Tax planning for businesses is a powerful tool that can significantly impact your bottom line. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how strategic tax planning can boost profitability and improve cash flow for companies of all sizes.

Effective tax planning goes beyond mere compliance; it’s about proactively managing your tax obligations to maximize savings and minimize liabilities. In this post, we’ll explore key strategies to optimize your business’s tax planning approach and set you on the path to greater financial success.

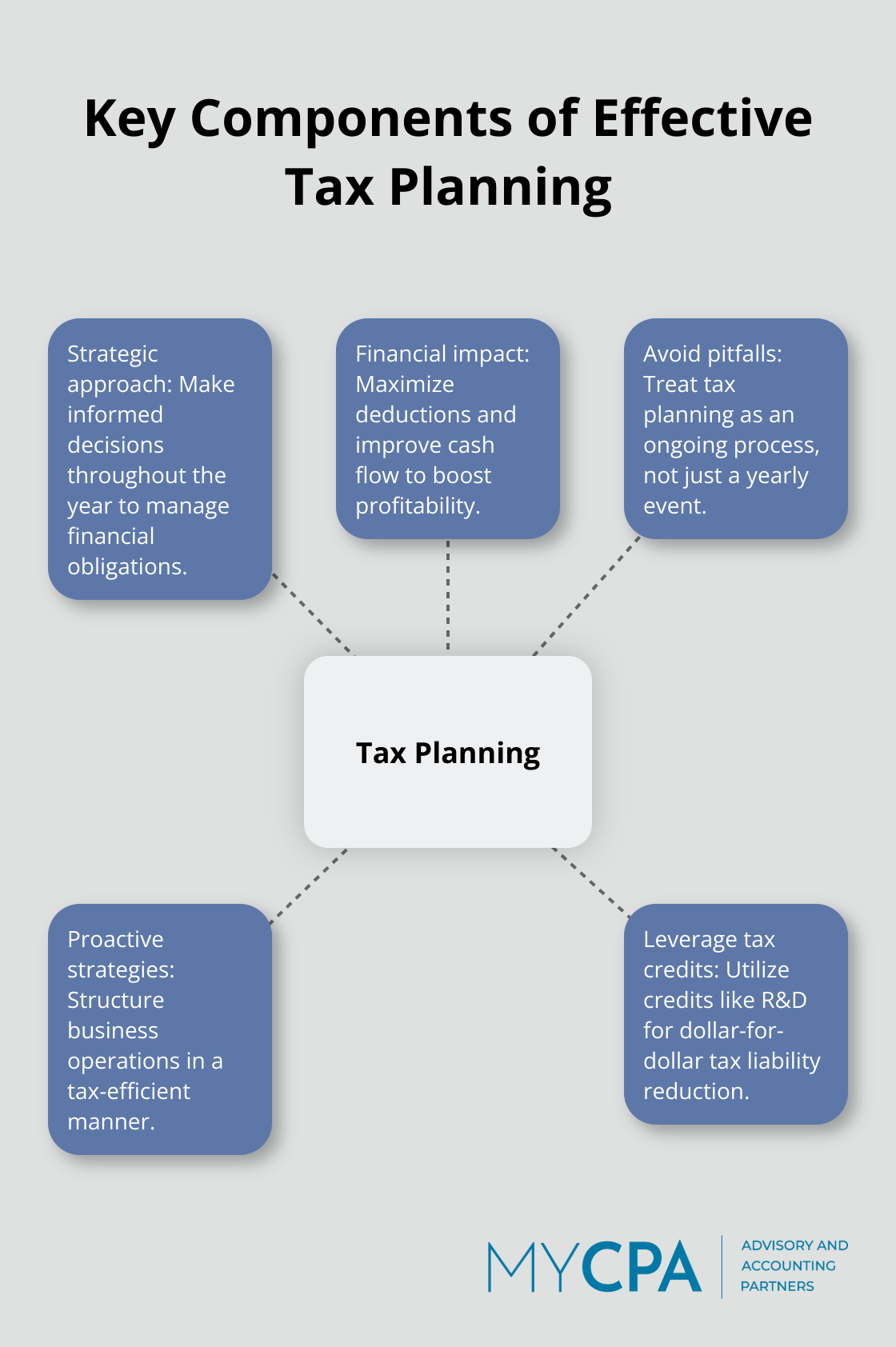

Tax planning transcends mere compliance; it’s a strategic approach to manage your business’s financial obligations. This proactive strategy involves making informed decisions throughout the year that can significantly impact your bottom line. Expert tax planning strategies can help maximize deductions and tackle financial complexities with ease.

