Business owners who implement strategic tax planning save an average of 15-30% on their annual tax liability compared to those who only focus on compliance.

At My CPA Advisory and Accounting Partners, we see companies miss thousands in potential savings by waiting until tax season to address their obligations.

Effective tax planning strategies for businesses require year-round attention and proper implementation across different business structures.

Business tax planning requires management of four primary tax categories that directly impact your bottom line. Federal income taxes represent the largest burden for most businesses, with C-corporations facing a flat 21% rate while pass-through entities like LLCs and S-corps transfer tax liability to owners at individual rates up to 37%. Payroll taxes consume 15.3% of wages through Social Security and Medicare contributions, with businesses paying half and employees covering the remainder. State and local taxes vary dramatically by location, with some states like Texas having no corporate income tax while California imposes rates up to 8.84%.

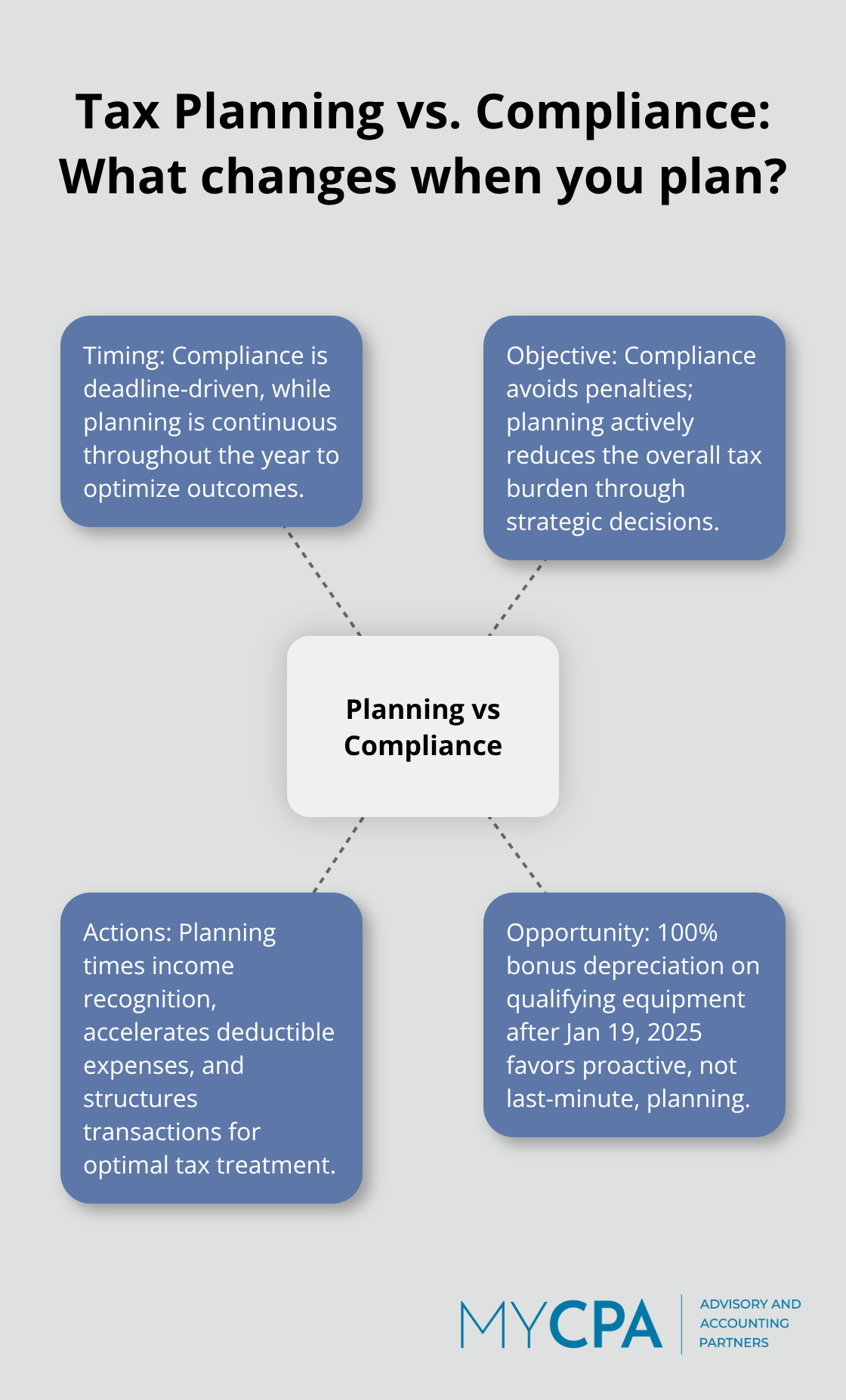

Tax compliance focuses solely on meeting filing deadlines and avoiding penalties, while tax planning actively reduces your overall tax burden through strategic decisions. Compliance work typically occurs in the final months before deadlines, which limits available options and forces reactive decisions. Tax planning operates continuously throughout the year and allows businesses to time income recognition, accelerate deductible expenses, and structure transactions for optimal tax treatment. The One Big Beautiful Bill Act now permits 100% bonus depreciation on equipment purchased after January 19, 2025, but only businesses engaged in proactive planning can fully capitalize on these opportunities.

