Tax planning can be a complex and time-consuming process for many individuals and businesses. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how a streamlined tax planning process can lead to significant savings and reduced stress.

This blog post will guide you through practical strategies to optimize your tax planning, helping you avoid common pitfalls and maximize your financial benefits. By implementing these tips, you’ll be well-equipped to navigate the tax landscape with confidence and efficiency.

Tax planning transcends the annual tax filing ritual. It represents a strategic approach to manage your finances effectively. At its core, tax planning involves a thorough analysis of your financial situation to minimize tax liabilities and maximize after-tax income. This process extends beyond the simple act of filing taxes; it encompasses making informed decisions throughout the year that can significantly impact your financial health.

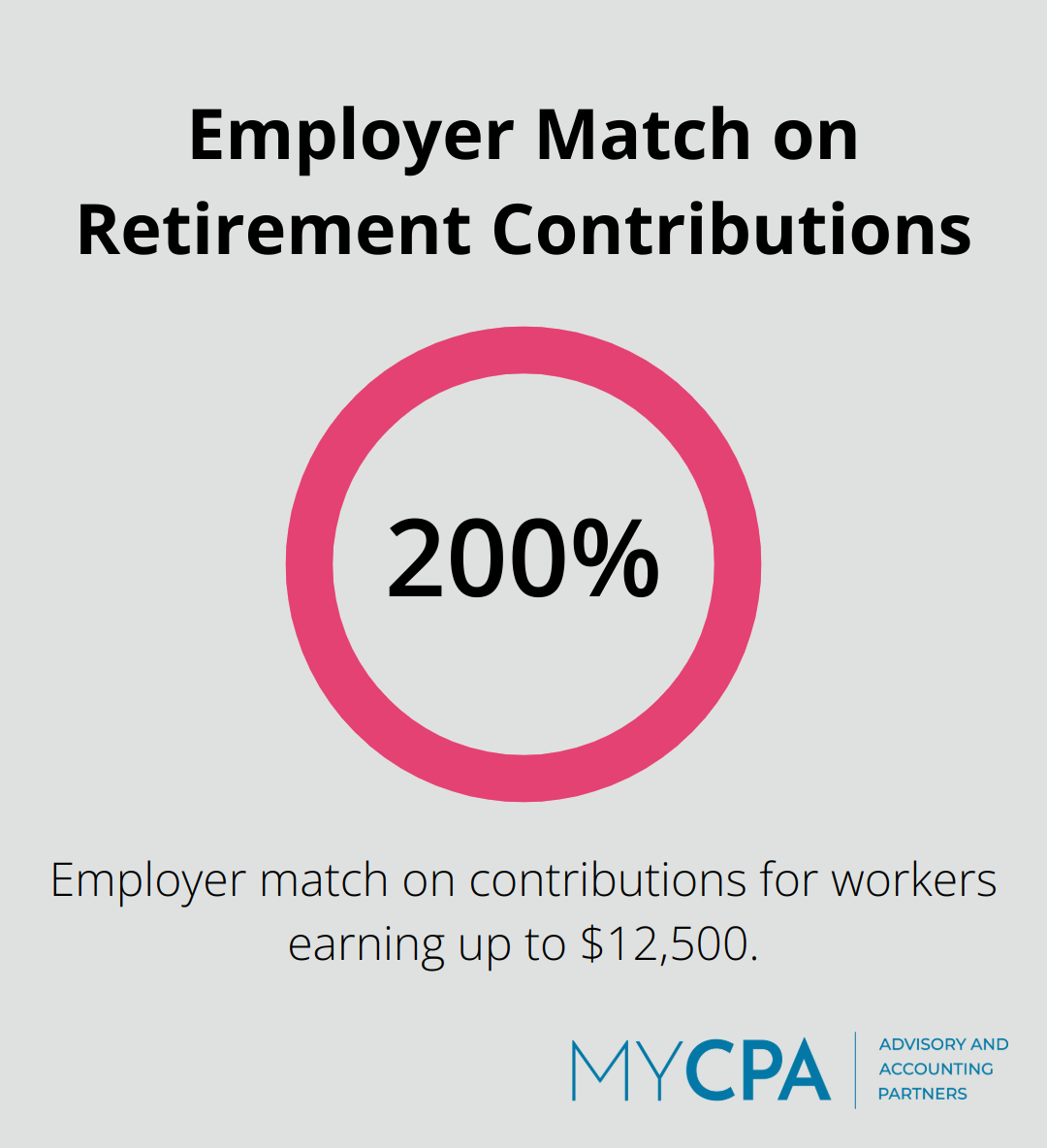

Proactive tax planning yields substantial benefits. A study by the Government Accountability Office reveals that tax-deferred accounts can provide significant savings. For instance, a worker earning up to $12,500 could receive a two-to-one (200 percent) match on their contributions to certain employer-sponsored saving plans or tax-deferred individual accounts. This translates to real dollars in your pocket.

