Tax planning can be a complex task, but creating an effective tax planning spreadsheet can simplify the process and help you stay organized.

At My CPA Advisory and Accounting Partners, we’ve seen how a well-designed spreadsheet can make a significant difference in managing tax obligations and identifying potential savings.

This guide will walk you through the essential steps to create a tax planning spreadsheet that works for your specific needs, whether you’re an individual or a small business owner.

Microsoft Excel and Google Sheets stand out as popular choices for tax planning spreadsheets. Excel excels in robust features and complex formulas, making it suitable for detailed tax calculations (especially for businesses with intricate financial structures). Google Sheets, a cloud-based alternative, offers real-time updates and easy sharing capabilities, enhancing collaboration among team members or with accountants.

While general spreadsheet software provides versatility, specialized tax planning software like TurboTax or H&R Block’s tax tools offer more focused features. These programs often include pre-built tax tables and automatic updates to reflect current tax laws. However, they may lack the flexibility of a custom-built spreadsheet.

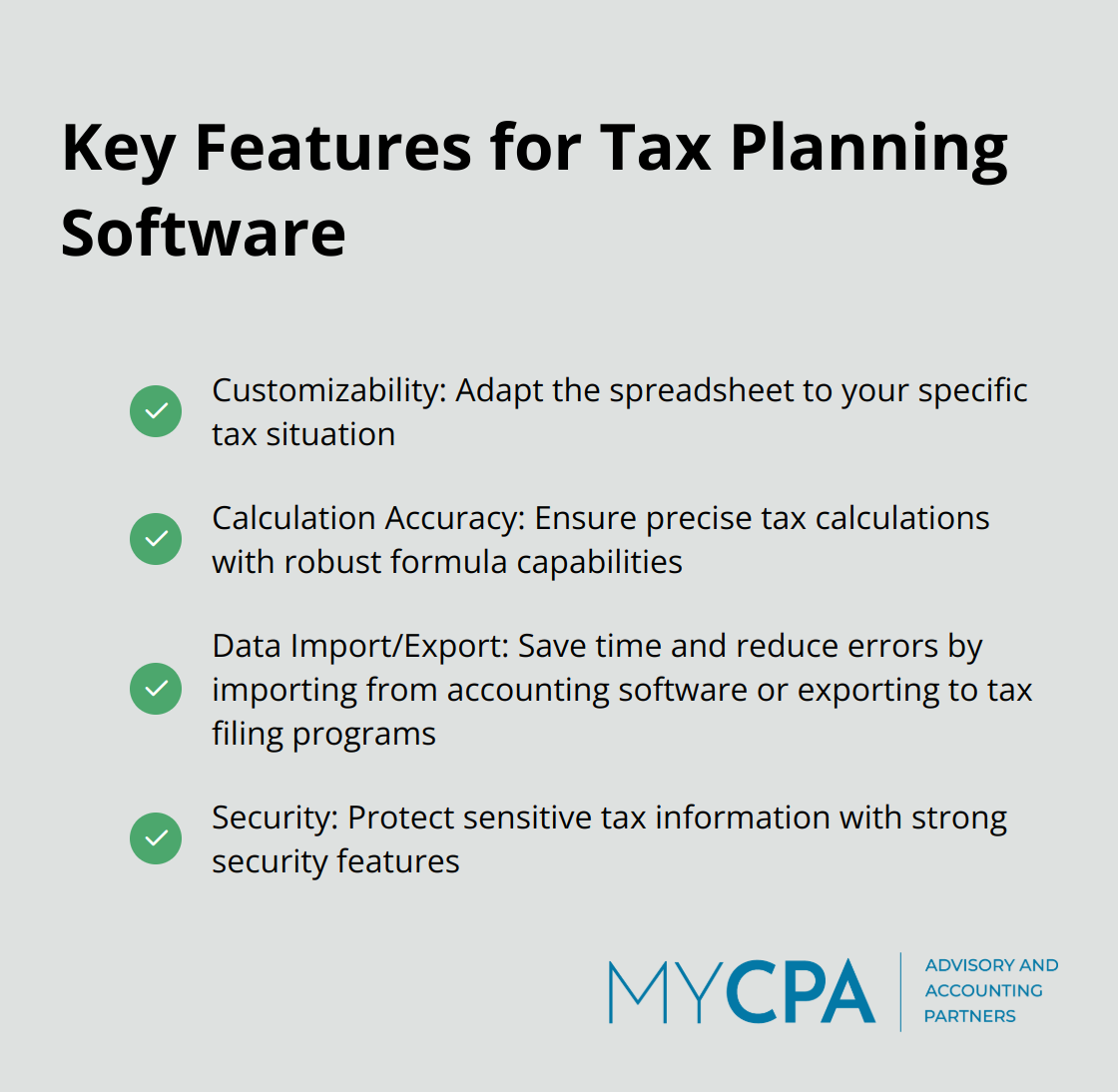

When selecting software for your tax planning spreadsheet, consider these essential features:

Small businesses often require more complex tax planning tools compared to individuals. Business owners should look for software that handles multiple income streams, depreciation schedules, and business-specific deductions. QuickBooks integration is a valuable feature, allowing seamless data transfer.

Individuals may find simpler software sufficient. Google Sheets works well for basic calculation capabilities and ease of use. However, Excel’s advanced features might better suit those with complex investment portfolios or multiple income sources.

A hybrid approach often yields the best results. Use general spreadsheet software for ongoing planning and tracking, then verify calculations with specialized tax software or professional assistance during tax season. This method combines the flexibility of customizable spreadsheets with the accuracy of purpose-built tax tools.

The choice of software lays the foundation for your tax planning spreadsheet. With the right tool in hand, you can move on to building the essential components that will make your spreadsheet truly effective.

A well-structured tax planning spreadsheet serves as your financial compass. This section outlines how to construct a spreadsheet that captures all essential elements for effective tax management.

Start with a detailed income section. List all revenue streams, including salaries, bonuses, investment income, rental income, and any other sources. Create separate columns for projected and actual amounts for each income type. This structure allows for easy comparison and adjustment throughout the year.

An automated Google Sheet has been popular for tracking investments, net worth with monthly progress reports, and includes a budget feature. This type of tool can be particularly useful for comprehensive income tracking.

