At My CPA Advisory and Accounting Partners, we understand that managing finances is a critical aspect of running a successful business.

All accounting services play a vital role in keeping your company financially healthy and compliant.

This blog post will guide you through the essential accounting services that can help your business thrive and grow.

Bookkeeping forms the cornerstone of sound financial management. It involves the meticulous recording of all financial transactions, from income to expenses. This statistic underscores the importance of professional bookkeeping services.

Accurate and up-to-date financial records provide a clear picture of your business’s financial position at any given time. Advanced software tracks transactions, categorizes expenses, and reconciles bank statements with precision (ensuring no detail is overlooked).

Financial statements serve as crucial tools that offer insights into your company’s financial health. These documents include the balance sheet, income statement, and cash flow statement. Better budgeting and forecasting are possible with financial reports that provide historical data, aiding in creating realistic budgets and improving cash flow.

Comprehensive financial statements tailored to your business needs do more than crunch numbers. They interpret data and provide actionable insights to guide your business decisions (transforming raw data into strategic advantage).

Effective tax planning transcends mere compliance; it strategically minimizes your tax burden while maximizing financial efficiency. This statistic emphasizes the need for proactive tax planning and preparation.

A year-round approach to tax planning stays ahead of the latest tax laws and regulations. It identifies opportunities for deductions and credits specific to your industry (potentially saving thousands in unnecessary taxes).

Payroll management directly impacts employee satisfaction and compliance. Professional payroll services can mitigate this risk.

Comprehensive payroll management covers everything from calculating wages and deductions to filing payroll taxes. Cutting-edge payroll software ensures accuracy and timeliness, allowing you to focus on growing your business while experts handle the complexities of payroll.

While these core accounting services form the foundation of financial management, growing businesses often require more specialized support. The next section will explore advanced accounting services that can propel your business to new heights of financial success and strategic growth.