One of the most frequent mistakes in tax planning is the oversight of deductions and credits. The IRS reports that millions of dollars in tax credits go unclaimed each year. In 2020, about $62 billion in Earned Income Tax Credit (EITC) was distributed to 25 million workers and families, with the average amount received nationwide being about $2,461. Staying informed and working with professionals can help you capitalize on these opportunities and avoid costly oversights.

Generic tax advice often falls short because every individual and business has unique financial circumstances. Personalized tax planning takes into account your specific income sources, business structure, and long-term financial goals. This tailored approach can lead to significant reductions in effective tax rates.

While self-education about tax planning is valuable, professional guidance often proves invaluable. Tax professionals stay current with ever-changing tax laws and can identify opportunities you might miss. They can also help you navigate complex situations, such as business transitions or major life events, which can have significant tax implications.

As we move forward, let’s explore key strategies that can help you streamline your tax planning process and maximize your financial benefits.

Tax planning requires attention throughout the year, not just during tax season. A proactive approach can lead to significant tax savings and financial benefits.

Quarterly tax reviews transform efficient tax planning. These reviews allow you to assess your current tax situation, identify potential issues, and make necessary adjustments before year-end. Regular reviews can help you avoid pitfalls by ensuring you set aside enough money for tax payments.

Tax planning software has revolutionized tax approaches. Tools like TaxCut and TurboTax offer features that help you project your tax liability and identify potential deductions. However, these tools work best when used alongside professional advice. Advanced tax planning software (used by many professionals) can evaluate over 1,500 tax-saving strategies, allowing for comprehensive strategy evaluation.

