Comprehensive accounting solutions are the backbone of successful businesses. They provide the financial clarity and strategic insights necessary for growth and sustainability.

At My CPA Advisory and Accounting Partners, we understand that effective accounting goes beyond number crunching. It’s about leveraging technology, implementing strategic financial planning, and providing tailored services that drive business success.

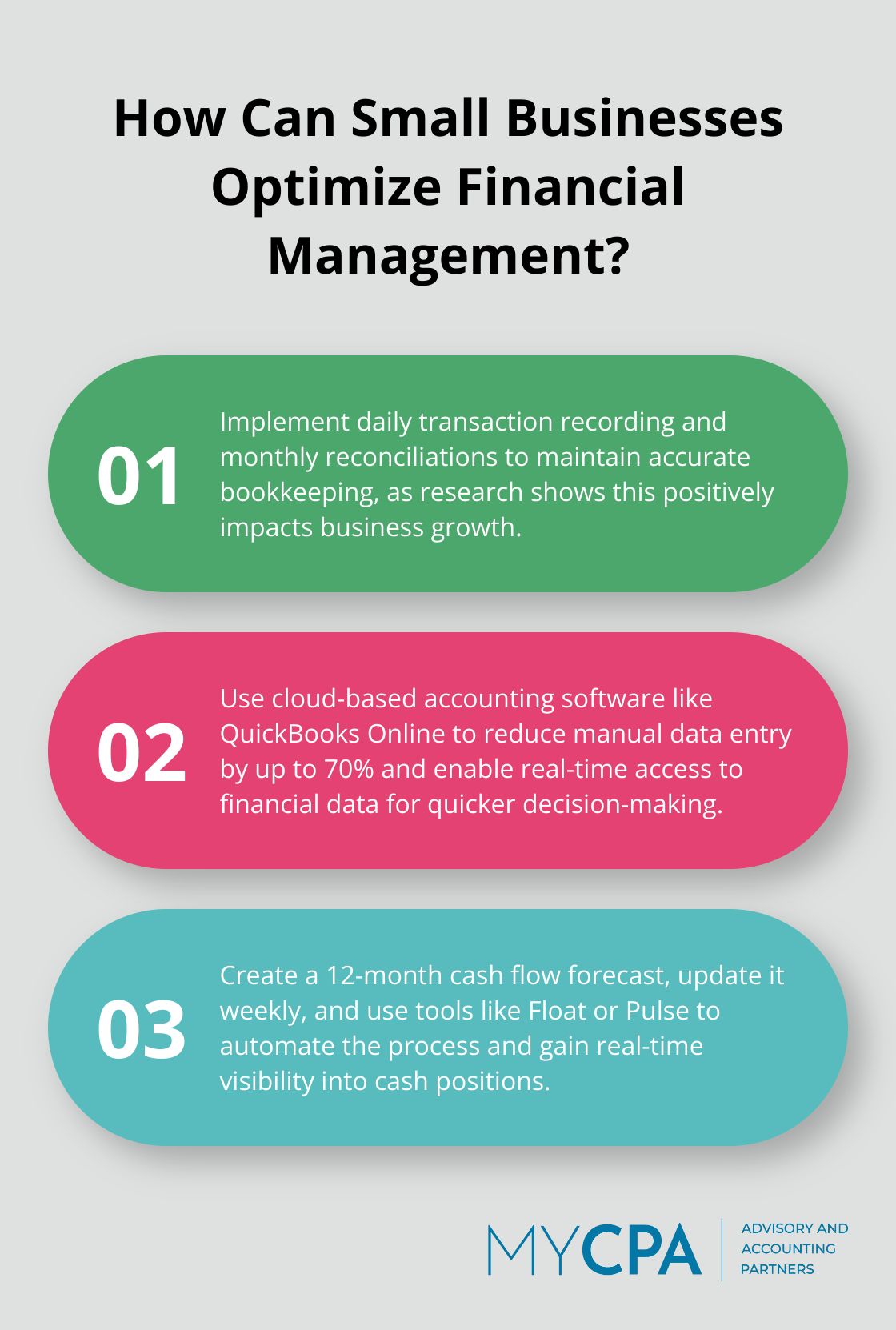

Accurate bookkeeping forms the cornerstone of financial success. It transcends mere transaction recording; it creates a clear financial picture. Research indicates that business records management and training have a positive indirect effect on business growth. We advocate for daily transaction recording and monthly reconciliations to maintain impeccable books.

Effective tax planning significantly impacts the bottom line. The IRS reports that in 2022, they suspended processing of 4.8 million tax returns, most with adjusted gross incomes less than 250% of the Federal Poverty Level. A year-round strategy (not just last-minute efforts) identifies deductions, credits, and structuring opportunities that align with business goals.

