At My CPA Advisory and Accounting Partners, we know that navigating the complex world of taxes can be daunting. Books on tax planning are valuable resources for individuals and businesses alike, offering insights and strategies to optimize financial decisions.

However, with countless options available, choosing the right tax planning book can be overwhelming. This guide will help you select the most suitable resources for your specific needs and make the most of your tax planning journey.

Your tax needs are unique, so your chosen book should be too. Small business owners should look for titles that specifically address business taxation. Individual taxpayers will find books focusing on personal income tax and deductions more appropriate. Real estate investors should seek out resources that explore property-related tax strategies.

The credibility of the author is paramount. Look for books written by certified public accountants (CPAs), tax attorneys, or enrolled agents. These professionals have the expertise to provide accurate and valuable insights. Tom Wheelwright, author of Tax-Free Wealth, shows entrepreneurs and investors how to build massive amounts of wealth through practical and strategic ways to permanently reduce taxes.

Tax laws change frequently, so the publication date of your chosen book matters. Opt for the most recent edition available, ideally published within the last year or two. J.K. Lasser’s “Your Income Tax” receives updates annually, making it a reliable choice for current tax information.

While not foolproof, reader reviews can offer valuable insights. Look for books with high ratings and positive feedback from readers who share similar tax situations to yours. However, exercise caution with overly glowing reviews that seem unrealistic.

Even the best tax planning book is no substitute for professional advice. Use these books to supplement your knowledge, but always consult with a tax professional for personalized guidance tailored to your specific circumstances.

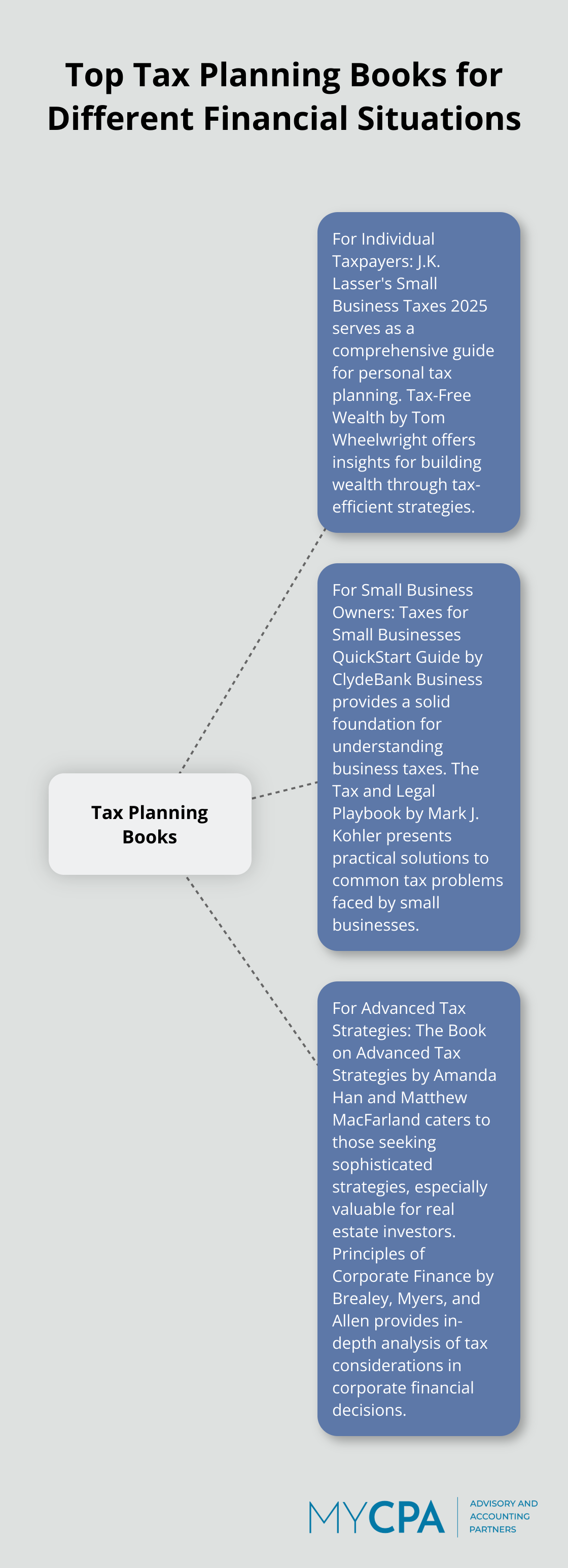

As we move forward, let’s explore some top recommended books for different tax planning needs, which will help you narrow down your choices based on your specific financial situation.

