Startup founders face a harsh reality: 82% of businesses fail due to cash flow problems. Financial management for startups isn’t optional-it’s survival.

We at My CPA Advisory and Accounting Partners see too many promising companies collapse from preventable financial mistakes. Smart money management separates thriving startups from failed ventures.

Financial chaos kills startups faster than any competitor. The average startup spends £300,500 on payroll in the first year according to recent industry data, yet most founders track expenses on spreadsheets or ignore bookkeeping entirely. This approach guarantees failure.

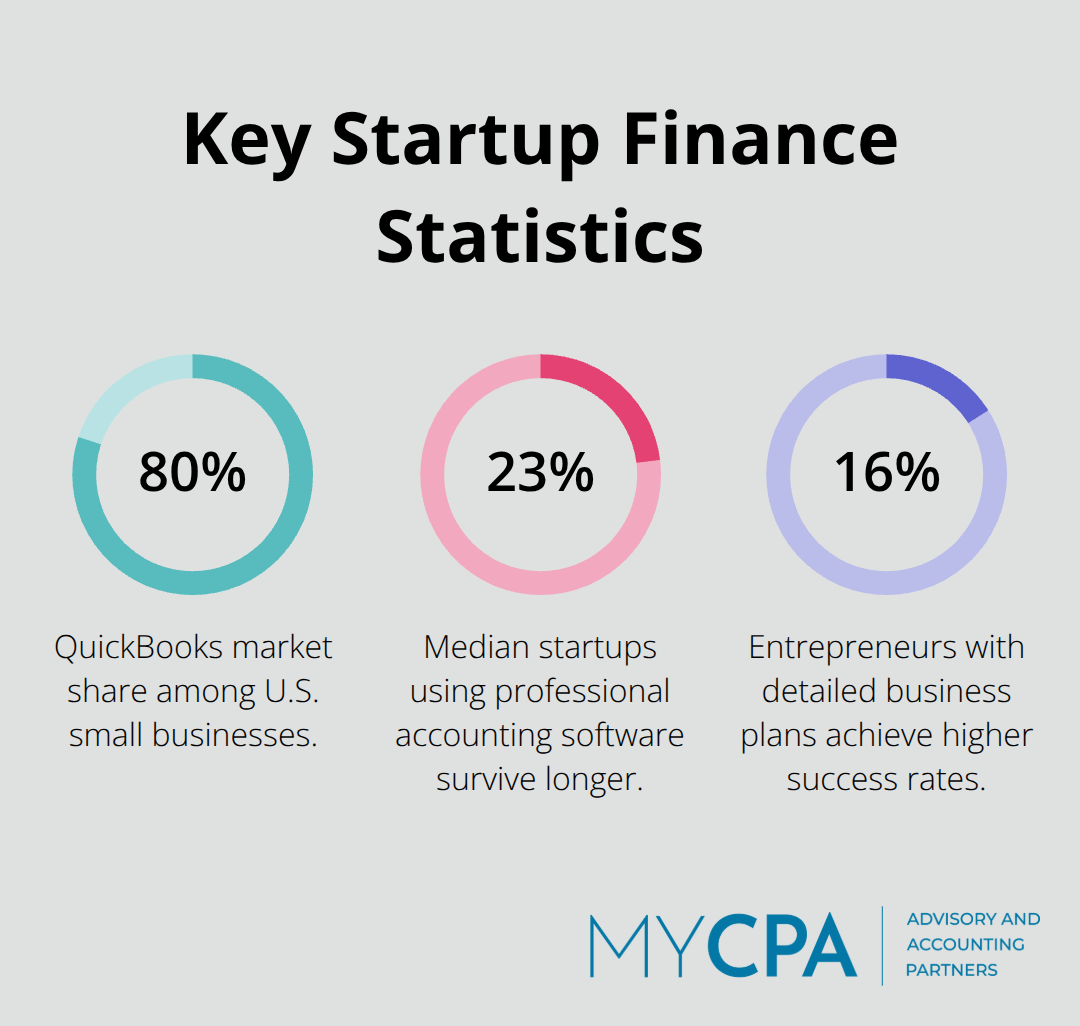

QuickBooks, Xero, and FreshBooks dominate the startup accounting space for good reason. These platforms automatically categorize transactions, generate financial reports, and integrate with bank accounts. QuickBooks holds 80% market share among small businesses because it handles complex scenarios like inventory tracking and multi-currency transactions. Xero excels for service-based startups with its superior invoicing features and real-time collaboration tools. The median startup that uses professional accounting software survives 23% longer than those that rely on manual systems.