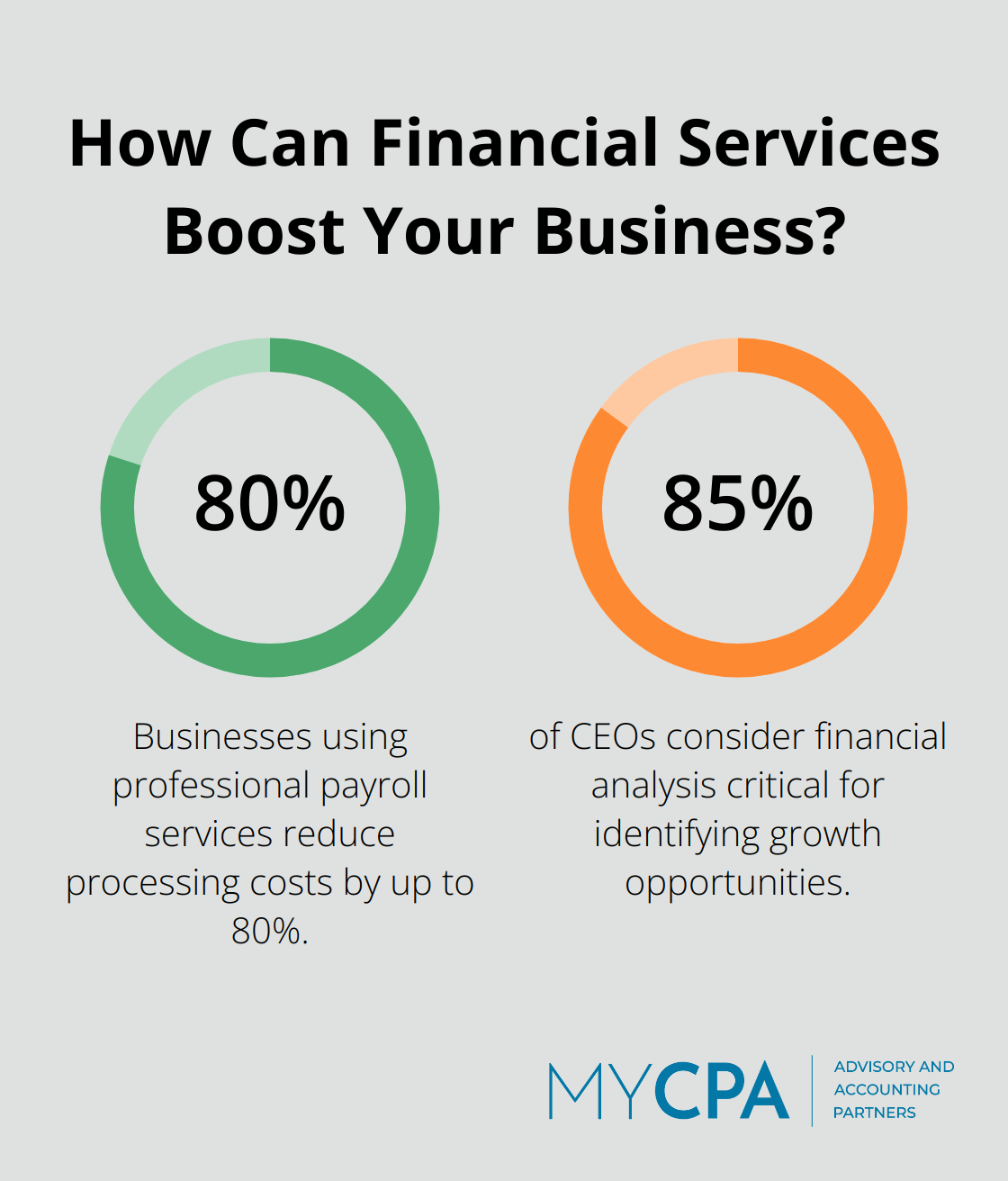

Payroll errors result in hefty penalties and employee dissatisfaction. The American Payroll Association found that businesses using professional payroll services reduce processing costs by up to 80%. Timely, accurate payments and complex tax calculations free businesses to focus on core activities.

Financial analysis transforms raw data into actionable insights. A KPMG survey revealed that 85% of CEOs consider financial analysis critical for identifying growth opportunities. Regular financial health checks, trend analysis, and forecasting enable informed decision-making.

At MyCPA Advisory and Accounting Partners, we offer tailored solutions that address these essential services. Our approach combines personalized strategies with cross-disciplinary expertise, ensuring businesses not only meet compliance requirements but also create a solid financial foundation for growth.

The integration of these core accounting services sets the stage for leveraging technology in modern accounting practices. As we move forward, we’ll explore how cloud-based solutions and automation revolutionize financial management, further enhancing business efficiency and growth potential.

Technology revolutionizes accounting practices in today’s fast-paced business environment. Modern digital solutions streamline operations and provide deeper financial insights, changing the landscape of financial management.

Cloud-based accounting software has become indispensable for businesses of all sizes. A recent Sage study reveals that 58% of accountants agree that cloud technology makes their role easier by enabling collaboration with clients and improving efficiency. These platforms offer real-time access to financial data, enabling quicker decision-making and improved collaboration. QuickBooks Online (which we at MyCPA Advisory and Accounting Partners expertly set up and manage) allows for seamless integration with bank feeds, reducing manual data entry by up to 70%.