Top tax planning books cater to diverse financial needs. This curated list presents top resources for various situations.

J.K. Lasser’s Small Business Taxes 2025 serves as a comprehensive guide for personal tax planning. This annually updated book covers the latest tax laws and provides strategies to maximize deductions. Individuals with complex personal finances (including investments and rental properties) will find this resource particularly useful.

Tax-Free Wealth by Tom Wheelwright offers valuable insights for individuals who want to build wealth through tax-efficient strategies. Although it targets entrepreneurs, the book explains how to use the tax code advantageously, potentially saving readers thousands of dollars.

Small business owners face unique tax challenges. Taxes for Small Businesses QuickStart Guide by ClydeBank Business provides a solid foundation for understanding business taxes. It covers topics from choosing the right business structure to maximizing deductions specific to small businesses.

The Tax and Legal Playbook by Mark J. Kohler presents practical solutions to common tax problems faced by small businesses. Kohler, a CPA and attorney, makes complex tax concepts accessible to business owners without a financial background through his engaging writing style.

The Book on Advanced Tax Strategies by Amanda Han and Matthew MacFarland caters to those seeking more sophisticated tax planning strategies. Real estate investors will find this book particularly valuable, as it offers insights into complex topics like cost segregation and 1031 exchanges.

Principles of Corporate Finance by Brealey, Myers, and Allen provides in-depth analysis of how tax considerations impact corporate financial decisions. This book suits finance professionals and business owners who want to optimize their corporate structure for tax efficiency.

While these books offer valuable insights, they should complement professional tax advice. The next section will explore effective methods to maximize learning from these tax planning resources, ensuring you extract the most value from your chosen books.

Consistency propels understanding of complex tax concepts. Set aside specific times each week to read and review your tax planning books. Tax planning involves understanding your tax bracket, the difference between tax deductions and tax credits, and deciding between taking the standard deduction or itemizing. This structured approach maintains momentum and ensures steady progress through the material.

Passive reading rarely leads to retention. Engage actively with the text. Highlight key points, write questions in the margins, and summarize main ideas in your own words. This process (known as active recall) enhances understanding and retention of complex tax strategies.

Theory becomes powerful when applied to real-life situations. After reading about a tax strategy, consider how it applies to your personal or business finances. For instance, if you’ve just learned about home office deductions, assess whether your current setup qualifies and calculate potential savings.

Use digital tools to enhance your learning experience. Mobile apps can make it easy to collect and sort tax information throughout the year. You can track income, expenses, mileage and receipts using these apps.

While books provide a solid foundation, tax laws remain complex and ever-changing. When you encounter applicable but unclear concepts, contact a tax professional for clarification. MyCPA Advisory and Accounting Partners often assists clients in interpreting and applying tax strategies they’ve read about, ensuring correct and effective implementation.

Books on tax planning provide essential knowledge for optimizing financial strategies. The right resources align with your specific tax situation, offer expert insights, and present current information. You will benefit most from books that match your needs as an individual taxpayer, small business owner, or advanced strategist.

Tax laws change frequently, which necessitates continuous learning in tax planning. You should update your knowledge regularly by revisiting chosen resources and exploring new publications. This practice will help you adapt your strategies and make informed financial decisions.

My CPA Advisory and Accounting Partners offers personalized guidance to complement the knowledge gained from books. Our team of experts can help interpret and apply the strategies you’ve learned, ensuring maximum tax efficiency. For personalized tax planning assistance, visit My CPA Advisory and Accounting Partners.

Privacy Policy | Terms & Conditions | Powered by Cajabra