The IRS collected $688 billion in individual income taxes in 2023, yet billions more go uncollected due to improper tax strategies. Understanding the line between legal tax planning and illegal activities can save you from severe penalties.

We at My CPA Advisory and Accounting Partners see businesses struggle with tax evasion, tax avoidance, and tax planning distinctions daily. The difference between these approaches can mean the difference between smart financial management and federal prosecution.

Tax evasion represents the willful attempt to avoid taxes through illegal means. Section 7201 of the Internal Revenue Code creates two offenses: the willful attempt to evade or defeat the assessment of a tax, and the willful attempt to evade or defeat the payment of tax. The IRS estimates a tax gap which represents the difference between true tax liability for a given tax year and the amount that is paid on time.

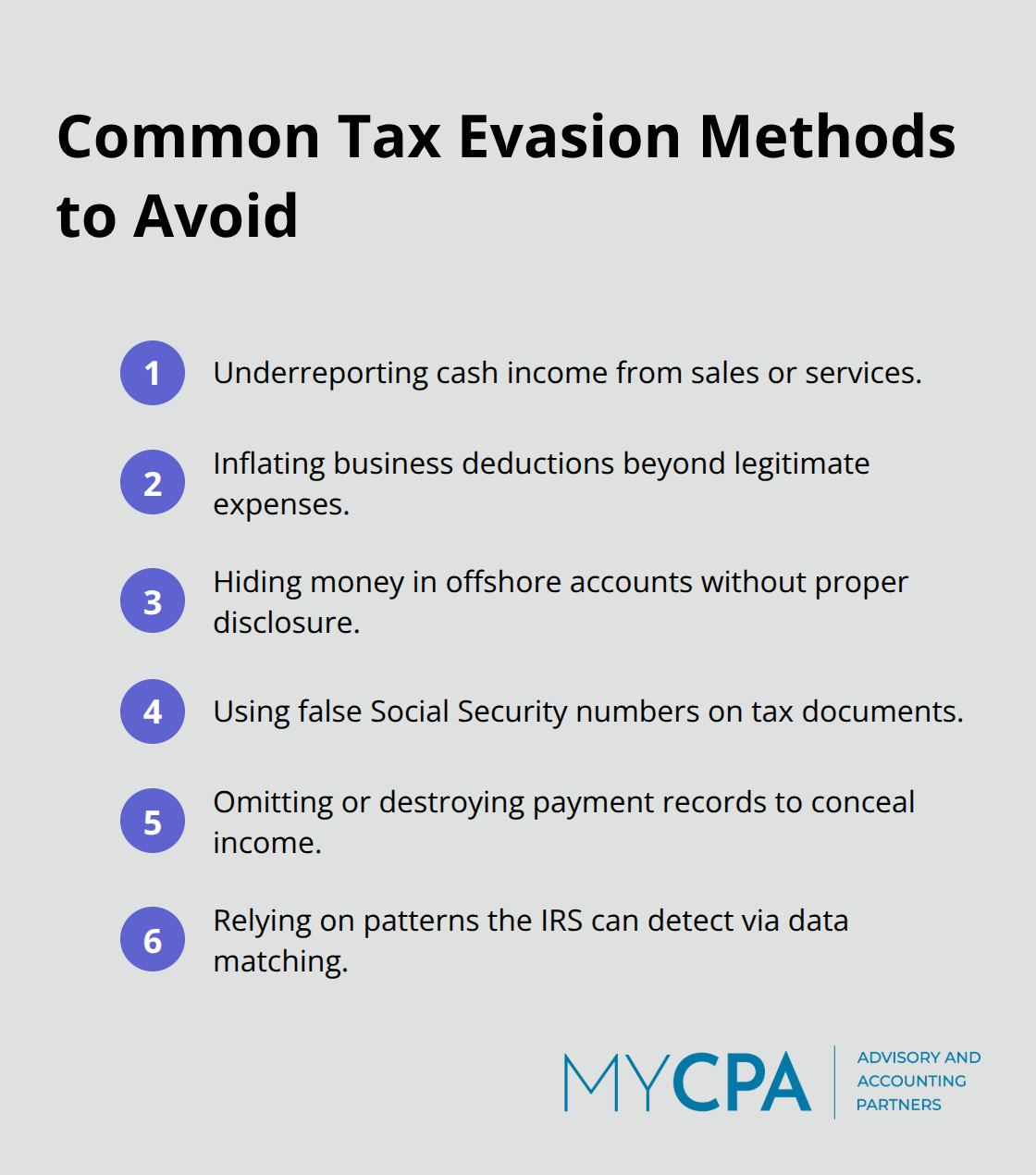

The most frequent evasion methods include underreported income from cash transactions, inflated business deductions beyond legitimate expenses, and hidden money in offshore accounts without proper disclosure. Restaurant owners frequently underreport cash sales, contractors omit payment records, and some individuals use false Social Security numbers on tax documents. The IRS Criminal Investigation Division tracks these patterns through sophisticated data analysis that compares reported income against third-party information from banks and employers.

Tax evasion convictions carry penalties of up to five years in federal prison and fines that reach $250,000 for individuals or $500,000 for corporations. Beyond criminal penalties, evaders must pay back taxes, interest, and additional civil penalties that can double the original tax debt. The IRS successfully prosecutes approximately 3,000 tax evasion cases annually, with conviction rates that exceed 90 percent when cases reach trial.

