At My CPA Advisory and Accounting Partners, we often hear small business owners ask about the average cost of accounting services for small businesses. It’s a critical question that can impact your bottom line.

Understanding these costs is essential for budgeting and making informed decisions about your financial management. In this post, we’ll break down the factors that influence accounting service costs and provide insights into typical pricing models and ranges.

The size and intricacy of your business significantly impact accounting costs. A sole proprietorship with a single income stream requires less accounting work than a multi-location retail business with inventory management and multiple employees. A study found that the average small business revenue across all types of small businesses is $1,221,884, based on the $40.2 trillion in revenue brought in by the small business sector.

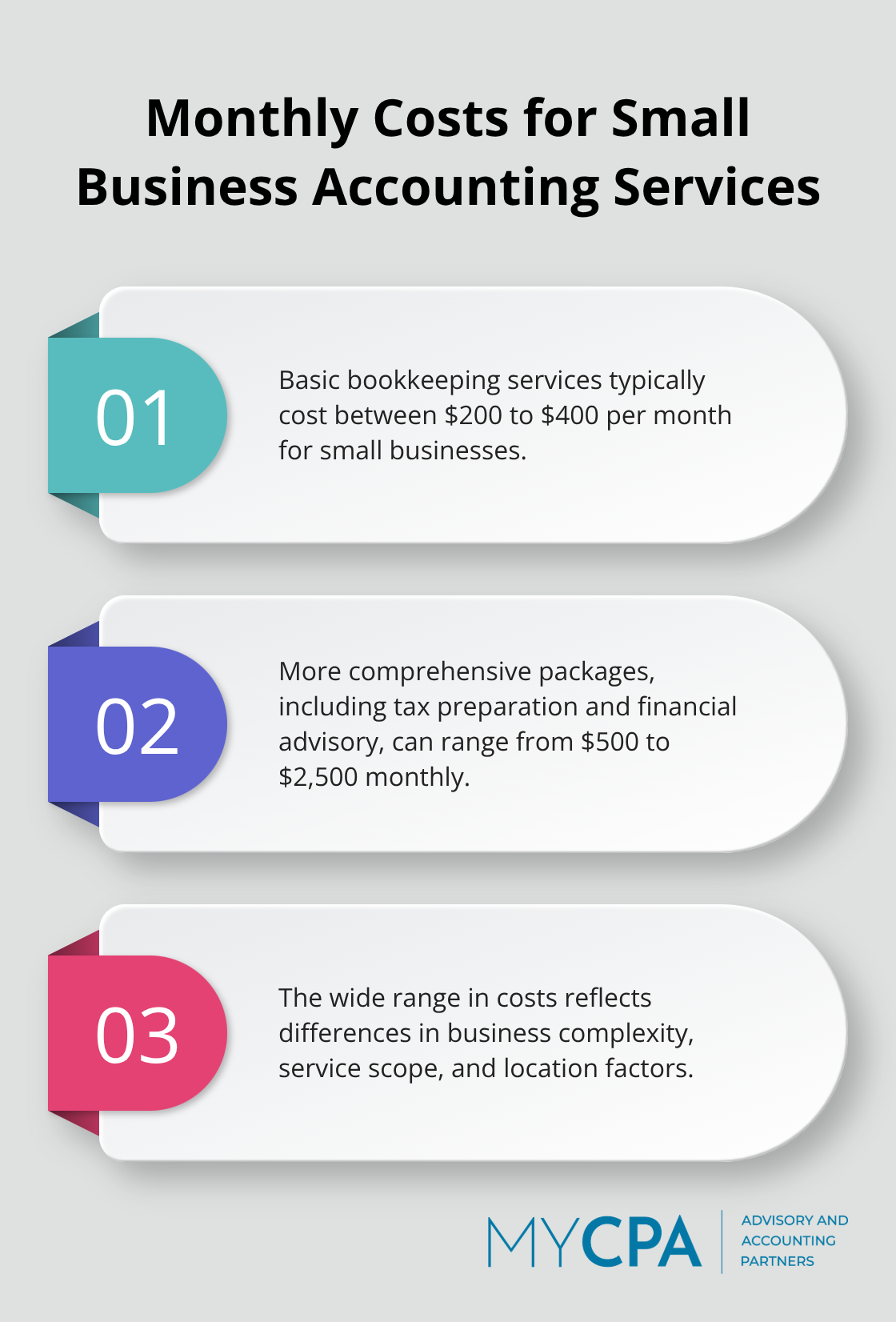

The types of services you need play a pivotal role in determining costs. Basic bookkeeping services cost less than comprehensive financial analysis or tax strategy planning. Monthly bookkeeping might cost between $200 to $400 per month for a small business, while preparing and filing taxes could range from $800 to $1500 annually (depending on the complexity of your tax situation).

