Your vendors handle critical parts of your business operations. Yet many companies overlook whether these partners actually meet tax standards.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how vendor tax compliance gaps create real problems-from audit exposure to operational disruptions. This guide walks you through auditing vendors, spotting red flags, and building a network you can trust.

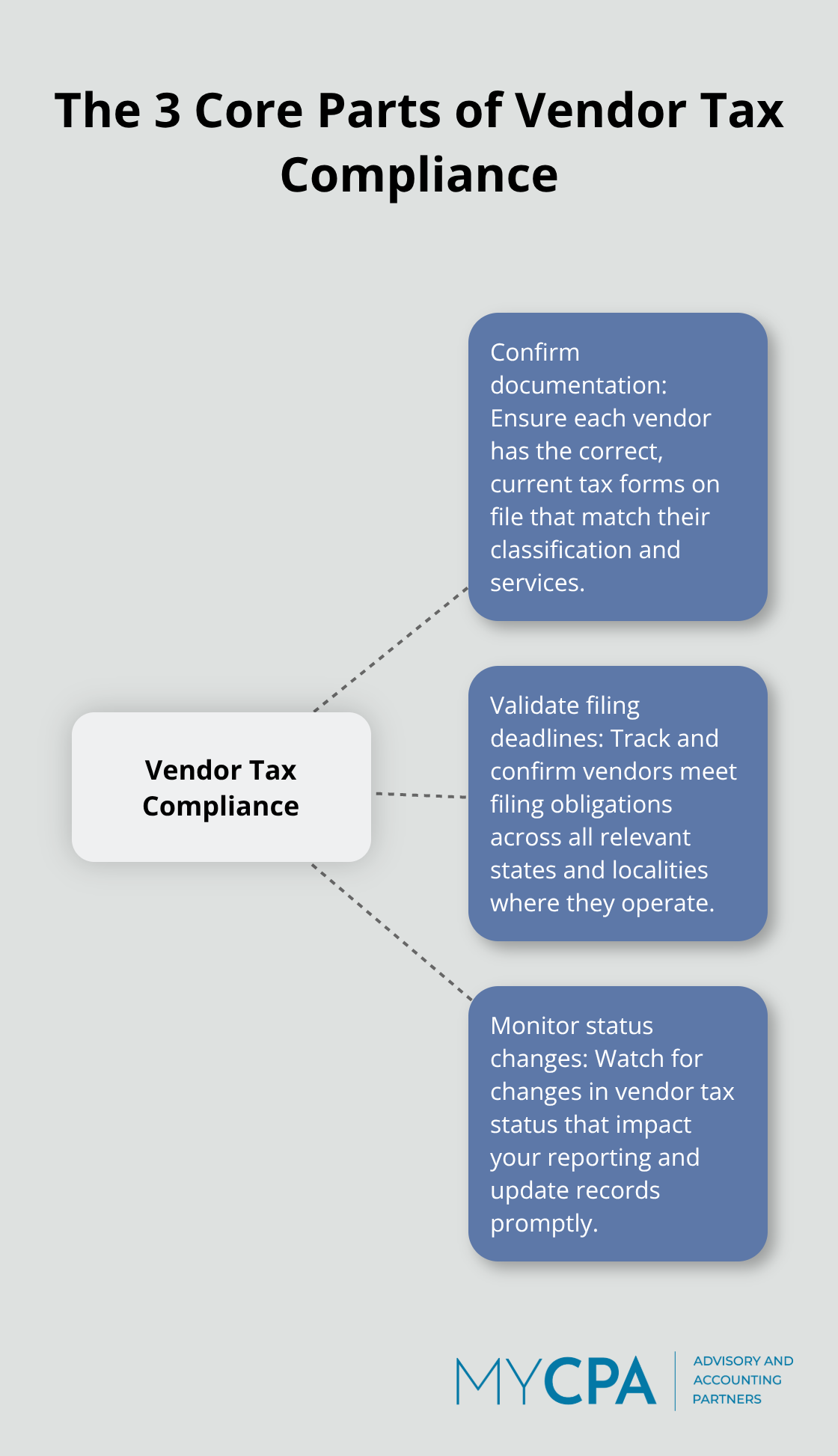

Vendor tax compliance means more than collecting forms and filing papers. You must verify that every partner in your business actually holds the correct tax status, registers in the right jurisdictions, and files their obligations on time. This responsibility breaks into three core parts: confirming vendors have proper tax documentation on file, validating they meet filing deadlines across all states and localities where they operate, and monitoring for changes in their tax status that affect your reporting requirements.

