Comprehensive loss accounting is a critical concept that often puzzles business owners and investors alike. At My CPA Advisory and Accounting Partners, we frequently encounter questions about this important financial metric.

Understanding comprehensive loss is key to grasping a company’s true financial performance beyond just net income. This blog post will break down the components of comprehensive loss and explain why it matters for your business.

Comprehensive loss represents a broader measure of a company’s financial performance than net income alone. It includes all changes in a company’s equity during a period, except those resulting from investments by owners and distributions to owners. This metric provides a more complete picture of a company’s financial health.

While net income focuses on the profit or loss from core business operations, comprehensive loss encompasses a wider range of financial activities. For example, a company might report a net income of $1 million for the year, but if it also experienced a $500,000 loss on foreign currency translations, its comprehensive loss would be $500,000.

Other Comprehensive Income (OCI) includes items that affect a company’s equity but are not reported in the income statement. Common components of OCI include:

For instance, if a U.S. company owns a foreign subsidiary, changes in exchange rates can affect the value of that subsidiary when translated back to U.S. dollars. These changes would be recorded in OCI.

Understanding comprehensive loss is essential for investors and business owners. It can reveal potential risks and opportunities that might not be apparent from net income alone. Large unrealized losses in OCI could indicate future challenges for the company.

In today’s global business environment, factors like currency fluctuations and changes in pension obligations can have a substantial impact on a company’s overall financial position. Considering comprehensive loss allows businesses to better prepare for these potential impacts and develop more robust financial strategies.

Comprehensive loss analysis helps in making more informed financial decisions. There have been cases where a company’s strong net income was overshadowed by significant losses in OCI, leading to necessary strategic adjustments. This metric provides valuable insights into a company’s true financial performance (beyond just operational results) and can highlight areas that require attention or present opportunities for improvement.

As we move forward, it’s important to understand how comprehensive loss is calculated and reported in financial statements. This knowledge will further enhance your ability to interpret and utilize this valuable financial metric.

Comprehensive loss serves as a vital tool for understanding a company’s true financial health. This metric reveals critical insights that net income alone might miss. Comprehensive loss captures a wider range of financial activities, providing a more complete picture of a company’s performance. For example, a tech company might report strong net income but face significant unrealized losses on foreign currency translations due to overseas operations. Without considering comprehensive loss, investors might overlook this potential risk factor.

