Retirement withdrawals can make or break your financial future. Poor timing costs retirees thousands in unnecessary taxes each year.

We at My CPA Advisory and Accounting Partners see clients lose 20-30% of their retirement income to avoidable tax mistakes. A tax-efficient retirement withdrawal planning calculator helps, but strategy matters more.

The right withdrawal sequence can save you six figures over retirement.

Your retirement accounts face completely different tax treatments that cost you tens of thousands if you withdraw in the wrong order. Traditional 401k and IRA withdrawals get taxed as ordinary income at rates up to 37%, while Roth account withdrawals come out tax-free after age 59½. Taxable investment accounts pay long-term capital gains rates of 0%, 15%, or 20% based on your income level.

Single filers in 2025 pay zero capital gains tax on income up to $48,350, which makes taxable accounts your smartest first withdrawal source. This zero-rate window disappears once your income exceeds this threshold, so you want to maximize withdrawals from taxable accounts while you qualify.

Withdrawal sequence determines whether you pay minimal taxes or get crushed by high rates. Pull $50,000 from a traditional IRA during a high-income year and you pay 32% in federal taxes. Take that same amount during a low-income year and you might pay just 12%. Required minimum distributions (starting at age 73) force withdrawals that push many retirees into higher brackets.

Your marginal tax rate changes everything about optimal withdrawal plans. Stay within the 12% bracket by keeping taxable income under $47,150 for single filers in 2025. Exceed this threshold and you jump to 22%, which costs an extra $1,000 per $10,000 withdrawal. Proportional withdrawal strategies that pull from all account types can reduce total lifetime taxes by over 40% compared to the standard taxable-first approach.

Fill up lower tax brackets with traditional account withdrawals before you touch higher-taxed sources. This approach sets you up perfectly for the next phase of retirement withdrawal optimization.

The 4% withdrawal rule remains the gold standard for retirement planning, but modern retirees need smarter approaches. Trinity Study research from 1998 showed that withdrawals of 4% of your initial portfolio value annually (adjusted for inflation) give you a 95% chance of lasting 30 years. However, this rule assumes you withdraw from all accounts proportionally, which wastes tax opportunities. A better approach combines the 4% framework with tax-efficient sequencing.

Tax-loss harvesting during retirement cuts your tax bill while it maintains portfolio balance. Sell losing investments to offset gains, reduce your taxable income and keep you in lower tax brackets. IRS wash-sale rules prevent you from buying identical securities within 30 days, but you can purchase similar investments to maintain market exposure. These capital losses are used to offset an equal amount of capital gains in other parts of an investor’s portfolio and/or up to $3,000 of ordinary income. Combine harvesting with the 0% capital gains rate for single filers earning under $48,350 and you maximize tax-free withdrawals from taxable accounts.

Roth conversion ladders transform high-tax traditional IRA money into tax-free Roth funds during retirement. Convert traditional IRA assets to Roth IRAs in years when your income drops below the next tax bracket threshold. Pay taxes on the conversion at your current lower rate, then withdraw the converted amount tax-free after five years. Convert $20,000 annually while you stay in the 12% bracket instead of waiting for required minimum distributions at 22% or higher rates. This strategy works best for retirees with substantial traditional account balances who expect higher future tax rates or want to reduce RMDs.

Smart retirees layer these strategies together rather than use them in isolation. Execute tax-loss harvesting while you fill up the 0% capital gains bracket, then convert traditional IRA assets to Roth accounts within your current tax bracket. This coordinated approach sets the foundation for the most important aspect of retirement tax planning: creating your personalized withdrawal sequence.