The IRS flags returns that show dramatic income fluctuations without explanation, excessive cash transactions relative to reported income, and businesses with unusually high expense ratios. Lifestyle inconsistencies also raise suspicions when taxpayers report minimal income while they maintain expensive assets or make large purchases. Financial institutions report suspicious cash deposits over $10,000 (creating an audit trail that often exposes unreported income).

Understanding these illegal practices helps clarify what constitutes legitimate tax reduction strategies versus criminal behavior. While tax evasion involves deception and fraud, legal tax avoidance operates within established tax laws and regulations.

Tax avoidance operates within the legal framework of the Internal Revenue Code and represents the strategic use of tax laws to minimize your tax liability. The World Bank reported in 2019 that governments worldwide lose trillions of dollars through legal tax avoidance schemes, yet these strategies remain completely lawful when properly implemented. The key distinction lies in transparency and compliance with existing regulations rather than concealment or fraud.

Maximum contributions to 401(k) plans reduce taxable income by up to $23,000 annually for 2024, while traditional IRA contributions can lower taxes by an additional $7,000 for most taxpayers. Business owners can deduct legitimate expenses that include equipment purchases, professional development costs, and home office expenses that directly support business operations. Timing strategies like accelerated depreciation and strategic capital gains harvesting help optimize tax positions across multiple years.

The IRS explicitly permits these methods when you document them properly and use them for legitimate business purposes.

Tax avoidance requires complete transparency with the IRS through proper record maintenance and accurate reports of all income and deductions. Every deduction must have documentation that supports it (receipts, contracts, and business justification) that demonstrates legitimate business purpose. The Government Accountability Office found that two-thirds of corporations had no federal income tax liability in each year from 2006 to 2012 through legal avoidance strategies. This highlights the difference between aggressive but legal tax planning and criminal evasion.

Qualified tax professionals understand current tax regulations and compliance requirements that change annually. They help you navigate complex tax codes while you maintain complete legal compliance. Professional advisors also provide audit protection and can represent you before the IRS if questions arise about your tax strategy (which adds another layer of security to your approach).

These legal strategies contrast sharply with illegal evasion methods, but the line between aggressive avoidance and questionable practices requires careful consideration.

The intent behind your tax strategy determines whether you operate within legal boundaries or cross into criminal territory. Tax avoidance requires genuine business purposes and complete transparency with the IRS, while tax evasion involves deliberate concealment and deception. The IRS Criminal Investigation Division evaluates whether taxpayers acted willfully to evade taxes, which may prove an intent to disobey or disregard the law rather than requiring proof of specific intent to evade or defeat a tax.

Courts examine documentation patterns, communication records, and behavioral evidence to establish intent. A taxpayer who maintains detailed records, reports all income accurately, and uses established tax provisions operates legally. Someone who hides income, destroys records, or uses false identities demonstrates criminal intent that prosecutors can prove beyond reasonable doubt.

Legal tax strategies require comprehensive documentation that supports every deduction and tax position you take. The IRS expects receipts, contracts, business justifications, and clear records that demonstrate legitimate business purposes for all claimed expenses. Tax avoidance succeeds when you can produce complete documentation that proves your compliance with tax regulations.

Evasion cases typically involve altered documents or insufficient evidence to support claimed deductions. Professional tax preparers know that aggressive but legal strategies require bulletproof documentation, while questionable schemes often rely on inadequate record-keeping that exposes taxpayers to criminal prosecution.

Qualified tax professionals protect you from legal boundaries while they maximize legitimate tax benefits. The Government Accountability Office found that IRS conducted hundreds of investigations that resulted in tens of millions of dollars in penalties assessed in fiscal years 2021 and 2022. Tax professionals understand current regulations, compliance requirements, and IRS enforcement patterns that change annually.

They help you distinguish between acceptable tax planning and risky strategies that could trigger investigations. Clients who attempt aggressive strategies without professional guidance face unnecessary scrutiny and penalties that proper planning would have prevented (which demonstrates the value of expert advice).

Smart taxpayers evaluate the risk-to-benefit ratio of any tax strategy before implementation. Legal tax avoidance carries minimal risk when you maintain proper documentation and work with qualified professionals.

Professional advisors help you identify strategies that provide substantial tax benefits without exposure to criminal prosecution or severe penalties.

Tax evasion, tax avoidance, and tax planning represent three distinct approaches that determine whether you face federal prosecution or achieve legitimate tax savings. Tax evasion involves illegal concealment and fraud that carries criminal penalties up to five years in prison. Tax avoidance operates within legal boundaries through transparent strategies and proper documentation, while tax planning encompasses broader financial strategies that optimize your tax position.

Professional guidance protects you from legal boundaries while it maximizes legitimate benefits. The IRS prosecutes thousands of evasion cases annually with conviction rates that exceed 90 percent. Qualified advisors understand current regulations, compliance requirements, and documentation standards that separate legal strategies from criminal activity.

Successful tax compliance requires complete transparency, detailed record maintenance, and legitimate business purposes for all deductions. We at My CPA Advisory and Accounting Partners help clients minimize tax liabilities while they maintain full legal compliance (which protects their financial interests within established legal frameworks). Our team provides comprehensive tax services that combine tax expertise with proactive financial strategies.

Privacy Policy | Terms & Conditions | Powered by Cajabra