Small businesses lose an average of $50,000 annually due to accounting errors and inefficiencies. The best outsourced accounting services can prevent these costly mistakes while freeing up valuable time for growth.

We at My CPA Advisory and Accounting Partners see companies struggle daily with choosing the wrong accounting partner. The key lies in knowing exactly what services you need and which red flags to avoid.

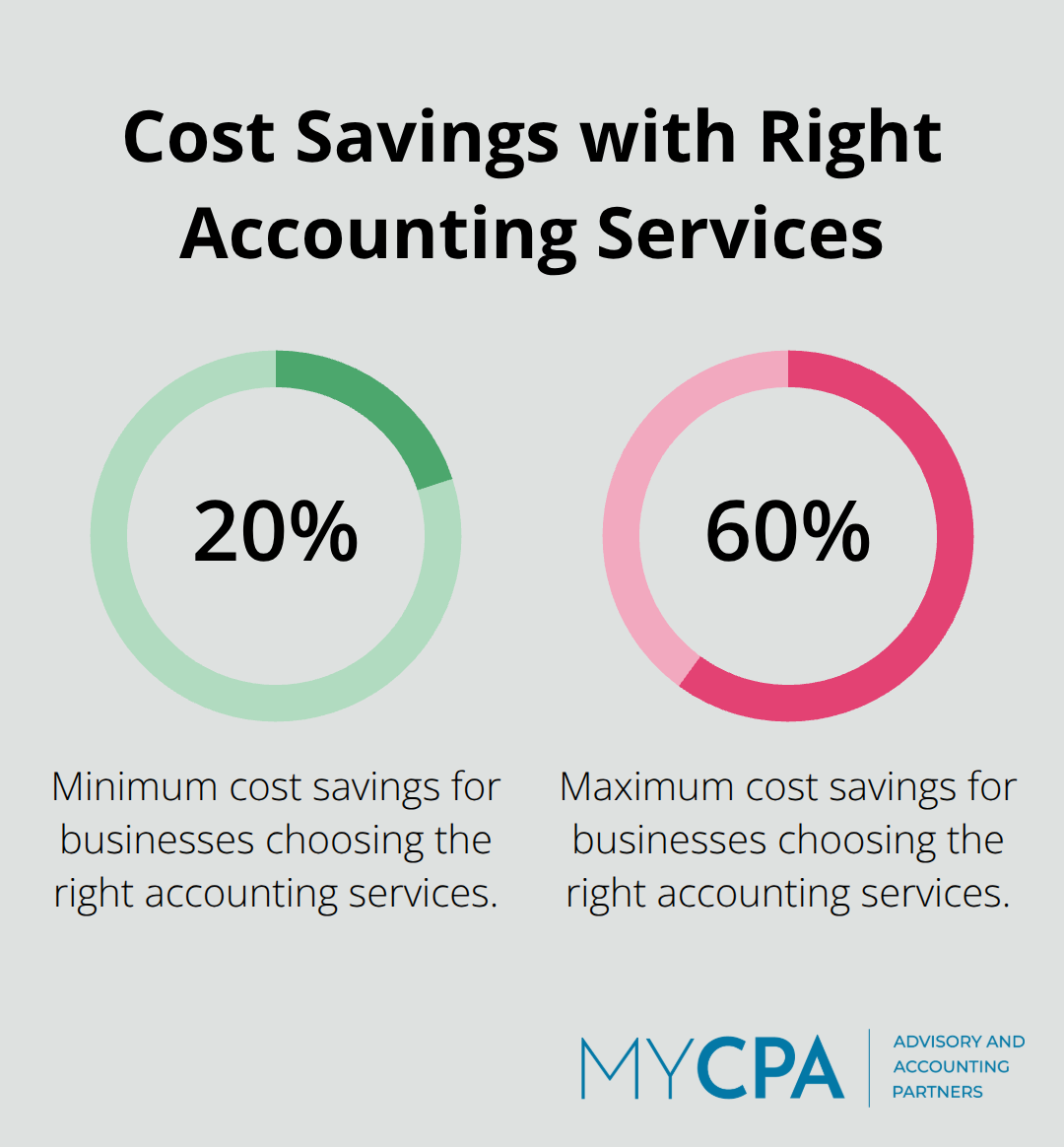

Your business needs four core accounting services that directly impact your bottom line. The global accounting outsourcing market is projected to hit $81.25 billion by 2030, growing at an 8.21% CAGR, with businesses saving 20-60% on costs when they choose the right services from the start.

Daily transaction recording and financial record management prevent the costly errors that drain small businesses. Real-time data capture through professional bookkeeping services provides immediate access to cash flow information and spending patterns. Outsourced bookkeepers use cloud-based systems that update your financial position instantly and eliminate the delays that hurt decision-making. Professional bookkeeping services significantly reduce financial errors compared to DIY approaches.