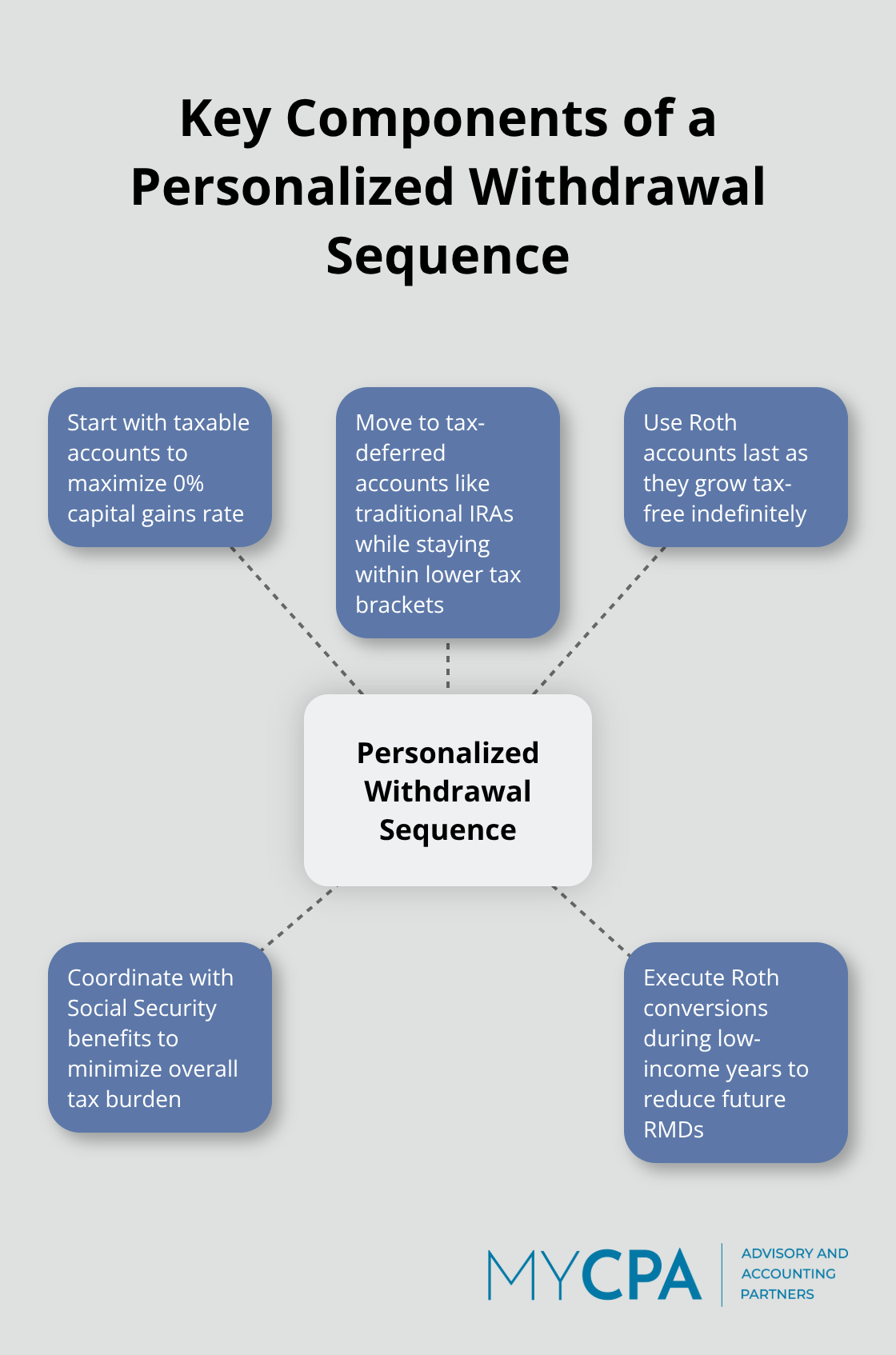

Your withdrawal sequence determines whether you keep your money or hand it to the IRS. Execute withdrawals from taxable accounts first to maximize the 0% capital gains rate for single filers who earn under $47,025 in 2025. Pull exactly enough to fill this bracket, then move to tax-deferred accounts like traditional IRAs while you stay within the 12% income tax bracket at $47,150. Save Roth accounts for last since they grow tax-free indefinitely. This sequence can reduce lifetime taxes by 40% compared to proportional withdrawals from all accounts.

Start with taxable investment accounts to capture the 0% capital gains rate. Sell investments you held for more than one year to qualify for long-term capital gains treatment. Move to traditional 401(k) and IRA withdrawals once you exhaust the capital gains window, but stay within your current tax bracket. Touch Roth accounts last because they face no required minimum distributions and continue tax-free growth throughout your lifetime.

Required minimum distributions start at age 73 and force withdrawals that spike your tax bracket whether you need the money or not. The RMD calculation divides your December 31st account balance by your life expectancy factor from IRS tables. A $500,000 traditional IRA balance at age 73 forces an $18,248 withdrawal that gets taxed as ordinary income.

Counter this tax bomb by executing Roth conversions in your 60s before RMDs kick in. Convert $25,000 annually from traditional to Roth accounts during low-income years, pay taxes at 12% instead of 22% later, and slash future RMD amounts.

Social Security planning amplifies these tax savings since up to 85% of benefits become taxable once your combined income exceeds $34,000 for single filers. Time your first Social Security claim to coordinate with your lowest-income years, then ramp up tax-deferred withdrawals before higher brackets hit.

Calculate your combined income by adding your adjusted gross income, nontaxable interest, and half of your Social Security benefits. Stay below the $34,000 threshold (for single filers) to keep Social Security benefits completely tax-free. This coordination can save $50,000 in taxes over a typical 20-year retirement.

Tax-efficient retirement withdrawal planning saves retirees six figures over their lifetime. The sequence matters more than any tax-efficient retirement withdrawal planning calculator can show. Start with taxable accounts to capture the 0% capital gains rate, move to traditional accounts within your tax bracket, and save Roth accounts for last.

Complex retirement tax situations require professional guidance when you manage multiple account types, plan Roth conversions, or coordinate withdrawals with Social Security benefits. We at My CPA Advisory and Accounting Partners specialize in tax services that minimize tax liabilities and enhance financial health through personalized financial plans and proactive advice. Our team helps clients navigate these complex decisions with confidence.

Strategic withdrawal planning compounds over decades and creates substantial wealth preservation. A retiree who follows optimal withdrawal sequences keeps 40% more money compared to those who withdraw proportionally from all accounts. This difference grows to hundreds of thousands in additional retirement income over 20-30 years (making the right strategy choice one of the most important financial decisions you’ll make).

Privacy Policy | Terms & Conditions | Powered by Cajabra