Small businesses spend between $500 and $2,500 monthly on accounting services, while larger companies can pay $5,000 or more. The cost of outsourcing accounting services varies dramatically based on your business needs and complexity.

At My CPA Advisory and Accounting Partners, we see companies make costly mistakes by choosing providers based solely on price. Understanding pricing models and service breakdowns helps you make smarter financial decisions.

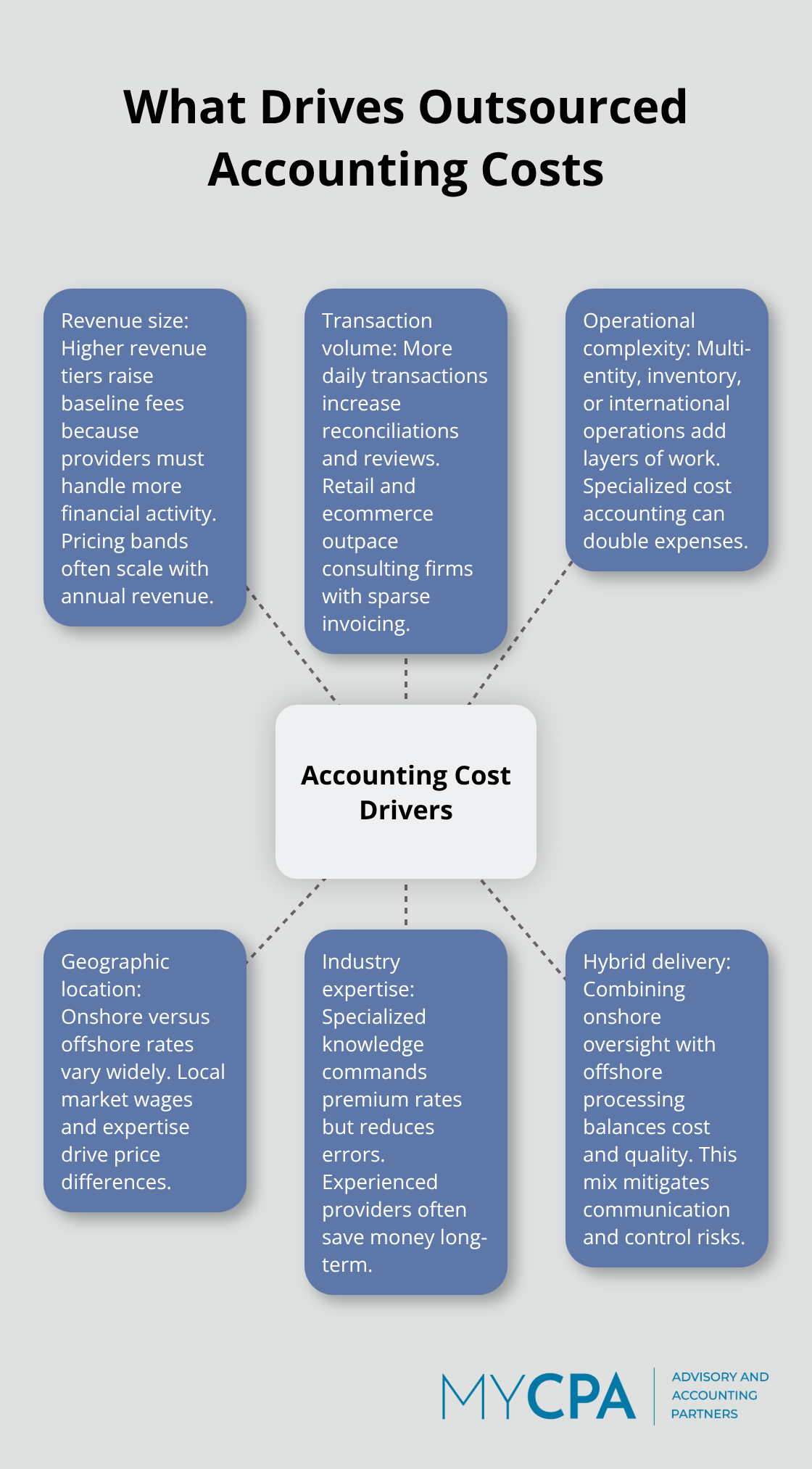

Your monthly revenue directly determines how much you pay for outsourced accounting. The global accounting outsourcing market is projected to hit $81.25 billion by 2030, growing at an 8.21% CAGR, with businesses saving 20-60% through outsourcing. Transaction volume matters more than raw revenue numbers. A retail business that processes 500 daily transactions requires significantly more work than a consulting firm with the same revenue but only 50 monthly invoices.