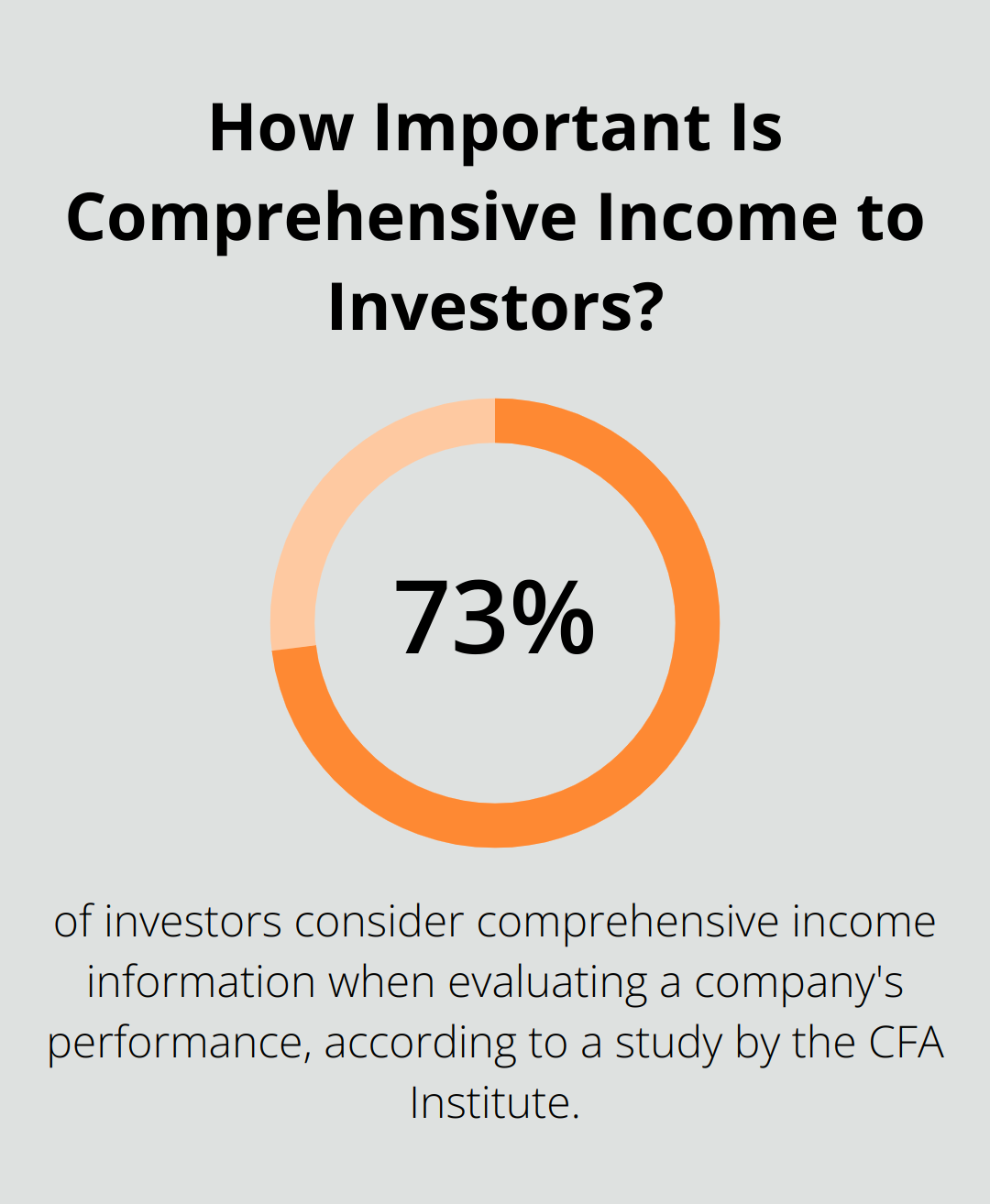

Investors and stakeholders rely on comprehensive loss data to make more informed decisions. A study by the CFA Institute found that 73% of investors consider comprehensive income information when evaluating a company’s performance. This metric can reveal potential volatility in earnings and highlight areas of financial strength or weakness (which might not be apparent from net income alone).

Both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) require companies to report comprehensive income. This standardization ensures transparency and comparability across different companies and industries. The Financial Accounting Standards Board (FASB) mandates standards for reporting and display of comprehensive income and its components (revenues, expenses, gains, and losses).

Understanding comprehensive loss allows businesses to develop more robust financial strategies. Companies can better prepare for potential impacts from factors like currency fluctuations and changes in pension obligations (which may not be reflected in net income). This foresight enables proactive financial planning and risk management.

Comprehensive loss reporting enhances financial transparency. It provides stakeholders with a clearer picture of a company’s overall financial position, including unrealized gains and losses. This increased transparency can build trust with investors and creditors, potentially leading to better access to capital and improved stakeholder relationships.

As we move forward, it’s important to understand how companies calculate and report comprehensive loss in their financial statements. This knowledge will further enhance your ability to interpret and utilize this valuable financial metric.

To calculate comprehensive loss, companies must add or subtract other comprehensive income (OCI) items from net income (or loss). The formula is:

Comprehensive Loss = Net Loss + Other Comprehensive Income (Loss)

For instance, if a company reports a net loss of $500,000 and has an OCI loss of $200,000 from foreign currency translation adjustments, the comprehensive loss would total $700,000.