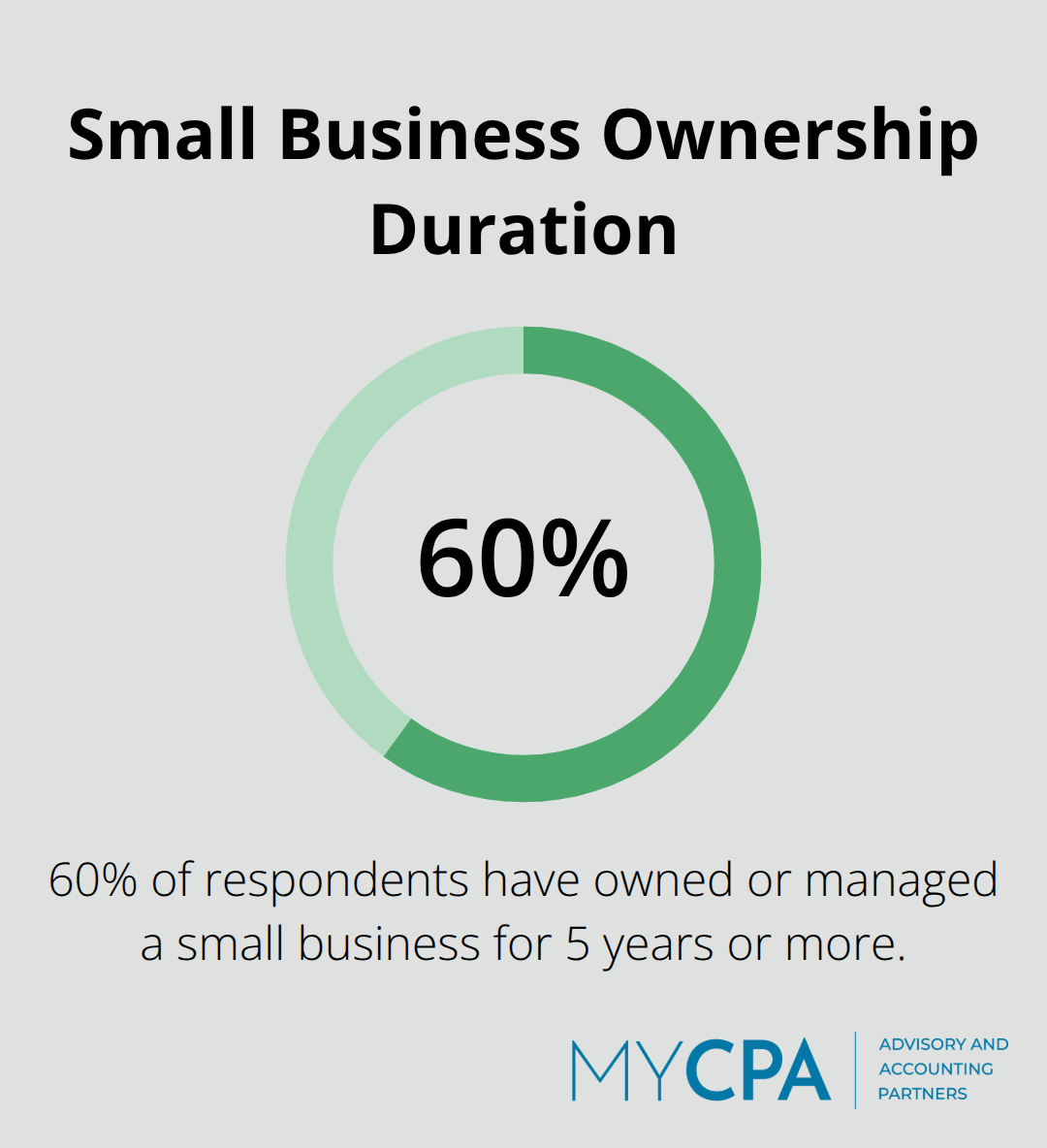

How often you require accounting services affects the overall cost. Some businesses opt for monthly services to stay on top of their finances year-round, while others seek assistance only during tax season. A survey found that 60% of respondents have owned or managed a small business for 5 years or more, which may influence their accounting needs and practices.

