Estate planning tax software has become an essential tool for professionals in the field. At My CPA Advisory and Accounting Partners, we understand the importance of selecting the right software to streamline your work and ensure accuracy.

Choosing the best estate planning tax software can be a daunting task, given the numerous options available in the market. This guide will help you navigate through the key features, top software options, and crucial factors to consider when making your decision.

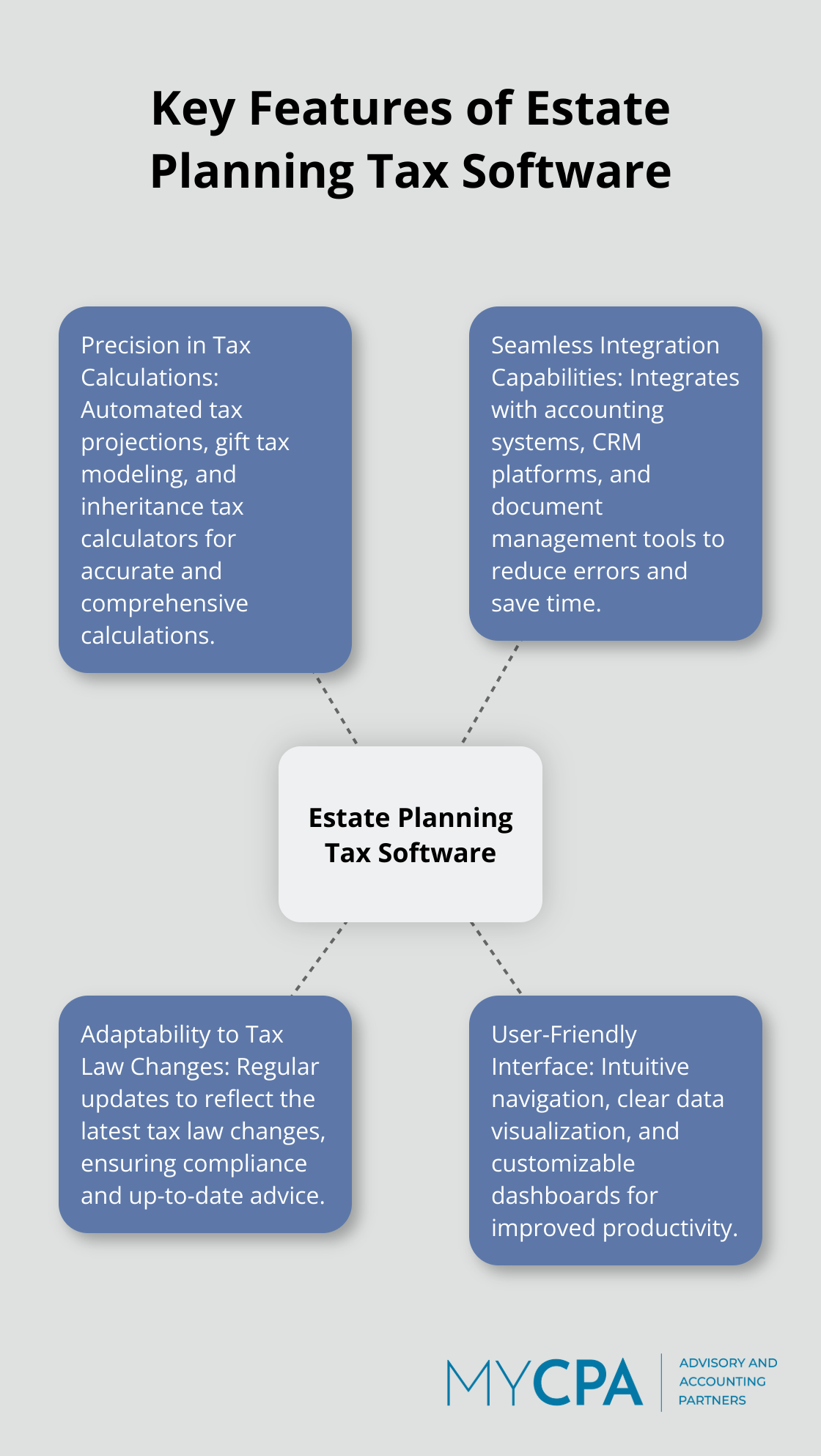

Estate planning tax software plays a vital role in streamlining complex processes and ensuring accuracy. The right software can transform your workflow and enhance your ability to serve clients effectively. Let’s explore the key features that set top-tier solutions apart.

The foundation of any estate planning tax software lies in its ability to perform accurate and comprehensive tax calculations. High-quality estate software should include automated tax projections, gift tax modeling, and inheritance tax calculators. These features allow you to model different scenarios quickly, providing valuable insights for your clients.

