Creating a Request for Proposal (RFP) for accounting services is a critical step in finding the right financial partner for your organization. At My CPA Advisory and Accounting Partners, we’ve seen how a well-crafted RFP can lead to successful collaborations.

This guide will walk you through the essential elements of an effective RFP, helping you clearly communicate your needs and expectations to potential accounting service providers.

The first step in creating an effective Request for Proposal (RFP) for accounting services involves a thorough evaluation of your organization’s financial processes. Identify your main financial challenges. Do you struggle with cash flow management? Does your tax planning need improvement? Are your financial reports in need of an overhaul? Pinpointing these issues helps potential accounting firms understand where they can provide the most value.

If cash flow management is a challenge for your organization, consider exploring alternative reporting options to GAAP, such as FRF for SMEs and IFRS for SMEs, which may be more suitable for entities that don’t necessarily need to prepare GAAP-compliant financial statements.

After assessing your needs, create a detailed list of the specific services you require. This list might include:

Specificity is key. Instead of simply requesting “tax services,” specify whether you need assistance with sales tax compliance, international tax issues, or estate planning.

Set concrete, measurable goals for the accounting engagement. Do you want to reduce your tax liability by a specific percentage? Do you aim to improve your financial reporting turnaround time? Clear objectives help accounting firms tailor their proposals to your specific needs.

For example, if you’re a nonprofit organization, you might set a goal to improve your grant compliance reporting. Nonprofits often face complex challenges with grant reporting, including unduly complex applications, dysfunctional electronic submission processes, and needless duplication. Including this objective in your RFP will attract firms with relevant expertise.

In today’s digital age, technology plays a crucial role in accounting services. Consider what accounting software you currently use (or plan to use) and include this information in your RFP. Do you need a firm that specializes in QuickBooks? Are you looking for a partner who can help you transition to cloud-based accounting systems?

Your organization’s needs may change over time. Consider your growth projections and how they might affect your accounting requirements. Will you need a firm that can scale its services as your business expands? Include these considerations in your RFP to ensure you find a long-term accounting partner.

A well-defined set of accounting needs forms the foundation of an effective RFP. The next step involves understanding the key components that make up a comprehensive income in accounting document.

Start your RFP with a concise overview of your organization. Include your industry, size, and any unique challenges you face. This context helps accounting firms understand your specific needs. For example, if you’re a rapidly growing tech startup, mention your growth rate and any plans for expansion or funding rounds.

Next, outline the project’s objectives. Specify what you want to achieve through this engagement. Do you need to streamline your financial reporting process? Or perhaps you require assistance with tax planning strategies? Be specific about your goals.

An accounting RFP is an organization’s document to request proposals from accounting firms or individual accountants. Define the services you need clearly. Instead of vague statements like “improve financial reporting,” specify exactly what you’re looking for. For instance, “Provide monthly financial statements (including balance sheet, income statement, and cash flow statement) within 10 business days of month-end.”

List all deliverables you expect. This might include:

The more detailed you are, the more accurate and tailored the proposals you receive will be.

Provide a clear timeline for your project. Include key dates such as:

If you have specific deadlines for deliverables, mention these as well. For example, if you need audited financial statements by a certain date for investor reporting, make this clear in your RFP.

Outline the criteria you’ll use to evaluate proposals. This might include factors like:

The weighted scoring approach breaks down your RFP evaluation criteria and assigns a value to each question or section. Explain how you’ll weigh these factors.

While you want to get the best value for your money, the lowest price isn’t always the best choice for accounting services. Instead of asking for a specific price, provide a budget range. This allows firms to propose solutions that fit within your financial constraints while still meeting your needs.

Ask for detailed pricing breakdowns. This might include hourly rates for different levels of staff, fixed fees for specific services, or a combination of both. Understanding the pricing structure helps you compare proposals more effectively and avoid surprises down the line.

A well-structured RFP with these key components will provide potential accounting firms with the information they need to create tailored, comprehensive proposals. This increases your chances of finding the right accounting partner to meet your organization’s unique needs. Now, let’s explore how to craft clear and comprehensive questions that will further enhance your RFP’s effectiveness.

Start your RFP with questions about the firm’s experience in your specific industry. For example, “How many years has your firm worked with companies in the [your industry] sector?” Follow up with inquiries about relevant certifications and qualifications of key team members who would handle your account.

