Most business owners leave thousands of dollars on the table each year simply because they don’t have a structured approach to income tax planning. The difference between a reactive tax strategy and a proactive one can mean tens of thousands in savings.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how strategic tax planning throughout the year beats scrambling in April. This guide walks you through the specific strategies, deductions, and timing tactics that actually work.

The 2025 tax landscape offers specific advantages that business owners can weaponize right now. A 401(k) contribution limit of $23,500 for 2025 combined with catch-up contributions for those 50 and older up to $31,000 means you have concrete levers to pull before December 31st. If you’re between 60 and 63, the IRS allows an additional $11,250 catch-up contribution, pushing your total to $34,750. These dollars reduce your taxable income dollar-for-dollar. Traditional IRA contributions max out at $7,000 with a $1,000 catch-up for those 50 and older, and the deadline extends to April 15th of the following year, giving you additional breathing room if cash flow tightens early in the year.

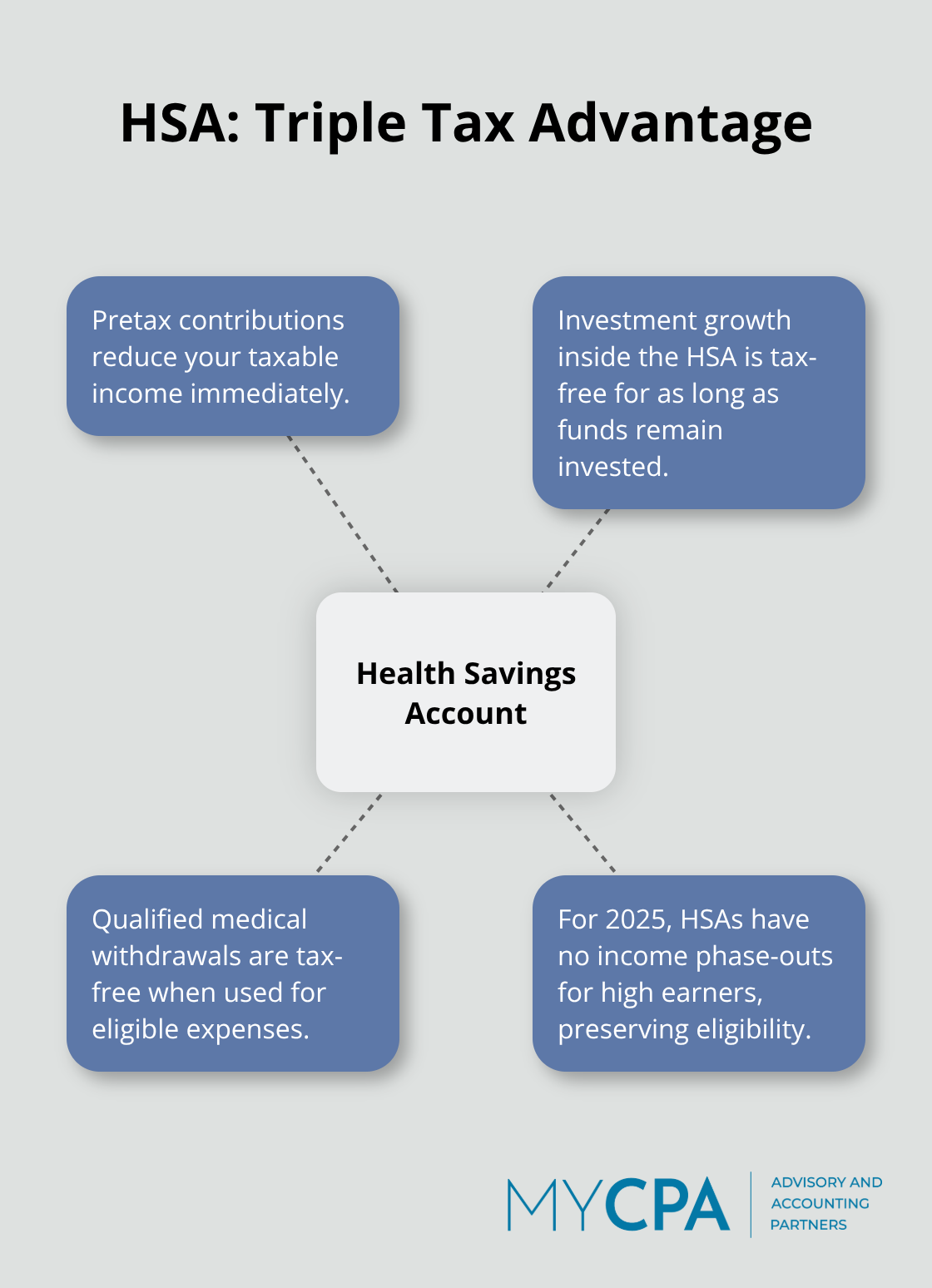

Health Savings Accounts deserve serious attention because they offer triple tax benefits: contributions are pretax, growth is tax-free, and qualified medical distributions are tax-free. For 2025, this account type remains one of the few without income phase-outs for high earners.

Your business structure directly impacts how much tax you actually owe. The difference between operating as a sole proprietor versus an S-corporation can save you thousands annually on self-employment taxes once your net income exceeds roughly $60,000 to $80,000, though the exact threshold depends on your specific situation. If you’re paid on a W-2 from your S-corp, that salary reduces self-employment tax exposure, while distributions beyond that salary typically avoid self-employment tax altogether.