Smart tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. This approach can free up capital for reinvestment, improve cash flow, and boost profitability.

Many businesses treat tax planning as a once-a-year event. This approach often leads to missed opportunities and unexpected tax bills. A frequent error is the failure to track expenses properly.

Effective tax planning involves more than maximizing deductions. It requires structuring your business operations in a tax-efficient manner. For instance, choosing the right business entity can have a significant impact.

Another key strategy is the use of tax credits. The Research and Development (R&D) tax credit provides a dollar-for-dollar reduction in tax liability.

The implementation of comprehensive tax planning strategies not only saves money but also positions your business for long-term financial success. In the next section, we’ll explore specific tactics you can use to optimize your tax position and maximize your business’s financial health.

At My CPA Advisory and Accounting Partners, we help businesses reduce their tax burden through strategic tax planning. Here are proven tactics that can make a significant difference in your tax liability:

The structure of your business impacts your tax obligations. S corporations can help owners save on self-employment taxes by splitting income between salary and distributions. LLCs offer flexibility in taxation, allowing you to be taxed as a sole proprietorship, partnership, or corporation.

Don’t leave money on the table. The IRS allows businesses to deduct ordinary and necessary expenses. This includes office rent, employee salaries, and even certain meal expenses. One often-overlooked deduction is the home office deduction. If you use a portion of your home exclusively for business, you may deduct a percentage of your mortgage interest, property taxes, and utilities.

Timing is everything in tax planning. If you expect to be in a lower tax bracket next year, consider deferring income to the following year. Conversely, if you anticipate being in a higher bracket, accelerate income into the current year. The same principle applies to expenses.

