Corporate tax planning can save businesses thousands of dollars annually when executed properly. The average company overpays taxes by 15-20% due to missed opportunities and poor timing strategies.

We at My CPA Advisory and Accounting Partners see businesses struggle with complex tax codes and changing regulations daily. Smart planning requires understanding both fundamental principles and advanced optimization techniques to maximize your bottom line.

Corporate tax planning operates on four fundamental variables that determine your tax liability: entity structure, timing, income classification, and jurisdiction. The timing variable alone can shift thousands in tax obligations when companies accelerate deductions into high-income years or defer income recognition during profitable periods. Cash method businesses gain significant advantages when they delay year-end billing to push income into the following tax year, while accrual method companies must plan around fixed recognition rules.

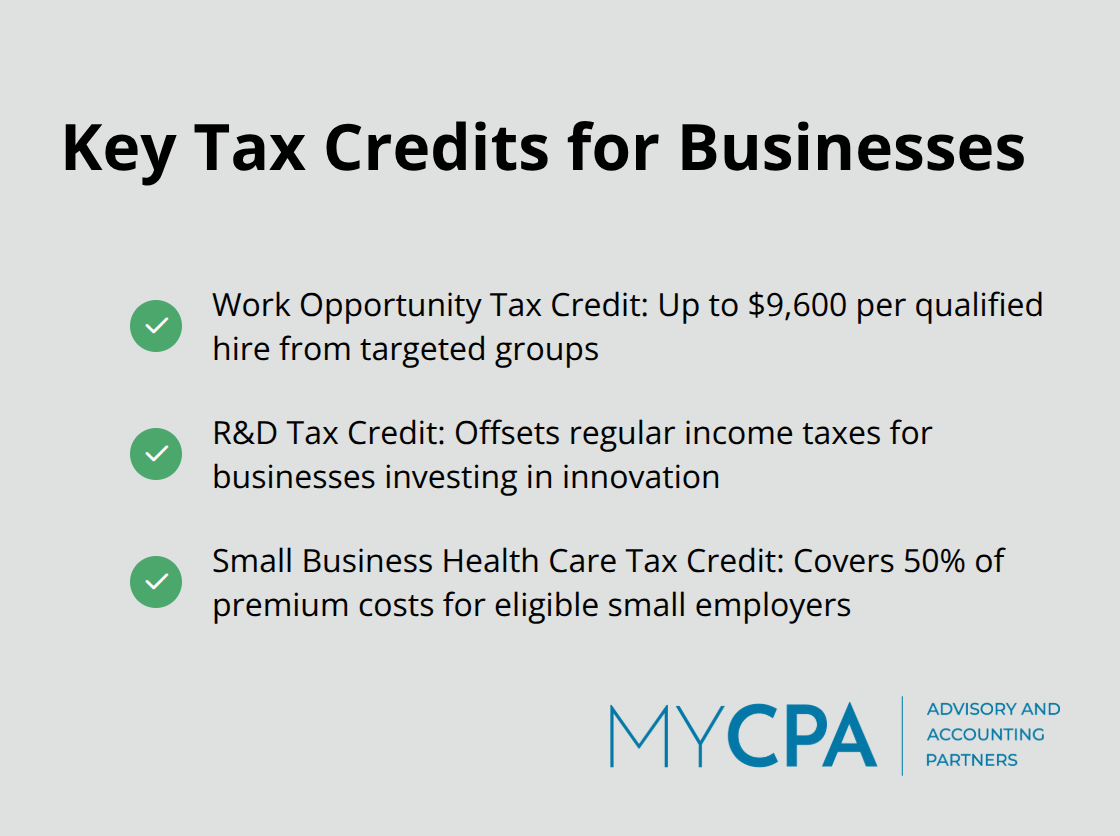

Section 179 expensing allows businesses to deduct up to $2,500,000 in equipment purchases for 2025, with a phase-out threshold of $2,890,000. Bonus depreciation drops to 40% in 2025 from 60% in 2024, which makes immediate equipment purchases more valuable before further reductions occur. The R&D Tax Credit requires detailed Form 6765 reporting but provides dollar-for-dollar tax reduction for qualified research activities. Work Opportunity Tax Credit delivers up to $9,600 per qualified employee hire, while the Small Business Health Care Tax Credit covers up to 50% of premium costs for eligible small employers.

Pass-through entities like S Corporations eliminate double taxation while they reduce self-employment taxes compared to sole proprietorships. The Qualified Business Income deduction provides 20% tax reduction for eligible pass-through income, but expires December 31, 2025 (which creates urgency for optimization strategies). C Corporations benefit from the permanent 21% tax rate and reinvestment advantages for companies that want to grow, while partnerships offer operational flexibility with favorable tax treatment. State tax obligations vary dramatically across jurisdictions, which makes entity selection location-dependent for optimal tax outcomes.

Companies can defer income through installment sales, which spread recognition over multiple years as payments arrive. Cash method taxpayers can accelerate deductible expenses before year-end while they postpone income recognition until January. Accrual method businesses must recognize income when earned but can still time certain expenses strategically (such as prepaid insurance or equipment maintenance contracts). These methods work best when businesses anticipate tax rate changes or expect significant income fluctuations between tax years.