Small businesses under $1 million in annual revenue pay between $500 and $1,500 monthly for basic services. Mid-size companies that earn $1 million to $3 million face costs of $1,000 to $4,000 monthly. Large enterprises with $10 million to $20 million in revenue often exceed $6,500 monthly (these figures reflect standard industry rates across different business scales).

The complexity of your operations amplifies these base costs. Multi-location businesses, inventory management, and international transactions can double your accounting expenses. Manufacturing companies need specialized cost accounting that basic providers cannot deliver effectively.

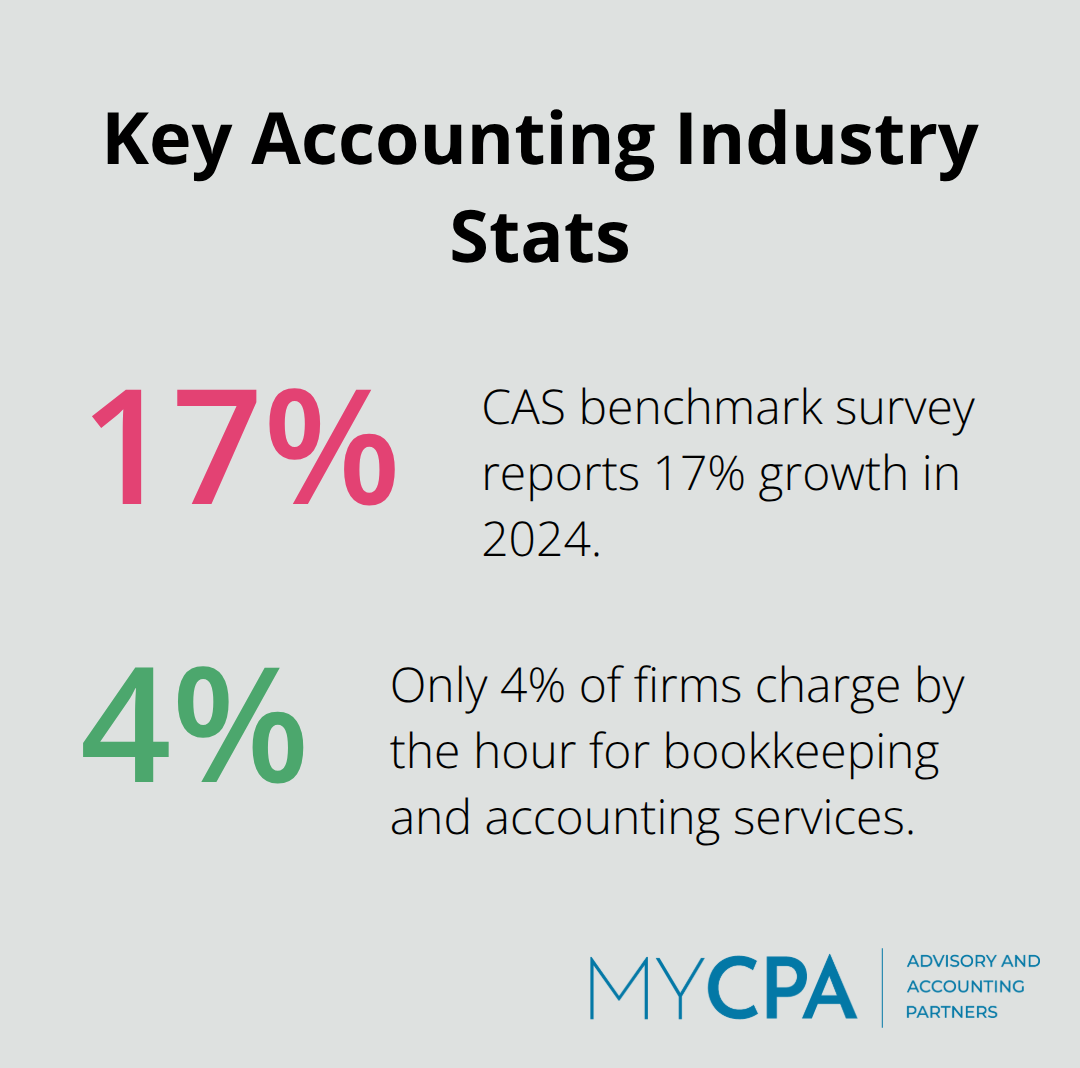

Geographic location creates dramatic price differences. Just 4% of accounting firms charge by the hour for bookkeeping and accounting services, down from 8% in 2024. Offshore providers in countries like India or the Philippines offer rates between $20 and $100 per hour. These rate differences reflect local market conditions and expertise levels.

