Strategic business advisory services go far beyond basic accounting and tax preparation. These comprehensive consulting solutions help companies navigate complex financial decisions and accelerate growth.

We at My CPA Advisory and Accounting Partners see businesses transform when they access expert guidance on financial planning, risk management, and strategic development. The right advisory partnership can mean the difference between surviving market challenges and thriving through them.

Strategic business advisors deliver three core service areas that directly impact your bottom line. These comprehensive solutions address the most pressing challenges that business owners face today.

Advisors create detailed budgets, perform cash flow forecasts, and develop capital management strategies that extend far beyond basic bookkeeping. They analyze your financial data to identify profit opportunities and cost reduction areas that most business owners overlook.

This analysis includes performance metrics evaluation, variance analysis between actual and projected results, and financial modeling for different business scenarios. Advisors transform raw financial data into actionable insights that drive strategic decisions.

The second pillar involves development of contingency plans and regulatory compliance frameworks. Advisors help businesses navigate complex regulations while they protect company assets through structured risk assessment processes.

This service becomes particularly valuable as regulatory scrutiny intensifies across industries. The global strategic consulting services market reached $74.37 billion in 2025, with financial services accounting for 29.81% of revenue share (primarily due to compliance needs).

Advisors analyze market trends and internal capabilities to create actionable expansion plans. They examine competitive landscapes, identify market opportunities, and develop strategies that align with your company’s resources and objectives.