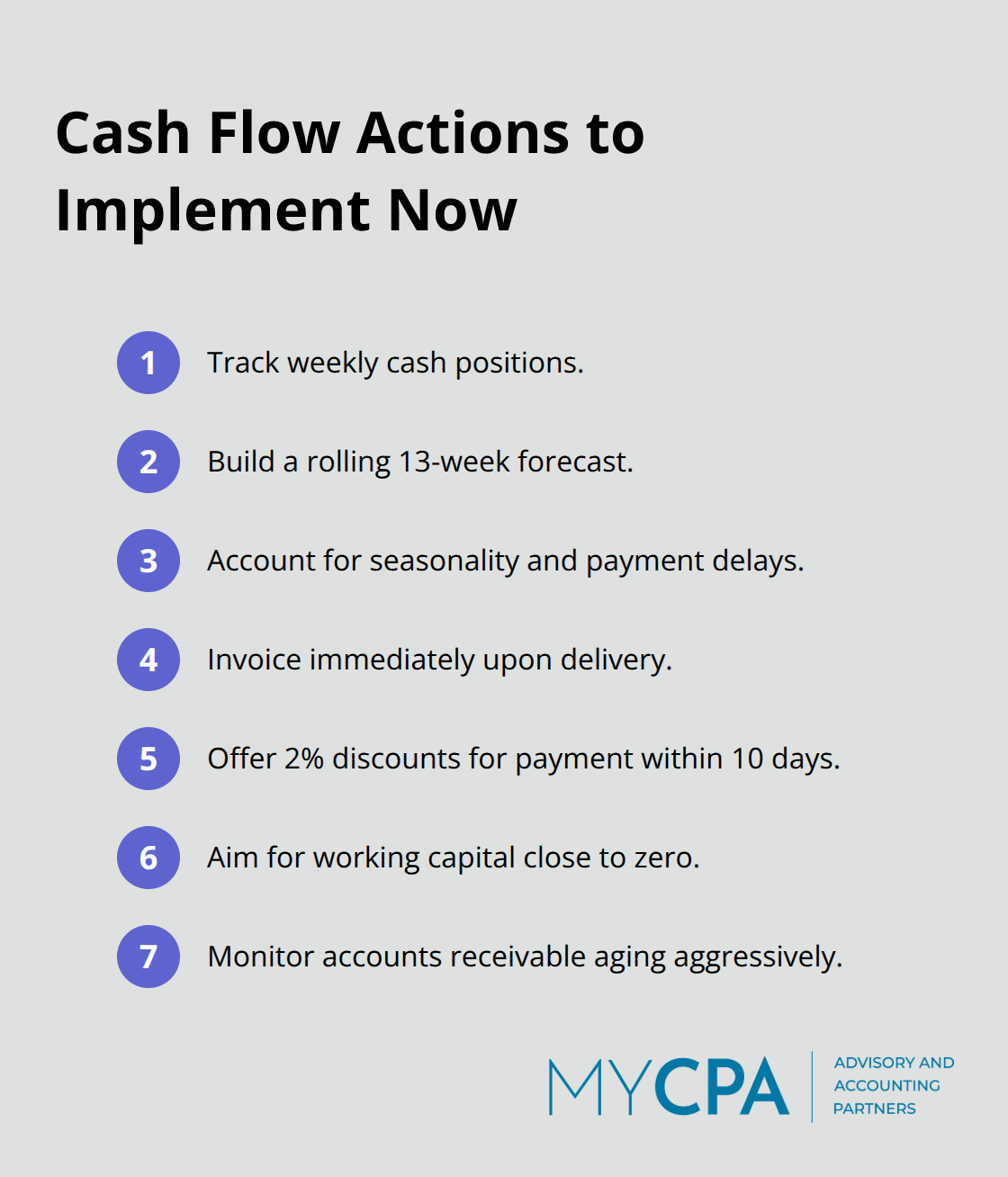

Cash flow forecasting prevents the financial disasters that destroy startups. Track weekly cash positions, not monthly summaries. Revenue arrives unpredictably while expenses hit like clockwork. Build rolling 13-week cash flow projections that account for seasonal variations and payment delays. Companies with negative working capital ratios close to zero operate most efficiently. Invoice immediately upon delivery and offer 2% discounts for payments within 10 days (this accelerates cash collection significantly).

Late payments kill more startups than bad products.

Financial projections based on wishful thinking waste investor meetings and founder time. Use bottom-up forecasting that starts with unit economics rather than top-down market size estimates. Harvard Business Review research shows entrepreneurs with detailed business plans achieve 16% higher success rates. Project three scenarios: conservative, realistic, and optimistic with 60%, 30%, and 10% probability weights respectively. Update projections monthly based on actual performance data, not quarterly reviews that arrive too late to matter.

