Advisory services in accounting have become a game-changer for businesses seeking financial expertise beyond traditional bookkeeping. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how these services can transform a company’s financial strategy and performance.

What are advisory services in accounting? They encompass a wide range of specialized guidance, from strategic planning to risk management, designed to help businesses make informed decisions and achieve their financial goals.

Advisory services in accounting represent a significant shift from traditional number-crunching to proactive financial guidance and strategic support for businesses. According to a biennial CPA.com report, firms offering client advisory services (CAS) project their CAS-related revenue to double over the next three years, indicating a growing demand for these services.

Traditional accounting focuses on historical data and compliance. In contrast, advisory services look forward. They involve the analysis of financial information to guide future decision-making and strategy. This shift responds to client needs, with 95% of tax professionals believing their clients want business advisory services beyond compliance work.

Advisory services cover a wide range of business needs. For example:

The integration of technology has revolutionized advisory services. AI and automation now handle routine tasks, which allows accountants to focus on high-value advisory work. For instance, AI-powered software can quickly analyze large datasets to identify financial trends and anomalies, providing valuable insights for decision-making.

This technological advancement aligns with industry trends, as the accounting sector projects a 42.5% Compound Annual Growth Rate in AI investment through 2027. These tools enable accountants to offer more comprehensive advice to their clients, improving efficiency and client service.

Advisory services significantly impact business performance. They provide:

These services help businesses navigate complex financial landscapes, make informed decisions, and achieve their financial goals.

As the demand for advisory services continues to grow, accounting firms must adapt to meet these evolving needs. The next section will explore the key benefits of advisory services for businesses in more detail.

