At My CPA Advisory and Accounting Partners, we understand the importance of tax minimization through legal means. Navigating the complex world of tax laws can be daunting, but it’s essential for individuals and businesses alike.

In this post, we’ll explore effective strategies to reduce your tax burden while staying compliant with current regulations. From understanding deductions and credits to strategic planning and professional guidance, we’ll cover key aspects of legal tax minimization.

Tax deductions and credits are powerful tools for reducing your tax liability. Effective use of these tools requires careful planning and meticulous documentation. Let’s explore how you can leverage these opportunities to minimize your tax burden legally.

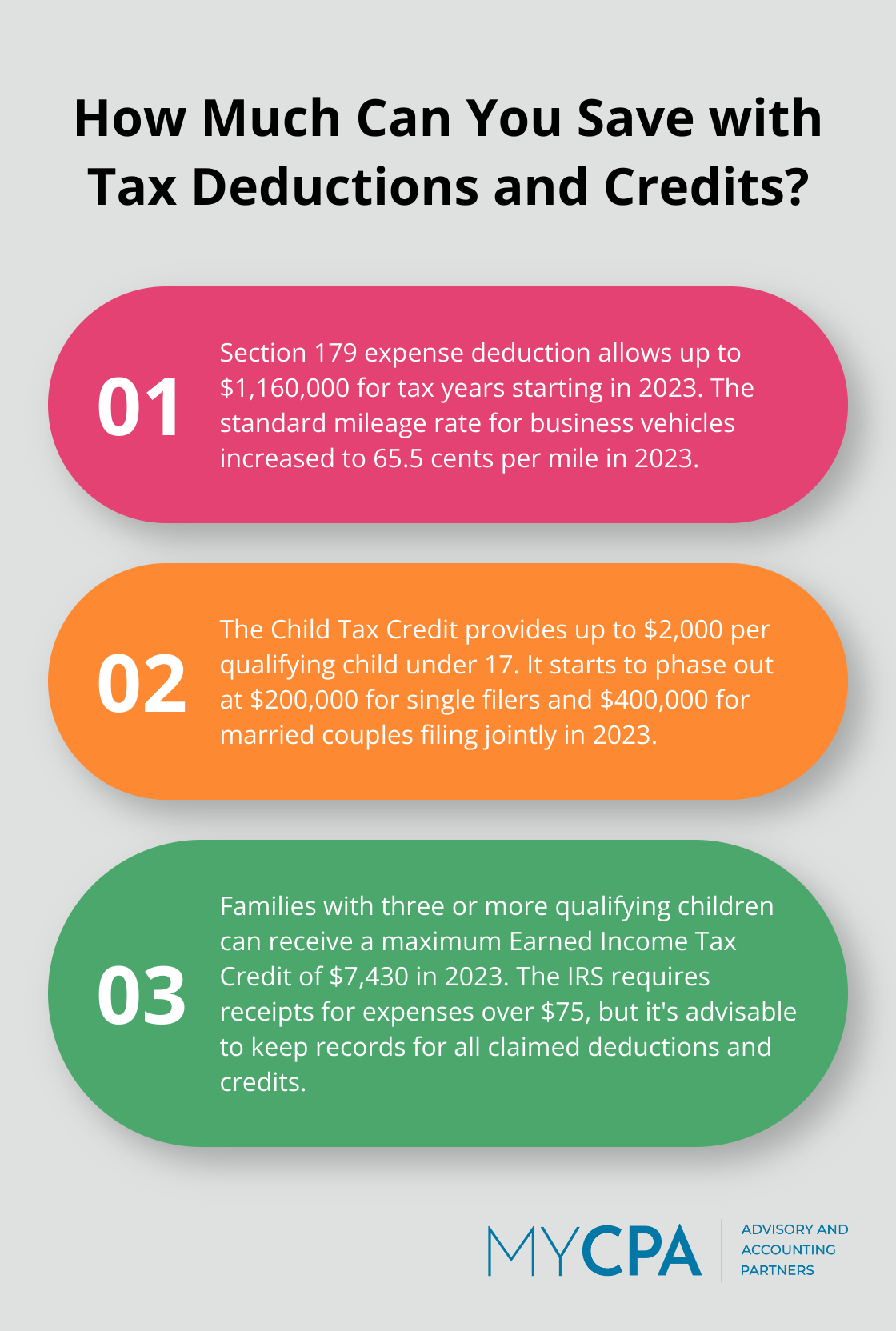

Business owners have access to numerous deductions that can significantly reduce their taxable income. Common write-offs include office expenses, travel costs, and employee wages. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. This substantial deduction can dramatically lower taxable income for small to medium-sized businesses.