Advanced optimization techniques build on these fundamentals to create comprehensive tax reduction strategies.

Advanced tax optimization requires precise execution of income acceleration and expense deferral strategies that most businesses overlook. The 1099-K reporting threshold drops to $2,500 in 2025, which forces payment platform users to recognize income earlier than expected. Smart companies combat this through strategic contract restructuring that pushes revenue recognition into favorable tax periods.

Equipment financing through operating leases rather than purchases can defer large deductions while companies maintain cash flow advantages. Prepaid expenses like insurance, maintenance contracts, and software subscriptions create immediate deductions when companies pay them before year-end.

Solo 401(k) contributions reach $23,000 annually for employee deferrals, which creates substantial deduction opportunities for business owners. Energy efficiency upgrades under the Inflation Reduction Act generate substantial credits that directly reduce tax liability dollar-for-dollar.

Retirement plan implementations reduce current taxable income while they build employee retention advantages. Asset purchase dates matter more than asset selection – companies that purchase equipment before December 31 capture maximum Section 179 benefits before phase-outs reduce available deductions.

Companies should prioritize renewable energy investments that align with operational needs because these generate both tax credits and long-term cost savings.

The Work Opportunity Tax Credit provides $9,600 per qualified hire from targeted groups, which makes strategic decisions profitable beyond operational benefits. R&D Tax Credits offset regular income taxes for businesses that invest in innovation, but require meticulous Form 6765 documentation that many companies bungle.

Small Business Health Care Tax Credits cover 50% of premium costs for eligible employers with fewer than 25 employees. These credits stack with other tax reduction strategies to create compound benefits that exceed simple deduction advantages.

Companies that operate across multiple states should evaluate each jurisdiction’s credit programs because state-level incentives often surpass federal opportunities for specific industries. State tax obligations vary dramatically, which makes strategic entity selection location-dependent for optimal outcomes.

However, even the most sophisticated tax optimization strategies fail when businesses make fundamental mistakes that trigger penalties and missed opportunities.

Documentation failures create the biggest tax disasters that companies face annually. The IRS requires businesses to substantiate every deduction with proper records, yet many small businesses struggle with audit compliance due to inadequate documentation. Missing receipts for equipment purchases eliminate Section 179 deductions worth thousands of dollars. Companies that claim R&D Tax Credits without detailed Form 6765 documentation face automatic disallowance and potential penalties that exceed the original credit value.

Digital expense management platforms like QuickBooks automatically categorize transactions and maintain audit trails that satisfy IRS requirements. Companies that use manual systems lose an average of $40,000 annually in missed deductions because employees forget to submit receipts or misclassify expenses. Businesses that file 10 or more returns must file digitally in 2025, which eliminates paper-based systems for most companies. The 1099-K threshold drops to $2,500 in 2025, which forces payment platform users to maintain detailed transaction records or face income disputes during audits.

Corporate tax returns face automatic penalties for late filings, with the penalty being 5% of the tax due for each month or partial month the return is late. Estimated tax payments require 90% accuracy to avoid underpayment penalties that reach 8% annually. State requirements vary dramatically across jurisdictions (with California imposing $800 minimum franchise taxes regardless of income levels). Multi-state businesses that miss individual state deadlines face penalties in each jurisdiction, which creates cascading compliance costs that dwarf the original tax obligations.

Companies often overlook state-specific credit programs that provide better returns than federal opportunities. Each state maintains different nexus rules that determine tax obligations for businesses with multi-state operations. Local tax authorities impose additional requirements that many businesses miss entirely. Property tax assessments frequently contain errors that companies accept without challenge, which results in overpayments that continue for years. Sales tax compliance across multiple jurisdictions creates complex obligations that businesses underestimate until penalties arrive. Implementing comprehensive accounting services helps businesses navigate these complex multi-jurisdictional requirements and avoid costly oversights.

Effective corporate tax planning combines strategic timing, proper documentation, and comprehensive understanding of available deductions and credits. Companies that master these fundamentals while they avoid common mistakes can reduce tax liabilities by 15-20% annually. The key lies in systematic approaches that capture Section 179 deductions, leverage tax credits like R&D and Work Opportunity programs, and maintain meticulous records that satisfy IRS requirements.

Professional tax advisory becomes essential as regulations evolve and opportunities shift. The expiration of TCJA provisions in 2025 creates urgency for businesses to optimize their strategies before favorable deductions disappear. Multi-state operations, complex credit programs, and new requirements (like the lowered 1099-K threshold) demand expertise that most internal teams lack.

We at My CPA Advisory and Accounting Partners help businesses navigate these complexities through comprehensive tax services that minimize liabilities and maximize opportunities. Start your optimization journey with a thorough review of your current tax position to identify missed opportunities and establish systems that prevent costly mistakes.

Privacy Policy | Terms & Conditions | Powered by Cajabra