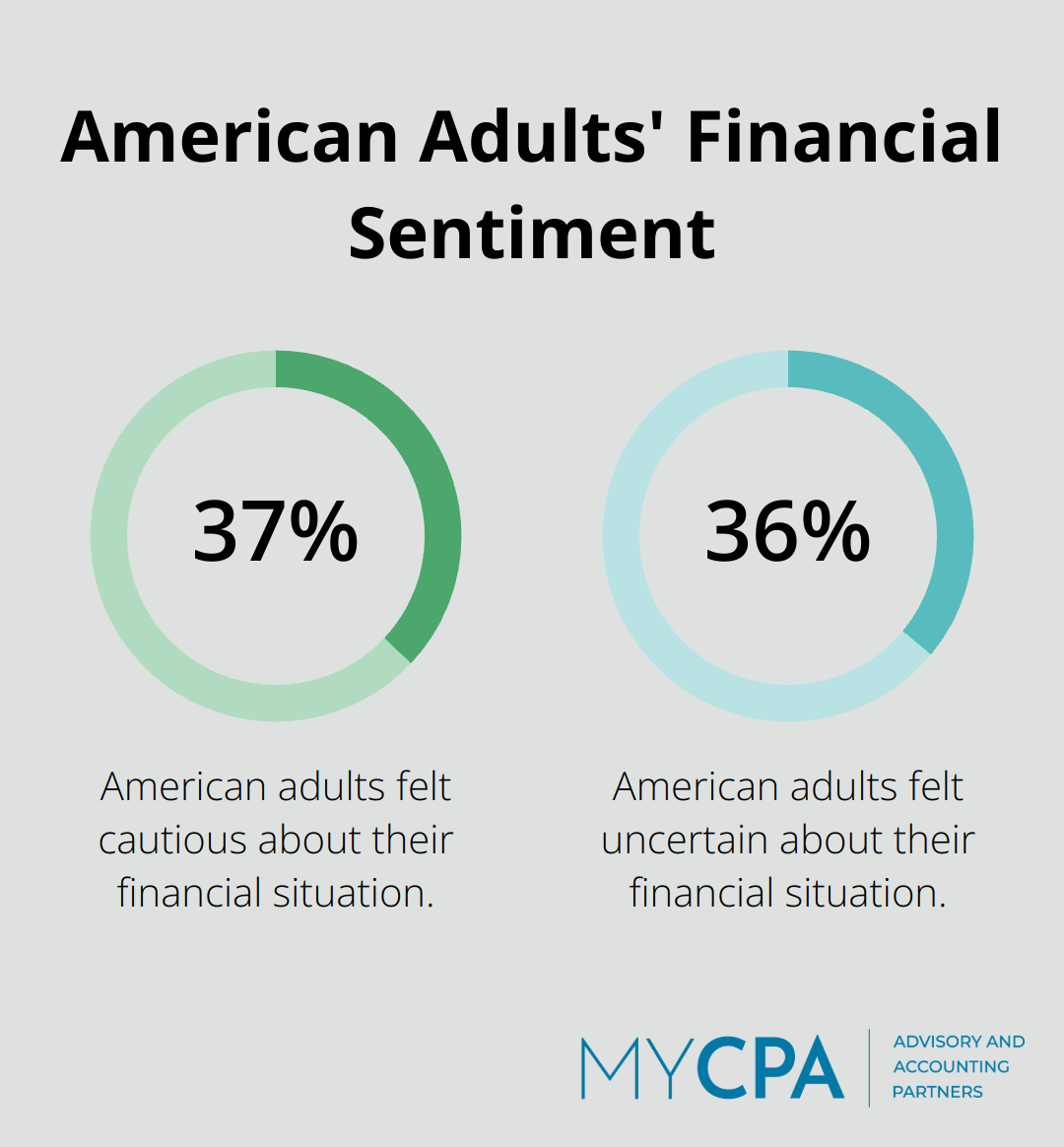

Advisory services in accounting transform financial management from reactive to proactive. These services empower businesses to make more informed choices about investments, expansions, and resource allocation. A study by AICPA found that more than one third of American adults have felt cautious (37%) or uncertain (36%) about their financial situation in the past 12 months. This highlights the importance of advisory services in providing confidence and clarity in financial decision-making.

Risk management stands out as a key benefit of advisory services. Accountants identify potential financial pitfalls and develop strategies to mitigate them. This proactive approach saves businesses money and protects their reputation. A 2024 Report documents that the presence of certain Controls was associated with at least a 50% reduction in both the fraud loss and duration of the fraud.

Advisory services play a vital role in enhancing overall business performance. Through in-depth analysis of financial data and industry benchmarking, accountants identify areas for improvement and develop strategies to boost efficiency and profitability. For example, a manufacturing company saw a 15% increase in profit margins after implementing cost-saving measures and pricing strategies recommended by their advisory team.

In today’s digital age, technology integration is essential for business success. Advisory services help companies navigate the complex landscape of financial technology, ensuring they adopt the right tools for their specific needs. A report by Sage indicated that businesses that received technology advisory services from their accountants were 30% more likely to successfully implement new financial systems, leading to improved efficiency and data accuracy.

Advisory services provide invaluable support for long-term growth planning. Accountants analyze market trends, financial projections, and competitive landscapes to help businesses develop robust growth strategies. This strategic approach (often involving scenario planning and risk assessment) enables companies to make informed decisions about expansion, diversification, or consolidation.

The next chapter will explore the specific types of advisory services offered by accounting firms and how they address various business needs.

Modern accounting firms have expanded their service offerings beyond traditional bookkeeping to provide comprehensive advisory services. These services offer strategic guidance to businesses of all sizes, helping them navigate complex financial landscapes and make informed decisions. Let’s explore some of the most impactful advisory services that accounting firms provide today.

Accounting firms use sophisticated financial models and industry benchmarks to determine a company’s worth. This service proves invaluable for businesses considering mergers, acquisitions, or seeking investment.

In M&A situations, accountants conduct due diligence, perform financial analysis, and plan post-merger integration. They identify potential synergies and risks, which ensures that deals are structured for maximum benefit.

Effective cash flow management forms the lifeblood of any business. Automated cash flow forecasting provides three primary benefits: risk reduction, increased efficiency and improved quality. Accountants also help establish the best sources for data to ensure accurate forecasting.

Accountants also implement strategies to improve cash flow, such as optimizing inventory management, negotiating better terms with suppliers, and improving accounts receivable processes.

Tax planning has evolved from simple compliance to a strategic business function. Accounting firms now offer year-round tax advisory services, which help businesses structure their operations and transactions in the most tax-efficient manner. A CPA may charge $8,000 for annual tax planning to a business owner, advising on equity compensation, retirement and estate planning, and investment strategies.

These services often include international tax strategies for expanding businesses, R&D tax credit optimization, and state and local tax planning to navigate complex multi-jurisdiction requirements.

For business owners looking towards retirement or exit, accounting firms provide invaluable guidance. This includes developing comprehensive succession plans, structuring buyout agreements, and optimizing the business for sale.

Accountants also assist in estate planning, which ensures that business assets are transferred efficiently and tax implications are minimized for the next generation.

Accounting firms play a key role in helping businesses modernize their financial systems. This includes selecting and implementing accounting software, setting up cloud-based solutions, and integrating financial data across various platforms.

At My CPA Advisory and Accounting Partners, we offer QuickBooks services, providing setup and management expertise to streamline financial operations for our clients. This hands-on approach allows businesses to fully leverage their financial technology for better decision-making and reporting.

Advisory services in accounting transform financial management from reactive to proactive. These services empower businesses to make informed decisions about investments, expansions, and resource allocation. The question “What are advisory services in accounting?” encompasses a wide range of specialized guidance designed to help businesses achieve their financial goals.

Advisory services address critical aspects of business operations that impact a company’s success. From cash flow forecasting to succession planning, these services provide businesses with tools and insights to navigate complex financial challenges. The proactive approach of advisory services helps businesses stay ahead of market trends and regulatory changes.

At My CPA Advisory and Accounting Partners, we offer personalized solutions tailored to each business’s unique needs. Our team of experts provides cutting-edge advisory services to help clients achieve their financial goals (and thrive in today’s competitive landscape). We stand ready to support your business with strategic insights and guidance that go beyond traditional accounting.

Privacy Policy | Terms & Conditions | Powered by Cajabra