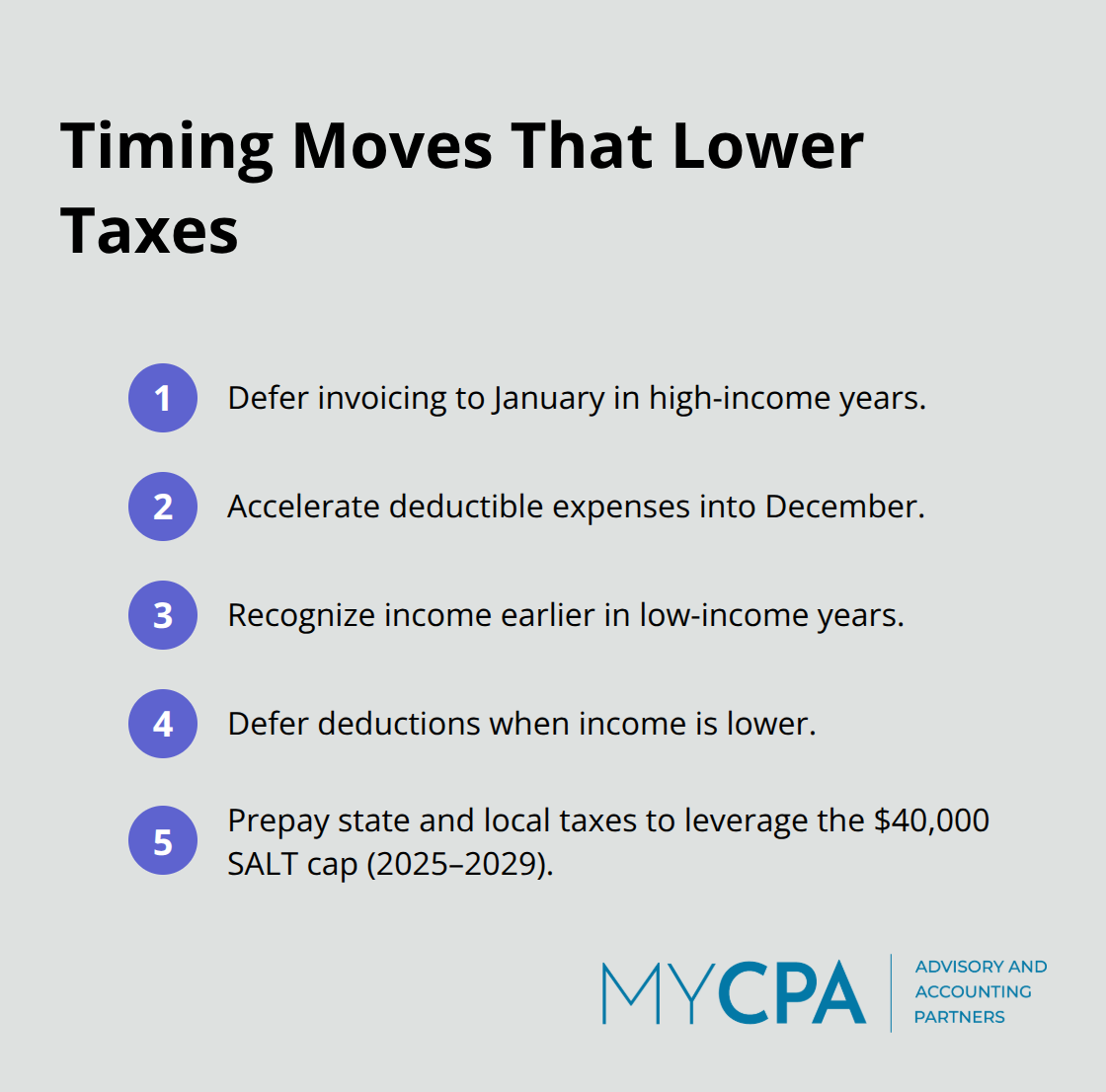

Income timing and deduction bunching work together to lower your tax bill. If you anticipate a high-income year, defer invoicing to clients until January or accelerate business expenses into December. Conversely, in lower-income years, recognize income earlier and defer deductions. The One Big Beautiful Bill Act raised the SALT deduction cap to $40,000 for 2025 through 2029, which means prepaying state and local taxes before year-end could maximize itemized deductions if you’re tracking toward that ceiling.

Tax-loss harvesting in your investment portfolio offsets capital gains with capital losses, and you can deduct up to $3,000 of ordinary income annually, with excess losses carrying forward indefinitely. This strategy requires disciplined documentation and strict adherence to wash-sale rules-you cannot repurchase substantially identical securities within 30 days. The mechanics demand precision, but the payoff justifies the effort. These tactical moves set the foundation for what comes next: identifying deductions and credits that most business owners completely overlook.

Most business owners claim the obvious deductions and miss thousands in legitimate write-offs sitting right in front of them. Your home office and vehicle expenses are real business costs that directly reduce your taxable income, yet self-employed individuals and small business owners consistently under-claim these categories according to IRS data.