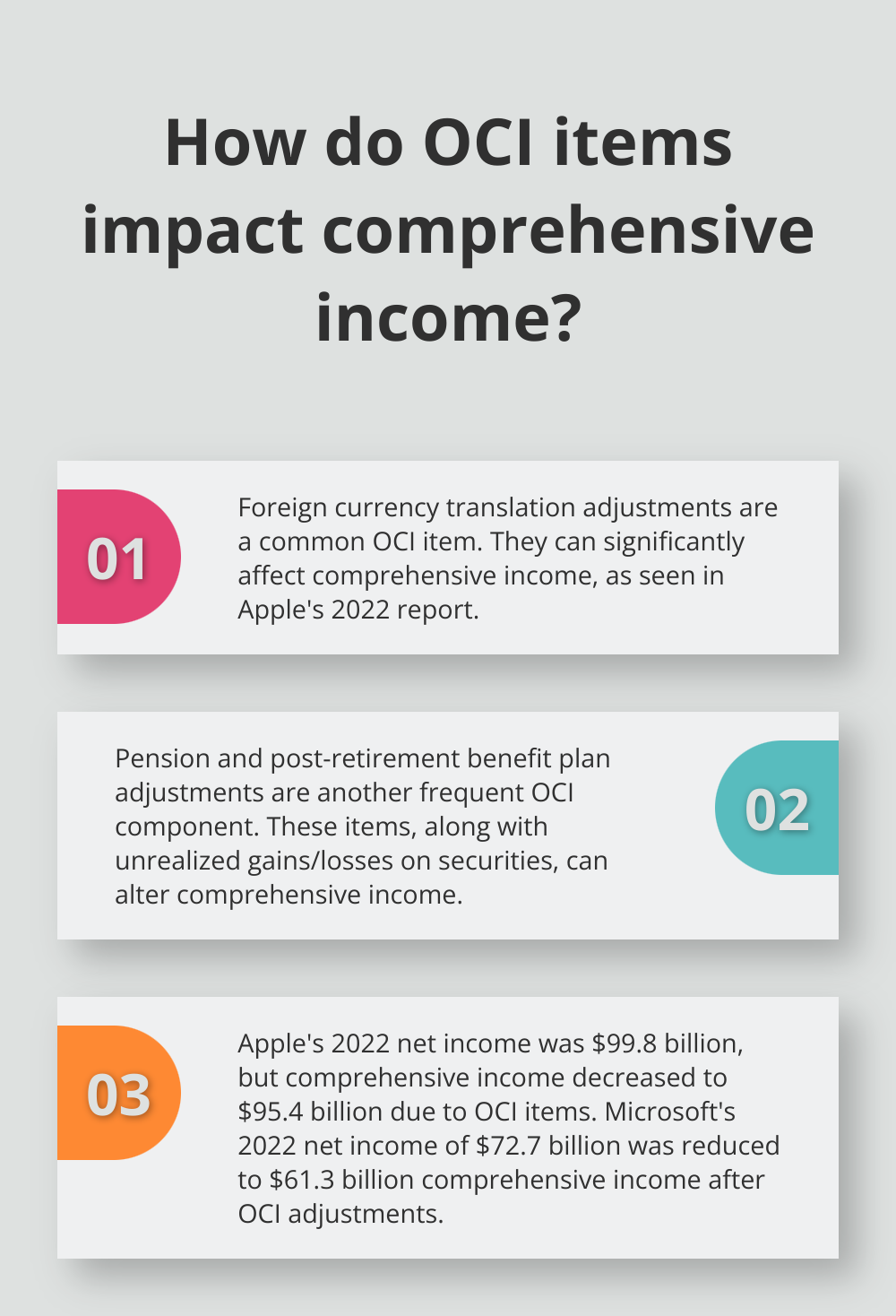

OCI can include various components. A study by the Financial Accounting Standards Board (FASB) found that the most common OCI items are foreign currency translation adjustments, pension and other post-retirement benefit plan adjustments, and unrealized gains or losses on available-for-sale securities.

Companies typically report comprehensive loss in two places within their financial statements:

The Statement of Comprehensive Income: This standalone statement shows the transition from net income to comprehensive income or loss.

The Statement of Changes in Equity: Here, comprehensive loss appears as a separate line item affecting the overall equity of the company.

Some companies opt for the single statement approach, combining their income statement with the statement of comprehensive income. This method provides a clear progression from net income to comprehensive income in one document.

Major companies demonstrate various approaches to reporting comprehensive loss:

Apple Inc.’s 2022 annual report presented a separate consolidated statement of comprehensive income. This statement showed a net income of $99.8 billion, but after accounting for OCI items (such as foreign currency translation adjustments and unrealized losses on marketable securities), the comprehensive income decreased to $95.4 billion.

Microsoft Corporation’s 2022 annual report included a comprehensive income statement that bridged the gap between net income and comprehensive income. Their net income of $72.7 billion was adjusted by OCI items, resulting in a comprehensive income of $61.3 billion.

These examples highlight the significant impact that OCI items can have on a company’s overall financial picture. (Companies must pay close attention to these adjustments to provide an accurate representation of their financial health.)

Proper calculation and reporting of comprehensive loss is essential for businesses of all sizes. It ensures compliance with accounting standards and provides a more complete view of a company’s financial performance. This comprehensive perspective enables better decision-making for both management and investors.

Accurate reporting also helps companies identify potential risks and opportunities that might not be apparent from net income alone. For example, large unrealized losses in OCI could indicate future challenges for the company, prompting proactive measures to address these issues.

Comprehensive loss accounting provides a broader view of a company’s financial performance. It captures important financial activities beyond traditional profit and loss statements, such as foreign currency translations and unrealized gains or losses on investments. This metric enables businesses to identify potential challenges and opportunities that might not appear in net income alone.

Investors benefit from comprehensive loss reporting as it reveals a more complete picture of a company’s financial position. This additional information can highlight areas of financial strength or weakness, leading to more informed investment decisions. It also allows for better assessment of potential earnings volatility and overall financial health.

At My CPA Advisory and Accounting Partners, we understand the importance of comprehensive loss accounting in today’s complex financial landscape. Our team of experts can assist businesses in accurately calculating, reporting, and interpreting comprehensive loss. For more information on how we can support your financial management needs, visit our website.

Privacy Policy | Terms & Conditions | Powered by Cajabra