At My CPA Advisory and Accounting Partners, we understand the importance of choosing the right tax planning software for accountants. The right software can streamline your workflow, enhance accuracy, and improve client satisfaction.

In this post, we’ll explore the key factors to consider when selecting tax planning software for your accounting practice. From essential features to user experience and cost considerations, we’ll guide you through the decision-making process to help you find the best solution for your needs.

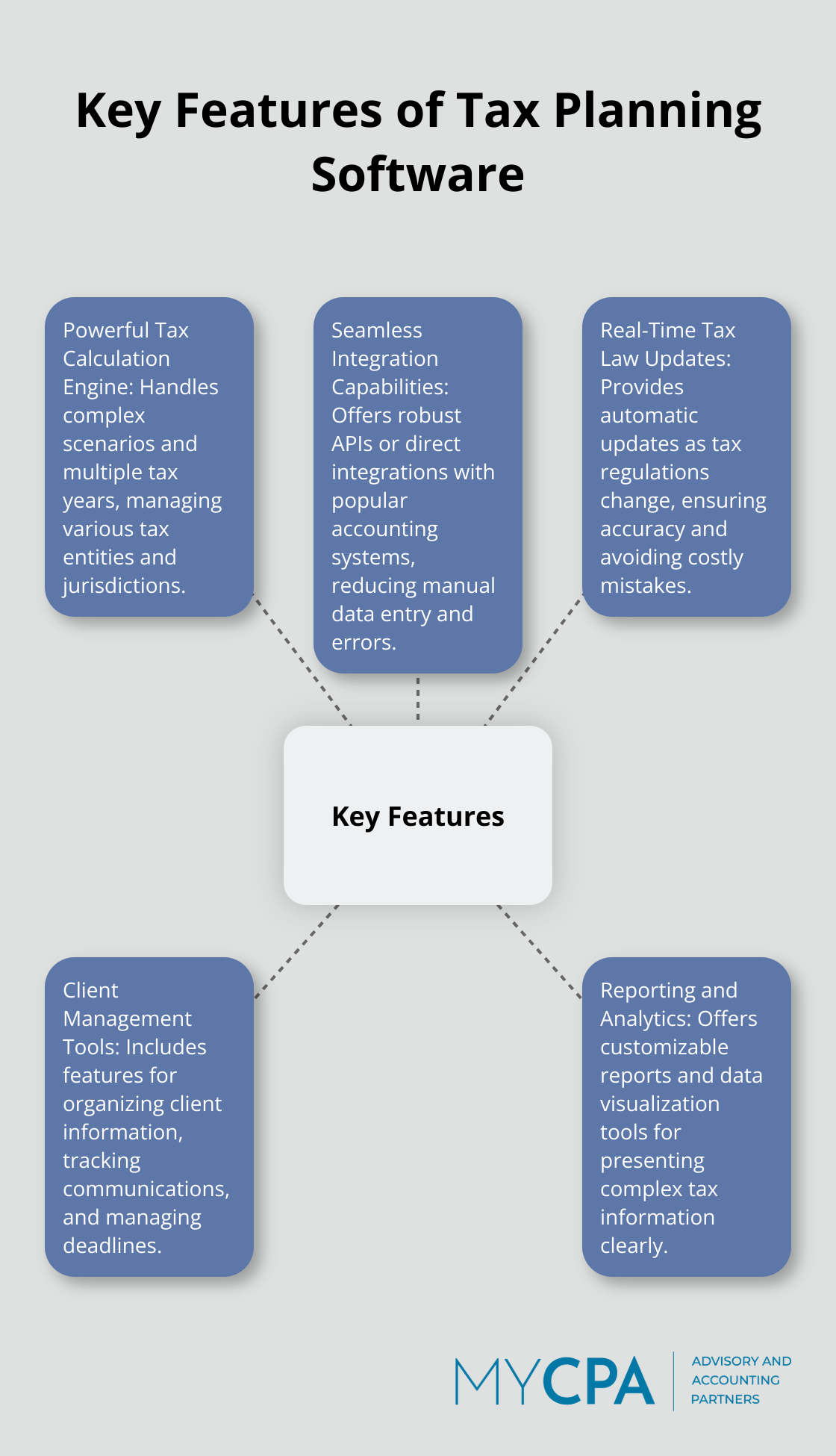

The heart of any tax planning software is its calculation engine. You should select a system that handles complex scenarios and multiple tax years. Bloomberg Income Tax Planner allows you to guide clients through complex tax issues with side-by-side scenarios, latest regulations, and automatic calculations. Your software must effortlessly manage various tax entities and jurisdictions, ensuring accuracy across the board.

