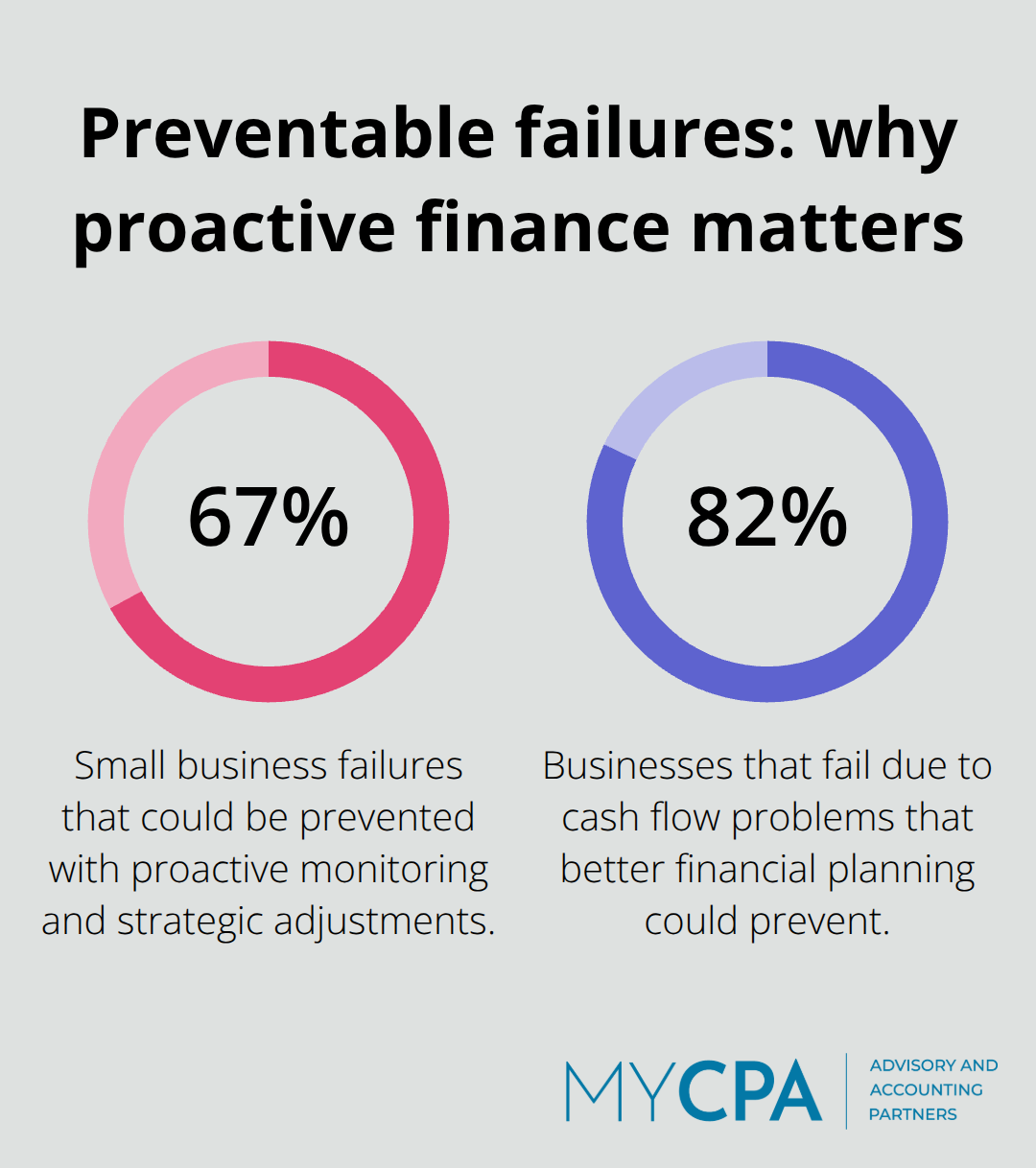

Small business financial consulting goes beyond basic bookkeeping to provide strategic guidance that drives growth. According to the Small Business Administration, 82% of businesses fail due to cash flow problems that proper financial planning could prevent.

We at My CPA Advisory and Accounting Partners see how the right financial consultant transforms struggling businesses into profitable ventures. This guide covers everything you need to know about finding and working with financial experts who understand your unique challenges.

Small business financial consultants provide strategic analysis and forward-looking guidance that standard accounting cannot match. While bookkeepers record transactions and accountants prepare financial statements, financial consultants interpret data to drive business decisions. The Bureau of Labor Statistics reports that employment in business and financial occupations is projected to grow faster than average from 2024 to 2034.