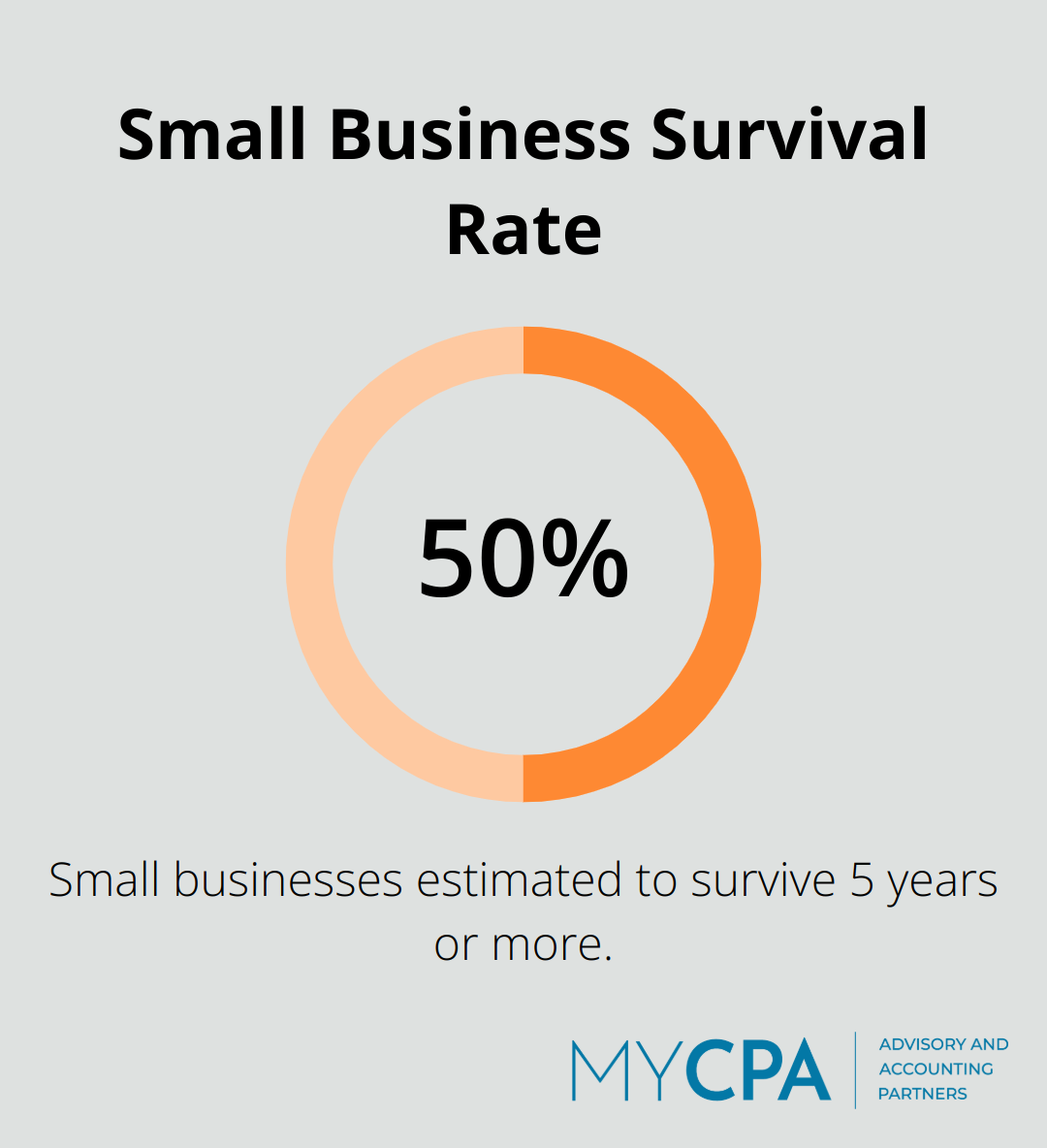

Business advisory services provide a competitive edge by offering insights beyond basic accounting. A study by the Small Business Administration shows that only half of small businesses are estimated to survive 5 years or more. Expert advisors leverage industry expertise to help you make informed decisions about expansion, diversification, and operational efficiency.