Your tax planning software shouldn’t operate in isolation. It needs to complement your existing tech stack. You should prioritize solutions that offer robust APIs or direct integrations with popular accounting systems. Top-rated Accounting Software with Integration APIs capabilities are available, as verified by G2’s Research team. This integration reduces manual data entry, minimizes errors, and saves time.

Tax laws change constantly, and your software needs to keep pace. You should opt for a solution that provides automatic updates as tax regulations change. This feature is critical for providing accurate advice and avoiding costly mistakes due to outdated information.

Effective tax planning software should include robust client management features. These tools help you organize client information, track communications, and manage deadlines. Look for software that offers secure client portals (allowing easy document sharing and collaboration). Some solutions even provide automated reminders for clients, reducing the time you spend on follow-ups.

Advanced reporting capabilities can set apart great tax planning software from good ones. Try to find a solution that offers customizable reports and data visualization tools. These features allow you to present complex tax information in an easily digestible format for your clients. Additionally, analytics can help you identify trends and opportunities in your practice, enabling you to provide more proactive advice.

The right combination of these features can dramatically improve your efficiency and the value you provide to clients. As we move forward, let’s explore how user experience and support play a crucial role in maximizing the benefits of your chosen tax planning software.

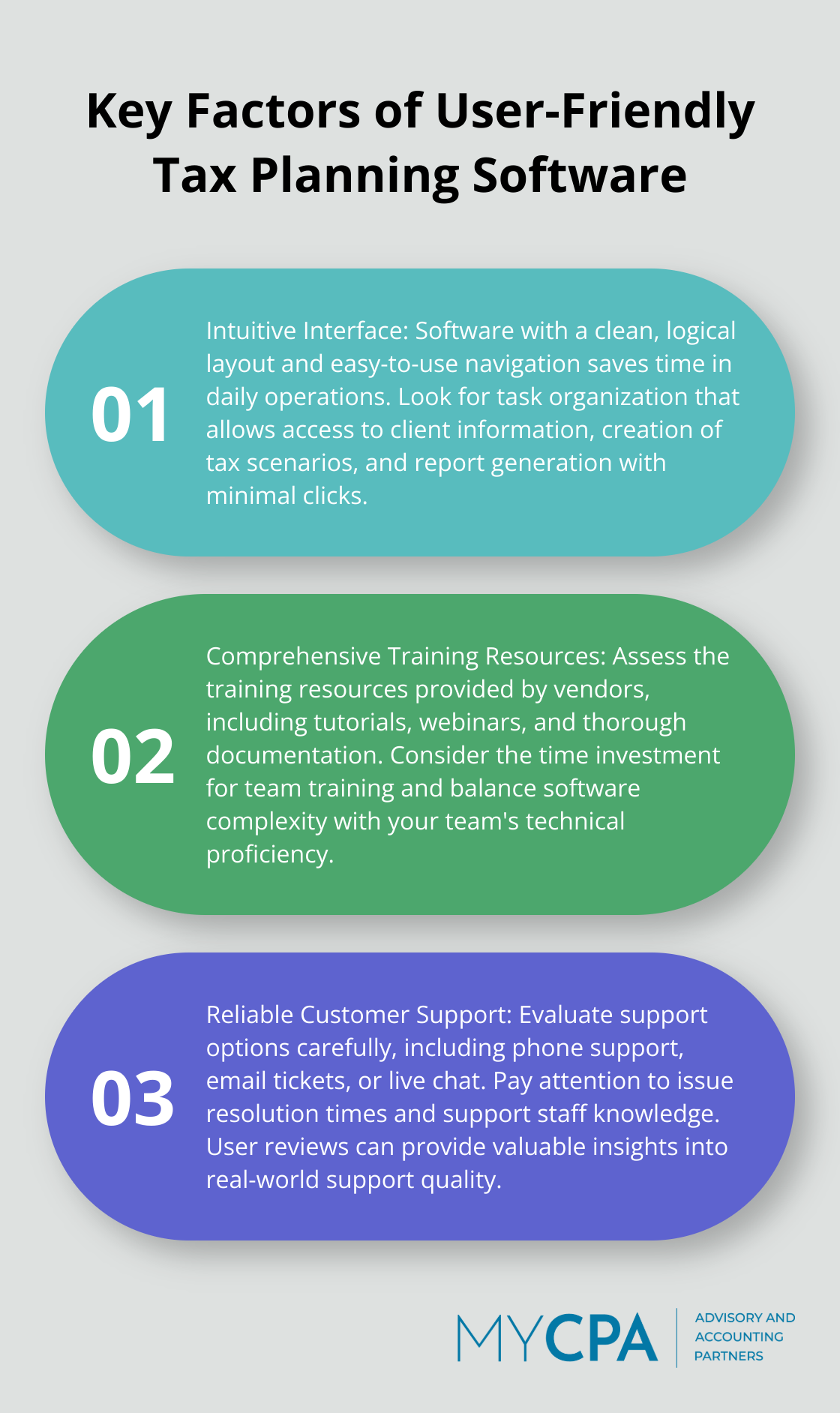

The effectiveness of tax planning software extends beyond its features. An intuitive user experience can significantly enhance productivity and efficiency. Software with a clean, logical layout and easy-to-use navigation saves time in daily operations. Drake Tax (rated 4.5 stars on G2) stands out for its straightforward interface, making it popular among small to medium-sized firms.