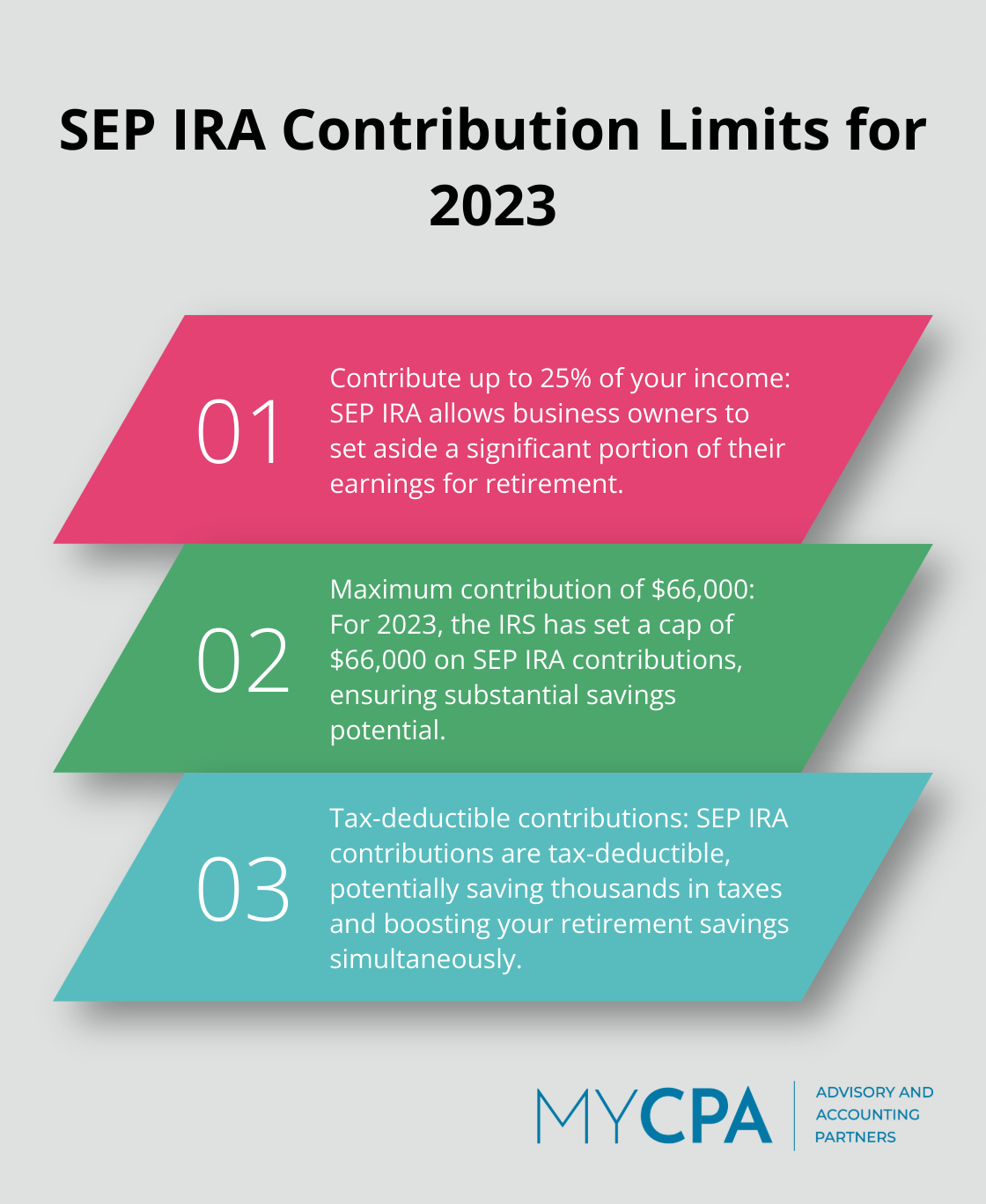

Implementing a retirement plan isn’t just good for your future; it’s a powerful tax-saving tool. A SEP IRA, for instance, allows you to contribute up to 25% of your income or $66,000 (for 2023), whichever is less. These contributions are tax-deductible, potentially saving you thousands in taxes.

Tax laws change frequently, and staying informed is key to maximizing your tax savings. Professional advice can make a significant difference in your tax strategy. Certified Public Accountants (CPAs) and tax advisors stay up-to-date with the latest tax laws and regulations, ensuring you take advantage of every possible tax-saving opportunity.

Effective tax planning is an ongoing process, not a once-a-year event. The strategies outlined above are just the beginning. In the next section, we’ll explore how working with tax professionals can further enhance your tax planning efforts and provide additional benefits to your business.

CPAs and tax advisors offer invaluable knowledge to businesses. They maintain up-to-date understanding of evolving tax laws, which ensures businesses capitalize on all potential savings. The Tax Cuts and Jobs Act changed deductions, depreciation, expensing, tax credits and other things that affect businesses.

Each business requires a unique approach to tax planning. Tax professionals analyze specific situations to develop strategies that align with individual business goals. They provide guidance on complex issues such as entity selection, which can have significant tax implications. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Modern tax planning utilizes advanced technology to maximize efficiency and accuracy. Sophisticated tax software can quickly analyze vast amounts of financial data, identifying potential deductions and credits that might otherwise go unnoticed.

At MyCPA Advisory and Accounting Partners, we employ state-of-the-art tax planning software to simulate various scenarios and identify the most tax-efficient strategies for our clients. This technology enables us to provide real-time advice and make data-driven decisions that can significantly impact your bottom line.

Tax planning extends beyond mere compliance; it represents strategic financial management. Partnering with tax professionals and leveraging modern technology not only saves money but also positions your business for long-term success. Try to view tax planning as an ongoing process rather than an annual event to maximize its benefits.

Tax planning transforms your business’s financial landscape. It reduces tax burdens, improves cash flow, and boosts profitability. Strategic choices in business structure, deductions, income timing, and retirement plans form the foundation of effective tax planning for businesses.

Proactive tax planning yields benefits beyond immediate savings. It positions your company for sustained financial health and provides flexibility to reinvest in growth opportunities. Your organization will develop a culture of financial awareness and responsibility through this process.

We at My CPA Advisory and Accounting Partners offer comprehensive tax planning services to help businesses navigate complex tax landscapes. Our team (equipped with cutting-edge technology) will assess your current financial situation and identify areas for improvement. Take the first step towards a more financially secure future for your business today.

Privacy Policy | Terms & Conditions | Powered by Cajabra