Business valuation is a critical process for any company looking to understand its true worth. At My CPA Advisory and Accounting Partners, we specialize in providing expert business valuation advisory services to help organizations make informed decisions.

Our team combines in-depth financial analysis with industry-specific knowledge to deliver accurate and comprehensive valuations. Whether you’re planning for a merger, seeking investment, or simply want to gauge your company’s market position, our tailored approach ensures you get the insights you need.

Business valuation determines the economic value of a company. This complex task requires a deep understanding of financial metrics, market conditions, and industry trends. Accurate valuations can significantly impact crucial business decisions.

Precise business valuations provide a solid foundation for strategic planning, attract investors, and ensure fair pricing in mergers and acquisitions. A 2023 study by Kroll examined the relationship between historical returns of over 13,000 publicly traded companies across various geographies and their ESG ratings, highlighting the growing importance of non-financial factors in valuation.

Multiple factors affect a company’s value:

ESG (Environmental, Social, and Governance) factors have gained prominence recently. A 2024 report indicated that 75% of mid-sized companies have begun preparing for new climate-related regulations, with 84% of respondents saying they are monitoring developments before taking action, suggesting a potential area for value enhancement.

Business valuations prove essential in various situations:

The IRS often scrutinizes these valuations closely, making professional expertise invaluable.

Different sectors have unique value drivers and metrics. For instance, SaaS companies often achieve the highest valuations due to their subscription models and predictable monthly recurring revenue (MRR) streams. Understanding these nuances is vital for accurate valuations.

As we move forward, it’s important to explore the various methods used in business valuation. These techniques allow professionals to capture the full spectrum of a company’s worth, from tangible assets to future earning potential.

At My CPA Advisory and Accounting Partners, we use several proven methods to determine a company’s worth accurately. Each approach offers unique insights, and our experts often combine multiple techniques to provide a comprehensive valuation.

Asset-based approach uses the value of the assets to calculate a business entity’s valuation. Simply put, the asset-based value is equal to the book value of the company’s assets minus its liabilities. This method works well for asset-heavy industries or businesses with significant tangible assets. However, it may undervalue companies with substantial intangible assets or intellectual property.

Income-based methods focus on a company’s earning capacity. We analyze historical financial data and project future cash flows to determine the present value of expected returns. This approach works particularly well for established businesses with consistent earnings.

A key metric in this method is the capitalization rate, which reflects the risk associated with the business. For instance, a company with annual earnings of $500,000 and a cap rate of 20% would be valued at $2.5 million ($500,000 / 0.20).

The market approach compares a business to similar companies that have recently sold. We use industry-specific multiples (such as price-to-earnings ratios or revenue multiples) to estimate value. This method works well when there’s ample data on comparable sales within the industry.

For example, if similar businesses in the industry typically sell for 2.5 times their annual revenue, a company with $2 million in annual revenue might be valued at $5 million.

DCF is a valuation method that estimates the value of an investment using its expected future cash flows. This method works particularly well for high-growth companies or those with variable cash flows.

We typically use a projection period and apply a discount rate that reflects the company’s risk profile. The present value of these projected cash flows forms the basis of the company’s valuation.

Our team’s expertise in these methods, combined with our industry knowledge, ensures that you receive an accurate and defensible valuation. This precision matters whether you plan for a sale, seek investment, or make strategic decisions about your company’s future. In the next section, we’ll explore how our expert business advisory services can benefit your organization.