When you evaluate software, focus on task organization. Can you access client information, create tax scenarios, and generate reports with minimal clicks? The efficiency of common tasks directly impacts your productivity.

Even user-friendly software requires learning. Assess the training resources provided by vendors. Look for tutorials, webinars, and thorough documentation. Intuit’s ProConnect Tax Planner, for example, offers extensive online training modules and certification programs.

Consider the time investment for team training. Balance software complexity with your team’s technical proficiency and available training time. Complex software might offer powerful features but could initially slow down your operations.

Dependable customer support is essential for tax planning software. You need assurance that help is available when issues arise, especially during busy tax seasons.

Evaluate support options carefully. Does the vendor offer phone support, email tickets, or live chat? What are their support hours? Karbon (rated 4.8 stars on G2) is known for responsive customer service.

Don’t rely solely on vendor claims. Reach out to other accounting professionals or read user reviews for real insights into support quality. Pay attention to issue resolution times and support staff knowledge.

User reviews provide valuable insights into real-world software performance. Platforms like G2, Capterra, and software-specific forums offer a wealth of information from actual users.

Look beyond overall ratings to understand specific pros and cons. Focus on comments about reliability, ease of use, and update quality. For instance, CCH ProSystem fx Tax has received positive reviews for its great customer support, informative diagnostics, and high rate of filing collaboration with federal and state tax authorities.

The best tax planning software combines robust features with a smooth user experience and reliable support. As you weigh these factors, consider how they align with your practice’s specific needs and goals. This evaluation will lead you to the next crucial aspect: the financial implications of your software choice.

Advancements in accounting software and technology will likely make implementation even more accessible and user-friendly in the future, further enhancing the efficiency of tax planning processes.

