Retirement tax planning can be a complex maze, but it’s essential for securing your financial future. Many retirees face unexpected tax burdens that could have been mitigated with proper planning.

At My CPA Advisory and Accounting Partners, we specialize in retirement tax planning CPA services to help you navigate these challenges. Our expertise can make a significant difference in maximizing your retirement savings and minimizing your tax liability.

Retirement brings a new set of financial challenges, particularly when it comes to taxes. Many retirees face unexpected tax burdens that proper planning could have mitigated. Understanding these obligations is key for effective retirement planning.

Different retirement accounts have varying tax implications. Traditional 401(k)s and IRAs offer tax-deferred growth, meaning you pay taxes on withdrawals in retirement. Your distribution will be includible in your taxable income and it may be subject to a 10% additional tax if you’re under age 59 1/2. Roth accounts, funded with after-tax dollars, offer tax-free withdrawals in retirement (if certain conditions are met).

Many retirees don’t realize that Social Security benefits can be taxable. The Social Security Administration reports that about 40% of people who receive Social Security must pay income taxes on their benefits. The amount of tax you’ll owe depends on your combined income (which includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits).

Single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. This can significantly impact your overall tax liability in retirement.

While federal taxes are uniform across the country, state taxes on retirement income vary widely. Some states (like Florida and Texas) have no state income tax, making them attractive retirement destinations. Others (such as California and New York) have high tax rates that can eat into your retirement savings.

Strategic choice of retirement location can lead to substantial tax savings. For example, moving from a high-tax state to a low-tax state could potentially reduce your effective tax rate by several percentage points, resulting in annual savings of thousands of dollars.

Navigating these complex tax implications requires expert knowledge. A qualified CPA can help you develop a comprehensive retirement tax strategy tailored to your specific situation. They can assist you in understanding the nuances of different retirement accounts, optimizing your Social Security benefits, and making informed decisions about your retirement location.

As you consider these various aspects of retirement taxation, it’s clear that proactive planning is essential. In the next section, we’ll explore specific strategies you can employ to minimize your retirement tax burden and maximize your retirement income.

