations.

As we move forward, let’s explore how technology can further enhance your ability to stay updated on tax efficiency developments.

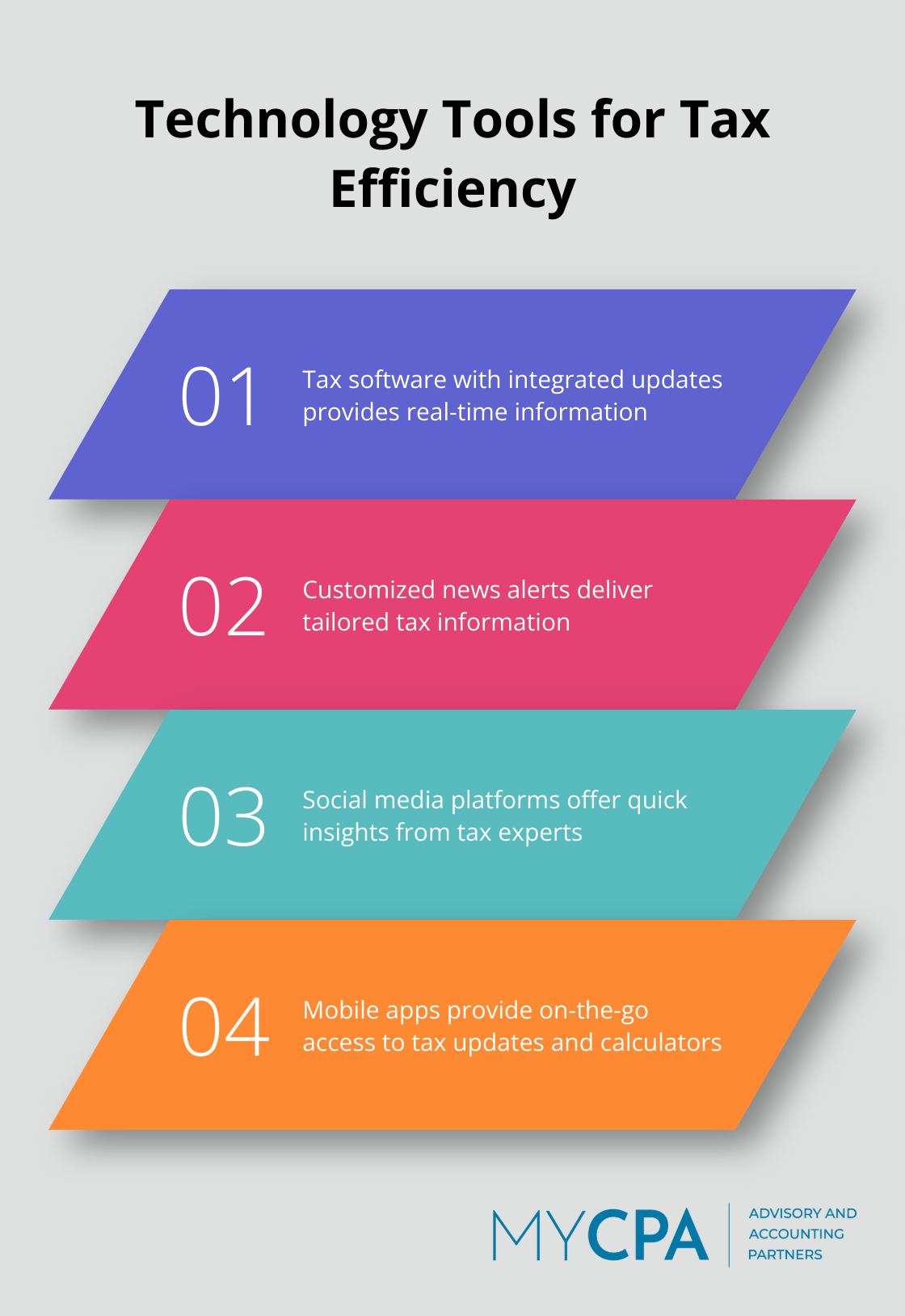

Technology plays a pivotal role in staying current with tax efficiency developments. Modern tools and platforms offer real-time updates and insights, revolutionizing how professionals and individuals access tax information.

