Wealth management and tax planning are two critical components of financial success. At My CPA Advisory and Accounting Partners, we understand the importance of integrating these strategies to maximize your financial potential.

Effective wealth management involves careful asset allocation and risk management, while smart tax planning can significantly reduce your tax burden. By combining these approaches, you can create a robust financial strategy that protects and grows your wealth over time.

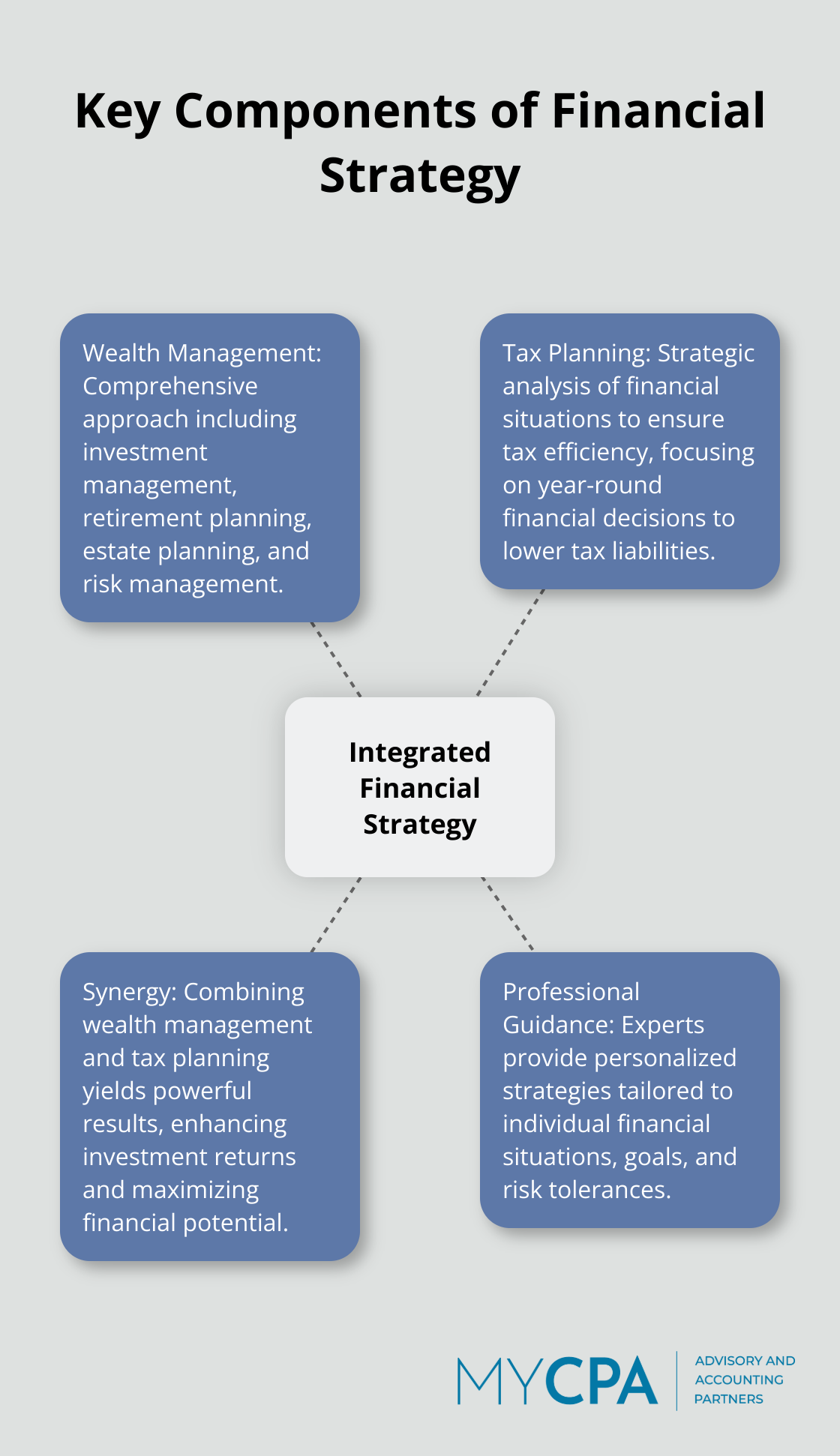

Wealth management and tax planning form the cornerstone of a robust financial strategy. These interconnected practices aim to grow and protect assets while reducing tax burdens.

Wealth management encompasses a comprehensive approach to financial planning. It extends beyond mere investing to create a holistic strategy aligned with life goals. This practice includes investment management, retirement planning, estate planning, and risk management.

A 2023 study by Cerulli Associates projects a transfer of up to $84.4 trillion in wealth from Baby Boomers to younger generations by 2045. This massive shift highlights the need for adaptive wealth management strategies that cater to evolving generational needs.

Tax planning involves the strategic analysis of financial situations to ensure tax efficiency. It transcends annual return filing, focusing on year-round financial decisions that can lower tax liabilities.

The U.S. employs a progressive tax system with seven federal income tax brackets (ranging from 10% to 37%). Understanding these brackets and their application to income proves essential for effective tax planning. For example, only income exceeding a bracket threshold faces taxation at the new rate, not the entire income.

