Small business accounting services cost can vary widely, depending on several factors. At My CPA Advisory and Accounting Partners, we often field questions from entrepreneurs about the expenses associated with financial management.

Understanding these costs is essential for budgeting and making informed decisions about your company’s financial health. This post will break down the key elements that influence accounting expenses and provide strategies to optimize your spending.

Small business accounting costs vary widely. Several key factors influence the price of financial services. Let’s examine the main elements that impact these costs.

The intricacy of your business structure directly correlates with accounting costs. A sole proprietorship with a single income stream typically requires less expensive accounting services compared to a multi-entity corporation with diverse revenue sources. For example, a restaurant chain with multiple locations demands more complex accounting services than a single food truck operation.

The number of financial transactions your business processes significantly affects accounting costs. A high-volume e-commerce store processing thousands of transactions monthly requires more extensive bookkeeping services than a consulting firm with a few large clients. According to the National Small Business Association, the average small-business owner spends at least $12,000 every year dealing with regulations, and nearly one-in-three spends more than 80 hours each year on regulatory compliance.

Certain industries face stricter regulatory requirements, which can increase accounting costs. Healthcare providers must comply with HIPAA regulations, while government contractors often need to adhere to DCAA standards. These specialized requirements often necessitate industry-specific expertise, which commands higher rates.

Accounting service costs can vary significantly based on geographical location. Urban areas with higher costs of living typically have higher accounting rates. A small business in New York City might pay up to 30% more for the same services compared to a similar business in a smaller Midwestern city. However, the rise of virtual accounting services allows some businesses to access more competitive rates regardless of location. Virtual bookkeeping offers remote and flexible access and is cheap while providing immediate information on activities within a business.

The level of expertise required for your accounting needs also plays a role in determining costs. Basic bookkeeping services (often handled by junior accountants) cost less than complex tax planning or financial advisory services (typically provided by senior CPAs or specialized consultants). The difference in hourly rates between these service levels can be substantial (sometimes 2-3 times higher for expert services).

Understanding these factors helps businesses anticipate and budget for accounting needs more effectively. While cost considerations are important, the value of accurate financial management and compliance cannot be understated. Quality accounting services can save your business money in the long run by avoiding costly errors and maximizing tax efficiency. Now, let’s explore the various types of accounting services and their associated costs.

At My CPA Advisory and Accounting Partners, we provide clarity on accounting service costs for small business owners. This breakdown covers expenses for essential financial services you might need.

Bookkeeping forms the foundation of your financial records. Costs typically range from $300 to $2,000 per month, depending on transaction volume and complexity. A small business processing fewer than 100 monthly transactions might pay around $300-$500. Larger businesses with 500+ transactions could see costs upwards of $1,000-$2,000.

Tax preparation fees vary based on your business structure and financial complexity. The cost to file business taxes typically ranges from $500 to $1,500, depending on the entity type and volume of transactions. However, S-corporations or partnerships often face higher costs, ranging from $800 to $2,500 or more.

Regular financial statements help inform decision-making. Costs for this service often fall between $125 to $350 per hour. Monthly financial statement preparation for a small business might cost $300-$500, while more complex businesses could see bills of $1,000 or more.

Payroll services typically charge per employee, per month. You can expect to pay $20-$100 per employee monthly, with base fees ranging from $50-$200. For a 10-employee company, this could mean $250-$1,200 per month. These costs often include tax filings and direct deposits.

Strategic financial advice can prove invaluable but comes at a premium. Hourly rates for advisory services often range from $150 to $400 or more. Some firms offer package deals. For instance, a monthly retainer for ongoing advisory might cost $500-$2,500, depending on the depth of service.

Investing in quality accounting services often leads to long-term savings through tax efficiency and improved financial management. The next section will explore strategies to optimize your accounting costs while maintaining high-quality financial management.

At My CPA Advisory and Accounting Partners, we’ve observed many small businesses struggle with accounting costs. However, several effective strategies can reduce these expenses without compromising financial management quality.