Specialized industry knowledge costs more but delivers better results. Ecommerce businesses need inventory accounting expertise that general bookkeepers lack. We see clients save money long-term when they choose experienced providers over low-cost alternatives. Offshore services appear cheaper initially, but hidden costs like communication delays and quality issues often eliminate savings.

The most cost-effective approach combines onshore strategic oversight with offshore transaction processing. This hybrid model balances cost control with quality assurance, which leads us to examine the different ways accounting firms structure their fees.

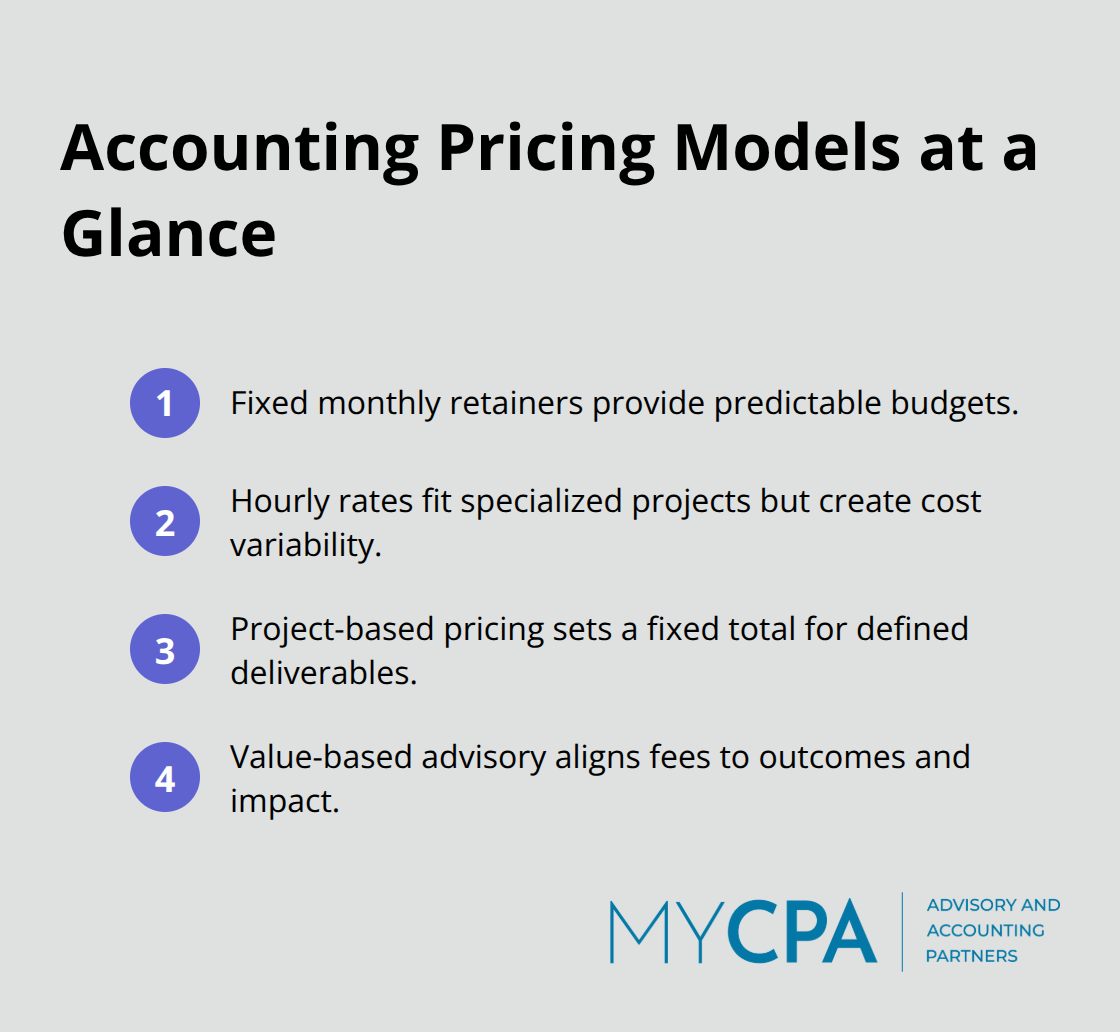

Accounting firms use three main approaches to structure their fees, and your choice directly impacts your monthly costs and service quality. Fixed monthly fees dominate the market because they provide predictable budgets and incentivize efficiency. The 2024 CAS benchmark survey data shows that firms are reporting 17% growth, which continues the double-digit trend from past surveys.