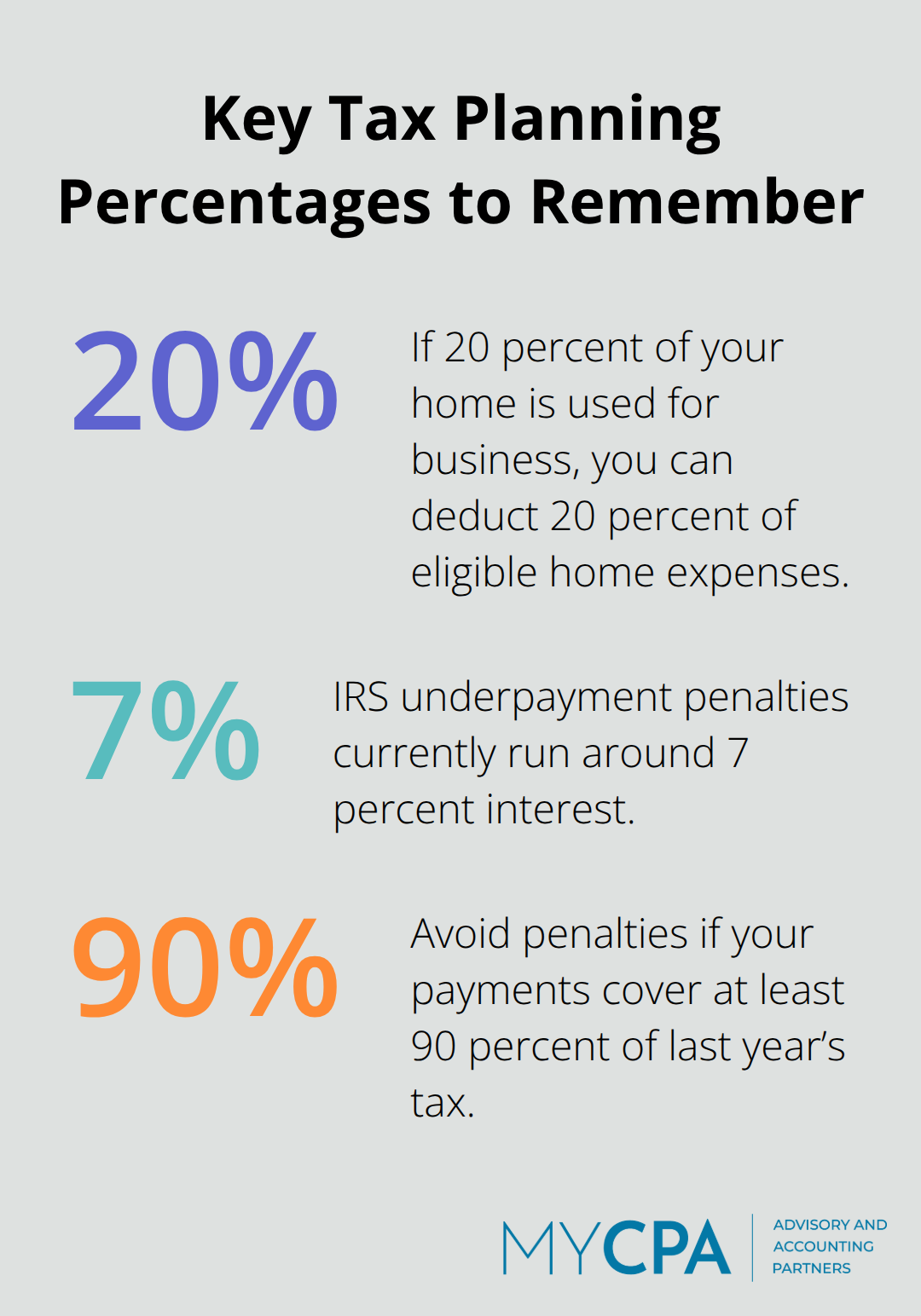

The home office deduction uses either the simplified method at $5 per square foot (up to 300 square feet) or the actual expense method, which requires tracking utilities, rent or mortgage interest, insurance, and depreciation. If you use 20 percent of your home for business, you deduct 20 percent of those costs. Vehicle expenses work two ways: the standard mileage rate for 2025 sits at 67.5 cents per mile for business use, or you track actual expenses including fuel, maintenance, insurance, and depreciation. The mileage route works best for most owners because it requires less documentation, though actual expenses win if you drive an expensive vehicle with high maintenance costs.

Professional development and education expenses directly tied to your business qualify for full deductions, including conference registration, online courses, industry certifications, and books or software subscriptions that improve your business skills. The IRS does not require these expenses to lead to a new profession or business-only that they maintain or improve skills in your current trade.

Quarterly estimated tax payments and tax extensions represent another overlooked lever that affects your cash flow and tax liability simultaneously. If you’re self-employed or have income without withholding, the IRS requires quarterly payments on April 15, June 15, September 15, and January 15 to avoid underpayment penalties. Most owners guess at these payments and either overpay or underpay substantially. Calculate your estimated tax by projecting your full-year income, subtracting deductions, and applying your expected tax rate, then divide by four. If your actual tax bill lands within 90 percent of last year’s tax or 100 percent of this year’s projected tax, you avoid penalties.