Automation is not just a trend; it’s a necessity for modern accounting. The American Productivity & Quality Center reports that top-performing finance functions spend 20% less time on data gathering and 25% more time on analysis compared to their peers. Businesses can redirect their focus to strategic financial planning and growth initiatives by automating routine tasks like invoice processing and expense categorization.

Data analytics tools transform raw financial data into actionable insights. A KPMG survey found that 85% of CEOs believe financial analysis is essential for identifying growth opportunities. Advanced analytics allow leadership to create evidence-based strategy, understand customers to better target marketing, and improve decision-making processes. Sophisticated data analysis tools help optimize pricing strategies, resulting in significant profit margin increases.

The true power of accounting technology lies in its ability to integrate with other business systems. Gartner predicts that by 2025, 70% of new applications developed by enterprises will use low-code or no-code technologies, facilitating easier integration. This interconnectedness allows for a holistic view of business operations, from sales to inventory management. Integrated systems can reduce manual data reconciliation time by up to 30%.

As businesses continue to adopt these technological advancements, they not only streamline their accounting processes but also gain a competitive edge through data-driven decision-making. The next frontier in financial management lies in strategic planning, where these technological insights translate into actionable growth strategies. Let’s explore how strategic financial planning can leverage these technological advancements to drive business growth.

Cash flow management forms the foundation of any thriving business. A U.S. Bank study revealed that 82% of small businesses fail due to cash flow mismanagement. To avoid this pitfall, businesses should implement a robust cash flow forecasting system. This involves the projection of cash inflows and outflows for the next 12 months, weekly updates, and variance analysis.

Tools like Float or Pulse automate this process and provide real-time visibility into cash positions. A clear view of cash flow allows businesses to anticipate potential shortfalls, negotiate better terms with suppliers, and make informed decisions about investments or cost-cutting measures.

Effective capital allocation drives growth. A McKinsey study found that companies which reallocate more than 50% of their capital expenditures among business units over 10 years create 50% more value than those that reallocate less.

Regular portfolio reviews assess the performance of each business unit or product line. This allows for strategic reallocation of resources from underperforming areas to high-potential opportunities. For instance, if an e-commerce channel shows higher growth rates than brick-and-mortar stores, it signals a need to shift more capital towards enhancing the online presence.

Risk management plays an integral role in strategic financial planning. The Association for Financial Professionals reports that 76% of organizations have a formal risk management process in place. However, risk identification alone is insufficient; businesses must quantify potential impacts and develop mitigation strategies.

Scenario planning prepares organizations for various outcomes. This involves the creation of best-case, worst-case, and most-likely scenarios for the business, along with the development of action plans for each. Tools such as Oracle Crystal Ball aid in this process, allowing businesses to model different scenarios and their financial implications.

The establishment of clear performance metrics and Key Performance Indicators (KPIs) enables businesses to track progress towards financial goals. These metrics should align with overall business objectives and provide actionable insights.

Common financial KPIs include gross profit margin, net profit margin, and return on investment (ROI). Non-financial metrics like customer satisfaction scores and employee retention rates also offer valuable insights into business health. Regular review and adjustment of these metrics ensure they remain relevant and drive the desired outcomes.

The integration of technology enhances the effectiveness of strategic financial planning. Cloud-based financial management systems provide real-time data access and facilitate collaborative planning. Advanced analytics tools transform raw data into actionable insights, enabling data-driven decision-making.

Artificial Intelligence (AI) and Machine Learning (ML) technologies predict future trends and identify potential risks or opportunities. These technologies analyze vast amounts of data to uncover patterns and insights that might otherwise go unnoticed, giving businesses a competitive edge in their financial planning efforts. Proactive and strategic guidance from cross-disciplinary experts can further enhance a business’s ability to leverage these technologies and increase its net worth.

Comprehensive accounting solutions form the foundation of business success in today’s dynamic financial landscape. These solutions encompass essential services, cutting-edge technology, and strategic financial planning, which work together to drive growth and sustainability. The integration of cloud-based software, automation, and data analytics has transformed financial management, providing deeper insights and enabling data-driven decision-making.

Strategic financial planning, built on robust cash flow management and informed capital allocation, proves essential for long-term success. This proactive approach allows businesses to navigate risks, seize opportunities, and measure progress through carefully selected performance metrics. Businesses that optimize their accounting practices position themselves to thrive in today’s competitive marketplace.

MyCPA Advisory and Accounting Partners offers tailored solutions that address the full spectrum of financial needs. We provide the expertise and support necessary to navigate complex financial landscapes and drive sustainable growth. Our comprehensive accounting solutions (including tax optimization, QuickBooks management, and personalized business advisory services) can help unlock your business’s full potential.

Privacy Policy | Terms & Conditions | Powered by Cajabra