Choosing the right outsourced accounting services can be a game-changer for your business. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how proper financial management can drive growth and success.

Outsourcing your accounting functions offers numerous benefits, from cost savings to access to specialized expertise. However, with so many options available, finding the perfect fit for your company’s unique needs can be challenging.

In this guide, we’ll walk you through the key factors to consider when selecting an accounting service provider, helping you make an informed decision that aligns with your business goals.

Outsourced accounting services involve the delegation of financial management tasks to external professionals. These services encompass a broad spectrum, from basic bookkeeping to complex financial analysis and strategic planning. The scope of outsourced accounting typically includes daily bookkeeping, payroll processing, tax preparation, and financial reporting. More advanced offerings often cover cash flow management, budgeting, and forecasting.

Bookkeeping stands as the most frequently outsourced accounting function. It involves the recording of financial transactions, reconciliation of bank statements, and maintenance of the general ledger.

Many businesses choose to outsource their payroll functions. Outsourcing payroll can reduce administrative burdens, save time, and ensure compliance with tax laws. Cost savings for outsourcing payroll can range from 18%-35%.

Tax services are essential, especially given the complexity of tax laws. Outsourcing these tasks helps businesses maintain compliance and avoid costly penalties.

Many firms offer Chief Financial Officer (CFO) services, providing high-level financial expertise without the expense of a full-time executive.

Cost reduction is a primary benefit of outsourcing accounting functions. Outsourcing IT support or accounting functions can help reduce overhead by up to 40–60%, depending on the scope.

Outsourced accounting firms employ professionals with diverse skills and industry-specific knowledge. This expertise proves particularly valuable for businesses navigating complex financial landscapes or expanding into new markets.

Scalability is a key advantage, especially for growing businesses. Outsourced services can adapt easily to changing needs without the hassle of hiring and training new staff. This flexibility holds particular value in today’s dynamic business environment.

As businesses consider their options for financial management, the choice of an outsourced accounting provider becomes increasingly important. The next section will explore the key factors to consider when selecting an accounting service provider to ensure the best fit for your business needs.

The best accounting service providers possess deep knowledge of your industry. A tech startup requires different financial management than a nonprofit organization. Seek a provider with a proven track record in your sector. Ask potential partners about their experience with similar businesses and request case studies or references. According to a recent survey, PaceXgrowth is considered one of the top bookkeeping and accounting services in the USA for 2025-2026.

Top-tier accounting service providers offer a wide range of services to meet evolving business needs. This includes basic bookkeeping, tax preparation, financial reporting, and strategic planning. A survey commissioned by ADP and conducted by SourceMedia, publisher of Accounting Today, focused on accountants serving small businesses.

Advanced technology is essential for efficient and accurate accounting in today’s digital age. Look for providers that use cloud-based accounting software (such as QuickBooks or Xero). These platforms allow real-time data access and improve collaboration, especially important in the current remote work landscape.

