Most businesses fail not from lack of revenue, but from poor financial management. Companies with strong financial strategies for business growth are 3x more likely to scale successfully than those without structured approaches.

We at My CPA Advisory and Accounting Partners see this pattern repeatedly. Smart financial planning separates thriving businesses from struggling ones.

Cash flow kills more businesses than any other financial problem. The U.S. Small Business Administration reports that 60% of small businesses struggle with cash flow management, yet most wait until crisis hits to address it. Smart businesses track their cash position daily and maintain 13-week forecasts that show exactly when money flows in and out. This approach transforms reactive panic into proactive planning and gives you the power to make strategic decisions instead of desperate ones.

You must set up credit lines before you need them for explosive growth. Banks love to lend to businesses that don’t desperately need money, and they hate to lend to those that do. Tools like Float and Pulse automate cash flow monitoring and send alerts when your position drops below predetermined thresholds. Automated collection systems and payment scheduling eliminate the guesswork from receivables management and turn cash flow from a constant worry into a predictable business asset. Companies that use cloud-based cash flow tools face challenges with data privacy and security, with research showing that businesses must address these concerns when implementing financial technology solutions.

Your tax structure works hand-in-hand with cash flow management to maximize the money you keep from every dollar earned.

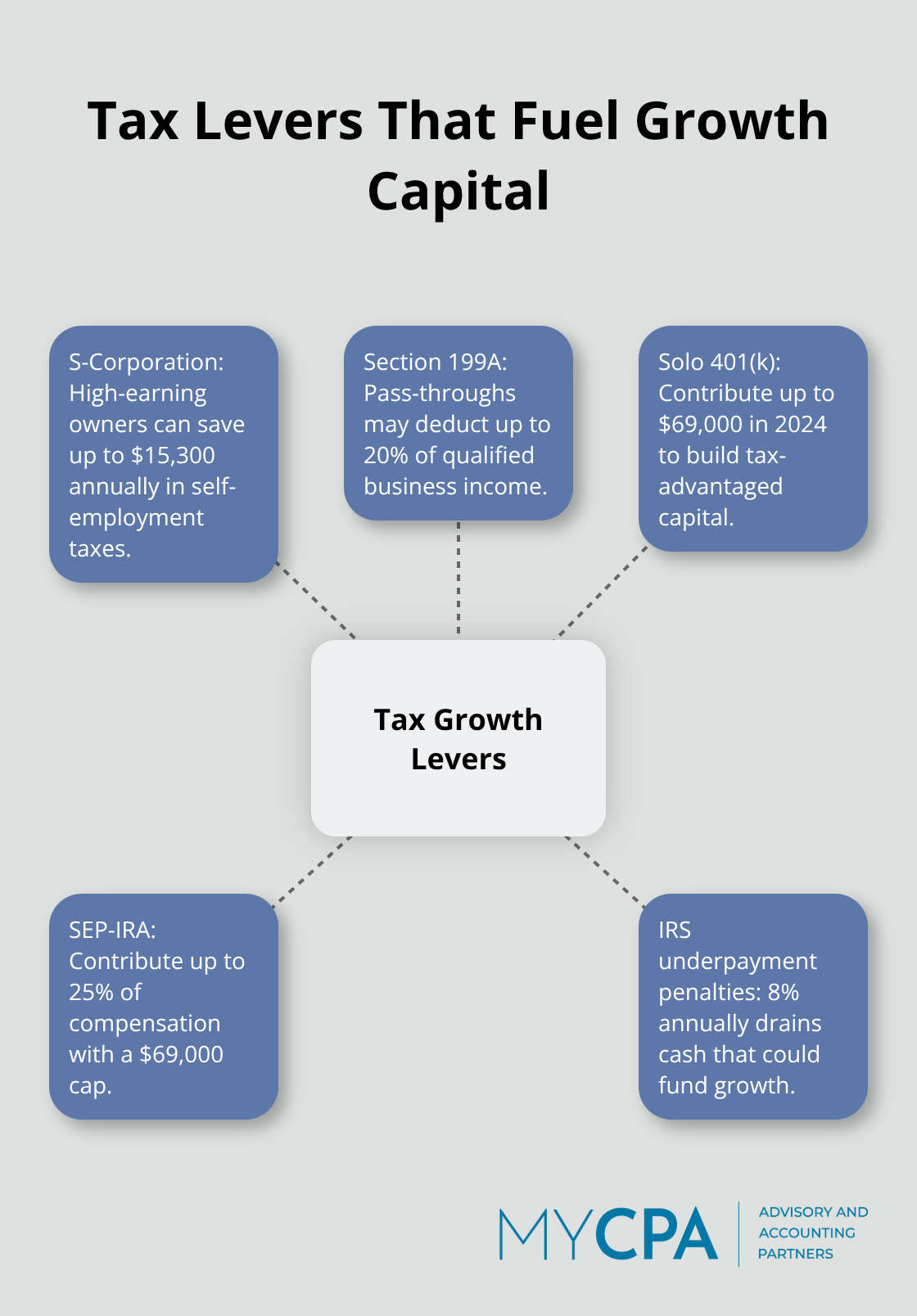

Your business entity structure controls how much growth capital you retain from every profit dollar. S-Corporations save high-earning business owners up to $15,300 annually in self-employment taxes compared to sole proprietorships, according to the IRS. Pass-through entities like LLCs and S-Corps qualify for Section 199A deductions that reduce taxable income by up to 20%, which puts thousands back into your expansion fund. Solo 401(k) plans allow business owners to contribute up to $69,000 annually in 2024, while SEP-IRAs permit contributions up to 25% of compensation with a $69,000 cap.

