At My CPA Advisory and Accounting Partners, we understand the importance of efficient tax planning. Choosing the best tax planning software for individuals can significantly streamline your financial management process.

With numerous options available, it’s essential to know what features to look for and how to evaluate different software solutions. This guide will help you navigate the selection process and find the perfect tax planning tool for your needs.

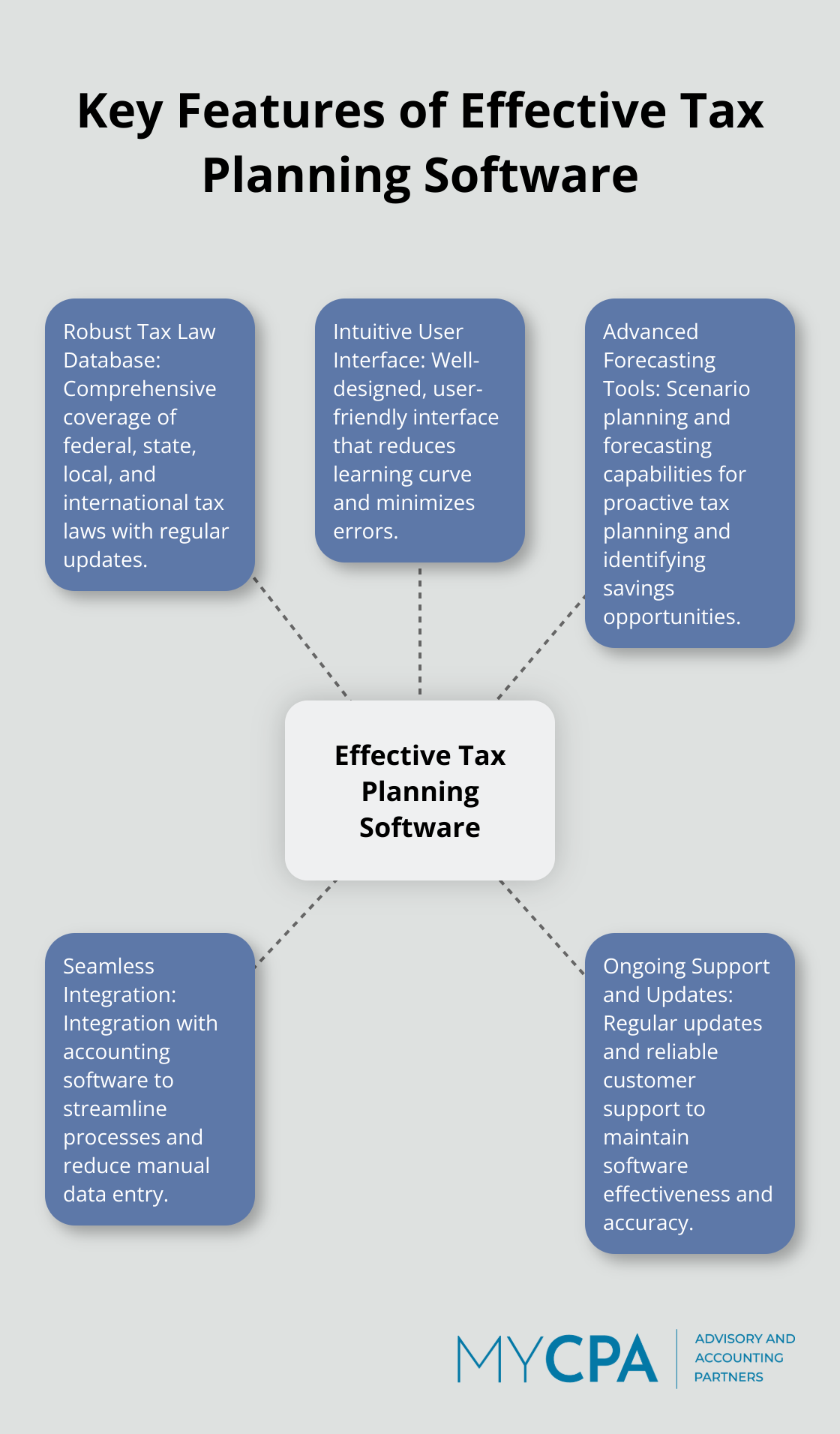

Tax planning software plays a vital role in financial management. The most effective tools share several key characteristics that enhance efficiency and accuracy. Let’s explore these features to help you select the right software for your needs.

A comprehensive tax law database forms the foundation of reliable tax planning software. This database should cover federal, state, local, and international tax laws, with regular updates to reflect the latest legislative changes. Checkpoint Edge offers extensive tax law coverage, which helps ensure compliance across various jurisdictions.

