Business owner tax planning can make or break your company’s financial health. At My CPA Advisory and Accounting Partners, we’ve seen countless entrepreneurs miss out on valuable opportunities to reduce their tax burden.

This guide will walk you through essential strategies to keep more money in your business. From maximizing deductions to choosing the right business structure, we’ll cover actionable tips to optimize your tax situation.

Business owners who use part of their home exclusively for work may qualify for the home office deduction. The IRS allows a deduction of $5 per square foot of home office space, up to 300 square feet (resulting in a maximum deduction of $1,500 annually). Alternatively, you can calculate actual expenses related to your home office, which might include a portion of mortgage interest, property taxes, and utilities.

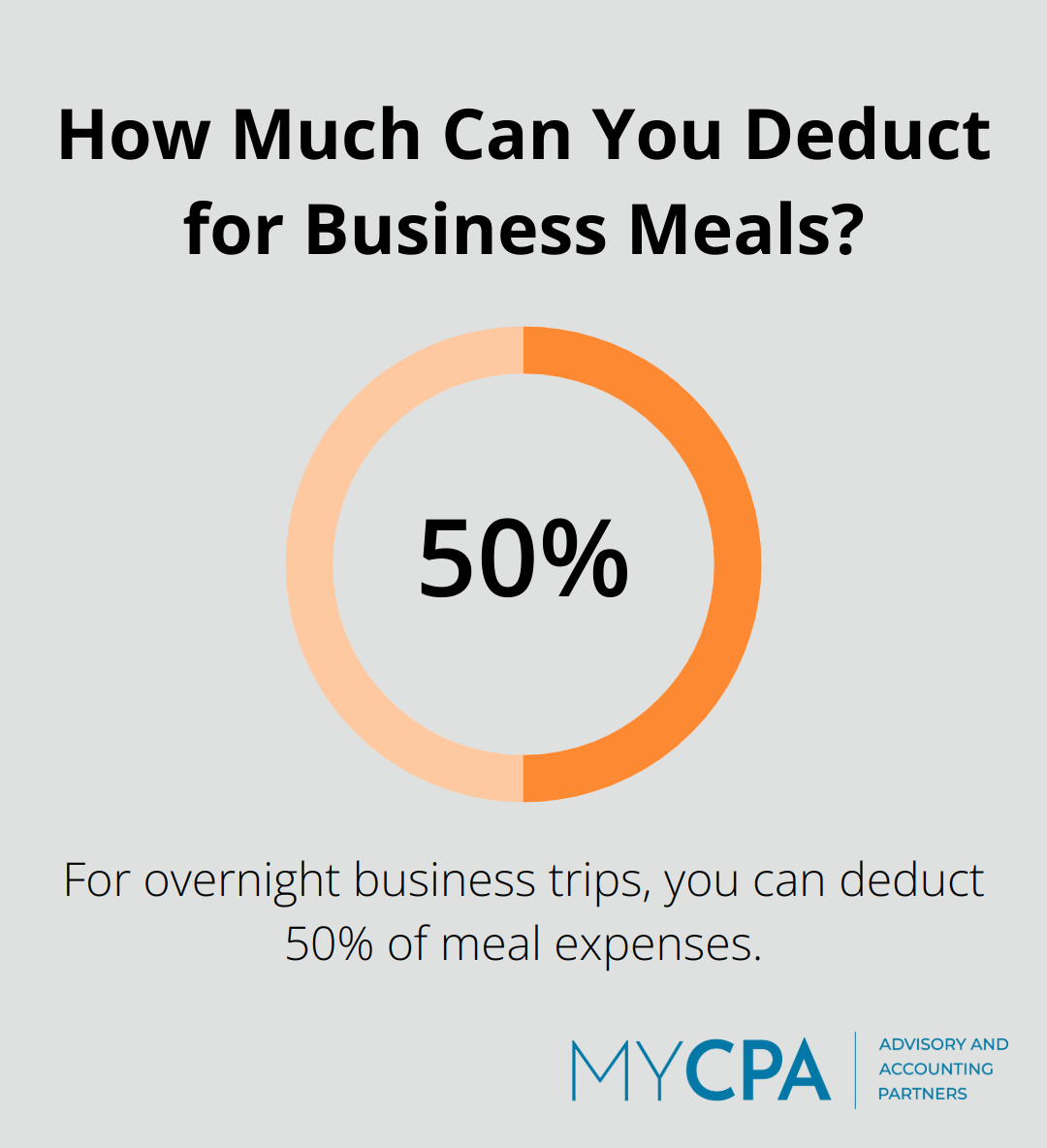

Business-related travel offers significant deduction opportunities. The IRS standard mileage rate for 2025 stands at 70 cents per mile for business use. This covers gas, oil, repairs, and depreciation. Maintain a detailed log of your business miles to maximize this deduction. For overnight trips, you can deduct lodging costs and 50% of meal expenses. These must be ordinary and necessary expenses directly related to your business.