Tax preparation services that focus only on filing returns waste money. Strategic tax planning services identify deductions and credits throughout the year, not just during tax season. Specialized tax professionals stay current with changing regulations and can restructure business operations to minimize tax liability. Harvard Business Review found that startups with strategic tax services save an average of 23% on their annual tax burden compared to reactive tax filing approaches.

Payroll errors cost businesses an average of $845 per mistake (according to the IRS). Outsourced payroll processing handles wage calculations, tax withholdings, and regulatory compliance across multiple jurisdictions. Professional payroll services maintain compliance with GAAP standards and automatically adjust for changing employment laws. Companies with outsourced payroll report 92% fewer compliance violations than those that manage payroll internally.

Monthly financial statements and analysis reports transform raw data into actionable business intelligence. Professional financial reporting services create comprehensive balance sheets, profit and loss statements, and cash flow analyses that reveal performance trends. Advanced reporting tools identify cost-saving opportunities and growth patterns that internal teams often miss. These detailed financial insights become the foundation for evaluating potential accounting providers and their ability to support your specific business needs. Understanding how to maximize benefits of outsourcing accounting services ensures you select providers that deliver measurable results for your organization.

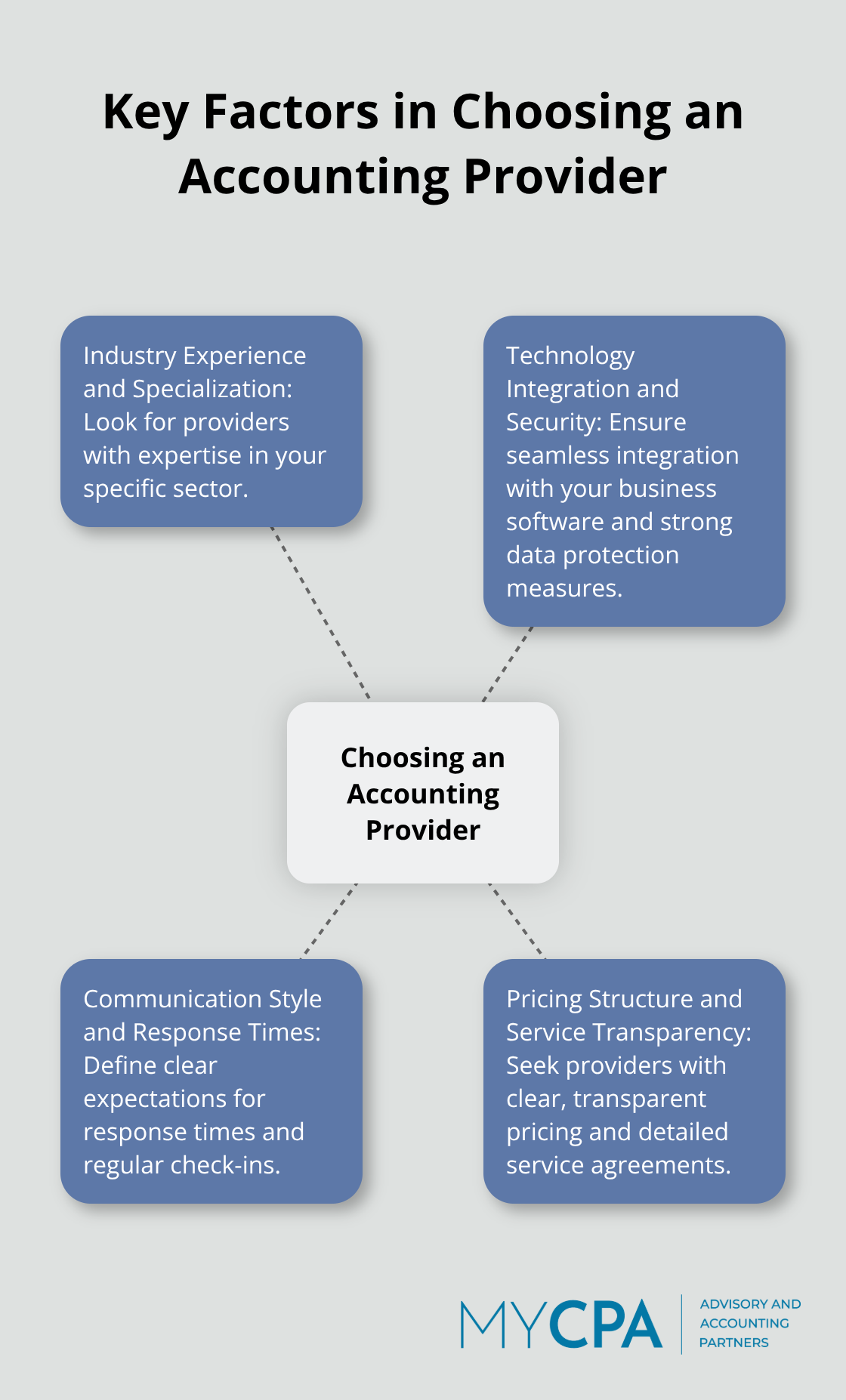

Industry specialization beats generic accounting services every time. Accounting firms that focus on your specific sector understand unique compliance requirements, tax implications, and financial challenges that generalist providers miss. E-commerce businesses need partners familiar with sales tax nexus rules across multiple states, while healthcare companies require expertise in medical billing regulations and HIPAA compliance. Businesses working with industry-specialized accountants face increasingly complex and uncertain regulatory environments that require specialized expertise to navigate effectively.