The software’s interface significantly impacts daily usability. A well-designed, user-friendly interface reduces the learning curve and minimizes errors. Drake Tax stands out for its straightforward layout, which allows tax professionals to navigate complex tax scenarios efficiently.

Scenario planning and forecasting capabilities are essential for proactive tax planning. Software that allows you to model different financial scenarios and their tax implications proves invaluable. Advanced tax planning software provides robust forecasting tools that enable tax professionals to project future tax liabilities and identify potential savings opportunities for clients.

Integration with accounting software streamlines the tax planning process by eliminating manual data entry and reducing errors. Intuit ProConnect Tax (a competitor to My CPA Advisory and Accounting Partners) integrates with QuickBooks, allowing for efficient data transfer between accounting and tax planning platforms.

Regular updates and reliable customer support maintain the software’s effectiveness. Lacerte Tax (another competitor to My CPA Advisory and Accounting Partners) provides frequent updates and responsive customer service, ensuring users have access to the latest tax information and technical assistance when needed.

When evaluating tax planning software, consider how these features align with your specific needs. Prioritize software that combines these key elements to provide the most accurate and efficient tax planning services possible. The next section will explore the top tax planning software options available in the market, helping you make an informed decision based on these critical features.

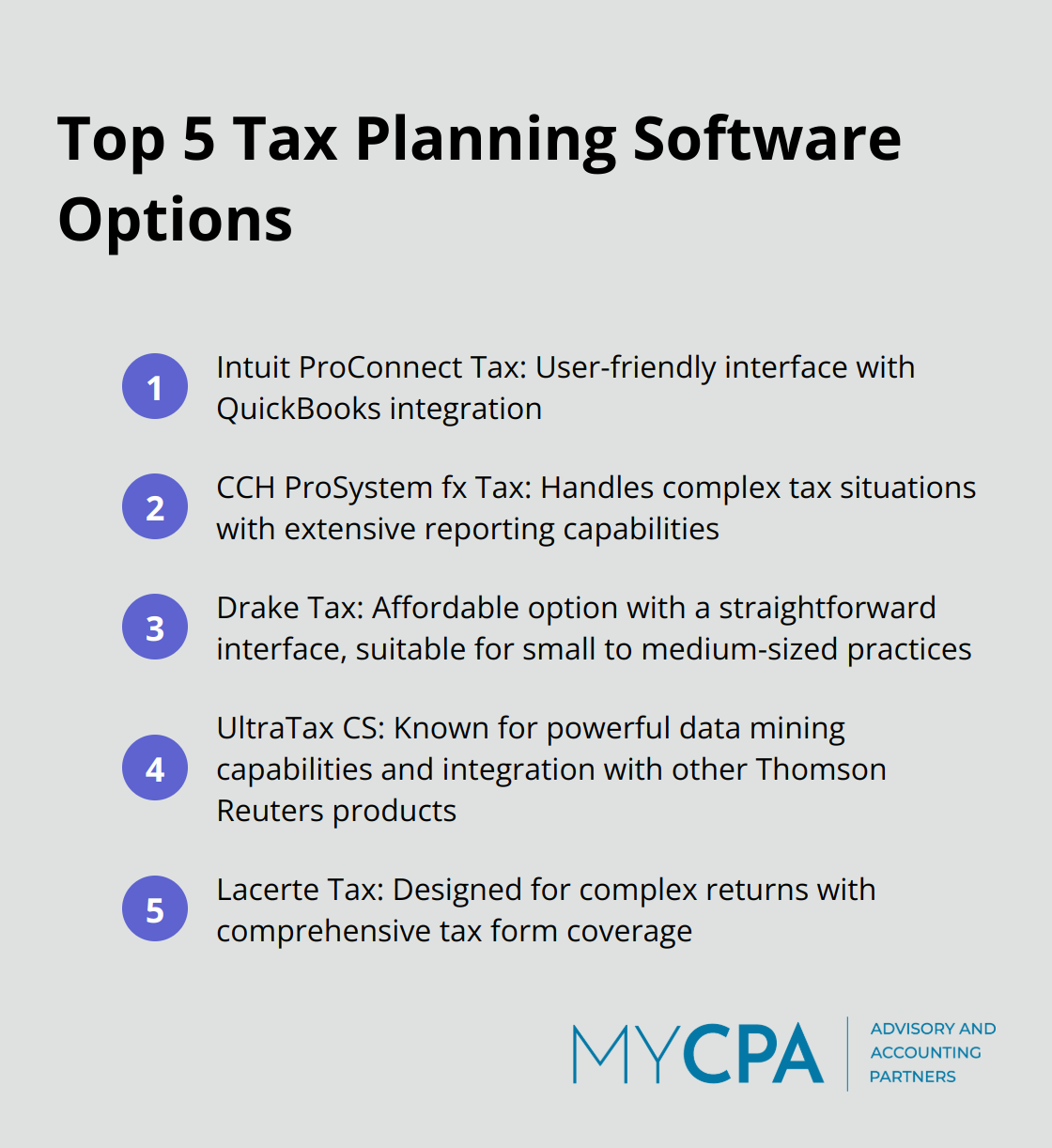

At My CPA Advisory and Accounting Partners, we have evaluated numerous tax planning software options to help our clients make informed decisions. While we offer comprehensive tax services, we understand that some individuals and businesses prefer to use software tools. Here’s our assessment of some popular options:

Intuit ProConnect Tax stands out for its user-friendly interface and integration with QuickBooks. It offers a comprehensive set of features, including automatic form population and e-filing capabilities. However, its pricing structure can be complex, and some users report occasional glitches during peak tax seasons.