The IRS requires you to collect Form W-9 from domestic vendors and Form W-8BEN-E from foreign vendors before you issue payments. These forms establish the vendor’s tax classification, which determines whether you file Form 1099, Form 1042-S, or neither. A missing W-9 exposes you to backup withholding penalties and IRS reporting errors that can cost thousands in corrections and fines. You should request these forms before your first payment and integrate them into your vendor onboarding workflow to prevent delays. Retain all forms for at least four years after the last payment to cover backup withholding and information return purposes.

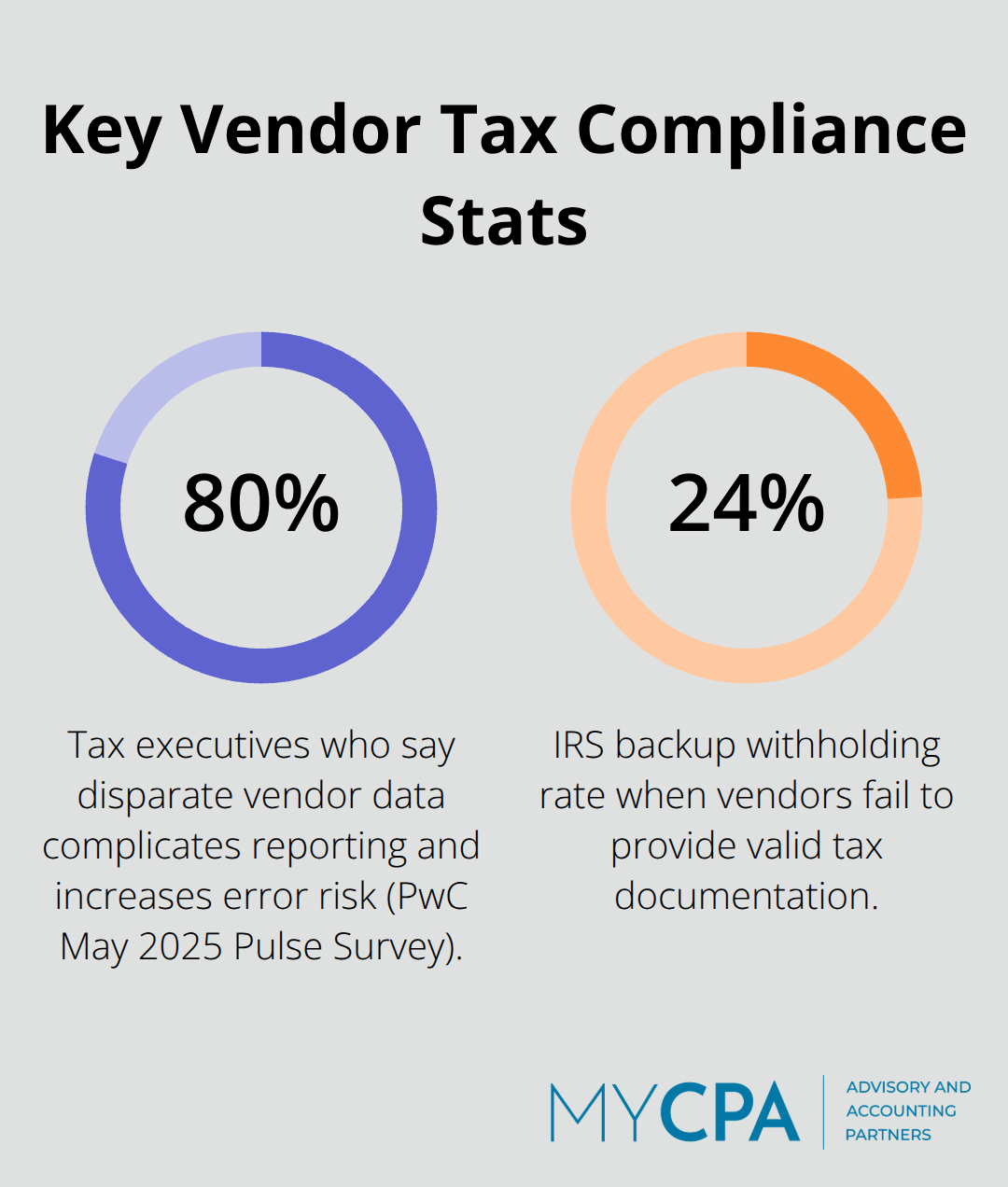

Your company remains responsible for accurate vendor tax reporting, even when vendors fail to provide correct information. The IRS holds you accountable for Form 1099 filings due January 31 and Form 1042-S filings due March 15 each year. According to PwC’s May 2025 Pulse Survey, 80% of tax executives report that disparate vendor data sources complicate reporting and increase error risk. If a vendor misrepresents their tax status or operates without proper licenses in a state where they perform services, your business faces audit exposure.

Incorrect vendor TINs trigger IRS notices and penalties that you must resolve, even if the vendor provided the wrong information. Vendors performing services in multiple states must register for sales tax, use tax, and potentially income tax withholding in each jurisdiction. Missing these registrations means you may unknowingly partner with non-compliant vendors, creating liability that flows back to you during audits.

Compliance requirements shift dramatically based on vendor classification and the services they provide. A domestic contractor classified as a sole proprietor must provide Form W-9 and typically receives Form 1099 if you pay them $600 or more in a calendar year. A corporation or LLC taxed as a corporation generally does not require 1099 reporting, but exceptions exist for legal services, medical services, and certain other payments. Foreign vendors performing work in the United States must provide Form W-8BEN or W-8BEN-E and receive Form 1042-S reporting