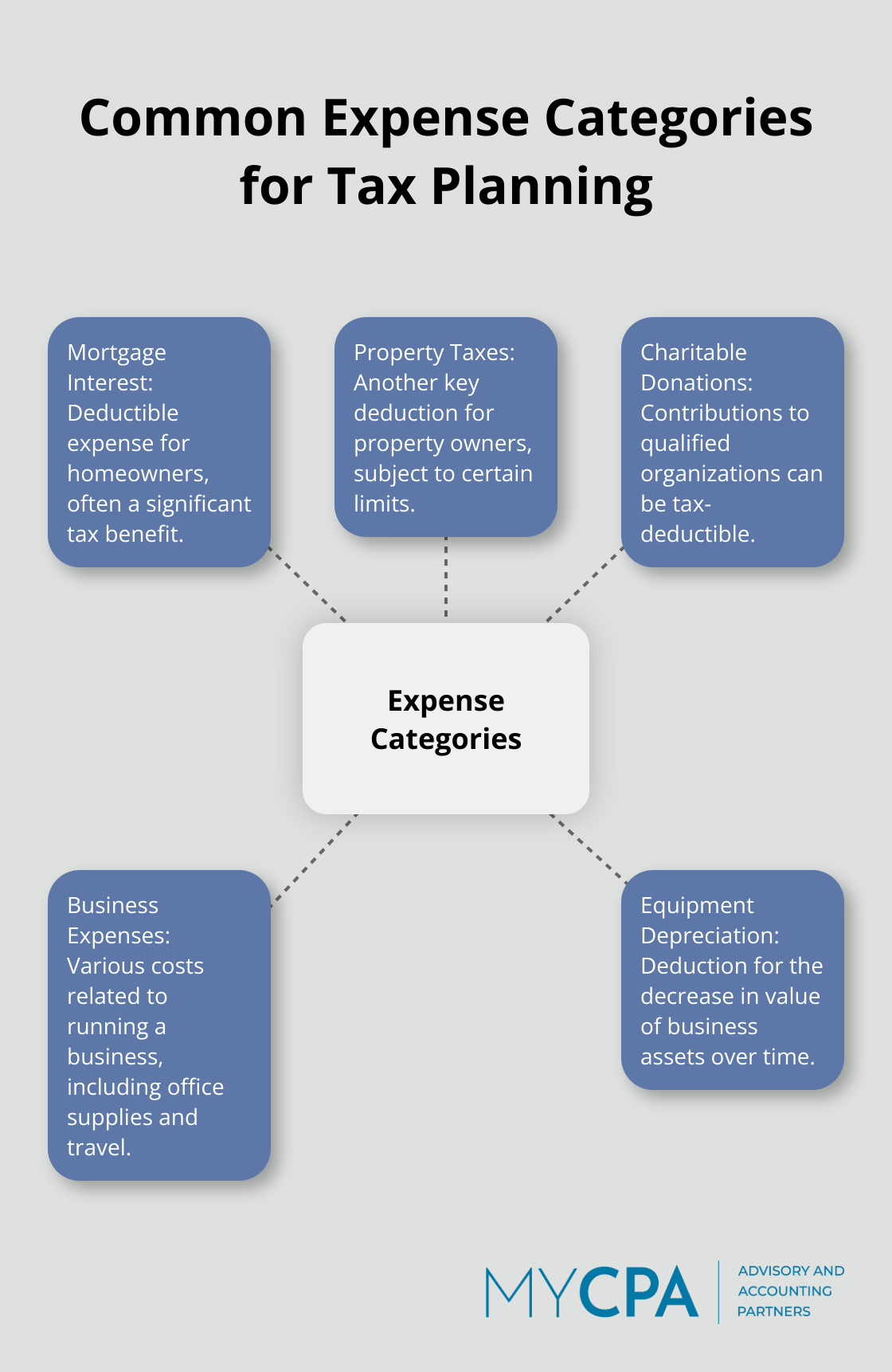

Create an expense section with categories aligned with IRS Schedule A and C forms. Common categories include mortgage interest, property taxes, charitable donations, and business expenses. For business owners, include sections for office supplies, travel, and equipment depreciation.

Don’t overlook less common deductions. Your spreadsheet should prompt you to consider deductions like student loan interest or home office expenses (which are often forgotten).

Develop a central area for tax calculations. Include federal tax brackets, state tax rates, and any applicable local taxes. Use lookup functions to automatically apply the correct tax rates based on your projected income.

The current period expense or benefit amount can be calculated automatically on a Current Tax Provision worksheet based on current federal tax rates.

Implement projection tools to estimate future tax liabilities. Use historical data and growth assumptions to forecast income and expenses. Create scenarios for different financial situations, such as a job change or major investment.

Apply this principle to your personal taxes by using your spreadsheet to model different scenarios and their tax implications.

The next step in creating an effective tax planning spreadsheet involves organizing and maintaining your data efficiently. Let’s explore some practical tips to keep your spreadsheet accurate and up-to-date.