The combination of wealth management and tax planning yields powerful results. Tax-advantaged accounts like 401(k)s and IRAs offer significant benefits. In 2023, individuals can contribute up to $22,500 to a 401(k), allowing for substantial tax-deferred growth.

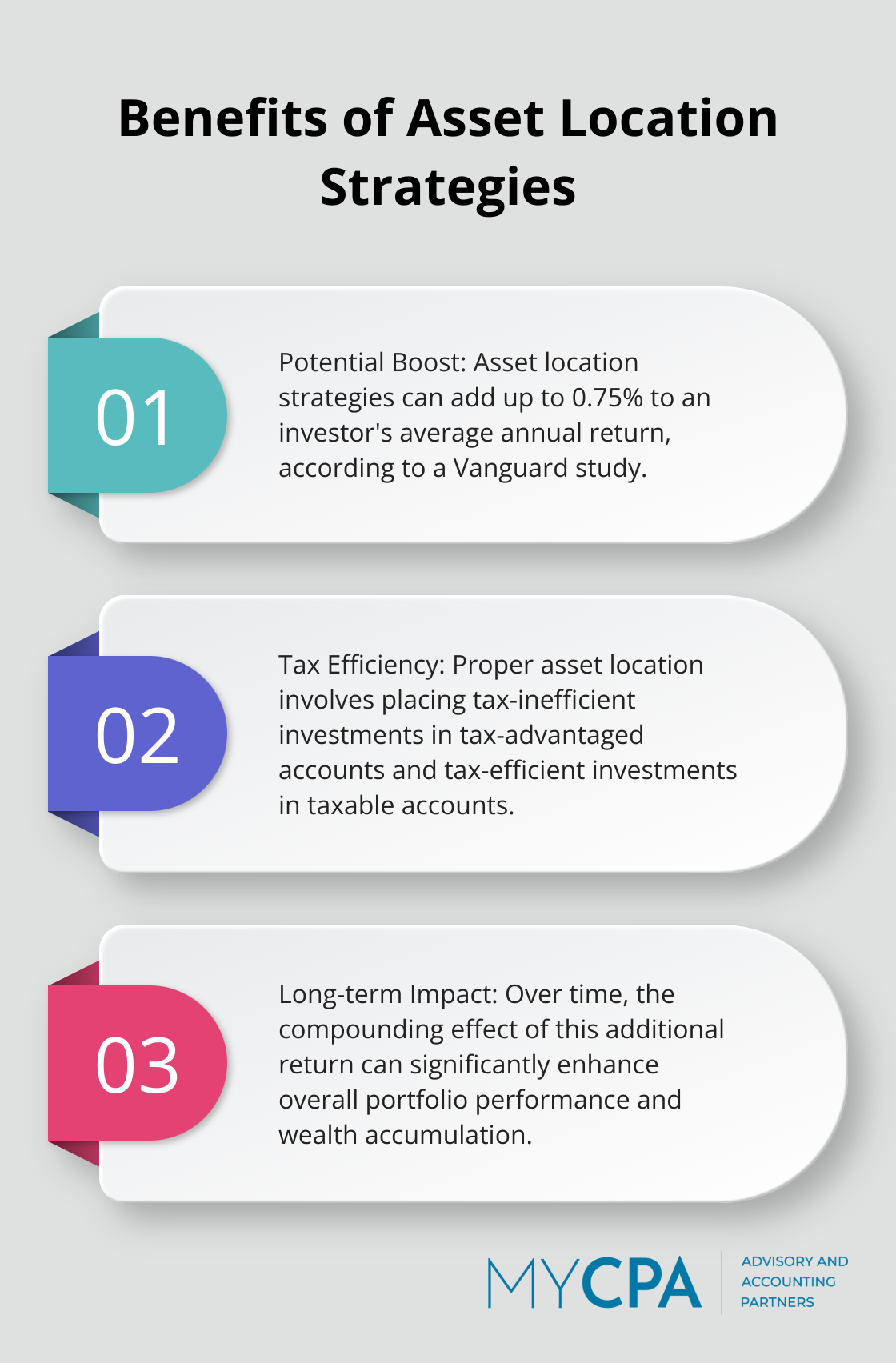

Moreover, strategic tax planning enhances investment returns. A Vanguard study found that proper utilization of asset location strategies can add up to 0.75% to an investor’s average annual return.

Professional guidance proves invaluable in navigating the complexities of wealth management and tax planning. Experts can provide personalized strategies tailored to individual financial situations, goals, and risk tolerances.

For instance, MyCPA Advisory and Accounting Partners offers tailored financial services for business owners and individuals seeking tax efficiency and confident financial management. Their cross-disciplinary expertise ensures a comprehensive approach to wealth management and tax planning.

The integration of wealth management and tax planning strategies forms the foundation of a solid financial future. As we move forward, we’ll explore specific strategies to optimize these practices and maximize your financial potential.

One of the most effective ways to optimize your wealth management strategy is through diversification. Vanguard Research indicates that advice, both human and algorithmic, can help investors diversify their portfolios. This approach protects your wealth from market volatility and provides opportunities for growth across various economic conditions.