Professional accounting firms demonstrate their expertise through certifications and client portfolios within your industry. Manufacturing companies benefit from partners who understand inventory valuation methods and cost accounting principles. Restaurant businesses need accountants familiar with tip reporting requirements and food cost analysis. Specialized firms stay current with industry-specific regulations and can restructure operations to optimize tax positions. These providers offer insights that generic firms simply cannot match.

Cloud-based accounting platforms and real-time data access define modern accounting partnerships. Top providers integrate seamlessly with popular business software like Shopify, Salesforce, and inventory management systems without manual data entry requirements. Security certifications matter more than marketing promises (look for SOC 2 Type II compliance and ISO 27001 certifications that prove data protection standards). The right accounting system can significantly improve the accuracy of financial reports for businesses. Software-agnostic providers adapt to your existing tools rather than force expensive platform changes.

Response time expectations need clear definition upfront. Professional accounting firms respond to urgent requests within 4 hours and routine questions within 24 hours during business days. Blended shore teams provide extended coverage while they maintain cultural alignment and communication quality. Regular check-ins and progress updates keep projects on track and build stronger working relationships.

Transparent pricing structures eliminate surprise fees and hidden charges that plague many outsourcing relationships. Fixed monthly fees for defined services provide budget predictability, while hourly rates work better for project-based needs (such as audit preparation or system implementations). Firms that provide detailed service agreements and regular performance reports build trust through accountability and clear expectations. These factors become even more important when you need to identify potential red flags that could derail your accounting partnership.

Unlicensed accounting providers create significant risks for businesses, as highlighted by the National Association of State Boards of Accountancy’s ongoing efforts to support Boards of Accountancy and build trust in the accounting profession. Accounting firms without CPA credentials or proper state licensing cannot represent you during IRS audits or sign tax returns, which leaves your business vulnerable during critical financial situations.

Legitimate accounting partners display their credentials prominently and maintain active memberships with professional organizations like the American Institute of CPAs. Firms that avoid discussions about their qualifications or provide vague responses about licensing status create unnecessary risk for your business operations. Professional accountants hold current CPA licenses and carry professional liability insurance that protects both parties during service delivery.

Response delays that exceed 48 hours for routine requests indicate systemic communication problems that worsen during busy periods like tax season. Professional accounting firms establish clear communication protocols and response time commitments in their service agreements. Providers who miss scheduled meetings, ignore follow-up requests, or delegate client communication to unqualified staff members demonstrate poor operational management. Research shows that communication breakdowns create barriers among key players and erode trust, collaboration, and communication in strategic relationships.

Hidden fees and unclear contract terms signal predatory practices that can double your accounting costs without warning. Reputable accounting firms provide detailed service agreements that specify exactly what tasks base fees include versus additional charges. Providers who refuse to explain their structure or demand payment before they define service scope operate unprofessionally and create budget uncertainty. Contracts without termination clauses or those that require long-term commitments without performance guarantees protect the provider at your expense.

Technology limitations become apparent when firms cannot integrate with popular business software or require manual data entry that increases errors and delays reports. Modern accounting partnerships require cloud-based platforms and real-time data access that support efficient workflows. Accounting firms that use outdated communication methods like fax machines or refuse video conference capabilities cannot support modern business needs (especially for remote collaboration and quick decision-making).

The best outsourced accounting services combine bookkeeping, tax strategy, payroll management, and financial reports into a comprehensive solution that prevents costly errors and supports business growth. Your choice of accounting partner directly impacts your bottom line through improved accuracy, compliance, and strategic insights. Industry specialization matters more than generic experience when you select providers.

Technology integration and transparent fees separate professional providers from problematic ones. Avoid firms without proper credentials, poor communication practices, hidden fees, or outdated processes that create unnecessary risks. Start with clear definitions of your specific needs and budget parameters (then request detailed service agreements from potential partners and verify their credentials through professional organizations).

We at My CPA Advisory and Accounting Partners provide tailored financial services that include tax optimization, accurate accounting, QuickBooks expertise, and business advisory consultation. Our personalized approach combines cross-disciplinary expertise with proactive engagement to deliver stress-free financial management. We support business owners and individuals who seek tax efficiency and confident decision-making support.

Privacy Policy | Terms & Conditions | Powered by Cajabra