Quarterly estimated tax payments prevent penalties that drain cash flow during growth phases. The IRS charges penalty rates of 8% annually on underpayments – money that should fuel your expansion instead. Smart tax planning means you time income recognition and expense deductions to optimize cash availability during peak growth periods. Converting from sole proprietorship to S-Corporation status typically pays for itself within the first year for businesses that earn over $60,000 in profit.

Proper entity selection and retirement plan implementation can reduce tax burden by 15-30%, which frees up capital that directly funds your next growth phase. Technology amplifies these tax savings through automated systems that track deductions and streamline compliance processes.

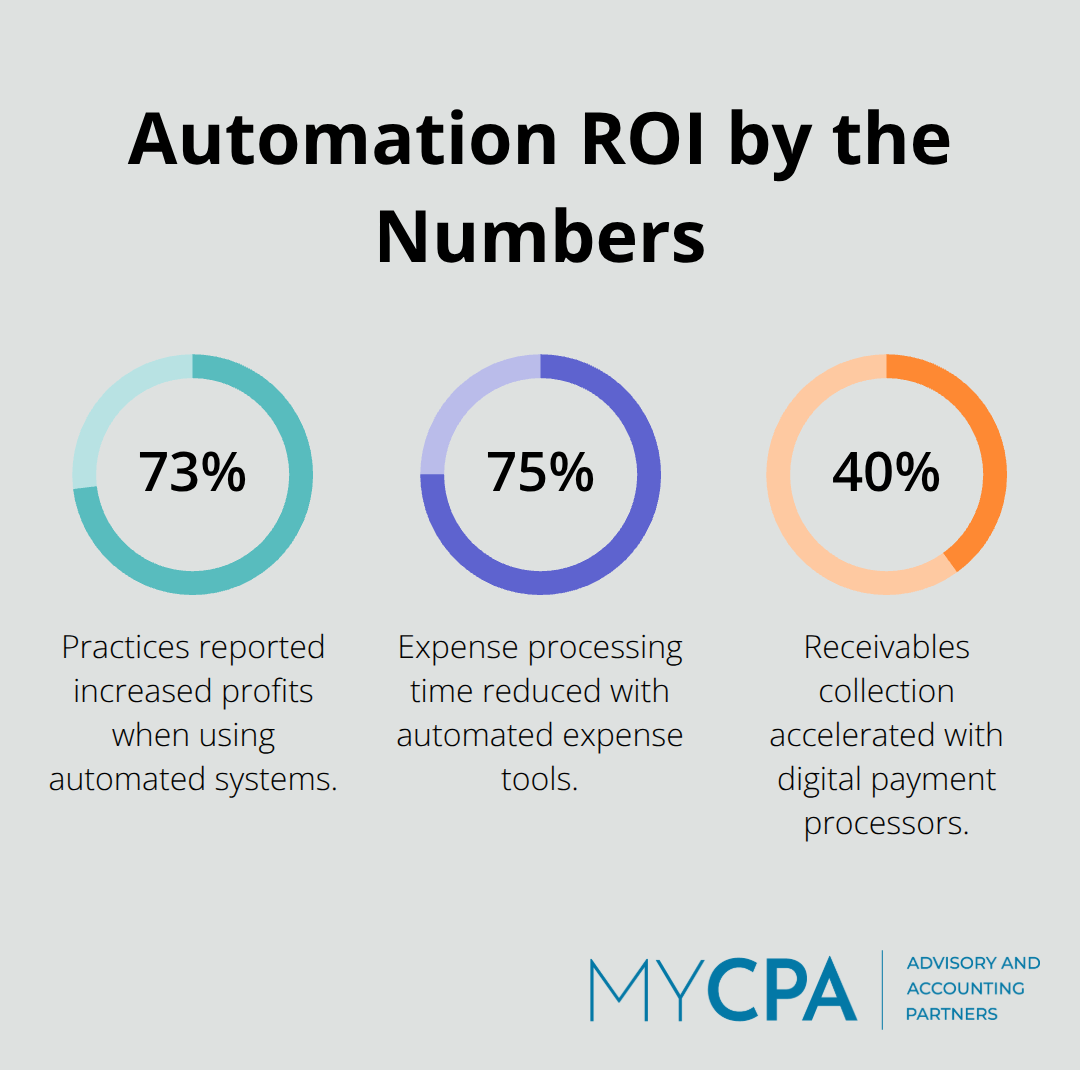

Cloud-based accounting systems like QuickBooks Online and Xero transform your financial operations from manual chaos into automated precision. According to Xero research, nearly three-quarters (73%) of practices report increased profits in the past year when using automated systems. Automated bookkeeping integration eliminates data entry errors that cost approximately $2,650 per employee annually through productivity losses. Expense management platforms like Expensify and Receipt Bank categorize spending automatically and capture receipts through mobile apps, which reduces expense processing time by 75% compared to manual systems. Digital payment processors like Stripe and Square accelerate receivables collection by 40% through automated invoicing and instant payment processing capabilities.

These systems eliminate the human error factor that plagues manual financial processes.

Real-time financial dashboards provide instant visibility into cash position, profit margins, and key performance indicators that manual reporting systems simply cannot match. Companies that use automated financial reporting tools make decisions 3x faster than those that rely on monthly manual reports according to CFO Insights research. These systems send alerts when cash drops below thresholds, when customers exceed payment terms, or when expenses spike beyond budget parameters. The integration between accounting software, payment processors, and banking systems creates a seamless financial ecosystem that operates 24/7 without human intervention, which frees business owners to focus on growth strategies instead of administrative tasks. Smart debt management and strategic investment planning build on this automated foundation to create sustainable growth capital.

Business lines of credit deliver the most flexible financing for inventory purchases and seasonal cash flow gaps. Commercial businesses with annual revenues between $10 million and $500 million are cautiously optimistic about future growth as interest rates decline. SBA loans offer the lowest cost capital for equipment purchases and expansion projects, with interest rates typically 2-3 percentage points below conventional business loans. Tesla’s focus on affordable new cars highlights how strategic financing decisions impact profitability and operational improvements. Good debt generates revenue or appreciates in value, while bad debt drains cash flow without producing returns.

Investment accounts specifically designed for business growth create tax-advantaged savings that compound over time. Companies that separate growth capital from operating funds reduce the temptation to spend expansion money on daily expenses. Corporate investment accounts that earn 4-5% annually through treasury bills and CDs provide liquidity while generating returns that offset inflation. Smart businesses maintain three separate funding pools: operating cash, emergency reserves, and growth capital investments. This structure prevents cash flow emergencies from derailing expansion plans and creates predictable funding for strategic opportunities.