Instead of investing solely in U.S. large-cap stocks, consider adding small-cap stocks, international equities, bonds, and alternative investments like real estate investment trusts (REITs).

Markets change constantly, and your portfolio’s asset allocation can shift over time. Regular review and rebalancing are essential to maintain your desired risk level and investment strategy. A study by Morningstar found that portfolios rebalanced annually outperformed those that were never rebalanced by 0.35% per year.

We recommend you review your portfolio at least quarterly and rebalance when your asset allocation shifts more than 5% from your target. This disciplined approach helps you sell high and buy low, capitalizing on market movements.

Your wealth management strategy should match your personal risk tolerance and investment time horizon. A young professional with a long time horizon might choose a more aggressive, growth-oriented portfolio, while someone nearing retirement might prefer a more conservative approach focused on capital preservation and income generation.

A survey by Allianz Life Insurance Company revealed that 67% of Americans say they’re more concerned about a market crash than running out of money in retirement. This highlights the importance of aligning your strategy with your personal comfort level to avoid panic-driven decisions during market volatility.

Tax-advantaged accounts are a powerful tool to optimize your wealth management strategy. Accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs) offer significant tax benefits that can boost your long-term wealth accumulation.

For instance, contributing to a traditional 401(k) can reduce your current taxable income. In 2023, you can contribute up to $22,500 to a 401(k) (or $30,000 if you’re 50 or older). Over time, these tax savings can compound significantly. A study by Fidelity found that a 25-year-old who maxes out their 401(k) each year could potentially have $1.6 million more at retirement compared to someone who doesn’t contribute.

HSAs offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2023, families can contribute up to $7,750 to an HSA, providing a powerful tool for managing healthcare costs and building wealth.

These strategies can significantly enhance your wealth management efforts. However, navigating the complexities of investment choices, tax laws, and financial planning can be challenging. Professional guidance becomes invaluable in creating a personalized wealth management strategy that aligns with your unique financial goals and circumstances. As we move forward, let’s explore how effective tax planning techniques can further optimize your financial strategy and complement your wealth management efforts.

Tax planning forms a key part of successful wealth management. Strategic tax planning can boost wealth accumulation significantly. This chapter explores powerful techniques to reduce your tax burden and maximize your financial growth.

Timing plays a critical role in tax planning. You can potentially lower your tax bill by managing when you receive income or incur expenses strategically. If you expect a lower income year, consider accelerating income into that year. In higher income years, look for opportunities to defer income or accelerate deductions.

The National Bureau of Economic Research found that taxpayers who actively manage the timing of their income and deductions can reduce their tax liability by up to 7%. This could result in thousands of dollars in savings for high-income individuals.

Your choice of tax-efficient investments can dramatically impact your after-tax returns. Municipal bonds are commonly tax-free at the federal level but can be taxable at state or local income tax levels or under certain circumstances. For those in high tax brackets, this can result in a higher after-tax yield compared to taxable bonds.

Exchange-Traded Funds (ETFs) provide another tax-efficient option. Unlike mutual funds, ETFs typically generate fewer capital gain distributions, thus reducing your tax burden. A recent analysis showed that over the past decade, the average ETF investor lost just 0.06% of returns to taxes annually, compared to 0.77% for the average mutual fund investor.

You can reduce your current tax liability while building wealth for the future by maximizing contributions to tax-advantaged retirement accounts. In 2023, you can contribute up to $22,500 to a 401(k) ($30,000 if you’re 50 or older), and up to $6,500 to an IRA ($7,500 if you’re 50 or older).

High-income earners might benefit from a backdoor Roth IRA strategy. This involves making a non-deductible contribution to a traditional IRA and then immediately converting it to a Roth IRA. While this strategy requires careful execution to avoid tax pitfalls, it can provide significant long-term tax benefits.

Tax planning involves complexity and constant change. What works this year might not prove optimal next year due to changes in tax laws or your personal financial situation. Working with experienced professionals can provide personalized guidance tailored to your unique circumstances. MyCPA Advisory and Accounting Partners stays current with the latest tax laws and strategies to optimize your taxes and maximize wealth growth.

Effective wealth management and tax planning strategies form the cornerstone of financial success. These approaches protect and grow assets while providing financial security and peace of mind. A proactive approach to financial management builds resilient portfolios that withstand market volatility and capitalize on growth opportunities.

The complexities of financial markets, tax laws, and individual circumstances highlight the importance of professional guidance. Experts in wealth management and tax planning provide tailored strategies that adapt to changing financial landscapes and personal goals. Their insights prove invaluable in navigating the intricacies of investment choices, tax regulations, and long-term financial planning.

MyCPA Advisory and Accounting Partners offers personalized financial services for business owners and individuals seeking tax efficiency and confident financial management. Our team’s cross-disciplinary expertise ensures a comprehensive approach that addresses all aspects of your financial life. We invite you to explore how our integrated wealth management and tax planning services can help you achieve your financial goals.

Privacy Policy | Terms & Conditions | Powered by Cajabra