Financial consultants analyze your cash flow patterns to predict future needs and identify growth opportunities. They create financial models that show how different scenarios affect your bottom line. Basic accounting tells you what happened last month, but financial consultants tell you what will happen next quarter and how to prepare for it.

The Small Business Administration tracks loan program performance and reports on approved loans by fiscal year for major programs.

Financial consultants spot problems before they become critical. They monitor key performance indicators and alert you when trends shift negatively. Standard accounting services report problems after they occur (often too late for effective intervention). Research from the National Federation of Independent Business shows that 67% of small business failures could be prevented with proactive financial monitoring and strategic adjustments.

Your business needs financial consultants when revenue exceeds $500,000 annually, when you plan major investments, or when cash flow becomes unpredictable. Tax planning becomes critical as your business grows because the complexity increases exponentially (especially with multiple revenue streams). Financial consultants also become indispensable during economic uncertainty, helping you navigate market volatility and maintain stability through strategic financial management.

The next step involves understanding the specific services these consultants provide and how each service addresses different aspects of your business growth.

Financial consultants deliver three core services that transform how small businesses manage money and plan growth. Tax planning represents the most immediate value, with strategic consultants reducing tax liabilities by an average of 15-20% compared to reactive tax preparation. The key difference lies in quarterly tax projections and year-round optimization strategies rather than April deadline scrambling.

Effective tax consultants analyze your business structure, recommend timing for major purchases, and coordinate retirement contributions to minimize your overall tax burden. They create comprehensive strategies that account for both current-year obligations and future tax implications. The Internal Revenue Service reports that businesses working with tax professionals have fewer audit issues than those handling taxes independently. Professional tax consultants also help you navigate complex deductions and credits that many business owners miss (particularly equipment depreciation and research credits).

Cash flow management extends far beyond basic budgeting to include 12-month rolling forecasts that account for seasonal variations and market cycles. Professional consultants create scenario models showing best-case, worst-case, and most-likely outcomes for your revenue streams. They establish credit lines before you need them and structure payment terms that optimize working capital.