Advanced tax software now includes built-in update features that simplify the entire tax process with technology that automates tedious work, minimizes risk, and puts users in the best tax position possible. This ensures users have access to the most current information when preparing returns or planning tax strategies.

Google Alerts serves as a powerful tool for staying informed about specific tax topics. Users can set up alerts for keywords such as “tax efficiency,” “IRS updates,” or “tax law changes.” This customization allows individuals to tailor their information intake to their specific interests and needs, receiving notifications when new content is published online.

Social media platforms have transformed into valuable sources of tax information. Twitter, LinkedIn, and Facebook host numerous reputable tax experts and organizations that share quick insights into breaking tax news and efficiency strategies. The IRS’s official Twitter account (@IRSnews) regularly posts updates on tax deadlines, new regulations, and taxpayer resources.

Many accounting firms maintain active social media presences to share tax tips and updates. Following these accounts provides access to professional insights and information about potential tax-saving opportunities.

Several mobile applications now cater to tax professionals and individuals seeking up-to-date tax information. These apps offer push notifications for breaking tax news, calculators for quick estimates, and access to tax code libraries. Users can stay informed on-the-go, making it easier to adapt to new tax developments quickly.

Technology offers numerous ways to stay updated on tax efficiency, but interpreting and applying this information requires professional expertise. The next section will explore how continuous education and professional development complement these technological tools in maintaining tax efficiency knowledge.

Online courses transform the way professionals enhance their tax efficiency knowledge. Platforms like Coursera and edX collaborate with prestigious universities to offer comprehensive tax courses. The University of Illinois presents a Taxation course on Coursera that covers fundamental concepts and recent tax law developments. These courses often incorporate practical case studies and real-world applications, enabling immediate application of newly acquired knowledge.

Virtual seminars offer quality education without the need for travel. The American Institute of CPAs (AICPA) hosts regular webinars on various tax topics. These sessions feature leading tax experts and include Q&A segments, allowing participants to address specific concerns directly.

In-person conferences offer unmatched networking opportunities alongside educational content. The annual IRS Nationwide Tax Forum unites tax professionals from across the country, offering workshops on the latest tax law changes and enforcement initiatives.

For those specializing in international taxation, the International Fiscal Association (IFA) organizes an annual congress that attracts experts from over 100 countries. This event provides a global perspective on tax efficiency strategies and emerging trends in cross-border taxation.

Many professional organizations offer specialized training programs tailored to specific areas of tax law. The National Association of Tax Professionals (NATP) provides in-depth courses on topics such as estate planning, business entity taxation, and tax practice management. These programs allow tax professionals to develop niche expertise and stay ahead of industry trends.

Tax professionals who commit to ongoing education position themselves to provide the most current and effective tax strategies to their clients. This commitment to learning ensures that advice is based on the latest tax efficiency strategies and regulations. While self-study and online resources provide valuable information, the insights gained from experienced professionals remain irreplaceable.

Tax efficiency news impacts financial decisions for individuals and businesses. We at My CPA Advisory and Accounting Partners recommend a multi-faceted approach to stay informed about the latest developments. This includes subscribing to IRS newsletters, utilizing technology, and pursuing continuous education through various channels (such as industry conferences).

Professional interpretation often proves necessary due to the complexities of tax law. Our team at My CPA Advisory and Accounting Partners specializes in translating complex tax information into actionable strategies for our clients. We stay at the forefront of tax efficiency developments to provide tailored financial services that minimize tax liabilities.

Take a proactive stance in your tax planning through regular engagement with tax professionals. They offer personalized advice based on your unique financial situation. Combining your knowledge with expert guidance will equip you to navigate tax efficiency intricacies and make decisions aligned with your financial goals.

Privacy Policy | Terms & Conditions | Powered by Cajabra