instead, with withholding rates determined by country-specific tax treaties. A vendor performing services entirely outside the U.S. avoids 1099 and 1042-S requirements entirely, but you still need their tax documentation on file to prove this status. Vendors selling goods across state lines must register for sales tax nexus in states where they exceed thresholds, commonly around $100,000 in gross receipts or 200 transactions annually, though thresholds vary by state and measurement period.

You should document which form applies to each vendor before your first payment, update vendor files when their business structure or location changes, and maintain records for at least four years after the last payment. This systematic approach prevents errors and positions you to respond quickly if an audit occurs. Consider tax planning software for accountants to streamline vendor documentation and compliance tracking across your organization.

Treat vendor tax documentation as non-negotiable. Request Form W-9 from every domestic vendor before you issue the first payment, not after. This upfront approach prevents payment delays and gives you immediate visibility into tax classification. When the W-9 arrives, verify three critical details: the vendor’s legal name matches your records exactly, the taxpayer identification number is valid by cross-checking against IRS records, and the tax classification in Part I aligns with the services provided. According to the IRS, incorrect TINs trigger notices and penalties that you must resolve, making accuracy during initial collection far cheaper than correcting errors later.

For foreign vendors, request Form W-8BEN or W-8BEN-E before payment and confirm they completed Part II or III detailing treaty benefits and withholding rates. Many companies skip this verification step and discover problems during year-end reconciliation when it becomes expensive to fix. Store all documentation in a centralized, encrypted digital platform rather than scattered email folders or spreadsheets. This approach protects sensitive vendor information and creates an auditable trail that demonstrates your compliance effort if regulators question your vendor relationships.