Location and local market rates influence accounting service costs. Urban areas with higher costs of living typically see higher rates for professional services. Accounting services in New York City might cost 20-30% more than in smaller cities or rural areas.

Understanding these cost drivers helps you make informed decisions about the accounting services your business needs. The next section will explore common pricing models used by accounting firms, providing further insight into how these factors translate into actual costs for small businesses.

At My CPA Advisory and Accounting Partners, we know that pricing for accounting services can be complex. Let’s explore the most common pricing models used in the industry and how they might affect your business.

Many accounting firms still use hourly rates. The National Society of Accountants conducts surveys that include information on hourly fees for accounting services. However, rates can vary widely based on location and expertise. In major cities, rates can reach up to $400 per hour for specialized services.

Fixed monthly fees have become popular, especially for ongoing services like bookkeeping. This model provides predictability for both the client and the accounting firm. Small businesses typically pay between $200 to $400 per month for basic bookkeeping services. More comprehensive packages (including tax preparation and financial advisory) can range from $500 to $2,500 monthly.

For one-time projects or annual services, project-based pricing offers clarity. Tax return preparation for a small business typically costs between $500 to $1,500, depending on the entity type and volume of transactions. A full audit could range from $6,000 to $20,000, based on the size and intricacy of the business.

Value-based pricing focuses on the value delivered to the client rather than the time spent. This model often results in higher satisfaction for both parties. Businesses benefit from more comprehensive services tailored to their specific needs, while accountants can focus on delivering high-value solutions without the constraints of hourly billing.

When selecting an accounting service, consider which pricing model aligns best with your business needs and budget. My CPA Advisory and Accounting Partners offers flexible pricing options to ensure you receive the most value for your investment in financial management.

Now that we’ve covered pricing models, let’s move on to discuss the average cost ranges for specific accounting services that small businesses commonly require.

At My CPA Advisory and Accounting Partners, we provide small business owners with clear, actionable information about accounting costs. Let’s examine the typical expenses for essential accounting services.

Bookkeeping forms the cornerstone of sound financial management. For small businesses, basic bookkeeping services typically cost between $300 and $2,000 per month. This wide range reflects differences in transaction volume, complexity, and service frequency. A study by Clutch revealed that 27% of small businesses spend $1,000 to $5,000 annually on accounting services, with bookkeeping constituting a significant portion.

Tax preparation costs vary based on business structure and complexity. CPA tax preparation services for a simple sole proprietorship return could cost approximately $200 to $800, while S-corporations or partnerships often face fees between $800 and $1,500 (according to a National Society of Accountants survey). Quality tax preparation can lead to substantial savings through proper deductions and credits.

Preparing financial statements proves essential for decision-making and investor relations. Costs typically range from $150 to $400 per statement. However, compiled or reviewed financial statements for lenders or investors can increase prices to $1,500 to $5,000 due to the additional work required.