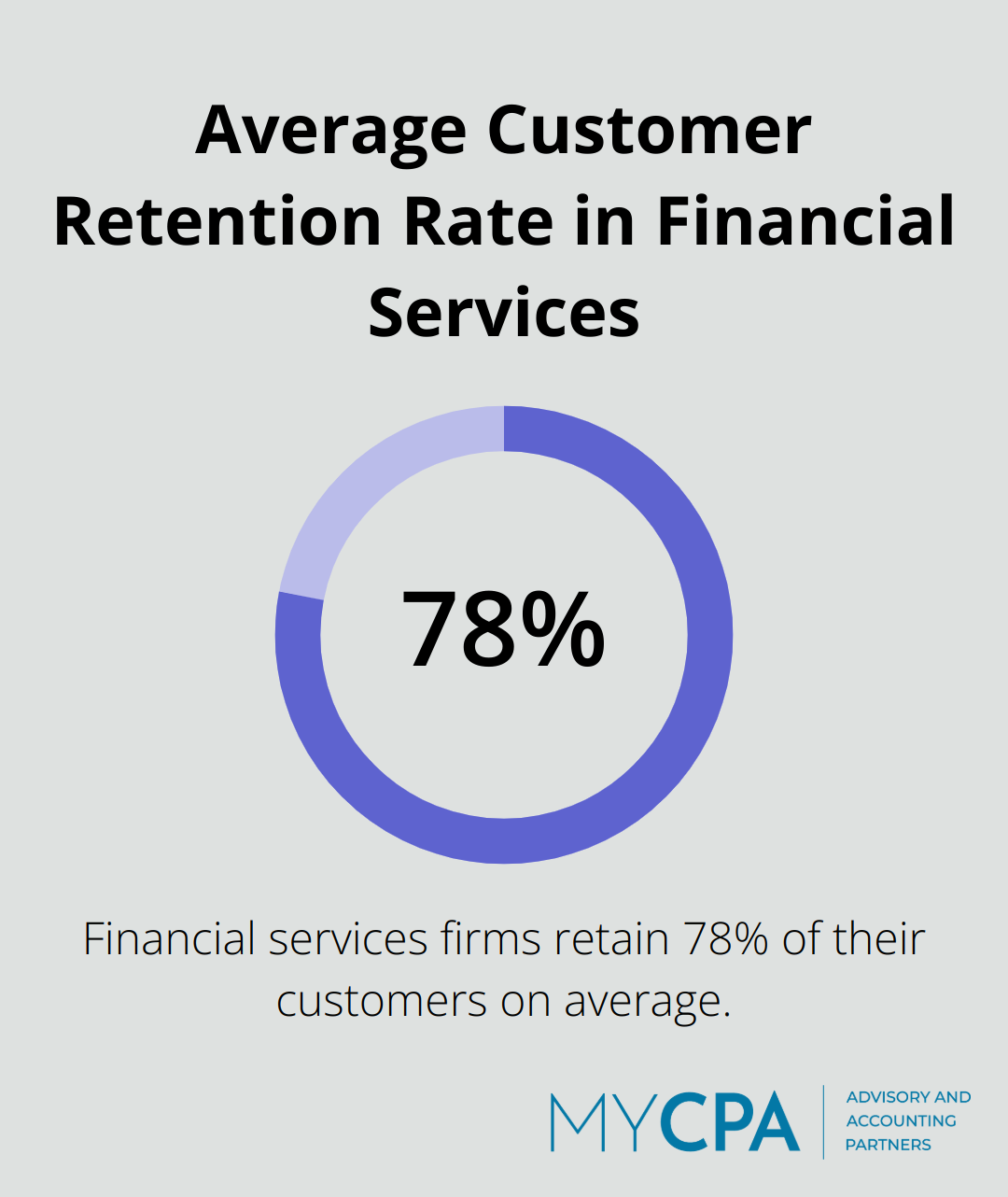

Ask about the firm’s client retention rate. A high retention rate often indicates satisfied clients and consistent service quality. You might ask, “What is your client retention rate?” The average customer retention rate for financial services is 78%.

Understanding a firm’s approach to accounting services is important. Ask about their process for handling common accounting tasks relevant to your needs. For instance, “What is your methodology for reconciling complex accounts receivable discrepancies?”

If you’re looking for tax services, you might ask, “How do you stay updated on changing tax laws, and how quickly do you implement new strategies for your clients?” This question can reveal a firm’s proactiveness and adaptability.

Case studies and client references provide tangible evidence of a firm’s capabilities. Ask for specific examples that relate to your industry or financial challenges. For instance, “Can you provide an example of how you helped a client in our industry improve their cash flow management?”

When requesting references, be specific about what you want to know. Instead of asking for general references, request contacts of clients who have similar needs or have worked with the firm for an extended period.

In today’s digital age, technology and data security are paramount. Ask about the accounting software they use and their experience with systems you currently employ. For example, “What is your experience with [specific accounting software], and how would you handle the transition from our current system?”

Regarding security, inquire about their data protection measures. A good question might be, “What specific protocols do you have in place to protect client financial data, and have you ever experienced a data breach?”

Effective communication is key to a successful accounting partnership. Ask about their reporting processes and frequency of updates. For instance, “How often do you provide financial reports, and what is your typical turnaround time for responding to client queries?”

It’s also worth asking about their approach to explaining complex financial concepts to non-financial stakeholders. This can be particularly important if you need to present financial information to board members or investors (or other key decision-makers in your organization).

According to Sage, 82% of accounting firms report that clients expect more services and resources from accountants today than they did five years ago.

A well-structured request for proposal for accounting services will help you find the right financial partner for your organization. You will uncover areas for improvement and ensure fair comparisons between potential accounting firms. The time you invest in crafting a comprehensive RFP will increase your chances of finding an accounting partner who understands your business and provides the service level you need.

We at My CPA Advisory and Accounting Partners offer expert guidance in developing effective RFPs tailored to your unique financial needs. Our team can help you articulate your requirements clearly, ask the right questions, and evaluate proposals effectively. We ensure that your RFP covers all important aspects of financial management (including tax services, accounting, and business advisory).

In today’s complex financial landscape, you need the right accounting partner. A well-crafted RFP is your first step towards building this vital relationship. Take the time to prepare thoroughly, be clear about your needs and expectations, and seek professional assistance if needed.

Privacy Policy | Terms & Conditions | Powered by Cajabra