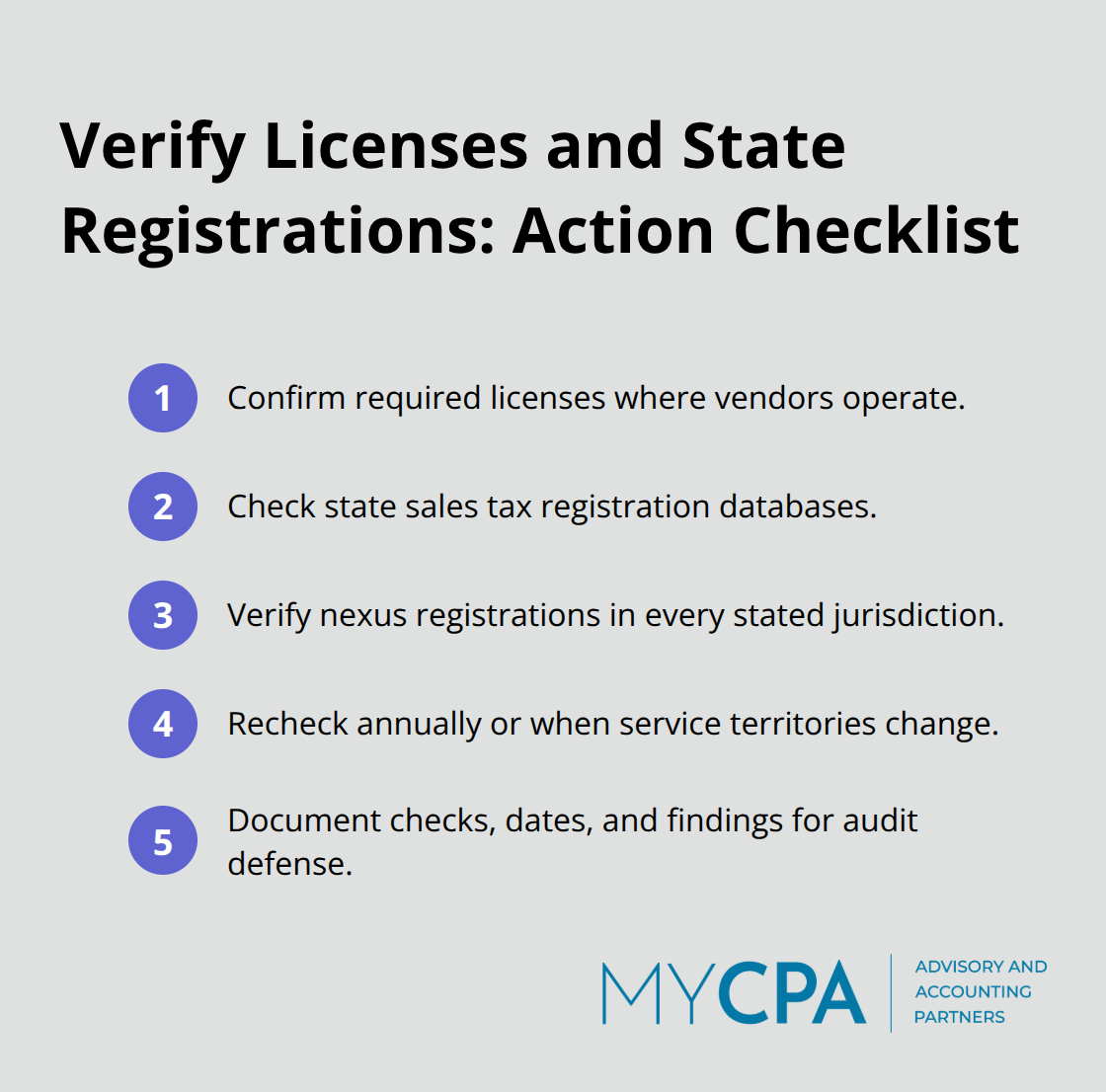

Verify that your vendors actually hold required licenses and registrations in states where they operate. Check your state’s sales tax registration database to confirm vendors performing taxable services registered properly. If a vendor claims to operate in five states, verify they hold nexus registrations in each one. Economic nexus thresholds typically trigger registration requirements around $100,000 in gross receipts, though specific thresholds vary significantly by state and measurement period.