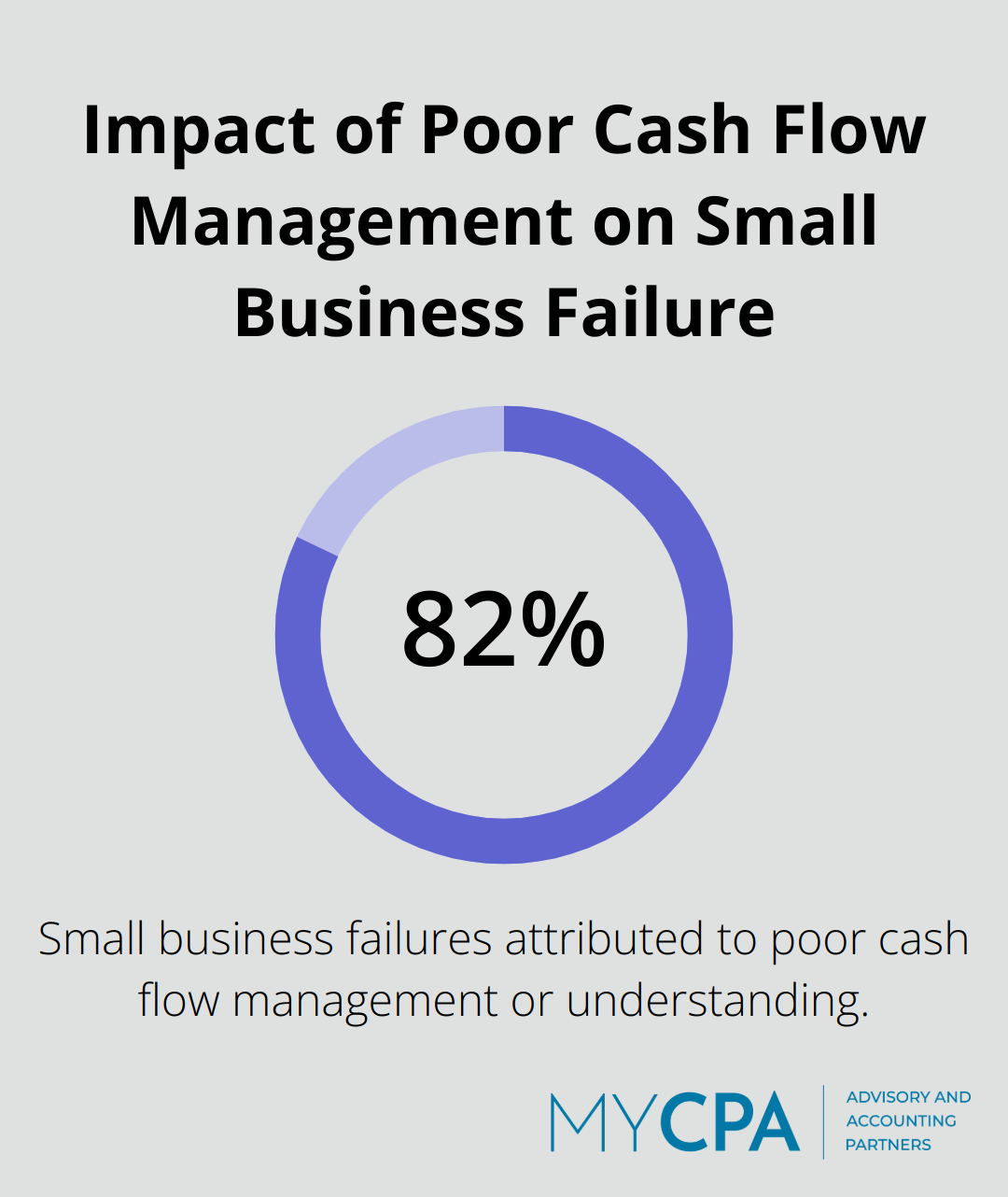

Cash flow management is the lifeblood of any business. A study reveals that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of small businesses. Robust cash flow forecasting models anticipate potential shortfalls and identify opportunities for improvement. Analysis of payment cycles, inventory management, and credit policies helps maintain a healthy cash position to fuel growth and weather economic uncertainties.

Effective budgeting and forecasting set realistic financial goals and measure performance. The Institute of Management Accountants reports that companies with formal budgeting processes are 24% more likely to be top financial performers in their industry. A combination of historical data analysis with market trends creates dynamic budgets that adapt to changing business conditions. This proactive strategy allows efficient resource allocation and swift responses to market opportunities.

Internal controls and risk assessment protect business assets and ensure financial integrity. The Association of Certified Fraud Examiners estimates that organizations lose 5% of their annual revenue to fraud. Tailored internal control systems safeguard assets, improve operational efficiency, and enhance the reliability of financial reporting. Risk assessment protocols identify potential financial vulnerabilities, allowing businesses to mitigate threats before they impact the bottom line.

The integration of advanced financial services with cutting-edge technology creates a robust foundation for sustainable growth. As businesses evolve, so do their financial needs. The next chapter explores how technology revolutionizes accounting practices, offering even more opportunities to streamline financial operations and gain valuable insights (a game-changer for forward-thinking companies).

Technology reshapes the accounting landscape in today’s fast-paced business environment. Modern tools streamline financial processes and provide deeper insights for businesses of all sizes.

Cloud-based accounting software transforms financial management for businesses. These platforms offer:

Xero and QuickBooks Online allow multiple users to work simultaneously on financial records (reducing errors and improving efficiency).

Data analytics transforms how businesses interpret their financial information. A KPMG study found that 85% of CEOs believe applying data analytics to financial data provides significant value. Advanced analytics tools:

This proactive approach enables businesses to make data-driven decisions that positively impact their bottom line (often leading to substantial improvements in profitability).

Automated reporting and dashboard creation save time and provide instant insights. The American Institute of CPAs reports that businesses using automated financial reporting reduce the time spent on report preparation by up to 50%. Tools like Tableau and Power BI create dynamic dashboards that visualize key performance indicators. These real-time reports allow business owners to:

Artificial Intelligence (AI) continues to make significant inroads in accounting practices. AI-powered systems can:

These capabilities free up accountants to focus on higher-value tasks such as strategic planning and advisory services.

Blockchain technology offers enhanced security and transparency in financial transactions. It provides:

As blockchain adoption grows, it promises to revolutionize how businesses handle financial transactions and maintain their records.

All accounting services play a pivotal role in driving business success and growth in today’s dynamic landscape. These services form the backbone of sound financial management, from core functions to specialized offerings. The integration of technology enhances these services, providing real-time insights and streamlining processes (improving overall efficiency).

Professional accounting support offers numerous benefits, including improved financial accuracy, strategic decision-making, and compliance with ever-changing regulations. Businesses can focus on their core operations while ensuring their finances receive expert attention. This approach allows companies to navigate complex financial landscapes with confidence.

To improve your business’s financial management, consider partnering with a trusted accounting firm. At My CPA Advisory and Accounting Partners, we offer a comprehensive suite of services tailored to your specific needs. Our team of experts provides personalized solutions, ensuring you have the financial clarity and support necessary to thrive in today’s competitive market.

Privacy Policy | Terms & Conditions | Powered by Cajabra