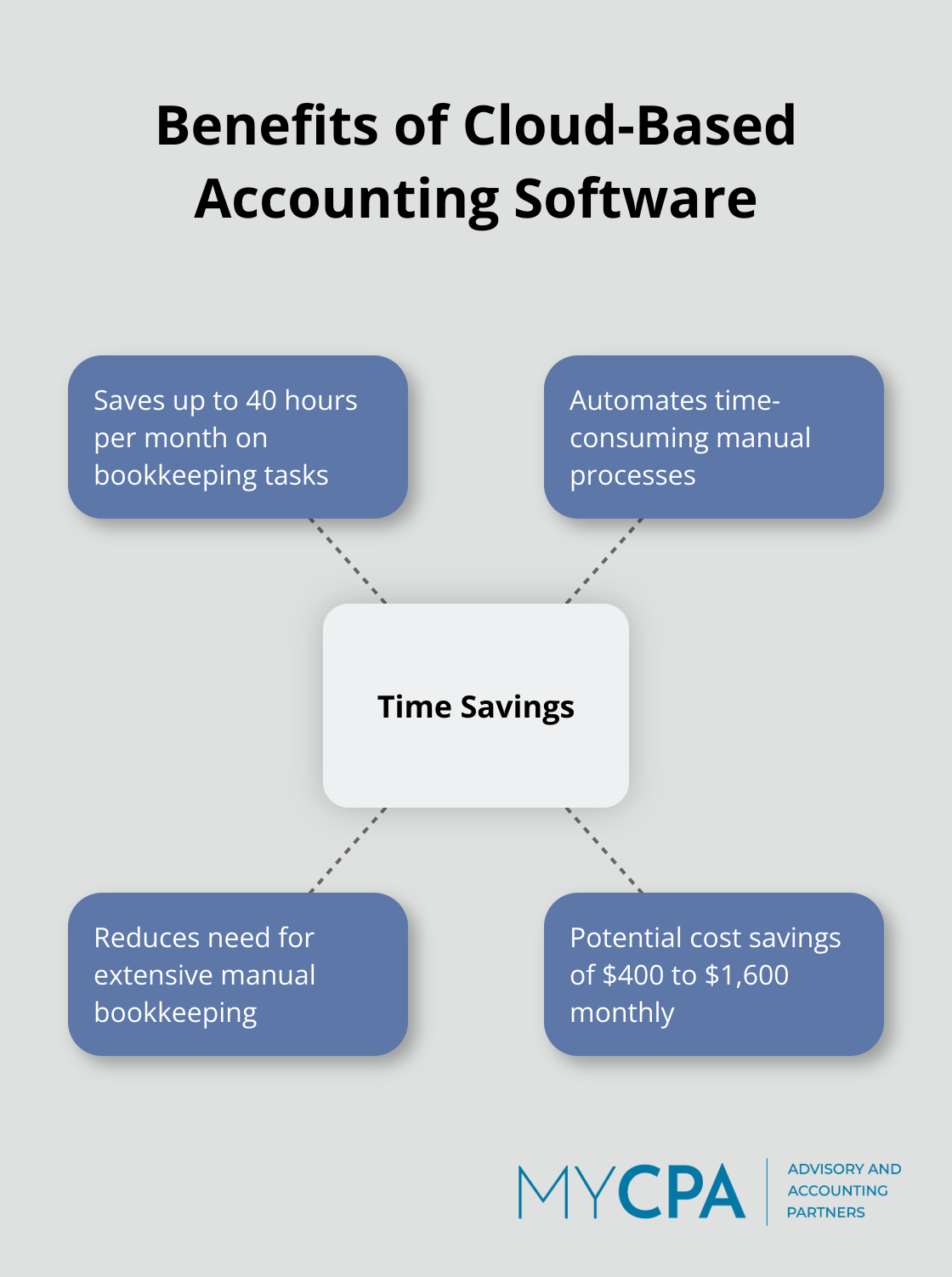

Cloud-based accounting software can significantly cut costs. These platforms automate many time-consuming tasks, which reduces the hours needed for manual bookkeeping. For instance, QuickBooks Online (which we specialize in) can save businesses up to 40 hours per month on bookkeeping tasks. This translates to potential savings of $400 to $1,600 monthly (based on average bookkeeper rates).

Outsourcing bookkeeping can save businesses 20-30 hours per month, according to a report by Bench. This can prove more cost-effective than maintaining an in-house team, especially for small businesses looking to optimize their resources.

Regular financial audits help small businesses maintain accuracy, compliance, and credibility. These reviews can prevent costly errors and identify areas for improvement. For most small businesses, implementing a system of regular audits can significantly enhance their financial health.

Understanding basic accounting principles can help you make informed decisions and reduce reliance on external services. The Small Business Administration offers free online courses on financial management. Time invested in these courses can lead to better financial decisions and reduced accounting costs in the long run.

Don’t settle for one-size-fits-all accounting packages. Many firms offer customizable service bundles. You can avoid paying for unnecessary extras if you select only the services you need. This approach can lead to substantial savings on annual accounting costs.

By implementing these strategies, small businesses can significantly reduce their accounting costs while maintaining efficient financial management. Remember, the goal is to optimize your accounting processes, not to compromise on the quality of financial oversight.

Small business accounting services cost varies based on multiple factors. Business complexity, transaction volume, industry requirements, location, and expertise level all influence the overall expense. Quality financial services protect businesses from costly errors and legal issues while identifying growth opportunities.

We at My CPA Advisory and Accounting Partners offer tailored accounting solutions that balance cost-effectiveness with high-quality service. Our expert team helps small businesses navigate financial complexities and maximize their investment value. We understand the unique challenges small businesses face in managing their finances.

Technology, strategic outsourcing, and the right service package optimize accounting costs without compromising quality. Regular financial reviews and proactive planning help businesses stay on top of finances and avoid unexpected expenses. Small business accounting services cost management focuses on maximizing value and insights from financial management (not just minimizing expenses).

Privacy Policy | Terms & Conditions | Powered by Cajabra