Run these verification checks annually or whenever vendors change their service territory, not just once at onboarding. Document what you checked, when you checked it, and what you found. This record demonstrates due diligence if an audit occurs and protects you from liability for vendor non-compliance.

Flag vendors who fail to respond to compliance requests within 10 business days as high-risk and escalate them for review. Unresponsive vendors often signal deeper problems with business stability or tax compliance. Consider whether continuing the relationship is worth the audit exposure. Treat vendor compliance as an ongoing operational requirement, not a one-time onboarding task. The effort you invest today in systematic verification eliminates surprises and penalties later.

As your vendor network grows, spotting compliance problems becomes harder without a structured process. The next chapter covers the red flags that demand immediate attention and how to address them before they create audit exposure.

Missing tax forms create the most immediate compliance problem you’ll face. When a vendor fails to provide Form W-9 or Form W-8BEN-E before you issue payment, you face two bad choices: hold the payment and risk damaging the vendor relationship, or pay without documentation and trigger backup withholding obligations that become your responsibility to resolve. The IRS requires you to withhold 24% of payments to vendors who don’t provide valid tax documentation, and you must remit those withholdings to the government while tracking the amounts separately for reconciliation. This creates administrative burden and cash flow complications that compound quickly across multiple non-compliant vendors.

Establish a hard rule: no payment without current tax documentation on file. Vendors who resist or delay providing forms signal deeper issues with their business practices or tax compliance posture. If you must work with a resistant vendor, document the delay in writing and implement the 24% backup withholding immediately to protect yourself from IRS penalties. Moving to alternative vendors who operate transparently eliminates this friction and reduces your audit exposure significantly.

Inconsistencies between a vendor’s reported tax status and their actual business operations demand investigation before you file any 1099 forms. A vendor who claims to be a corporation on their W-9 but operates as a sole proprietor, or who reports a business address in one state while performing work in multiple states without registering for sales tax in those states, represents real audit risk. Cross-check the vendor’s reported TIN against IRS records to confirm it matches their stated business structure. Request recent business licenses or articles of incorporation to verify their legal entity status matches their W-9 certification.

If a vendor performs services across multiple states, verify they registered for sales tax in each jurisdiction where economic nexus thresholds apply. When you spot inconsistencies, contact the vendor immediately and request corrected documentation. Some inconsistencies may reflect innocent errors, but others signal that the vendor operates without proper registrations or tax compliance, which makes them unsuitable as a business partner.

Unresponsive vendors who ignore compliance requests within 10 business days create a different problem: they demonstrate indifference to your compliance obligations and suggest their own tax compliance may be neglected. This behavior alone justifies replacing the vendor with someone more diligent about meeting business standards. If the vendor cannot reconcile discrepancies or becomes unresponsive to your requests, escalate the relationship to your finance leadership for a compliance decision.

Flag vendors who fail to respond to compliance requests within 10 business days as high-risk and escalate them for review. Unresponsive vendors often signal deeper problems with business stability or tax compliance. Consider whether continuing the relationship is worth the audit exposure. Treat vendor compliance as an ongoing operational requirement, not a one-time onboarding task.

Vendor tax compliance protects your business from audit exposure, penalties, and operational disruptions that compound over time. The practices outlined in this guide-collecting tax documentation upfront, verifying licenses and registrations, monitoring for red flags, and responding quickly to inconsistencies-form the foundation of a vendor network you can trust. When you systematize these practices, you eliminate surprises and catch problems before they create liability.

Strong vendor standards lower your compliance risk and improve your audit readiness significantly. Vendors who respond promptly to compliance requests and maintain transparent tax status become reliable partners, while those who resist or delay become candidates for replacement. Start by auditing your current vendor roster against the standards in this guide, then systematize your onboarding process so every new vendor provides required documentation before their first payment.

We at My CPA Advisory and Accounting Partners help business owners build vendor tax compliance programs that scale with your growth. Contact us to learn how we can strengthen your vendor compliance and keep your business audit-ready.

Privacy Policy | Terms & Conditions | Powered by Cajabra