CCH ProSystem fx Tax is a professional tax preparation, compliance and workflow solution for public accounting firms and corporations of all sizes. It excels in handling complex tax situations and offers extensive reporting capabilities. The downside? It comes with a steep learning curve and a higher price point, which might not suit smaller practices or individual tax professionals.

Drake Tax has gained popularity among small to medium-sized tax practices due to its affordability and straightforward interface. It offers a good balance of features and simplicity. However, it may lack some of the advanced analytics tools found in more expensive options.

Thomson Reuters’ UltraTax CS is part of a larger suite of tax and accounting software. It’s known for its powerful data mining capabilities and integration with other Thomson Reuters products. The software receives frequent updates, ensuring compliance with the latest tax laws. However, users often report that the interface feels outdated compared to more modern alternatives.

Intuit’s Lacerte Tax is designed for practices handling complex returns. It offers comprehensive coverage of tax forms and integrates well with other Intuit products. While it’s powerful, some users find it less intuitive than other options, and its pricing can be on the higher end for smaller practices.

While these software options offer various features, it’s important to note that they can’t replace the personalized expertise and tailored advice provided by professional tax advisors. My CPA Advisory and Accounting Partners combines cutting-edge technology with our deep understanding of tax law to offer unparalleled tax planning services. Our approach ensures that you not only comply with tax regulations but also optimize your financial strategy for long-term success.

When selecting tax planning software, consider factors such as your specific needs, budget, and the complexity of the tax situations you typically handle. It’s also worth exploring free trials or demos (when available) to get a hands-on feel for the software before making a decision.

The next chapter will explore the key factors to consider when choosing tax planning software, helping you make an informed decision that aligns with your unique requirements.