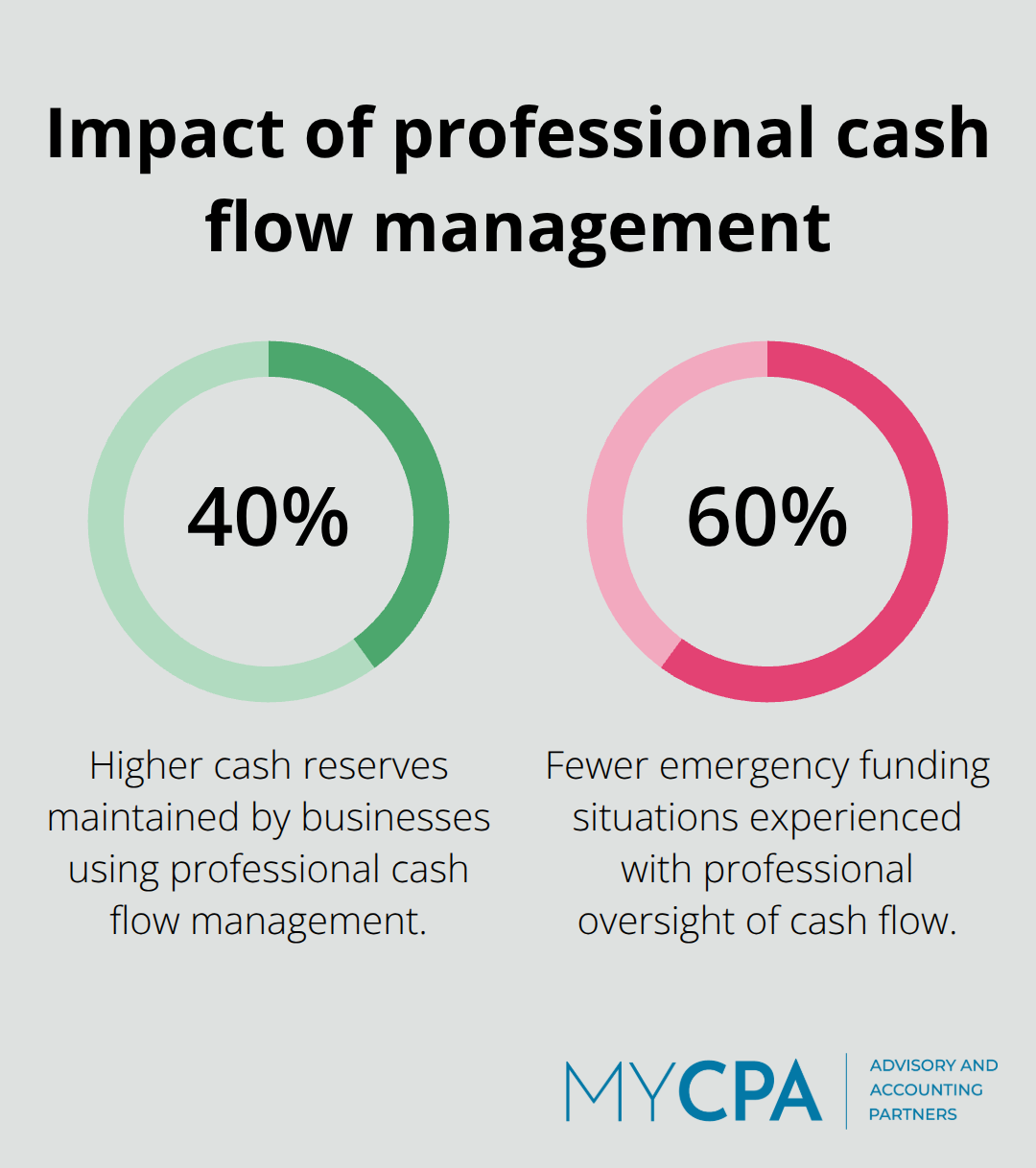

The National Federation of Independent Business found that businesses with professional cash flow management maintain 40% higher cash reserves and experience 60% fewer emergency funding situations.

Strategic financial planning involves comprehensive analysis of your business model, competitive positioning, and growth opportunities. Financial consultants evaluate potential acquisitions, expansion strategies, and exit planning scenarios with detailed financial modeling. They assess whether investments in new equipment generate positive returns and how different growth strategies affect your personal wealth accumulation (particularly important for businesses generating over $1 million annually). Strategic business advisory services help business owners navigate crisis management situations including renegotiated vendor terms and restructured debt obligations. The Exit Planning Institute reports that business owners experience regret after selling due to inadequate preparation.

The next critical step involves selecting the right consultant who possesses the qualifications and expertise to deliver these specialized services effectively.

Financial consultant selection demands examination of specific credentials that demonstrate competency beyond basic accounting knowledge. Research shows that most Americans prefer human financial advisors over automated solutions for critical financial decisions. Target consultants with CPA licenses, Certified Financial Planner designations, or Chartered Financial Analyst credentials. These certifications require extensive education and ongoing professional development that basic bookkeepers lack.

Experience matters more than credentials alone. Prioritize consultants who have worked with businesses in your industry and revenue range for at least five years. The most qualified consultants provide references from current clients and demonstrate measurable results like tax savings percentages or cash flow improvements.

Ask potential consultants how they reduced tax liabilities for similar businesses and request specific examples with dollar amounts. Inquire about their approach to cash flow forecasts and whether they provide quarterly financial reviews or annual check-ins. Research indicates that businesses with more frequent financial guidance maintain stronger cash reserves than those with less regular oversight.

Question their technology stack because modern consultants use cloud-based systems for real-time collaboration and advanced analytics. Demand transparency about fee structures upfront (hidden costs destroy trust and budget plans). Request their typical response time for urgent financial questions because cash flow crises require immediate expert guidance.

Avoid consultants who promise unrealistic tax savings above 30% without detailed analysis or those who guarantee specific financial outcomes. The Internal Revenue Service tracks aggressive tax strategies that trigger audits, which makes overly optimistic promises dangerous for your business.

Reject consultants who refuse to provide client references or cannot explain their methodologies clearly. Poor communication skills indicate they cannot translate complex financial concepts into actionable business strategies. Consultants who focus solely on tax preparation without broader financial plans provide limited value compared to strategic advisors who address cash flow, growth plans, and risk management comprehensively. Look for certified public accountants (CPAs) who demonstrate credibility through proper credentials and proven track records.

Small business financial consulting delivers measurable results that basic accounting cannot match. Professional consultants reduce tax liabilities by 15-20% while they maintain 40% higher cash reserves through strategic plans. The 82% business failure rate from cash flow problems drops significantly with expert guidance that provides quarterly forecasts and proactive problem detection.

Your next step involves evaluation of potential consultants based on credentials, industry experience, and proven results. Focus on CPAs with strategic plans expertise who demonstrate clear communication skills and transparent fee structures. Avoid consultants who make unrealistic promises or those who lack proper certifications.

We at My CPA Advisory and Accounting Partners provide comprehensive tax services, accounting, and business advisory solutions that minimize tax liabilities and enhance financial health. Our personalized approach combines cross-disciplinary expertise with proactive engagement to deliver stress-free financial management. Small business owners benefit from our QuickBooks expertise, accurate financial reports, and strategic financial plans that drive sustainable growth and long-term success (particularly for businesses with complex financial needs).

Privacy Policy | Terms & Conditions | Powered by Cajabra