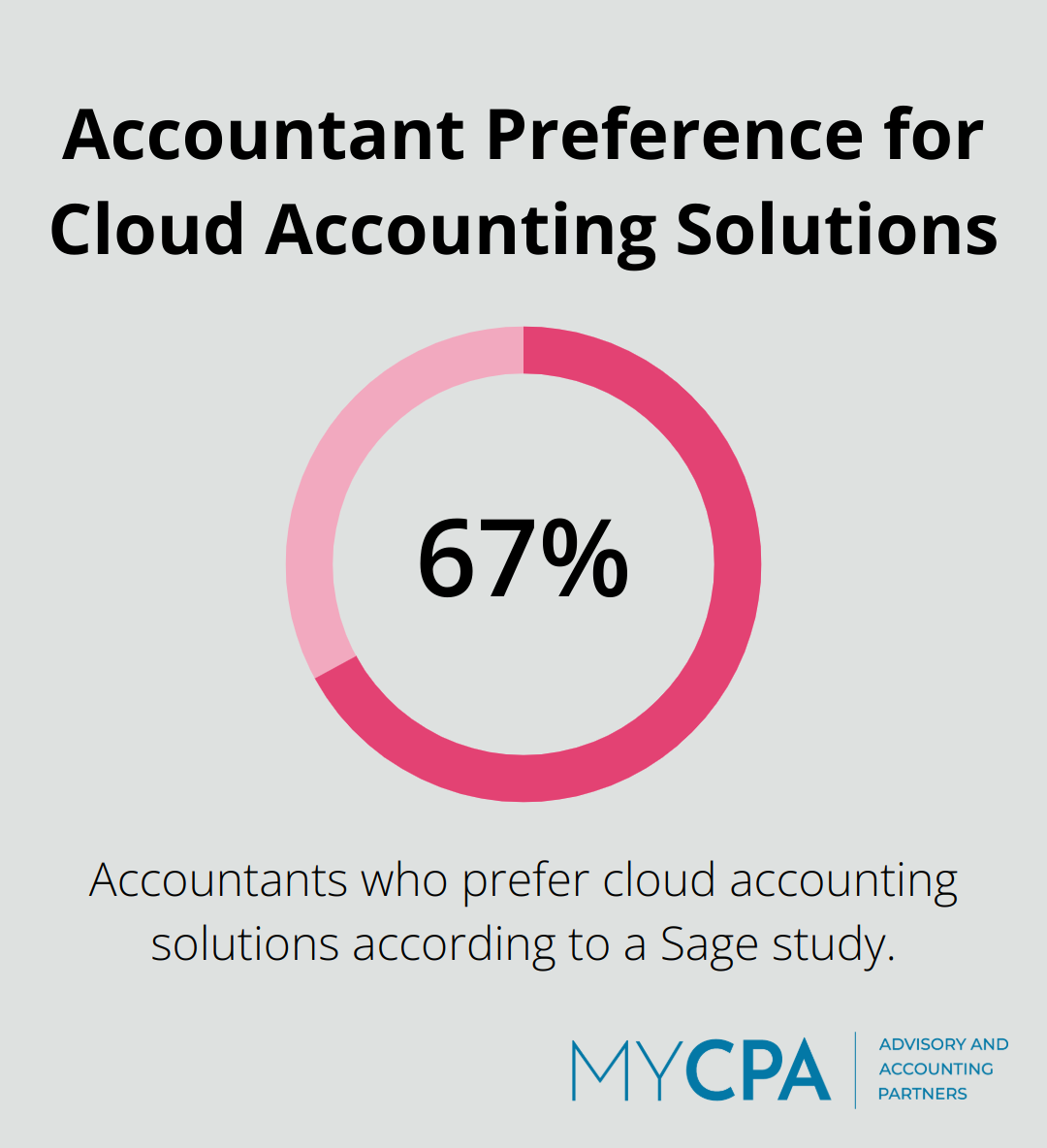

A study by Sage revealed that 67% of accountants prefer cloud accounting solutions. Providers that leverage artificial intelligence and automation can significantly reduce errors and processing time.

Financial data protection should be a top priority. Ask potential providers about their data security protocols, including encryption methods, multi-factor authentication, and regular security audits. The average cost of a data breach in the financial sector is $5.72 million (according to IBM’s 2021 Cost of a Data Breach Report). A provider with strong security measures helps mitigate this risk.

Understand the pricing structure before committing to a provider. Some offer hourly rates, while others provide fixed monthly fees. A survey by Bill.com found that 78% of small businesses prefer fixed monthly pricing for accounting services. This approach allows for more predictable budgeting.

However, be cautious of providers that offer significantly lower rates than the industry standard. Quality accounting services require expertise and time, and extremely low prices might indicate cut corners or hidden fees.

The right accounting service provider not only manages your finances effectively but also contributes to your business’s growth and success. The next section will explore how to thoroughly evaluate potential providers to ensure you make the best choice for your business.