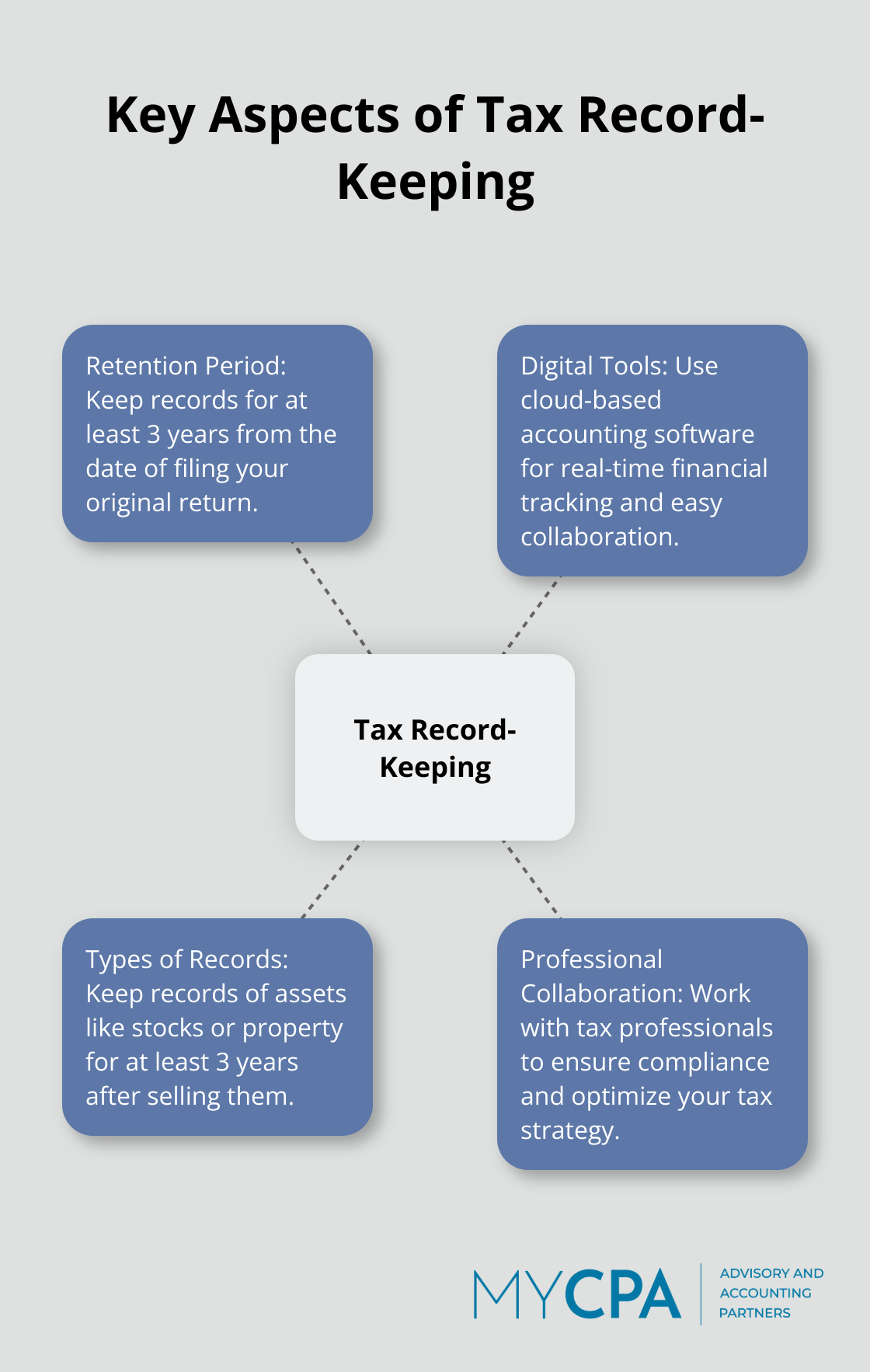

Accurate record-keeping forms the foundation of effective tax planning. The IRS recommends keeping tax records for at least three years from the date you filed your original return. However, some situations require longer record retention. For example, keep records of assets like stocks or property for at least three years after you sell them.

Digital record-keeping tools streamline this process. Cloud-based accounting software (such as QuickBooks Online) allows for real-time financial tracking and easy collaboration with tax professionals. This not only saves time but also reduces the risk of errors in your financial data.

While DIY tax planning tools abound, the complexity of tax laws often necessitates professional guidance. Collaborating with tax professionals provides access to specialized knowledge and experience. Tax laws change frequently, and professionals stay updated on these changes. For instance, the Tax Cuts and Jobs Act of 2017 brought significant changes to the tax code, affecting everything from individual tax rates to business deductions. A tax professional can help you navigate these changes and optimize your tax strategy accordingly.

Effective tax planning involves more than just compliance – it strategically manages your finances to minimize tax liabilities and maximize your after-tax income. The next section will explore practical tips to further optimize your tax planning process and potentially save thousands of dollars each year.

Tax planning involves making smart financial decisions. Here are some practical tips to optimize your tax planning process.

Knowing which deductions apply to your situation is crucial for effective tax planning. Self-employed individuals might qualify for the home office deduction. For example, if your taxable business income for the year was $3,000 without any deduction for office furniture, you can elect to take a deduction that could reduce your tax liability.

Strategic timing of income and expenses can significantly impact your tax liability. If you expect lower income next year, consider deferring some income to the following tax year. This could potentially put you in a lower tax bracket. Conversely, if you anticipate higher income next year, you might accelerate some deductions into the current year.