Filing an extension using Form 4868 gives you until October 15 to file your return, which buys you time to gather documentation and coordinate with a tax professional on last-minute deductions. The extension does not extend your payment deadline-taxes owed are still due by April 15. Smart owners use the extension window to identify additional deductions and timing strategies that lower their final bill.

Getting these numbers right the first time eliminates stress and penalties later, which is why the next section focuses on the systems and processes that keep your tax planning on track throughout the year rather than scrambling at the deadline.

The difference between owners who save thousands and those who scramble in April comes down to one thing: systems. Most business owners treat tax planning as an annual event rather than a quarterly discipline, which means they miss opportunities to adjust course when income spikes or expenses shift. Establish three concrete checkpoints throughout the year instead of one massive year-end push.

Start by pulling your profit-and-loss statement on April 15, June 15, September 15, and January 15-dates that align perfectly with your estimated tax payment deadlines. Compare actual income to your January projection and recalculate what you’ll owe for the full year. If your income tracks 20 percent higher than expected, your estimated tax payments need adjustment immediately, not in December when it’s too late.

Use the IRS Withholding Estimator to validate whether your W-4 settings match your actual tax liability, especially if you switched jobs, got married, or had major life changes. Owners who adjust quarterly avoid IRS underpayment penalties, which currently run around 7 percent interest, and more importantly, they never face surprise tax bills that force them to liquidate investments or take loans.

Documentation discipline matters far more than most owners realize because the IRS scrutinizes deductions that lack supporting evidence. Create a simple system where you photograph or scan receipts the day you incur an expense, then file them by category in a spreadsheet or accounting software like QuickBooks. Track mileage using your phone’s location history or a dedicated app rather than guessing at year-end, since the IRS expects contemporaneous records for vehicle deductions. For home office expenses, measure your workspace once and document the square footage, then photograph utilities, internet bills, and insurance statements quarterly so you have proof if audited. The owners who avoid audit friction are those who can produce receipts and documentation within minutes, not those digging through shoe boxes six months later.

Work with a tax professional quarterly rather than annually to transform your tax strategy from reactive to genuinely proactive. A CPA who reviews your numbers in June can spot patterns that suggest you should accelerate or defer income before year-end, recommend whether you should elect S-corp status before it’s too late, and identify charitable giving opportunities or investment loss harvesting windows you’d otherwise miss. This ongoing engagement costs less than scrambling to fix problems after filing, and it positions you to make intentional decisions about income timing and deduction bunching rather than defaulting to whatever happened to occur during the calendar year.

The gap between business owners who save tens of thousands annually and those who scramble in April comes down to one decision: you must treat income tax planning as a year-round discipline instead of a once-a-year scramble. The strategies outlined here work because they rest on concrete numbers and real deadlines, not vague promises. Maximizing retirement contributions, optimizing your business structure, timing income and deductions strategically, and harvesting investment losses aren’t theoretical concepts-they’re actionable levers you control right now.

Year-round planning beats last-minute approaches because it gives you time to adjust course when circumstances shift. When you run your numbers quarterly, you catch income spikes early enough to adjust estimated tax payments and avoid penalties. When you document expenses consistently throughout the year, you never face the panic of reconstructing receipts in March. When you work with a tax professional regularly, you spot opportunities in June that disappear by December.

The real cost of reactive tax planning isn’t just the taxes you overpay-it’s the stress, the penalties, and the missed deductions that compound year after year. We at My CPA Advisory and Accounting Partners offer tailored tax services and business advisory designed specifically for business owners seeking tax efficiency and confident financial management. Schedule a quarterly review with a tax professional who understands your business, pull your profit-and-loss statement, and identify one deduction category you’ve been under-claiming.

Privacy Policy | Terms & Conditions | Powered by Cajabra