Vehicle expenses present another opportunity for significant deductions. Business owners can choose between tracking actual expenses or using the standard mileage rate (65.5 cents per mile for 2023, up from 62.5 cents in late 2022). This increase reflects rising fuel costs and provides additional tax relief for businesses.

Tax credits offer direct reductions to your tax bill, making them particularly valuable. The Child Tax Credit, for example, provides up to $2,000 per qualifying child under 17. In 2023, this credit starts to phase out at $200,000 for single filers and $400,000 for married couples filing jointly.

The Earned Income Tax Credit (EITC) is a powerful tool for low to moderate-income earners. For 2023, families with three or more qualifying children can receive a maximum EITC of $7,430. This credit has proven instrumental in lifting millions out of poverty and continues to provide vital support for working families.

Accurate record-keeping forms the foundation of successful tax planning. The IRS mandates receipts for expenses over $75, but it’s advisable to maintain records for all claimed deductions and credits. Digital record-keeping tools can simplify this process, ensuring you’re prepared for potential audits.

While DIY tax software has simplified the filing process, it often misses nuanced opportunities for tax savings. Professional guidance from experienced CPAs can uncover additional deductions and credits, potentially saving you thousands in taxes. At MyCPA Advisory and Accounting Partners, we specialize in identifying often-overlooked tax-saving opportunities while ensuring full compliance with IRS regulations.

As we move forward, let’s explore how strategic tax planning can further enhance your tax minimization efforts. From timing income and expenses to optimizing retirement account contributions, these strategies can significantly impact your overall tax picture.

Tax planning requires a year-round approach to reduce your tax burden effectively. One powerful tactic involves the careful timing of income. Business owners can defer revenue recognition and accelerate expenses if it’s been a strong year. Employees might request their employers to postpone year-end bonuses until the new year. This strategy proves particularly effective if you anticipate a lower tax bracket in the upcoming year.

While you defer income, consider accelerating deductions into the current tax year. Small business owners might prepay some of next year’s expenses in December (e.g., rent, insurance premiums, or office supplies). Homeowners can also benefit by paying their January mortgage payment in December to claim additional mortgage interest deduction for the current year.