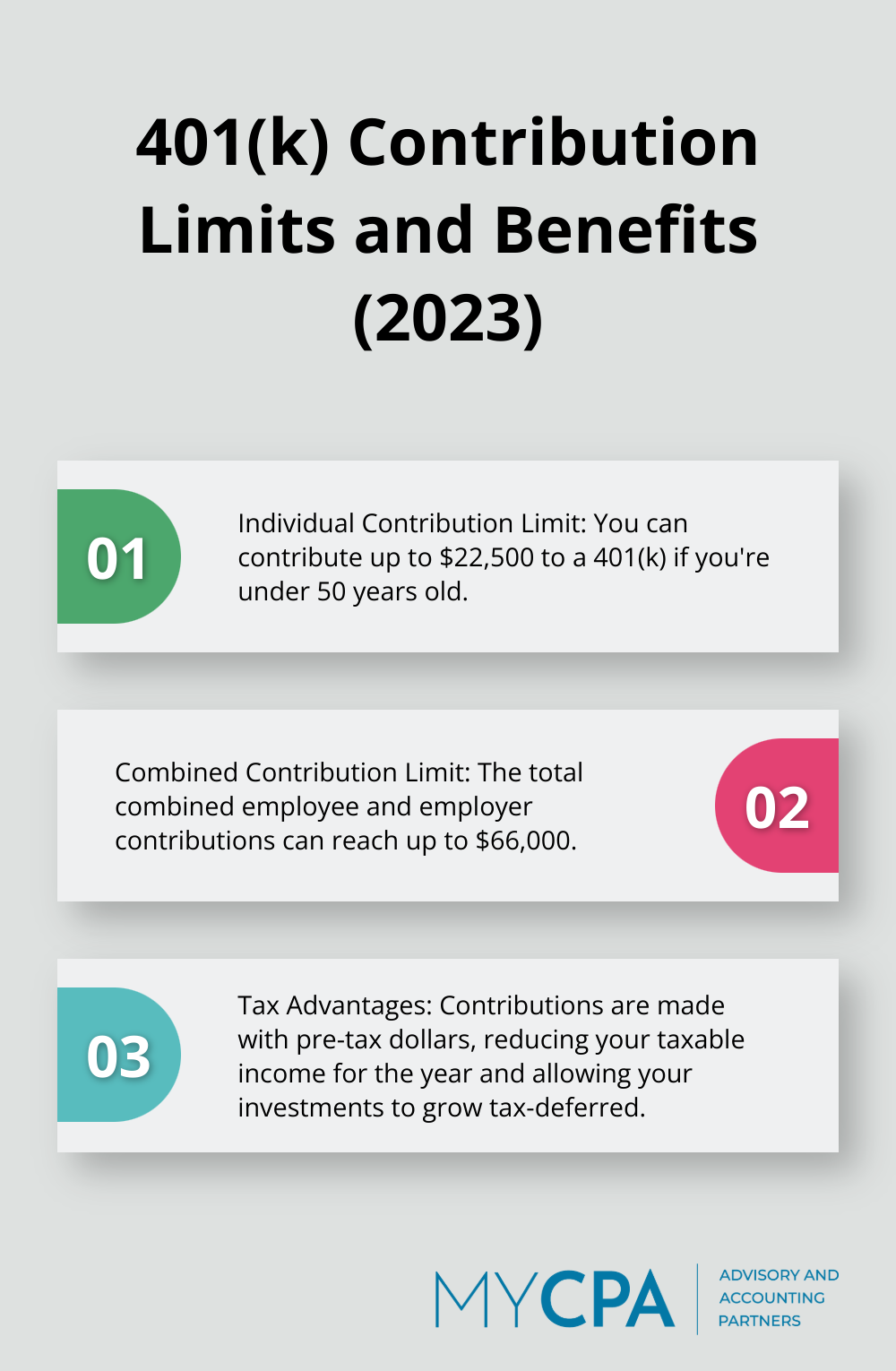

Tax-efficient investing helps you keep more of your returns. Try to max out your contributions to tax-advantaged accounts like 401(k)s and IRAs. For 2023, you can contribute up to $22,500 to a 401(k) if you’re under 50. The combined employee and employer contributions can be up to $66,000.

Municipal bonds present another tax-efficient investment option. The interest from these bonds typically avoids federal taxes (and often state and local taxes as well). This can result in a higher after-tax yield compared to taxable bonds with similar pre-tax yields.

Major life events carry significant tax implications. When buying a home, keep in mind that mortgage interest is tax-deductible on loans up to $750,000. For those starting a business, choosing the right business structure can have major tax consequences. S Corporations, for example, can help reduce self-employment taxes for some business owners.

Retirement planning requires careful consideration. This underscores the importance of early and thorough retirement planning, including tax considerations.

A streamlined tax planning process offers benefits beyond compliance. It reduces tax burdens, improves financial health, and enables informed decisions throughout the year. Proactive planning helps you maximize deductions, time income and expenses strategically, and capitalize on tax-efficient investment opportunities.

The tax planning process empowers you to navigate complex tax laws confidently and adapt to life changes seamlessly. It helps you avoid last-minute scrambles and potential penalties while identifying opportunities for growth and savings. You should review your current financial situation, set clear goals, and apply the tips shared in this post to your unique circumstances.

For personalized guidance in optimizing your tax planning process, consider partnering with professionals who provide tailored solutions. At My CPA Advisory and Accounting Partners, we help individuals and businesses navigate tax planning complexities (ensuring you make the most of every opportunity to minimize your tax liability). Take action today to set the foundation for long-term financial prosperity.

Privacy Policy | Terms & Conditions | Powered by Cajabra