Section 179 of the tax code allows businesses to deduct up to $1,250,000 in qualifying purchases for the tax year 2025. This can significantly benefit businesses investing in new technology or machinery. Bonus depreciation is another powerful tool, allowing for immediate expensing of certain business assets.

Small deductions can add up to substantial savings. Professional development courses, subscriptions to industry publications, and even a portion of your cell phone bill can be deductible if used for business purposes. The key lies in meticulous record-keeping. Use accounting software to track all expenses, no matter how small. This not only ensures you don’t miss deductions but also provides a clear audit trail if needed.

Tax laws change frequently, and it’s challenging to stay updated on all the latest deductions and credits available to your business. Working with a professional tax advisor (like those at MyCPA Advisory and Accounting Partners) can help you identify additional deduction opportunities and ensure you’re complying with all relevant tax laws.

As we move forward, it’s important to consider how your business structure impacts your tax situation. The next section will explore different entity types and their tax implications, helping you make informed decisions about your company’s legal structure.

The structure of your business plays a pivotal role in determining your tax obligations and overall financial strategy. Different entity types come with unique tax implications that can significantly affect your bottom line.

LLCs offer flexibility in taxation. Single-member LLCs typically face taxation as sole proprietorships, while multi-member LLCs receive treatment as partnerships. However, LLCs can opt for taxation as S-Corporations or C-Corporations, which may lower self-employment taxes for owners who actively participate in the business.

S-Corporations provide pass-through taxation. This means the business itself doesn’t pay taxes. Instead, profits and losses pass through to shareholders’ personal tax returns. This structure helps avoid double taxation on corporate income. However, S-Corps face restrictions on ownership and cannot exceed 100 shareholders.

C-Corporations pay corporate income tax on profits, and shareholders pay taxes on dividends (potentially resulting in double taxation). Despite this drawback, C-Corps offer advantages for businesses that plan to reinvest profits or attract outside investors.

Your initial business structure may not remain optimal as your company grows. Consider reassessing your structure if you notice:

For instance, a sole proprietorship experiencing significant growth might benefit from transitioning to an S-Corporation to reduce self-employment taxes on a portion of income.

Selecting the right business structure involves complex considerations. Working with a tax professional can provide:

The right business structure can lead to significant tax savings and better position your company for growth. Don’t leave this decision to chance – consult with a professional to make an informed choice that aligns with your long-term business objectives.

Now that we’ve explored how business structure impacts taxes, let’s turn our attention to another critical aspect of tax planning: timing strategies for income and expenses.

Your accounting method affects when you recognize income and expenses. Cash basis accounting records transactions when money changes hands. Accrual accounting recognizes income when earned and expenses when incurred, regardless of payment timing.

For most small businesses, cash basis accounting offers more flexibility for tax planning. It allows you to delay income recognition by waiting to invoice until the new year or to accelerate expenses by paying bills before year-end.

Businesses with inventory or annual gross receipts exceeding $26 million must use accrual accounting. Consult with a tax professional to determine the best method for your situation.

If you expect to be in a lower tax bracket next year, consider deferring income. For cash basis taxpayers, this might mean delaying invoicing for December work until January. For accrual basis taxpayers, it could involve postponing shipments or service completion until the new year.

Conversely, accelerate deductible expenses into the current year if you anticipate being in a higher tax bracket. Pay outstanding bills, stock up on supplies, or prepay some expenses before year-end. Just ensure these actions align with your business needs and cash flow.

Tax credits directly reduce your tax bill, making them more valuable than deductions. The Research and Development (R&D) Tax Credit can be particularly lucrative for innovative businesses. It’s not just for tech companies – manufacturers, software developers, and even some service businesses may qualify. The maximum amount of payroll tax research credit a small business can apply against payroll tax liability is $500,000.