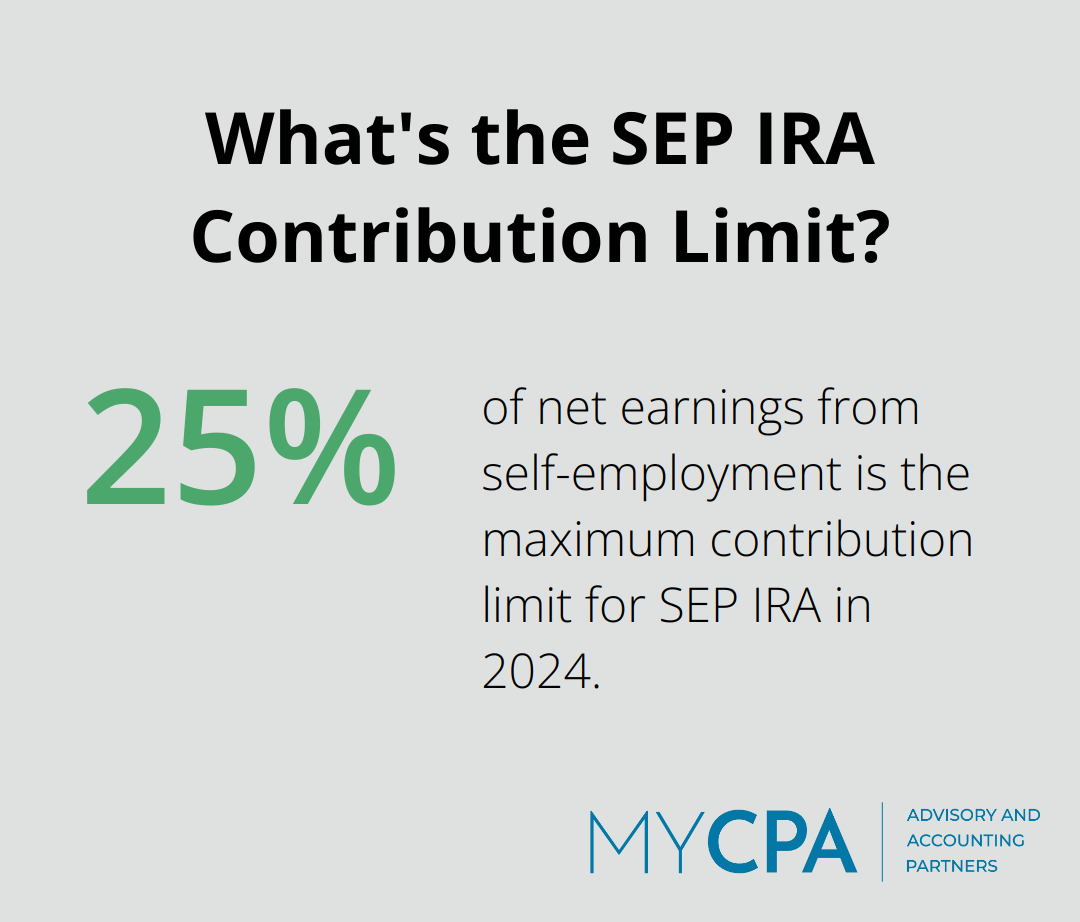

Retirement accounts offer excellent tax advantages. For 2024, you can contribute up to $23,000 to a 401(k), with an additional $7,500 in catch-up contributions if you’re 50 or older, raising your employee contribution limit to $30,500. These contributions reduce your taxable income dollar-for-dollar. Self-employed individuals should consider a SEP IRA, which allows contributions up to 25% of net earnings from self-employment (maximum of $69,000 for 2024).

Your investment approach plays a critical role in minimizing your tax burden. Try to hold investments for over a year to qualify for long-term capital gains rates, which typically fall below short-term rates. For 2024, individuals with taxable income up to $47,025 ($94,050 for married couples filing jointly) can benefit from a 0% long-term capital gains rate.

Tax-loss harvesting presents another powerful strategy. Selling investments at a loss allows you to offset capital gains and potentially reduce your taxable income by up to $3,000. However, exercise caution with the wash-sale rule, which disallows the loss if you repurchase the same or substantially identical security within 30 days.

While these strategies offer powerful tools for tax minimization, they should integrate into a broader financial plan. Tax laws and regulations change frequently, and what works for one individual might not suit another. Professional guidance ensures you leverage every available opportunity to minimize your tax liability while staying compliant with current regulations.

As we move forward, let’s explore how working with tax professionals can further enhance your tax minimization efforts and provide peace of mind throughout the tax planning process.

CPAs offer invaluable knowledge, especially for intricate tax scenarios. Business owners with multi-state tax obligations or individuals with international income sources benefit greatly from professional guidance.

Effective tax minimization requires ongoing attention. CPAs work with clients throughout the year to implement strategies that align with changing tax laws and personal financial situations. This proactive approach allows for timely adjustments to maximize tax savings. A CPA might advise to accelerate certain expenses or defer income based on projected tax brackets for the coming year.

In the event of an IRS audit, a CPA provides invaluable support. CPAs have unlimited representation rights before the IRS, offering expert navigation through the audit process.

The cost of professional tax services often pays for itself through tax savings. Many clients view CPA services as an investment in their financial future rather than an expense. CPAs identify tax-saving opportunities that DIY software often misses, potentially saving clients thousands of dollars annually.

CPAs develop personalized financial strategies that align with each client’s unique situation. This tailored approach (which considers factors such as income sources, business structure, and long-term financial goals) often results in more effective tax planning than one-size-fits-all solutions.

Legal tax minimization strategies provide powerful tools for individuals and businesses to reduce their tax burden while maintaining compliance with current regulations. These methods can significantly impact your overall tax picture, from maximizing deductions and credits to strategic income timing and retirement planning. Tax regulations change frequently, so staying informed about tax laws proves essential for successful tax planning.

We at My CPA Advisory and Accounting Partners specialize in tax minimization through legal means, offering personalized strategies tailored to your unique financial circumstances. Our team of experts stays up-to-date with the latest tax laws and regulations, ensuring you benefit from every available opportunity to reduce your tax burden. Effective tax planning requires attention throughout the year, not just during tax season.

Partnering with a qualified CPA often represents the most effective next step for those seeking to optimize their tax situation. Professional guidance can help you navigate the complex world of taxes, maximize your savings, and focus on growing your wealth and achieving your financial goals. Take a proactive approach to your tax planning and work with experienced professionals to secure your financial future.

Privacy Policy | Terms & Conditions | Powered by Cajabra