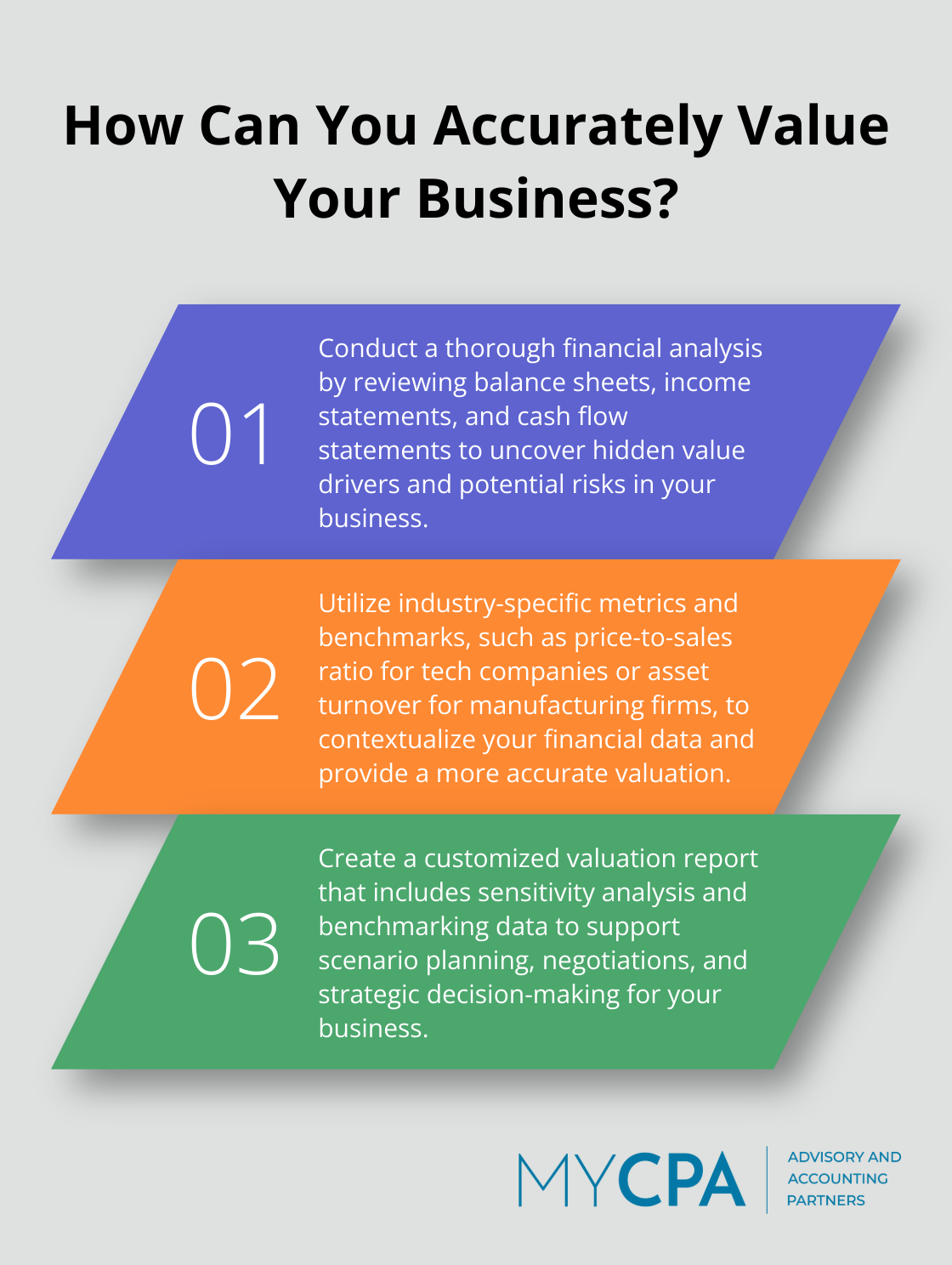

Expert valuation services start with a thorough examination of financial data. This process involves an in-depth review of balance sheets, income statements, and cash flow statements. Such a detailed analysis uncovers hidden value drivers and potential risks that might escape notice in a less rigorous evaluation.

A manufacturing client considering a sale benefited from this approach. The analysis revealed metrics such as asset turnover, quick ratio, receivables turnover, and debt to equity ratios, providing a comprehensive view of the company’s financial health.

Every sector has unique value drivers and challenges. Valuation experts stay current with the latest trends and benchmarks across various industries. This knowledge allows them to contextualize financial data and provide more accurate valuations.

In the tech sector, for example, metrics like price-to-sales (P/S) ratio often carry significant weight. A high P/S ratio might indicate that the market expects future growth, which is often true with high-growth tech companies, including SaaS businesses.

Effective valuation reports offer more than just numbers; they provide detailed explanations of methodology, assumptions, and findings. These reports typically include:

This information proves invaluable for scenario planning and negotiations.

Valuation experts often support clients through negotiations, due diligence processes, and transaction closings. They help clients understand the implications of different deal structures and negotiate terms that maximize value.

In a recent merger negotiation, an analysis of synergy potential helped a client secure additional value. The quantification of expected cost savings and revenue enhancements provided a solid foundation for the negotiations.

Expert valuation services empower businesses to make informed decisions. Whether planning for growth, considering a sale, or navigating complex financial decisions, these services provide clarity and confidence.

At My CPA Advisory and Accounting Partners, we offer valuation services that go beyond numbers. Our team provides strategic insights to help maximize your business’s value in any scenario.

Accurate business valuation forms the foundation for strategic decision-making in today’s dynamic business environment. Professional valuation services uncover hidden value drivers, identify potential risks, and provide a comprehensive view of a company’s financial health. This level of insight proves invaluable for strategic planning, attracting investors, and ensuring fair pricing in mergers and acquisitions.

At My CPA Advisory and Accounting Partners, we understand the critical role that expert business valuation advisory services play in maximizing a company’s value. Our team combines in-depth financial analysis with industry-specific expertise to deliver accurate and comprehensive valuations tailored to unique business needs. We provide strategic insights that empower clients to make informed decisions about their company’s future.

As the business landscape evolves, factors such as ESG considerations and industry-specific metrics become increasingly important in valuations. Our team stays at the forefront of these trends, ensuring that valuations reflect the full spectrum of a company’s worth. My CPA Advisory and Accounting Partners offers more than just numbers – we provide trusted advice to help navigate complex financial decisions and maximize business value.

Privacy Policy | Terms & Conditions | Powered by Cajabra