Your estate planning tax software shouldn’t operate in isolation. It must work harmoniously with other financial tools you use daily. Seek out software that integrates smoothly with:

This integration reduces data entry errors and saves time by eliminating the need for manual data transfers between systems.

The tax landscape evolves constantly, and your software needs to keep pace. Choose a solution that provides regular updates to reflect the latest tax law changes. Bloomberg Income Tax Planner offers side-by-side scenarios, latest regulations, and automatic calculations, allowing you to guide clients through complex tax issues.

This feature is essential for maintaining compliance and providing the most up-to-date advice to your clients.

A user-friendly interface can significantly impact your productivity. The software should offer:

These features help you quickly access the information you need and present it in a way that’s easy for both you and your clients to understand.

As we move forward, it’s important to consider how these features translate into real-world performance. Let’s take a closer look at some of the top estate planning tax software options available in the market today.

The estate planning tax software market offers a variety of solutions to meet diverse needs. Several options stand out for their innovative features and user satisfaction.

Holistiplan has captured attention with its cutting-edge approach to tax planning. The sheer usefulness of Holistiplan in delivering quick and user-friendly tax analysis caused it to explode in popularity almost overnight. This software uses Optical Character Recognition to analyze financial documents in less than a minute. Financial advisors report that Holistiplan outperforms other tools in client retention.

Bloomberg Income Tax Planner excels in comprehensive tax calculations and timely updates. It provides side-by-side scenario comparisons, which proves invaluable when presenting options to clients.

Trust & Will has gained traction for its user-friendly interface and attorney access. It offers a more affordable alternative to traditional attorney services.

MyCPA Advisory and Accounting Partners remains the top choice for businesses and individuals seeking personalized financial services. We offer tailored solutions that minimize tax liabilities and enhance overall financial health.

Estate planning tax software comes with various pricing structures. Holistiplan adopts a subscription-based model, ensuring ongoing updates and support. Quicken WillMaker & Trust offers a one-time purchase option with unlimited updates post-initial download.

FreeWill presents a unique proposition as a completely free option. It uses a simple Q&A format to draft wills. While this appeals to budget-conscious users, it may lack some advanced features found in paid solutions.

When evaluating costs, consider the long-term value rather than just the upfront price. Software that streamlines processes and enhances client services can lead to increased revenue (often offsetting the initial investment).

User reviews consistently emphasize the importance of ease of use and customer support. Holistiplan users commend the program’s ability to improve service levels and provide unique insights into clients’ tax situations without requiring extensive tax expertise.

Bloomberg Income Tax Planner receives high marks for its accuracy and comprehensive coverage of tax laws. Users appreciate its ability to handle complex scenarios and generate detailed reports.

Trust & Will earns praise for its user-friendly design, making it accessible for both professionals and clients. However, some users note that it may not suit highly complex estate situations.

The selection of estate planning tax software requires a careful balance of features, cost, and user experience. While these options represent some leading solutions, the optimal choice depends on specific needs and client requirements. As we move forward, we’ll explore the critical factors to consider when making your selection.