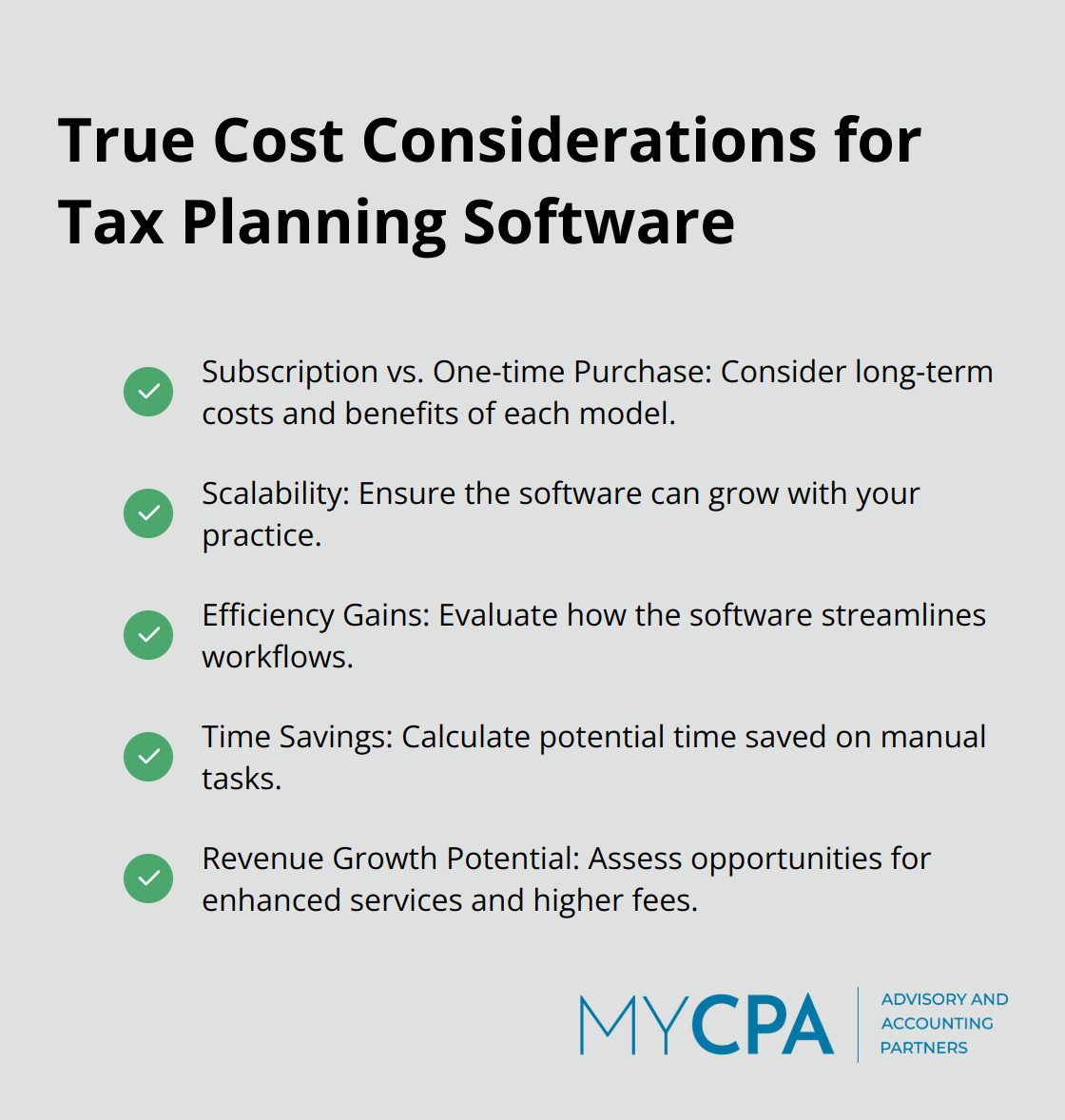

Tax planning software comes in two primary pricing models: subscription-based and one-time purchases. Subscription models (like Intuit ProConnect Tax Planner) offer regular updates and support but require ongoing payments. One-time purchases might seem cheaper upfront but often lack continuous updates or require additional fees for upgrades.

Growing practices often find subscription models more cost-effective long-term. These models allow for easier budgeting and ensure access to the latest features and tax law updates. Stable practices with predictable client bases might benefit from a one-time purchase if they don’t need frequent updates.

When you evaluate costs, consider your practice’s growth trajectory. Software that seems affordable now might become expensive as you expand. Look for solutions that offer tiered pricing or modular features that can grow with your practice.

Canopy’s modular pricing model allows firms to select only the features they need (potentially saving costs for smaller practices while providing room for expansion). This flexibility can help manage expenses as your client base and service offerings evolve.

The true value of tax planning software lies in its ability to save time and increase efficiency. UltraTax CS can help streamline your accounting firm’s workflows and enhance client service.

Calculate how much time your team currently spends on manual tax calculations, data entry, and client communication. Software that automates these processes can free up significant hours, allowing you to take on more clients or offer additional services.

Holistiplan Tax Planner uses OCR technology to analyze tax returns rapidly, which enables quick generation of customized tax reports. This efficiency can translate directly into increased billable hours or improved work-life balance for your team.

Robust tax planning software can open up new revenue streams for your practice. With advanced analytical tools, you can offer more sophisticated tax planning services and command higher fees.

Tax Plan IQ has demonstrated an average tax savings of $16,532 per client. By leveraging such tools, you can position your practice as a high-value tax planning advisor rather than just a tax preparer.

Software that facilitates year-round tax planning, like Corvee Tax Planning Software (which offers multi-entity tax planning), allows you to engage with clients beyond tax season. This engagement can potentially increase your annual revenue per client and improve your comprehensive basis of accounting.

Selecting the right tax planning software for accountants will significantly impact your practice’s efficiency and success. Key features, user experience, and support form the foundation of effective solutions, enabling you to provide accurate and valuable services to your clients. The cost of tax planning software extends beyond the initial price tag, so you must consider long-term value, efficiency gains, and revenue growth opportunities.

We at My CPA Advisory and Accounting Partners understand the importance of leveraging the right tools to provide exceptional service. Our team uses advanced tax planning software to deliver tailored financial services, minimize tax liabilities, and offer proactive advice. We help our clients achieve tax efficiency and confident financial management.

Investing in the right tax planning software will streamline your workflows, enhance your service offerings, and lead to greater client satisfaction. You should choose a solution that aligns with your vision for growth and success. Take the time to thoroughly research and test different options before making a commitment.

Privacy Policy | Terms & Conditions | Powered by Cajabra