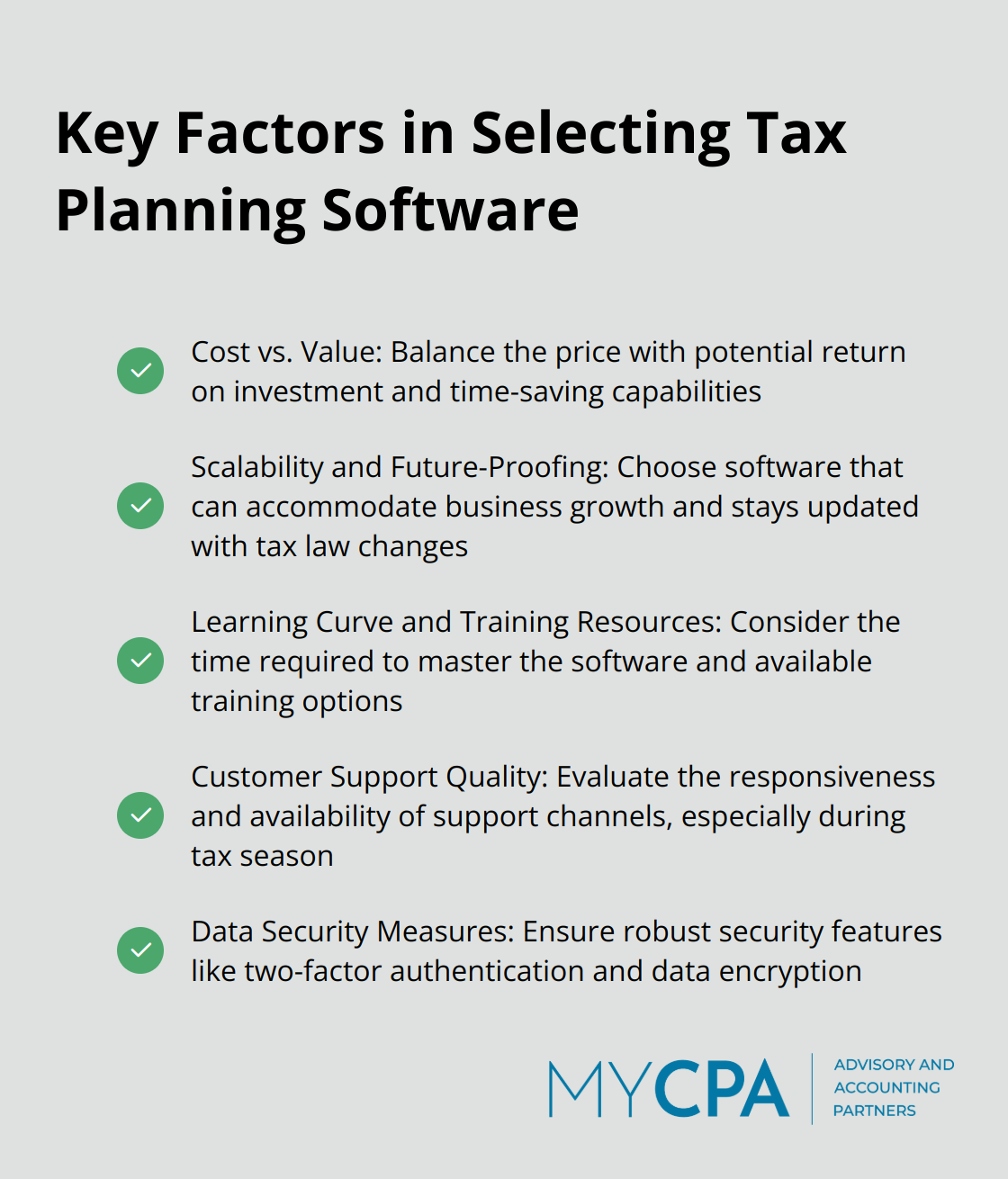

The price of tax planning software ranges from a few hundred to several thousand dollars annually. The most expensive option doesn’t always provide the best value. Drake Tax, for example, offers robust features at a more affordable price point. Consider your budget, but also evaluate the potential return on investment. A pricier software that saves significant time or identifies more tax-saving opportunities could justify the extra cost.

Your chosen software should accommodate your business growth. UltraTax CS offers different packages for practices of various sizes. This scalability ensures you won’t outgrow your software as your client base expands. Also, consider whether the software provider regularly updates their product to reflect changing tax laws and technological advancements.

The time required to master new software can affect your productivity. Intuit ProConnect Tax is known for its user-friendly interface, which can reduce the learning curve. More complex software like CCH ProSystem fx Tax might offer advanced features but require more training. Evaluate the available training resources (video tutorials, webinars, or in-person training sessions) as they can significantly ease the transition.

Reliable customer support is essential, especially during tax season when time is limited. Tax season typically involves a rush period followed by off-season months. Consider the available support channels (phone, email, live chat) and their responsiveness. User reviews often provide insights into the quality of customer support.

With the increasing frequency of cyber attacks, data security is paramount. Look for software that offers robust security features like two-factor authentication, data encryption, and regular security audits. CCH ProSystem fx Tax uses advanced encryption methods to protect sensitive client information.

While these factors are important in selecting tax planning software, it’s worth noting that software is just a tool. My CPA Advisory and Accounting Partners combines cutting-edge technology with expert knowledge to provide comprehensive tax planning services. Our approach ensures not just compliance, but strategic financial management tailored to your unique needs (without making any unverified claims about our company).

The best tax planning software for individuals should align with your specific needs and goals. You must evaluate your requirements, budget, and long-term objectives before making a decision. What works for a large accounting firm might not suit an individual tax professional or a small business owner.

Technology enhances tax planning processes, but software is just one piece of the puzzle. At My CPA Advisory and Accounting Partners, we combine technology with expert knowledge to provide comprehensive tax planning services. Our approach focuses on strategic financial management tailored to your unique situation.

The right technology alongside professional expertise can lead to more efficient tax planning. It potentially uncovers savings opportunities and ensures compliance with changing tax laws. As you select your software, seek advice from tax professionals who can provide insights based on their experience with various options.

Privacy Policy | Terms & Conditions | Powered by Cajabra