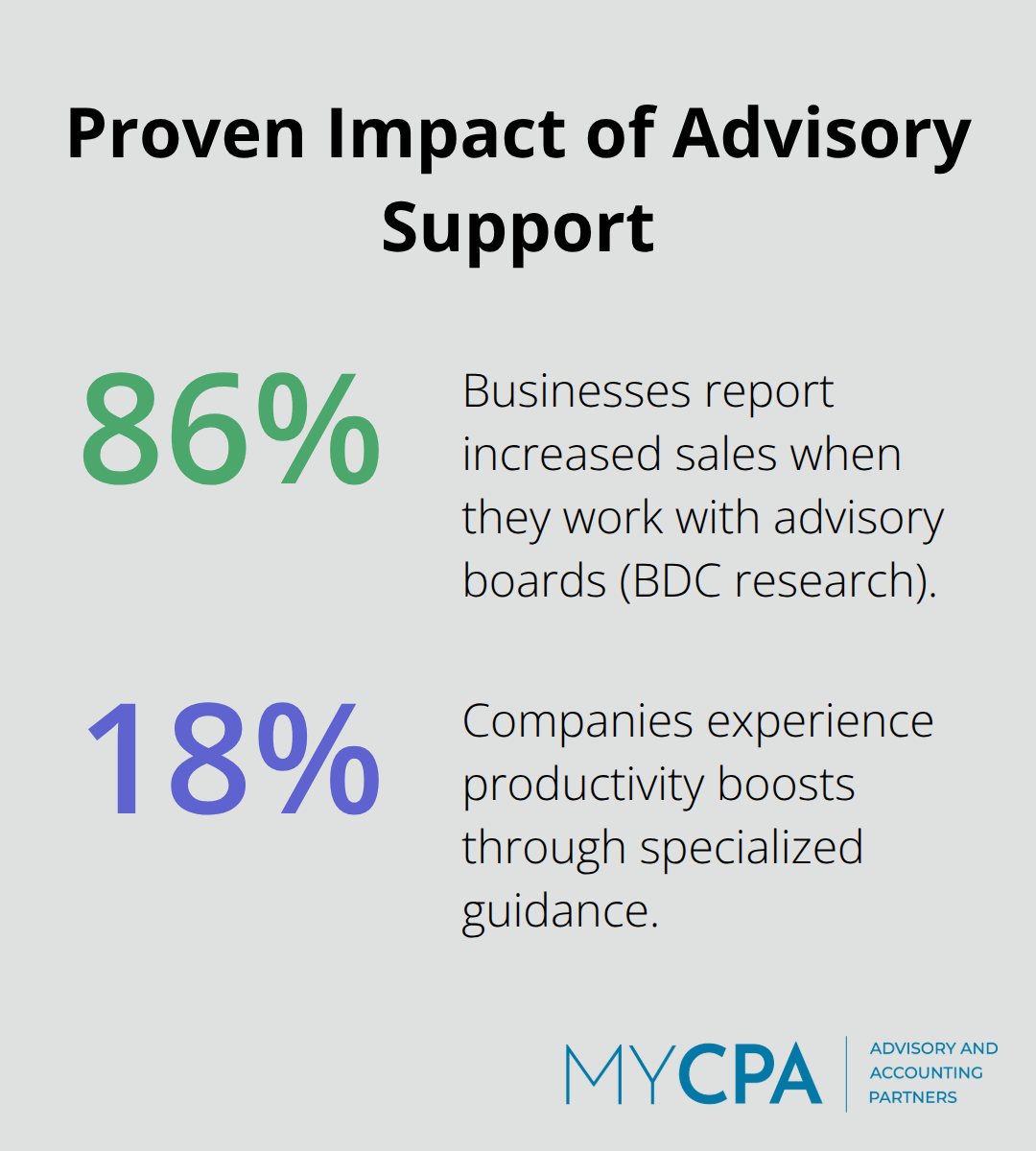

Companies that use business advisory services report higher sales and productivity gains, while setting up an advisory board leads to surprisingly large gains according to BDC research. These services work together to accelerate decision-making and provide real-time insights that help businesses respond effectively to market changes.

The impact of these services becomes most apparent when businesses face specific challenges or opportunities that require expert guidance.

Strategic advisory services deliver measurable improvements that extend far beyond traditional accounting support. Companies that work with advisory boards report superior growth according to BDC research, while businesses that use these services experience enhanced performance. These results reflect the tangible impact of data-driven decision-making and expert guidance on operational performance.

Advisory services transform raw financial data into actionable intelligence that speeds up critical business decisions. Advisors provide variance analysis, performance metrics evaluation, and financial modeling that helps executives respond to market changes within days rather than weeks. This acceleration becomes vital when market conditions shift rapidly or when competitors move aggressively. The consulting industry has grown significantly because businesses recognize the competitive advantage of faster, more informed decision-making processes.

Strategic advisors identify profit opportunities and cost reduction areas that business owners typically miss. They analyze cash flow patterns, evaluate capital allocation efficiency, and develop pricing strategies that maximize margins. Companies that implement advisor recommendations often see immediate improvements in profitability ratios and working capital management (with some reporting gains within the first quarter). The focus shifts from reactive financial management to proactive optimization that drives sustainable revenue growth.

Regulatory compliance requirements intensify across industries, which makes expert guidance essential for business protection. Advisors develop contingency plans, implement risk assessment frameworks, and maintain regulatory compliance systems that prevent costly violations. Financial services companies particularly benefit from this expertise, as compliance needs drive significant portions of strategic consulting revenue according to market data. This protection becomes investment insurance that safeguards business operations against regulatory penalties and operational disruptions.

These performance improvements become most apparent when businesses face specific situations that demand immediate strategic intervention.

Rapid expansion creates cash flow challenges that catch most business owners unprepared. Revenue growth often leads to working capital shortages, as companies must invest in inventory, equipment, and staff before they receive payment from new customers. M&A volumes globally continue to decline, dropping by 9% in the first half of 2025 compared with the first half of 2024, which demonstrates how growth strategies require sophisticated financial management for startups that goes beyond basic accounting support.

