At My CPA Advisory and Accounting Partners, we’ve seen firsthand how outsourcing accounting services can transform businesses. The benefits of outsourcing accounting services are numerous, from cost savings to access to specialized expertise.

In this post, we’ll explore how to maximize these advantages and implement effective strategies for successful outsourcing. We’ll also guide you through the process of selecting the right partner to ensure your outsourcing journey is a success.

Outsourcing accounting services leads to significant cost savings. A Deloitte study reveals businesses can reduce operational costs by up to 40% through outsourcing. This reduction stems from the elimination of full-time in-house accountants, associated benefits, office space, and expensive accounting software licenses. For small businesses, these savings prove crucial for survival and growth.

Outsourcing your accounting provides access to a team of specialized professionals. These experts stay current with the latest tax laws, accounting standards, and financial regulations. This expertise proves particularly valuable during tax season or when complex financial situations arise. The Robert Half Salary Guide provides insights into finance and accounting starting salaries, benchmarks, and hiring trends, highlighting the value of outsourced expertise.

The outsourcing of accounting tasks frees up valuable time and resources. Business owners and key personnel can redirect their focus to core activities that drive growth and innovation. The National Small Business Association revealed that small business owners spend an average of 40 hours per year dealing with federal taxes alone. This time could be better spent on strategic business initiatives.

As businesses grow, accounting needs evolve. Outsourced accounting services offer the flexibility to scale up or down based on current requirements. This scalability benefits seasonal businesses or those experiencing rapid growth particularly. Service levels can be adjusted without the hassle of hiring or laying off staff.

Outsourcing to professional accounting firms often results in improved financial accuracy. These firms use advanced software and have rigorous quality control processes in place. A study by Business News Daily found that organizations using outsourced accounting services can improve their financial accuracy by 30% (effectively reducing discrepancies).

The decision to outsource accounting services carries numerous benefits. However, to fully capitalize on these advantages, businesses must select the right outsourcing partner. The next section will guide you through the process of choosing an accounting service provider that aligns with your business needs and goals.

Selecting the ideal accounting outsourcing partner can significantly impact your business’s financial health and operational efficiency. This chapter will guide you through the essential factors to consider when making this critical decision.

The right partner should have a proven track record in your specific industry. A survey by Clutch found that 88% of small businesses consider industry expertise the most important factor when choosing an accounting firm. Look for partners who demonstrate a clear understanding of your sector’s unique challenges and regulations. Ask potential firms about their experience with businesses similar to yours and request case studies that showcase their industry-specific knowledge.

Advanced technology is essential for efficient accounting processes in today’s digital age. A study by Sage revealed that 67% of accountants prefer cloud-based solutions. Ensure your potential partner uses up-to-date accounting software and has robust cybersecurity measures in place. Inquire about their data backup procedures and disaster recovery plans to protect your sensitive financial information. A technologically advanced partner will help streamline your accounting processes and provide real-time insights into your financial health.

Don’t take the firm’s word at face value – investigate their client satisfaction levels. Request references and case studies from businesses similar to yours. A survey by the American Institute of CPAs found that 84% of businesses consider referrals as the primary factor in choosing an accounting firm. Contact these references to gain insights into the firm’s reliability, communication style, and ability to meet deadlines. This first-hand information will help you make an informed decision about the firm’s suitability for your business.

The success of your outsourcing relationship depends heavily on effective communication and cultural fit. A survey by UpCity found that 21% of companies that use outsourcing partners found communication issues to be their biggest challenge. Schedule meetings with potential partners to assess their communication style and responsiveness. Ensure they have a clear understanding of your business goals and can articulate how they’ll support your objectives. A partner who aligns with your company’s values and long-term vision will feel like an extension of your team.

While cost shouldn’t be the only factor, it’s an important consideration. Try to find a balance between affordability and quality of service. Request detailed pricing structures and compare them with the value offered (expertise, technology, additional services). Some firms might offer package deals or scalable pricing models that can provide better value for your specific needs.

The process of selecting the right accounting outsourcing partner requires careful consideration of multiple factors. Once you’ve chosen a partner that meets these criteria, the next step is to implement effective strategies to maximize the benefits of your outsourcing relationship. Let’s explore how to do this in the next chapter.

The first step in successful outsourcing requires a clear outline of your objectives and expectations. Businesses that adopted flexible IT service models saw a 30% faster time-to-market during expansion and a 25% lower total cost of ownership. To avoid challenges, create a detailed service level agreement (SLA) that specifies:

This clarity prevents misunderstandings and ensures both parties align from the start.