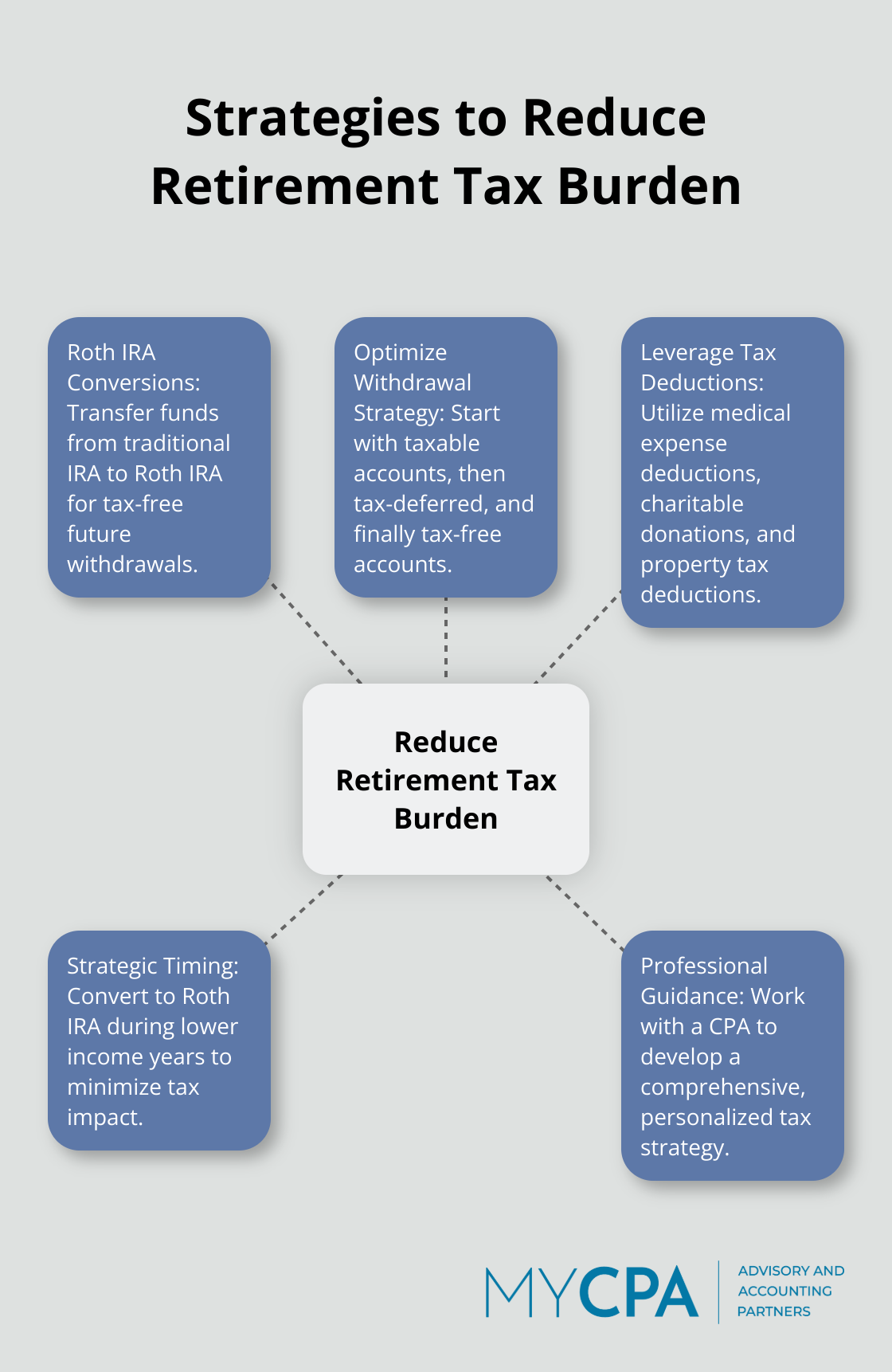

Roth IRA conversions offer an effective strategy to reduce your retirement tax burden. This process involves the transfer of funds from a traditional IRA to a Roth IRA. While you’ll pay taxes on the converted amount in the conversion year, future withdrawals from the Roth IRA will be tax-free.

Strategic timing of these conversions is key. You should consider converting during years when your income is lower, such as early retirement years before you start collecting Social Security. This approach can help you stay in a lower tax bracket during the conversion.

The main consideration when choosing between Roth and traditional accounts is whether your tax rate will be higher or lower during retirement.

The order in which you withdraw from your retirement accounts can significantly impact your tax liability. A common strategy starts with taxable accounts, then moves to tax-deferred accounts (like traditional IRAs), and finally taps into tax-free accounts (like Roth IRAs).

This approach allows your tax-advantaged accounts to continue growing tax-free for longer. It also provides flexibility in managing your taxable income each year, potentially keeping you in a lower tax bracket.

For example, if you’re close to the next tax bracket, you might choose to withdraw from your Roth IRA instead of your traditional IRA to avoid pushing your income into a higher tax rate.

Even in retirement, numerous tax deductions and credits can lower your tax bill. Here are some key ones to consider:

Tax planning is complex and highly individual. What works for one retiree may not be the best strategy for another. Professional guidance proves invaluable in navigating the intricacies of retirement tax planning.

A qualified CPA can help you develop a comprehensive retirement tax strategy tailored to your specific situation. They can assist you in understanding the nuances of different retirement accounts, optimizing your Social Security benefits, and making informed decisions about your retirement location.

As we move forward, let’s explore how working with a CPA can further enhance your retirement tax planning strategy and provide you with peace of mind in your golden years.

CPAs specialize in retirement planning and offer expertise in navigating the complex field of retirement tax planning. They analyze your specific financial situation, including income sources, investment portfolio, and long-term goals. This personalized approach allows them to develop strategies that maximize your retirement savings while minimizing your tax burden.

A CPA might recommend a series of Roth IRA conversions over several years to take advantage of lower tax brackets before you start receiving Social Security benefits. This strategy could potentially save you taxes over your retirement years (depending on your individual circumstances).

Tax laws change constantly, and these changes can significantly impact your retirement plans. CPAs stay up-to-date with the latest tax regulations and can adjust your strategy accordingly.

For example, when the SECURE Act changed the age for Required Minimum Distributions (RMDs), CPAs helped their clients adjust their withdrawal strategies. According to the IRS, owners of traditional IRA, and SEP and SIMPLE IRA accounts must begin taking RMDs once the account holder is age 73, even if they’re retired.

A CPA doesn’t just help you with your current tax situation; they look ahead to ensure your retirement plan remains tax-efficient for years to come. This proactive approach can lead to substantial savings over time.

A study by Vanguard found that working with a financial advisor (which includes tax planning) can potentially increase your portfolio value by about 3% net of fees. Over a 30-year retirement, this could translate to hundreds of thousands of dollars in additional wealth (though individual results may vary).

CPAs provide a comprehensive analysis of your financial situation. They examine all aspects of your finances, including retirement accounts, investments, real estate, and other assets. This holistic approach ensures that your retirement tax strategy aligns with your overall financial goals.

A CPA can help you develop a customized withdrawal strategy that minimizes your tax burden in retirement. They can advise on which accounts to withdraw from first and how much to withdraw each year to stay within optimal tax brackets. This strategic approach to withdrawals can significantly reduce your overall tax liability throughout retirement.

Retirement tax planning requires a strategic approach to secure your financial future. A Retirement Tax Planning CPA can provide personalized strategies tailored to your unique financial situation. These professionals stay current with the latest tax regulations and help you develop a comprehensive strategy that aligns with your long-term financial goals.

At My CPA Advisory and Accounting Partners, we specialize in helping individuals navigate the complexities of retirement tax planning. Our team of experienced CPAs can optimize your withdrawal strategy and identify tax-saving opportunities (while maximizing your retirement income). We commit to minimizing your tax burden and ensuring you make informed decisions about your financial future.

Don’t leave your retirement tax planning to chance. Partner with My CPA Advisory and Accounting Partners to optimize your finances for tax efficiency and long-term stability. With our expertise and personalized approach, you can enjoy your retirement years with confidence.

Privacy Policy | Terms & Conditions | Powered by Cajabra