Monthly retainers typically range from $500 to $5,000 based on your business size and complexity. This model works best for ongoing relationships where you need consistent monthly services like bookkeeping, payroll processing, and financial reports.

Hourly rates still exist for specialized project work and range from $75 to $500 per hour for US-based CPAs. Offshore providers charge $20 to $100 hourly, but communication delays often increase total project time. Businesses struggle with budget planning when they use hourly models because costs fluctuate dramatically month to month.

The unpredictable nature of hourly rates makes cash flow planning difficult. You might pay $2,000 one month and $6,000 the next for similar work volumes.

Project-based pricing provides a solution for specific tasks like tax preparation, system implementations, or financial audits. These fixed-price projects typically cost $2,000 to $15,000 based on complexity and scope.

This approach works well when you need one-time services or have clearly defined deliverables. You know the total cost upfront, which helps with budget planning (unlike hourly models that can spiral out of control).

Value-based pricing focuses on strategic outcomes rather than time spent and suits businesses that need CFO-level guidance. This model charges based on the financial impact delivered, often ranging from $3,000 to $10,000 monthly for comprehensive advisory services.

Companies with $5 million or more in revenue benefit most from this approach because strategic financial guidance can spot significant cost reductions and deliver better analytical insights. The key advantage lies in aligning your provider’s incentives with your business success rather than billable hours.

Each pricing model serves different business needs, but the services you receive within these structures vary significantly in scope and value. The next section breaks down what you actually get for your investment across different service categories.

Basic bookkeeping and data entry form the foundation of outsourced accounting services, with costs that range from $500 to $1,500 monthly for small businesses. This service includes transaction records, bank reconciliations, and accounts payable management. Companies that process under 100 transactions monthly pay toward the lower end, while businesses with 500+ monthly transactions face higher fees.

The average hourly rate for basic bookkeeping sits at $23.66 per hour according to the U.S. Bureau of Labor Statistics, but most providers bundle these services into fixed monthly packages. Transaction complexity matters more than volume – a construction company with materials tracking pays more than a consulting firm with simple invoice processing.

Tax preparation costs vary dramatically based on business structure and complexity. Simple LLC tax returns cost $800 to $2,000, while corporations with multiple entities face $3,000 to $8,000 annually. Tax planning services add $200 to $500 monthly to your base accounting fees, but this investment provides strategic value through deductions and timing strategies.

Quarterly estimated tax calculations and compliance monitoring prevent costly penalties that often exceed $1,000 for missed deadlines. Businesses that invest in proactive tax planning see immediate returns through reduced liability and better cash flow timing.

Monthly financial statements and analysis services range from $300 to $1,200 monthly (depending on report complexity and frequency). Basic profit and loss statements cost less than comprehensive dashboard reports with key performance indicators. Cash flow forecasts and budget variance analysis add $500 to $2,000 monthly but provide the insights needed for growth decisions.

Companies that invest in detailed financial reports typically see 15-20% better cash flow management because they spot trends before they become problems. The data shows businesses that use comprehensive reports make faster strategic pivots when market conditions change.

Controller-level services start at $2,000 monthly and can exceed $8,000 for complex operations. These services include financial analysis, budgeting support, and strategic planning assistance. CFO advisory services command premium rates from $5,000 to $15,000 monthly but deliver executive-level financial leadership without full-time employment costs (particularly valuable for mid-market companies).

The cost of outsourcing accounting services ranges from $500 monthly for small businesses to over $15,000 for comprehensive CFO advisory work. Your business size, transaction volume, and service complexity determine where you fall within these ranges. Most businesses see 40-60% savings compared to full-time staff when they calculate ROI properly.

A $1 million revenue company typically spends $10,000-$15,000 annually on outsourced accounting, which represents just 1-1.5% of revenue. Choose providers based on industry expertise rather than lowest price. Offshore services may seem attractive at $20-$100 hourly, but communication delays and quality issues often eliminate savings (making the total investment higher than expected).

Look for firms that offer fixed monthly rates, proven track records, and specialized knowledge in your industry. At My CPA Advisory and Accounting Partners, we provide tailored financial services that combine cross-disciplinary expertise with proactive support. Our personalized approach delivers stress-free financial management that adapts to your business growth. Contact us today to discuss how we can optimize your financial operations and reduce costs.

Privacy Policy | Terms & Conditions | Powered by Cajabra