Effective communication forms the backbone of any successful outsourcing relationship. Companies plan to outsource in order to realize a host of benefits, including improved efficiency and business growth. Implement these strategies to enhance communication:

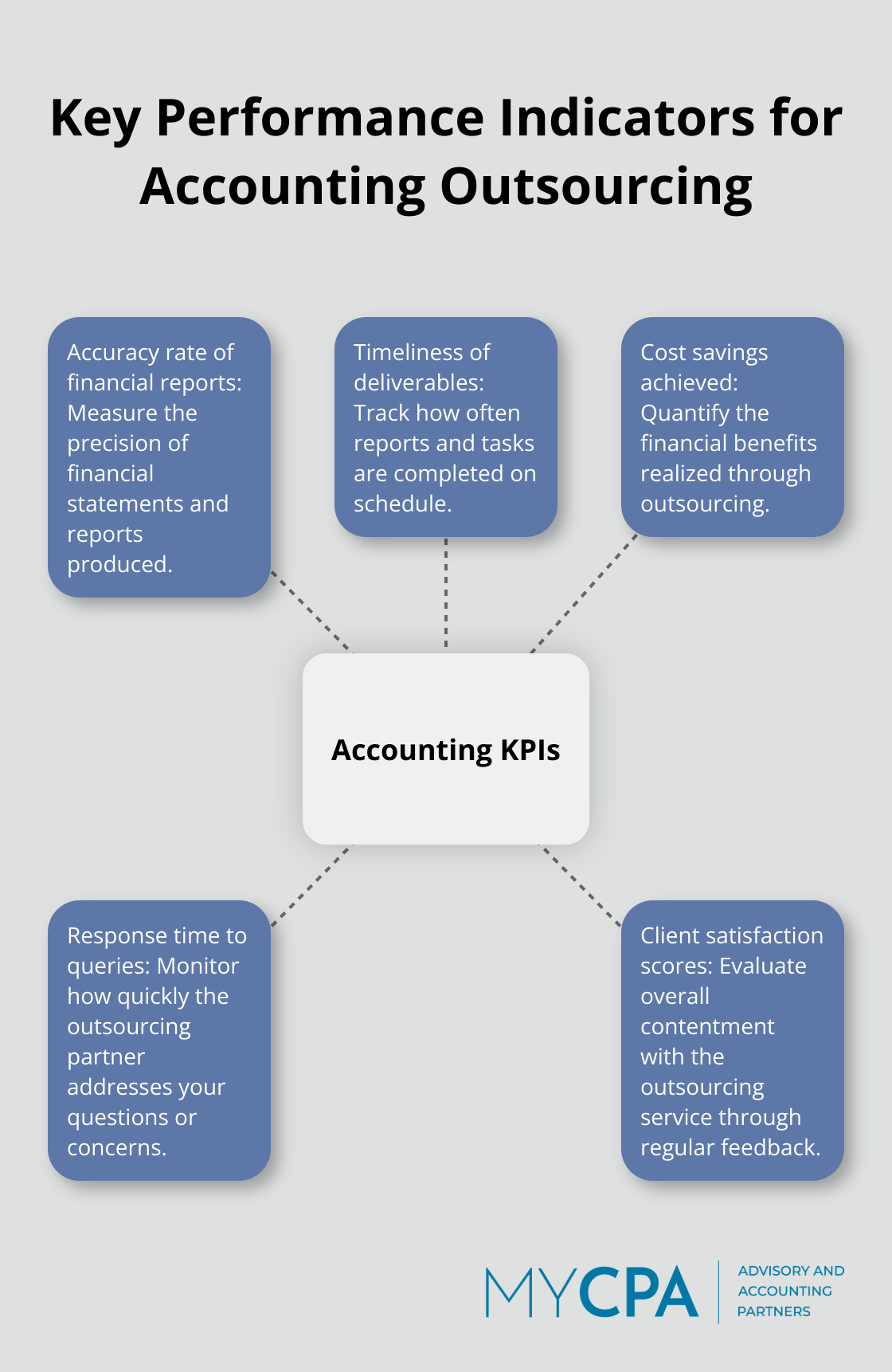

To gauge the success of your outsourcing efforts, you must establish and track key performance indicators (KPIs). Consider these KPIs for your accounting outsourcing:

Review these metrics regularly to ensure your outsourcing partner meets expectations and delivers value.

Don’t wait for issues to arise before you assess your outsourcing relationship. Schedule quarterly or bi-annual performance reviews to discuss progress, address challenges, and identify areas for improvement.

During these reviews:

These reviews foster a culture of continuous improvement and help strengthen your outsourcing partnership over time.

Technology plays a vital role in successful outsourcing relationships. Try to integrate your systems with your outsourcing partner’s platforms for real-time data sharing and improved efficiency. This integration can lead to:

A survey by Sage found that 67% of accountants prefer cloud-based solutions, highlighting the importance of leveraging modern technology in accounting outsourcing. These services can provide visibility into your cash position and offer strategies to improve collection rates and manage payables more effectively.

Outsourcing accounting services provides numerous advantages for businesses. Companies can reduce costs, access specialized expertise, and focus on core activities. The right accounting service provider aligns with business goals, understands industry nuances, and uses advanced technology to deliver accurate financial insights.

Effective communication and clear expectations form the foundation of a strong outsourcing relationship. Regular performance reviews help maintain a high standard of service. These practices ensure that businesses maximize the benefits of outsourcing accounting services and drive financial success.

My CPA Advisory and Accounting Partners offers tailored solutions to meet specific business needs. Our team provides comprehensive accounting services, tax optimization strategies, and valuable business advisory. We invite you to explore the transformative potential of outsourcing your accounting services and take the first step towards streamlined financial management and strategic growth.

Privacy Policy | Terms & Conditions | Powered by Cajabra