Strategic tax planning throughout the year generates compound benefits that extend far beyond simple tax savings. Businesses that implement quarterly tax reviews identify opportunities to defer revenue into lower-tax periods or accelerate expenses before year-end. The permanent 20% qualified business income deduction for pass-through entities requires careful income management to stay within eligibility thresholds (currently $191,950 for single filers and $383,900 for joint filers in 2024). Cash flow improves when businesses spread estimated tax payments strategically rather than scramble to meet quarterly deadlines with inadequate preparation.

Recent tax legislation has expanded opportunities for businesses that plan ahead. The qualified small business stock (QSBS) capital gains exclusion threshold increased to $75 million for stock issued on or after July 5, 2025, which benefits companies preparing for potential sales or investment rounds. Domestic research and development expenses can now be deducted immediately in the year incurred (starting in 2025), rather than amortized over five years. These changes require businesses to understand how different entity structures can maximize these new benefits and position themselves for optimal tax treatment.

LLCs and partnerships deliver the most flexibility for tax optimization through strategic income allocation and precise timing decisions. Partners can allocate different percentages of income, losses, and deductions based on their individual tax situations rather than ownership percentages. This creates opportunities to shift income to partners in lower tax brackets.

The Section 754 election allows partnerships to adjust the basis of partnership property under IRC Sections 734(b) and 743 when a partner sells their interest, potentially saving tens of thousands in future depreciation deductions. LLCs taxed as partnerships can also elect to pay state taxes at the entity level in states with pass-through entity taxes (generating federal deductions that can reduce overall tax liability by 8-12% in high-tax states like California and New York).

S-corporation elections generate immediate payroll tax savings for profitable businesses. The election converts self-employment income into distributions. Business owners must pay themselves reasonable compensation subject to payroll taxes, but profits above this amount flow through as distributions exempt from the 15.3% self-employment tax.

A business owner who earns $200,000 annually could save $3,000-$8,000 in payroll taxes through S-corp election and reasonable compensation set at $120,000-$140,000. The qualified business income deduction applies to S-corp distributions, which provides an additional 20% deduction for eligible taxpayers below the income thresholds.

C-corporations provide superior tax planning opportunities for businesses despite the perceived double taxation issue. The flat 21% corporate rate often results in lower effective tax rates than pass-through taxation for owners in higher individual brackets.

C-corps can retain profits at the corporate level and time distributions strategically. Qualified small business stock holders can exclude up to $15 million in capital gains when they sell shares acquired after July 4, 2025. Medical reimbursement plans, company cars, and other fringe benefits receive favorable treatment in C-corporations, which creates additional tax-free compensation opportunities for owner-employees.

Sole proprietorships face the highest tax burden but offer the simplest implementation path for new businesses. All business income flows directly to Schedule C and faces both income tax and self-employment tax on the full amount. However, sole proprietors can maximize the Section 179 deduction (up to $1.22 million in 2024) and take advantage of the home office deduction when they operate from their residence.

The key to successful tax planning lies in proper implementation and documentation throughout the year rather than last-minute compliance efforts.