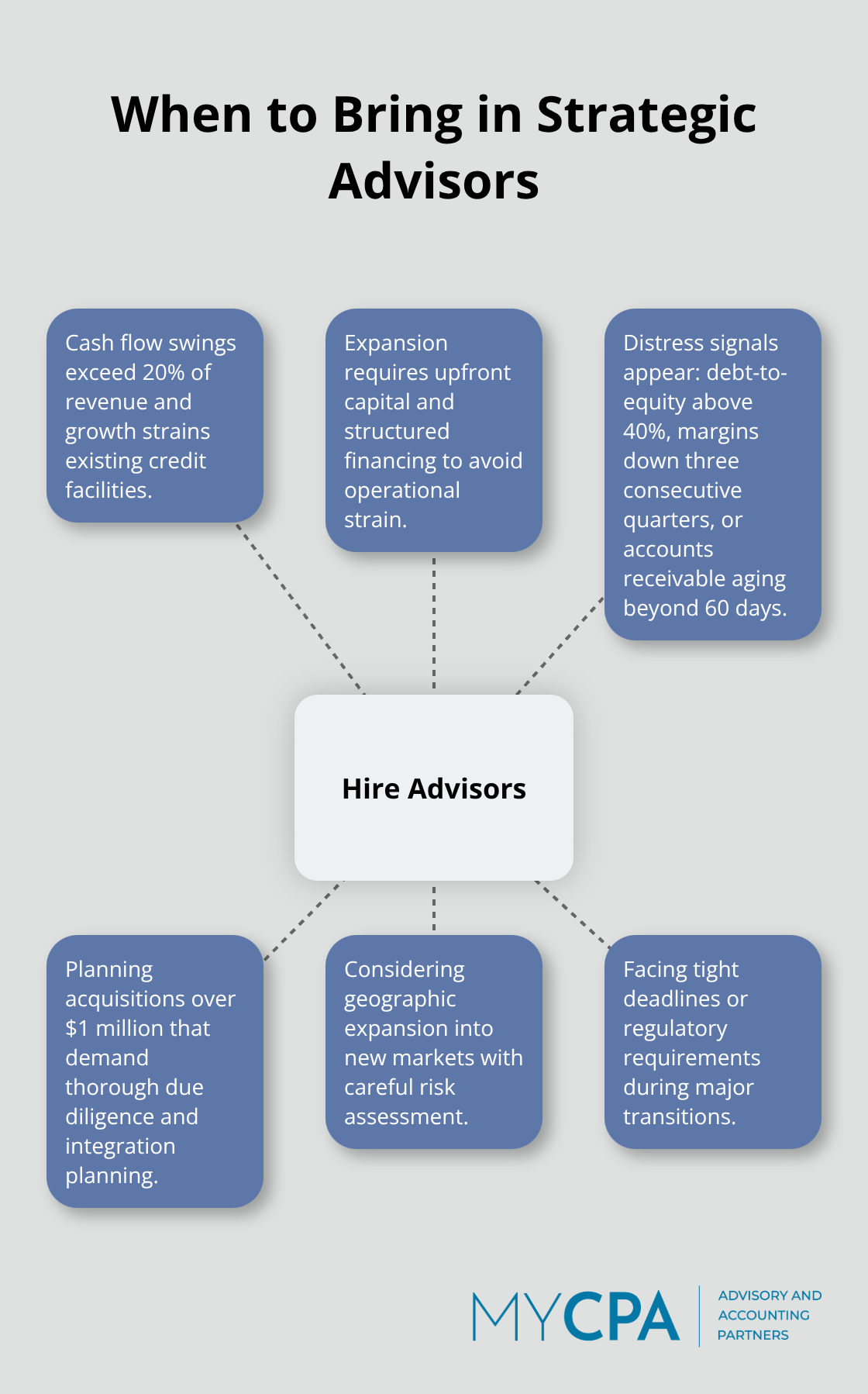

Strategic advisors become essential when monthly cash flow swings exceed 20% of revenue or when growth requires capital investments that strain existing credit facilities. They develop cash flow forecasts that predict funding needs 6-12 months ahead and structure financing solutions that support expansion without compromising operations.

Financial distress signals appear long before most business owners recognize them. Debt-to-equity ratios above 40%, declining gross margins for three consecutive quarters, or accounts receivable aging beyond 60 days all indicate the need for immediate advisory intervention. Companies that experience these warning signs require specialized expertise to restructure operations and restore financial stability.

Advisors provide crisis management strategies that include renegotiated vendor terms, restructured debt obligations, and cost reduction programs that preserve core business functions. The Asia-Pacific consulting market grows at 4.99% annually partly because businesses increasingly seek small business management consulting services during financial difficulties rather than attempt solutions independently.

Major business transitions require expert analysis before implementation. Acquisitions, divestitures, market expansions, or ownership changes involve complex financial implications that demand specialized knowledge. Companies that plan acquisitions exceeding $1 million in value or consider geographic expansion into new markets benefit from advisory services that evaluate risks and optimize deal structures.

Strategic advisors conduct due diligence analysis, develop integration plans, and structure transactions that maximize value while they minimize operational disruption. These professionals analyze market conditions, assess financial risks, and create implementation timelines that protect business continuity during major transitions (particularly when companies face tight deadlines or regulatory requirements).

Strategic business advisory services deliver measurable results that transform company performance and accelerate growth. The data shows clear benefits: 86% of businesses report increased sales when they work with advisory boards, while companies experience 18% productivity boosts through specialized guidance. These services become investment protection during market volatility and regulatory changes.

The global strategic consulting market reached $74.37 billion in 2025, which reflects the demand for expert financial analysis, risk management, and growth strategy development. Success depends on timing and partnership quality. Companies that engage advisors during growth phases, financial challenges, or major transitions position themselves for sustainable expansion.

We at My CPA Advisory and Accounting Partners provide comprehensive business advisory services that include tax optimization, accounting support, and personalized financial planning. Our expertise helps business owners navigate complex decisions while they maintain operational efficiency and regulatory compliance. Companies that act proactively rather than reactively consistently achieve better outcomes and stronger financial performance.

Privacy Policy | Terms & Conditions | Powered by Cajabra