Mixing personal and business expenses creates legal nightmares and tax complications. Open dedicated business bank accounts and credit cards within your first week of operations. This separation protects personal assets from business liabilities (a protection that disappears when finances mix). The IRS scrutinizes businesses that commingle funds, often triggering audits that cost thousands in professional fees. Track every business expense through your dedicated accounts to maximize tax deductions and maintain clean financial records.

Tax planning becomes exponentially more complex when you need to untangle mixed expenses, which leads us to the strategic decisions that can save or cost your startup thousands in unnecessary taxes.

Your business structure choice creates permanent tax consequences that compound over years. Limited Liability Companies save most startups significant money through pass-through taxation that avoids double taxation on profits. Corporations face corporate tax rates plus personal taxes on distributions, which creates effective tax rates above 40% in many states.

S-Corporations can benefit UK owners doing business in the U.S. through tax flow-through advantages, though eligibility requirements and filing steps must be carefully considered. Delaware incorporation costs more upfront but provides legal protections and investor familiarity that matter during funding rounds.

The IRS requires quarterly estimated tax payments when you owe more than £1,000 annually, with penalties that reach 8% for late payments and destroy cash flow. Track tax obligations monthly, not quarterly, because underpayment penalties accumulate daily.

The safe harbor rule requires payments equal to 100% of last year’s tax liability or 90% of current year estimates (whichever is lower). High-income founders face 110% requirements on previous year taxes. Set aside 25-30% of profits immediately for tax reserves because the average startup owner pays effective rates of 28% when you combine federal, state, and self-employment taxes.

The Inflation Reduction Act of 2022 has increased and modified the qualified small business payroll tax credit for increasing research activities. Revenue-based equipment purchases create immediate tax deductions that reduce quarterly payments significantly.

The Work Opportunity Tax Credit provides up to £9,600 per qualified employee hire from targeted groups. Home office deductions, business meals at 50%, and professional development expenses add thousands in savings when you document them properly.

Tax strategy mistakes compound over time and become expensive to fix later. Poor record maintenance leads to missed deductions and audit risks that drain resources from core business operations.

45% of small business owners experienced cash flow problems according to QuickBooks research, yet most founders check their bank balance weekly instead of forecasting cash needs. This reactive approach creates predictable disasters. Weekly cash flow monitoring catches problems when solutions still exist, while monthly reviews arrive too late for course corrections.

Companies that forecast cash flow 13 weeks ahead survive funding gaps that kill competitors. Track accounts receivable aging religiously because the average B2B payment takes 31 days, but late payments stretch to 60-90 days without aggressive follow-up. Set payment terms at net-15 instead of net-30 to accelerate cash collection, and charge 1.5% monthly interest on overdue balances to discourage late payments.

Founders who mix personal and business expenses face IRS audits and lose legal protections that business structures provide. The IRS scrutinizes businesses that commingle funds, often triggering audits that cost thousands in professional fees. This mixing also destroys the corporate veil that protects personal assets from business liabilities.

Open dedicated business bank accounts and credit cards within your first week of operations. Use business accounts exclusively for company expenses, even small purchases like office supplies or client meals. Track every transaction through your business accounts to maximize tax deductions and maintain clean financial records that satisfy legal requirements.

Inadequate record keeping costs startups thousands in missed deductions and audit penalties. The IRS requires documentation for every business expense, yet founders stuff receipts in shoeboxes or rely on memory during tax season. Digital receipt scanning through apps like Receipt Bank or Expensify takes seconds but saves hours during tax preparation.

Track mileage immediately using automatic apps like MileIQ because reconstructing business travel months later fails IRS scrutiny (the IRS requires contemporaneous records for mileage deductions). Bank statements alone won’t satisfy audit requirements – you need receipts, invoices, and business purpose documentation for every transaction. Poor records also prevent accurate financial analysis that guides strategic decisions, leaving founders blind to profit margins and cost trends that determine long-term viability.

Financial management for startups determines survival rates more than product quality or market timing. Companies with proper cash flow forecasts, separated business finances, and professional accounting systems survive 23% longer than those that operate on spreadsheets and hope. Statistics show that 82% of failed businesses collapse from preventable cash flow disasters.

Your financial priorities must focus on weekly cash flow monitoring, immediate separation of personal and business expenses, and professional-grade accounting software implementation. These basics prevent the financial disasters that destroy most startups. Professional financial support becomes necessary when monthly revenue exceeds £50,000 or when tax complexity overwhelms your internal capabilities (the cost of professional guidance pays for itself through avoided penalties and maximized deductions).

We at My CPA Advisory and Accounting Partners provide tailored financial services that include tax optimization, accurate accounting, and proactive business advisory services. Strong financial foundations require consistent execution of proven systems rather than complex strategies. Your startup’s survival depends on how seriously you treat financial management compared to product development.

Privacy Policy | Terms & Conditions | Powered by Cajabra