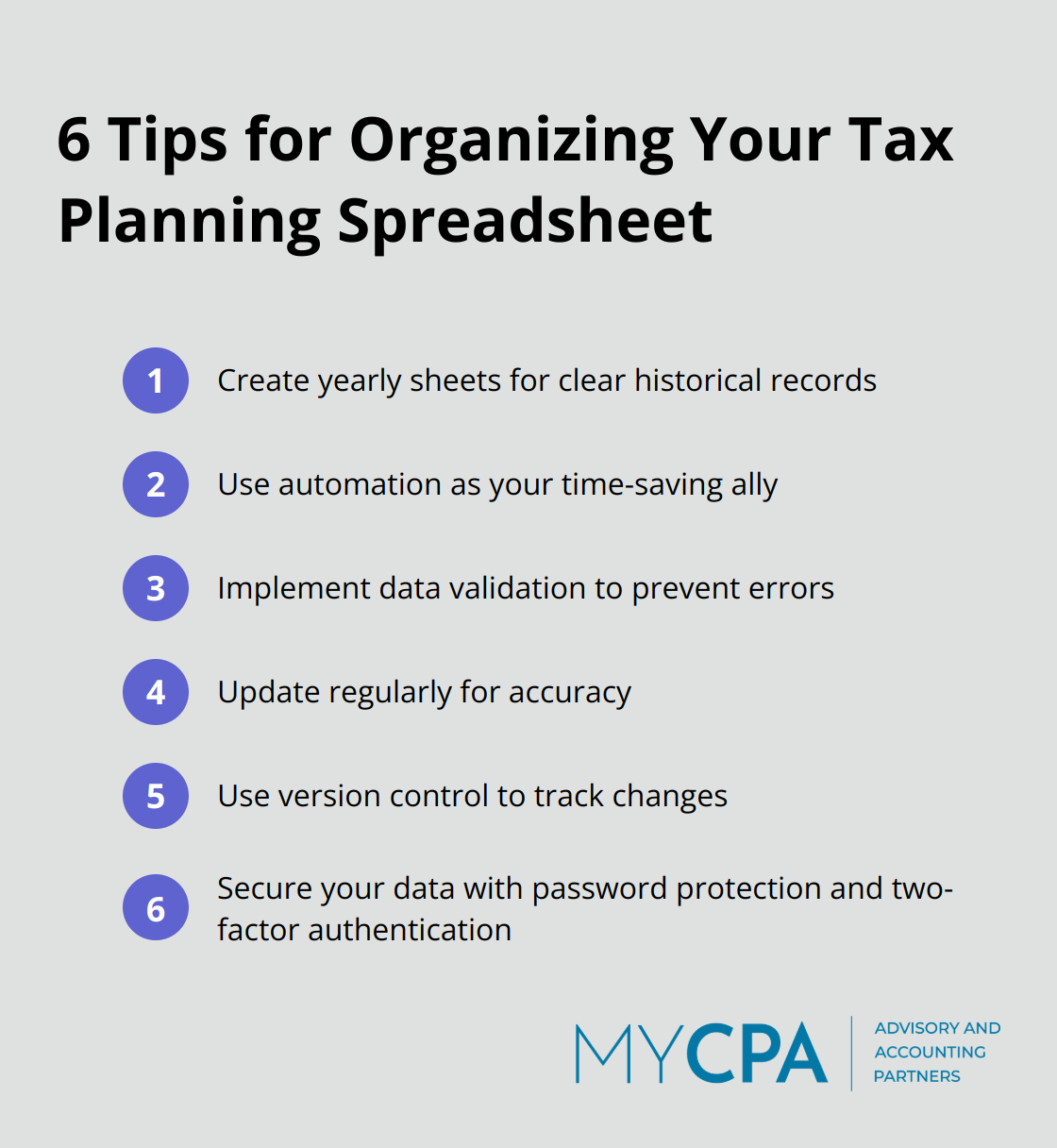

Create separate sheets for each tax year. This method allows you to track changes over time and quickly reference past data. Label each sheet clearly with the tax year and include a table of contents on the main page for easy navigation.

Leverage formulas and macros to automate calculations. Use SUM functions for totaling income and expenses, and IF statements to apply different tax rates based on income levels. For more complex calculations, consider VLOOKUP or INDEX-MATCH functions to pull data from tax rate tables.

Set up data validation rules to prevent common mistakes. Create drop-down lists for categories to ensure consistency and reduce typos. Use conditional formatting to highlight cells that exceed certain thresholds or contain unexpected values.

Schedule monthly or quarterly updates to your spreadsheet. This practice ensures your projections stay aligned with your actual financial situation. After each update, reconcile your spreadsheet with bank statements and other financial records.

Implement a version control system for your spreadsheet. Save a new version each time you make significant changes. This method allows you to track the evolution of your tax situation and revert to previous versions if needed.

Protect your sensitive financial information. Use password protection features in your spreadsheet software. If you use cloud-based solutions, enable two-factor authentication for an extra layer of security.

A tax planning spreadsheet empowers you to manage your financial future effectively. This powerful tool provides clarity on income tracking, expense categorization, and tax calculations. It enables you to make informed decisions, identify potential savings, and stay ahead of your tax obligations.

Professional guidance can enhance the effectiveness of your tax planning efforts. We at My CPA Advisory and Accounting Partners specialize in personalized tax planning strategies tailored to your unique financial situation. Our team of experts can help you optimize your tax planning spreadsheet and ensure compliance with current tax laws.

We offer comprehensive tax services, accurate accounting, QuickBooks expertise, and business advisory services to support your financial goals. Our professional insights can transform your tax planning from a yearly chore into a strategic tool for financial success. Let us help you approach tax season with confidence and peace of mind.

Privacy Policy | Terms & Conditions | Powered by Cajabra