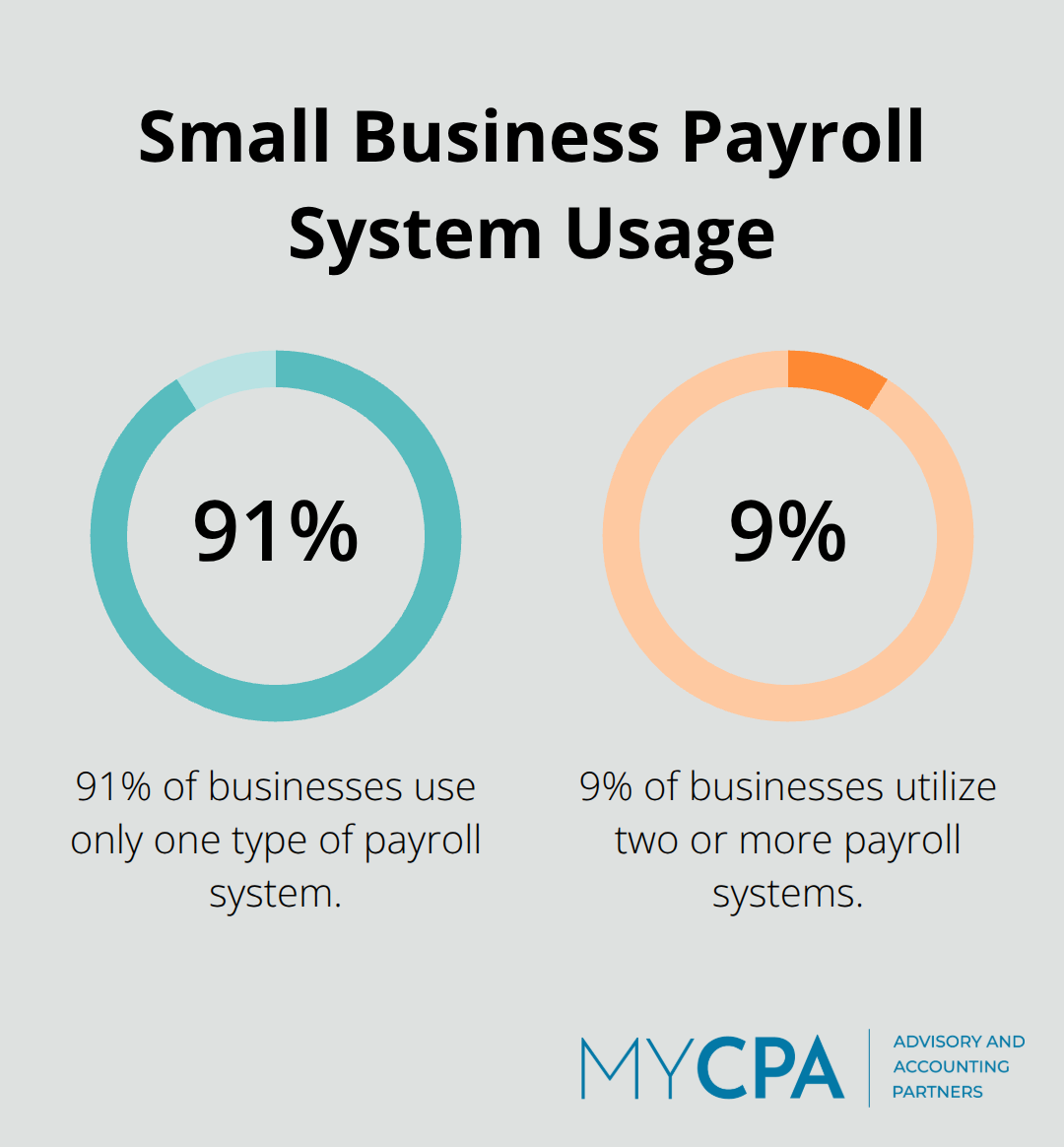

Payroll services often cost between $50 to $200 per month, plus $2 to $5 per employee. Factors affecting cost include pay frequency and additional services like tax filing. According to a recent study, 91% of businesses use only one type of payroll system, while 9% utilize two or more systems.

Business advisory services, including financial planning and strategy sessions, typically range from $150 to $400 per hour. Some firms offer package deals that can provide better value for comprehensive services.

These costs represent an investment rather than an expense. The right accounting partner can help identify cost-saving opportunities, improve cash flow, and support strategic decision-making.

The average cost of accounting services for small businesses varies based on factors like complexity, scope, and location. Professional accounting services provide accurate financial reporting, minimize tax liabilities, and offer valuable insights for decision-making. These services allow business owners to focus on core activities while ensuring financial health and compliance.

We at My CPA Advisory and Accounting Partners understand the unique challenges small businesses face. We offer tailored solutions that balance cost-effectiveness with comprehensive financial management (our goal is to provide you with the tools and insights you need to make informed decisions). Our team strives to help drive your business forward with strategic financial guidance.

The cost of accounting services represents an investment in your business’s financial health and future growth. Choosing the right accounting partner can improve financial performance, ensure compliance, and support strategic decision-making. We invite you to explore how our services can benefit your small business and contribute to its long-term success.

Privacy Policy | Terms & Conditions | Powered by Cajabra