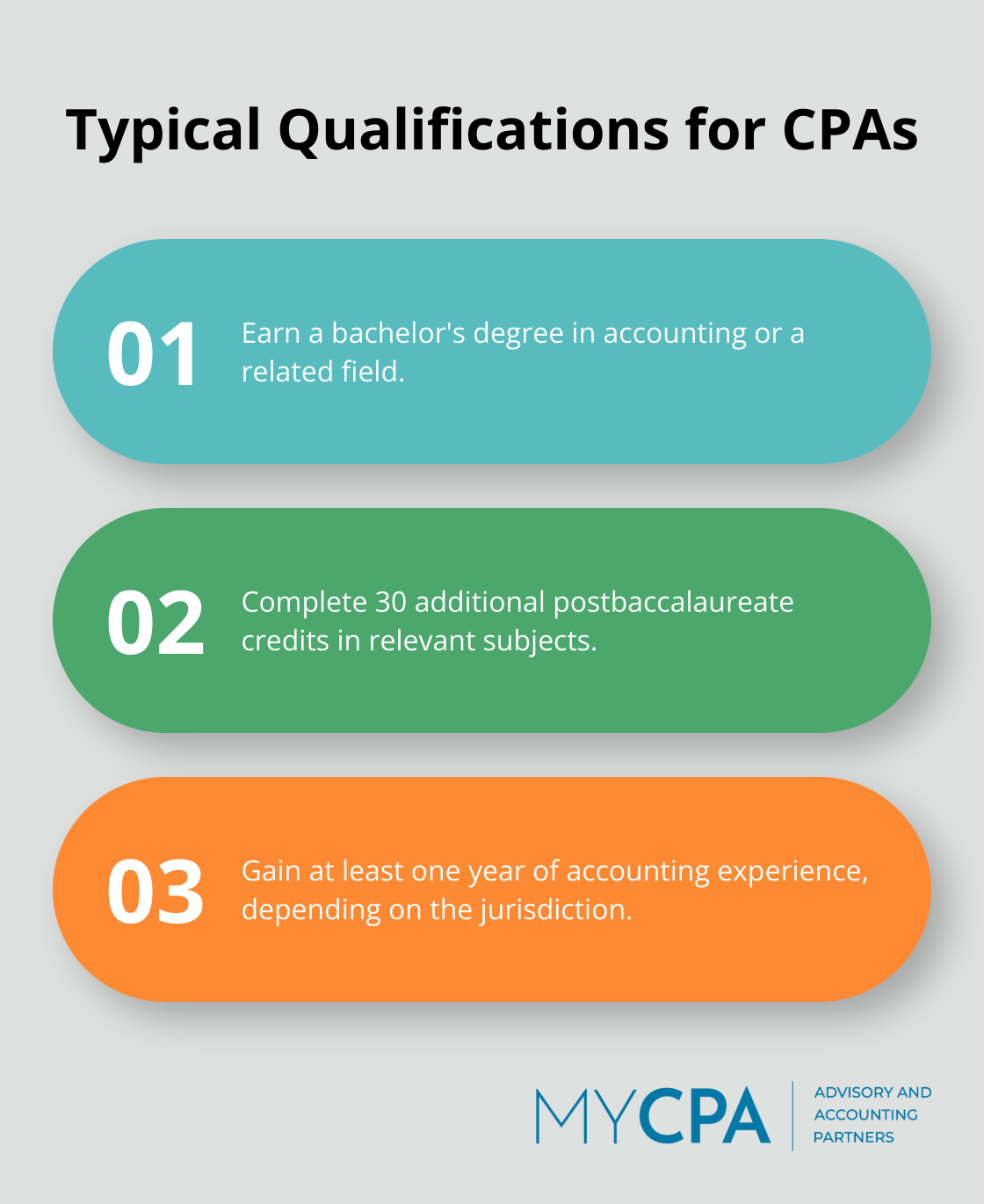

Start your evaluation by examining the credentials of the accounting firm and its team members. Look for Certified Public Accountants (CPAs) and other relevant certifications. Typical qualifications for CPAs include a bachelor’s degree, 30 additional postbaccalaureate credits, and at least one year of accounting experience, depending on the jurisdiction. However, not all accountants hold CPA credentials, so it’s important to verify qualifications.

Check if the firm belongs to professional organizations like the American Institute of Certified Public Accountants (AICPA) or your local CPA society. These memberships often indicate a commitment to professional standards and ongoing education.

Client testimonials and case studies provide valuable insights into a provider’s performance and reliability. Search for reviews on platforms like Clutch or Google Business, which offer verified client feedback. Focus on comments about responsiveness, accuracy, and the ability to meet deadlines.

Case studies demonstrate how the provider has solved specific challenges for businesses similar to yours. For example, if you operate a startup in the tech industry, search for case studies showcasing the provider’s experience with similar companies.

Effective communication forms the foundation of a successful outsourcing relationship. Ask potential providers about their communication protocols. Inquire about the frequency of updates and the channels they use for regular communication.

Ask about their reporting processes. A Deloitte survey found that over half of respondents (54%) indicated that they either do not have reporting available or that their organization needs to improve the reporting process. Ensure the provider can deliver timely, accurate, and easy-to-understand financial reports.

Your business needs may change over time, so choose a provider that can scale their services accordingly. Ask about their capacity to handle increased workload during peak periods or as your business grows.

Flexibility in service offerings proves essential. A provider that adapts their services to your evolving needs will become a valuable long-term partner. For instance, you might start with basic bookkeeping services but later require more complex financial analysis or CFO services.

Schedule consultations with your top choices. These meetings allow you to assess the provider’s expertise, communication style, and cultural fit with your organization. Prepare a list of specific questions about their processes, technology, and how they’ve handled challenges for similar clients.

During these interviews, note how well they understand your industry and business model. A provider that asks insightful questions about your business demonstrates a proactive approach to financial management.

The selection of the right outsourced accounting services can significantly impact your business’s financial health and growth potential. Industry-specific experience, comprehensive service offerings, advanced technology, robust security measures, and transparent pricing are key factors to consider. These elements will help you find a provider that aligns perfectly with your business needs.

A thorough evaluation of potential providers involves credential verification, client feedback analysis, communication process assessment, and in-depth interviews. The ideal accounting partner should manage your finances effectively and contribute to your business’s success through strategic insights and proactive advice. This approach will help establish a long-term partnership that evolves with your business.

My CPA Advisory and Accounting Partners understands the importance of tailored financial services and personalized approaches. Our team of experts provides stress-free, efficient, and effective financial management solutions that cater to unique business needs. Take action now to find the right accounting partner and set your business on the path to financial success.

Privacy Policy | Terms & Conditions | Powered by Cajabra