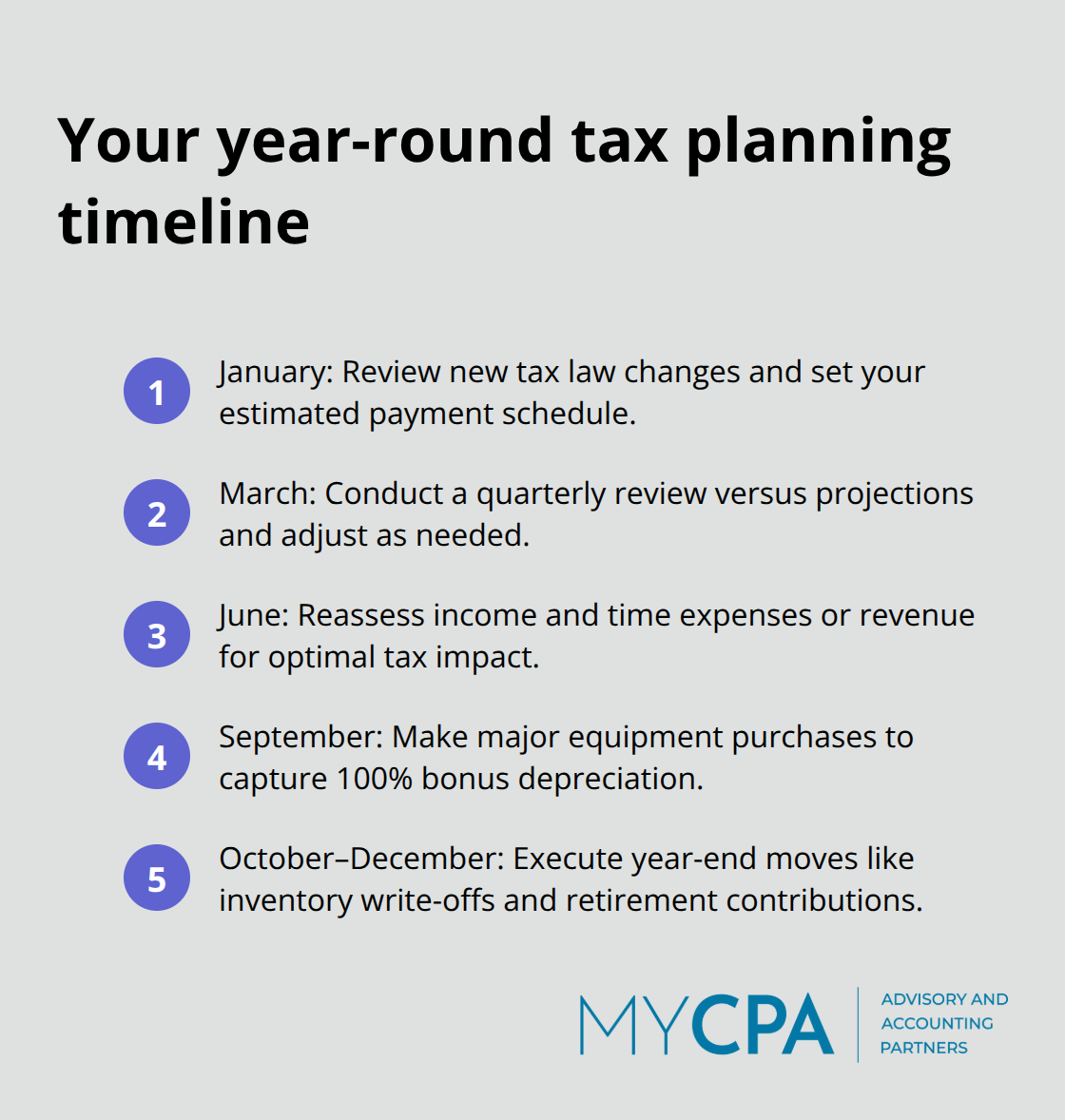

Successful tax planning requires specific actions at predetermined intervals rather than year-end scrambling. January demands review of new tax law changes and establishment of quarterly estimated payment schedules based on prior year income adjusted for expected growth. March and June require quarterly reviews to assess actual versus projected income and identify opportunities to accelerate expenses or defer revenue.

September marks the final quarter for major equipment purchases to capture 100% bonus depreciation, while October through December focus on year-end strategies like inventory write-offs and retirement plan contributions. The IRS Statistics of Income division reports that businesses with structured quarterly reviews reduce audit risk by 23% compared to those who file without ongoing planning.

Tax advisors must specialize in your business structure and industry rather than handle everything as generalists. CPAs with Section 199A expertise can navigate the qualified business income deduction that allows eligible taxpayers to deduct up to 20% of their qualified business income, while those experienced in your industry understand specific deductions and credits available to your business type.

Professional fees typically range from $2,000-$8,000 annually for comprehensive tax planning services, but businesses save an average of $12,000-$35,000 through strategic guidance (according to the National Association of Tax Professionals). Document all communications with your tax advisor and maintain copies of their recommendations to support your tax positions during potential audits.

Proper record keeping starts with digital systems that capture receipts and track mileage automatically rather than shoebox methods that fail during audits. The IRS requires contemporaneous records for business expenses, which means documentation created at the time of the expense rather than reconstructed later.

Cloud-based accounting systems like QuickBooks integrate with bank accounts and credit cards to categorize transactions automatically, while apps like MileIQ track business vehicle use with GPS precision. Businesses must retain records for three years after filing, but seven years for situations where underreported income exceeds 25% of gross income.

Quarterly estimated tax payments prevent cash flow disruptions and avoid underpayment penalties that can reach 8% annually. Calculate payments based on 100% of last year’s tax liability (or 110% if adjusted gross income exceeded $150,000) to establish a safe harbor from penalties.

Businesses should track monthly cash flow patterns to identify optimal timing for major purchases or revenue recognition. The IRS allows businesses to annualize income for estimated payments when earnings fluctuate significantly throughout the year, which can reduce required payments during slower quarters.

Proactive tax planning strategies for businesses deliver measurable returns that extend far beyond simple compliance. Companies that implement year-round planning reduce their tax liability by 15-30% while they improve cash flow through strategic timing of income and expenses. The One Big Beautiful Bill Act’s expanded depreciation benefits and permanent qualified business income deduction create substantial opportunities for businesses that plan ahead rather than react at year-end.

The most costly mistakes include waiting until December to implement strategies, failure to maintain proper documentation, and attempts at complex planning without professional guidance. Businesses that miss quarterly estimated payments face penalties that reach 8% annually, while inadequate record keeping leads to disallowed deductions during audits. These errors cost companies thousands in unnecessary tax liability and potential penalties.

We at My CPA Advisory and Accounting Partners help business owners navigate these complexities through comprehensive tax services that minimize liabilities and enhance financial health. Our tailored approach combines tax planning with accounting services and business advisory expertise to deliver proactive solutions throughout the year. Contact us today to develop a customized tax strategy that positions your business for long-term success.

Privacy Policy | Terms & Conditions | Powered by Cajabra