Performance-based financial controls transform these debt and investment strategies into measurable growth engines that track progress and optimize resource allocation.

Monthly financial reviews with predetermined key performance indicators separate thriving businesses from stagnant ones. Companies that conduct structured monthly reviews achieve better performance outcomes through systematic tracking of financial KPIs including profitability, liquidity, solvency, efficiency, and valuation metrics. Your monthly dashboard must track gross profit margins, customer acquisition costs, lifetime value ratios, and cash conversion cycles with specific targets for each metric. Budget variance reports expose inefficiencies that drain growth capital, with successful companies maintaining variance thresholds of no more than 5% per category. Smart businesses implement approval workflows that require dual authorization for expenditures above $5,000, which prevents impulsive decisions that derail expansion plans.

Financial ratio benchmarks against industry standards reveal competitive positions and growth opportunities that manual analysis misses. The current ratio stands as a key metric offering insights into a company’s short-term liquidity and overall financial health, while debt-to-equity ratios must stay below 0.4 to maintain capacity for growth investments. Companies that track gross profit margins against industry averages identify pricing opportunities worth 10-15% revenue increases. Quick ratios below 1.0 signal dangerous liquidity positions that require immediate attention before they threaten operations. These performance controls transform financial data into actionable intelligence that guides strategic decisions and prevents costly mistakes during rapid expansion phases, which sets the foundation for successful implementation of your complete financial growth strategy.

Action transforms financial strategies for business growth from theory into competitive advantage. Start with a comprehensive audit of your current financial systems to identify gaps between your processes and the five strategies we outlined. Most businesses discover they lack proper cash flow forecasts, automated financial reports, or structured performance controls that enable sustainable expansion.

Qualified accounting professionals become essential when you implement complex tax strategies and entity restructuring. We at My CPA Advisory and Accounting Partners help business owners navigate these financial growth strategies through personalized advisory services and proactive financial planning. Our expertise covers tax optimization, QuickBooks implementation, and strategic business consulting that transforms financial chaos into growth engines.

Cash flow management serves as your foundation strategy since it impacts every other financial decision. Once your cash flow systems operate smoothly, you can layer in tax optimization strategies that maximize retention of growth capital. Technology automation follows naturally as your third phase, which creates the infrastructure needed for debt management and performance controls. Professional guidance accelerates implementation while preventing costly mistakes that derail expansion plans.

Privacy Policy | Terms & Conditions | Powered by Cajabra