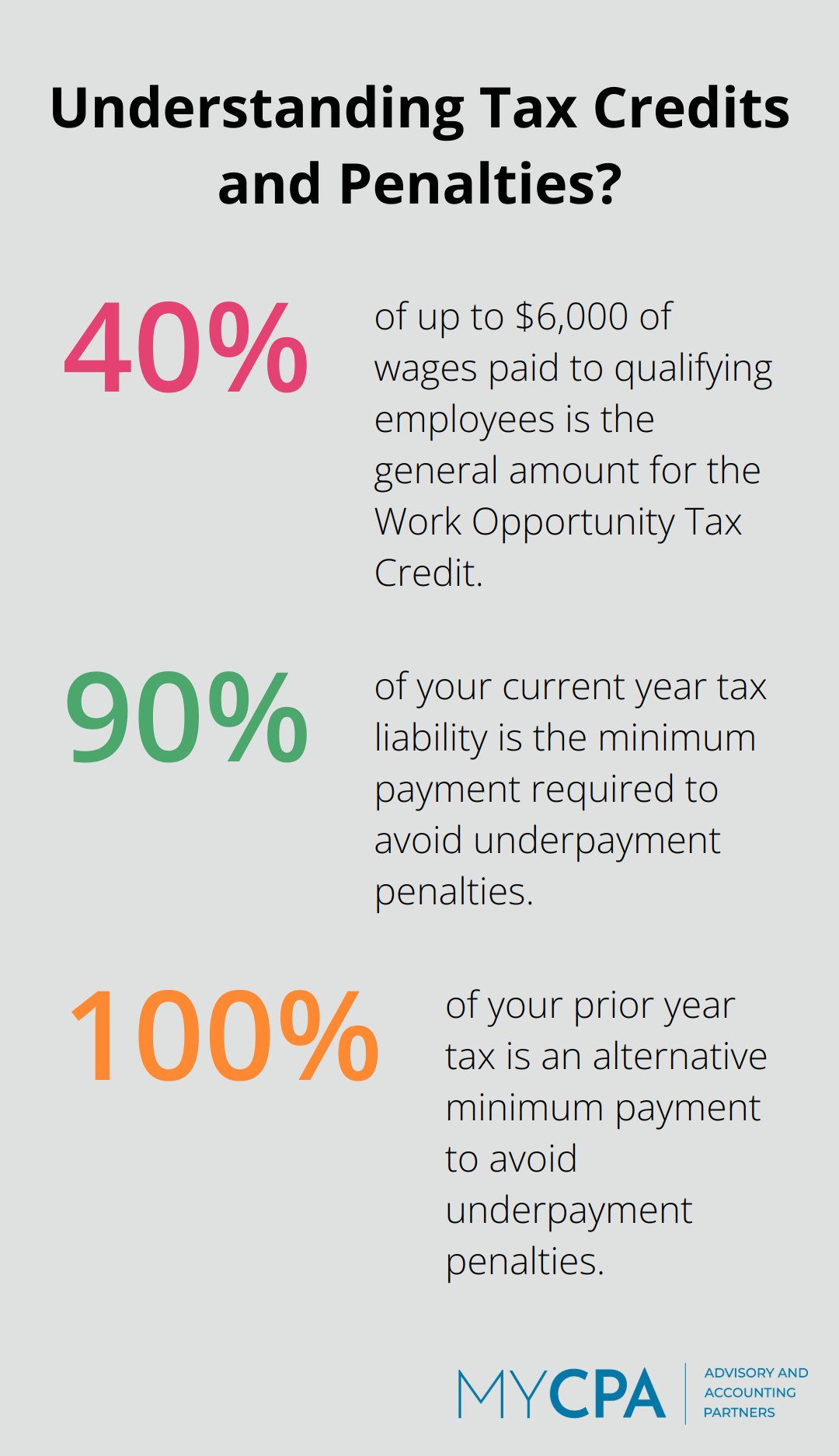

The Work Opportunity Tax Credit (WOTC) is generally equal to 40% of up to $6,000 of wages paid to, or incurred on behalf of, an individual who is in their first year of employment and meets certain criteria.

Energy-efficient improvements to your business property might qualify for tax credits under the Inflation Reduction Act. These credits can offset a significant portion of your investment in solar panels, electric vehicles, or energy-efficient building upgrades.

Failing to pay enough taxes throughout the year can result in penalties. Generally, you need to pay at least 90% of your current year tax liability or 100% of your prior year tax (110% if your adjusted gross income exceeds $150,000) to avoid underpayment penalties.

Review your tax situation quarterly with your accountant. If your income fluctuates significantly, you may need to adjust your estimated payments accordingly. This helps you avoid a large tax bill (and potential penalties) at year-end while also preventing overpayment that ties up your cash unnecessarily.

Effective tax planning requires an ongoing process, not a once-a-year event. Regular check-ins with your tax advisor can help you stay on top of changing tax laws and identify new opportunities to minimize your tax burden.

Business owner tax planning requires year-round attention to maximize financial benefits. Tax laws change frequently, and strategies that work for one company may not suit another. We at My CPA Advisory and Accounting Partners specialize in guiding business owners through complex tax planning processes.

Our team provides personalized advice to optimize tax strategies and reduce liabilities. We offer comprehensive tax services designed to identify overlooked deductions and recommend tax-efficient business structures. Our proactive approach helps clients make informed financial decisions that positively impact their tax situations.

Partnering with My CPA Advisory and Accounting Partners will help you develop a robust tax strategy aligned with your business goals. You can focus on growing your business while we handle your tax planning needs. Our expertise will support your long-term financial success and keep more money in your business.

Privacy Policy | Terms & Conditions | Powered by Cajabra