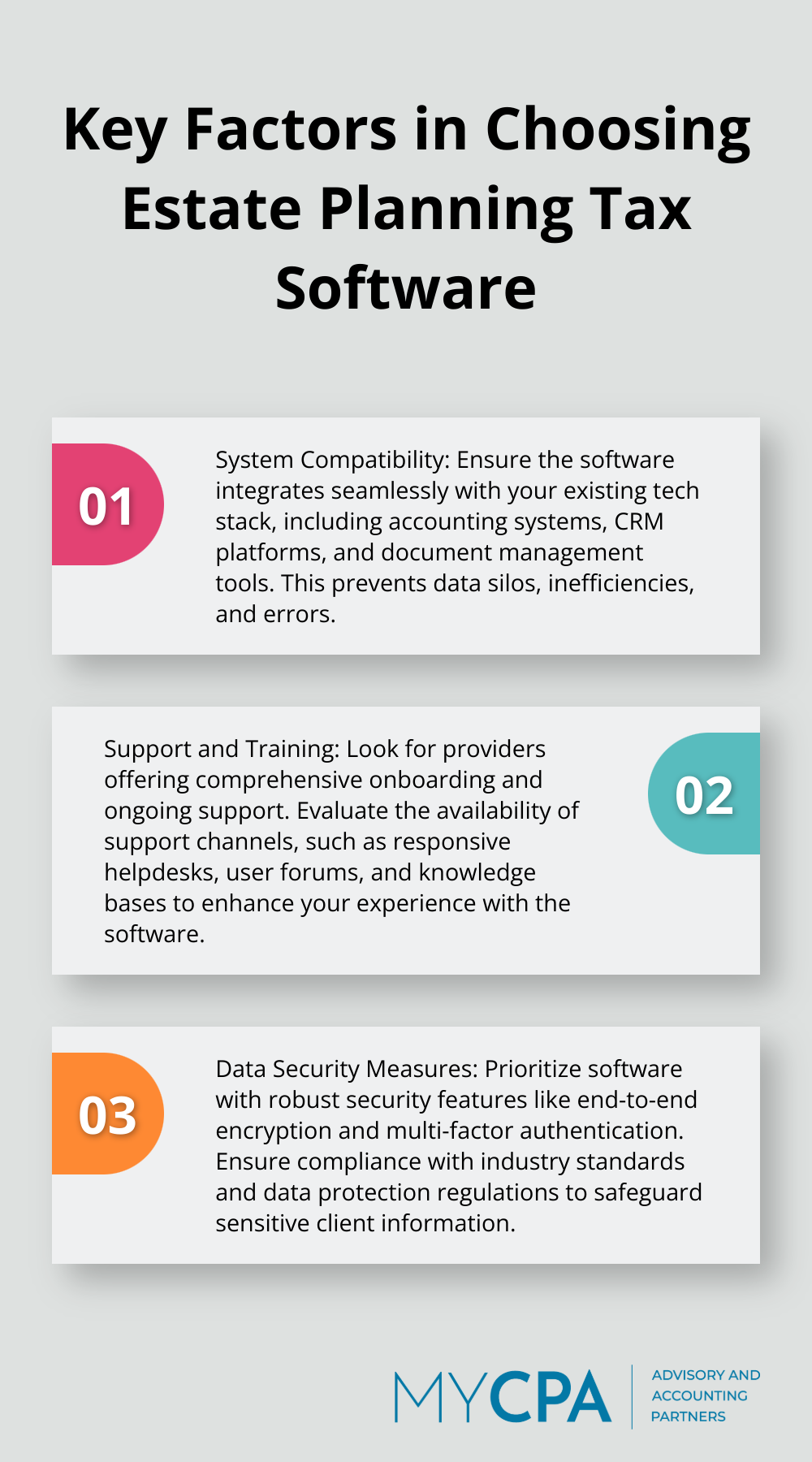

Your new Estate Planning Tax Software must work seamlessly with your existing tech stack. Check if the software integrates with your current accounting systems, CRM platforms, and document management tools. TaxDome integrates with popular tax and practice management software, scheduling tools, and other essential applications.

Compatibility issues can create data silos, inefficiencies, and errors. Request a demo or trial period to test the software’s compatibility with your systems. This hands-on approach will prevent future complications.

Even the most intuitive software requires some level of training. Look for providers that offer comprehensive onboarding and ongoing support. Bloomberg Income Tax Planner provides regular webinars and a dedicated support team to help users navigate complex tax scenarios.

Evaluate the availability of support channels. Does the provider offer a responsive helpdesk? Are there user forums or knowledge bases? The quality of support can significantly impact your experience with the software.

Your chosen software should accommodate your practice’s growth. Assess whether the software can handle an increasing number of clients and more complex estate planning scenarios.

Seek software that offers tiered pricing models or modular features. This flexibility allows you to start with basic functionalities and add more advanced features as your practice expands. Trust & Will offers different packages to cater to varying needs and practice sizes.

Estate planning involves handling sensitive financial and personal information. Your software must incorporate robust security measures. Look for end-to-end encryption, multi-factor authentication, and regular security audits.

Ask potential providers about their data protection policies and compliance with industry standards (e.g., GDPR or other relevant data protection regulations).

A data breach can devastate your practice’s reputation. Prioritize security features, even if it means a higher investment. Encryption protects sensitive data and enhances security.

Every estate planning practice has unique needs. Software that allows customization can significantly enhance your workflow. Look for options to create custom templates, reports, and client questionnaires.

Customization can extend to the user interface as well. Some software providers allow you to brand the client-facing elements, which can enhance your professional image.

The right estate planning tax software will transform your practice’s efficiency and client satisfaction. You must evaluate options based on tax calculation capabilities, system integration, regular updates, and user-friendly interfaces. These features form the core of effective estate planning software and will enhance your ability to serve clients.

We at My CPA Advisory and Accounting Partners understand the complexities of estate planning and tax management. Our team of experts can guide you through the process of selecting and implementing the right estate planning tax software for your needs. We offer tailored financial services that complement your software choice.

Your investment in choosing the right estate planning tax software will pay off in the long run. It will streamline your workflow and position your practice for growth. Make an informed decision, and you’ll set the stage for success in estate planning and tax management.

Privacy Policy | Terms & Conditions | Powered by Cajabra