Tax planning courses online have become essential for professionals looking to stay ahead in the ever-changing world of taxation. At My CPA Advisory and Accounting Partners, we understand the importance of finding the right educational resources to enhance your skills and knowledge.

In this post, we’ll guide you through the process of selecting the best tax planning courses available on the internet. We’ll cover key factors to consider, top platforms to explore, and how to evaluate course quality to make an informed decision.

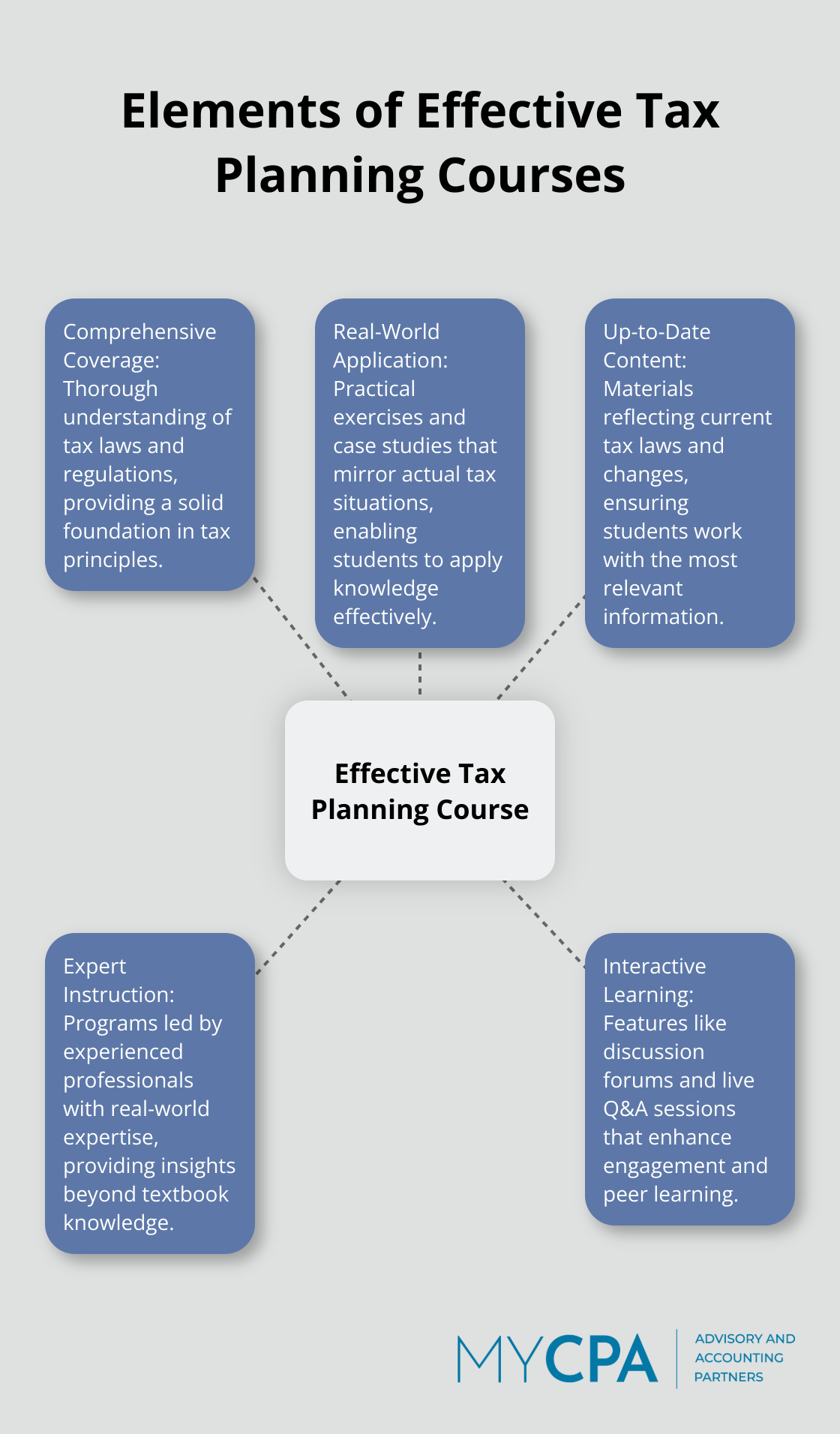

An effective tax planning course must provide a thorough understanding of tax laws and regulations. Federal Taxation I: Individuals, Employees, and Sole Proprietors, part of the U.S. Federal Taxation Specialization taught by Matthew Hutchens, exemplifies this approach. It offers students a solid foundation in tax principles, which is essential for success in the field.

Theory alone doesn’t suffice in tax planning. The best courses incorporate practical exercises and case studies that mirror real-world scenarios. PwC India’s course on GST Taxation (with a 4.6-star rating) stands out for its focus on compliance and taxation practices. This hands-on approach equips students to apply their knowledge to actual tax situations (a skill that’s invaluable in the field).

Tax laws change frequently. A top-tier course must reflect these changes promptly. Many online platforms now offer materials updated for current tax laws, ensuring students work with the most relevant information. Universal savings accounts are tax-advantaged savings vehicles with unrestricted use of funds, which can improve financial security.

The quality of instruction can make or break a course. Programs led by experienced professionals with real-world expertise provide the most value. The TPCP® Program, offered by The American College of Financial Services, features video lectures by industry experts and provides support from leading academics. This level of expertise ensures that students gain insights beyond textbook knowledge.

Courses that include interactive features, such as discussion forums and live Q&A sessions, enhance the learning experience. These elements allow students to engage with the material, ask questions, and learn from their peers.

The combination of these elements creates a powerful learning experience. As you explore different tax planning courses, consider how each program addresses these key factors. The next section will guide you through the top online platforms where you can find these high-quality tax planning courses.

The digital age has opened up a wealth of educational opportunities for tax planning. This chapter explores the best online platforms to enhance your tax planning skills.

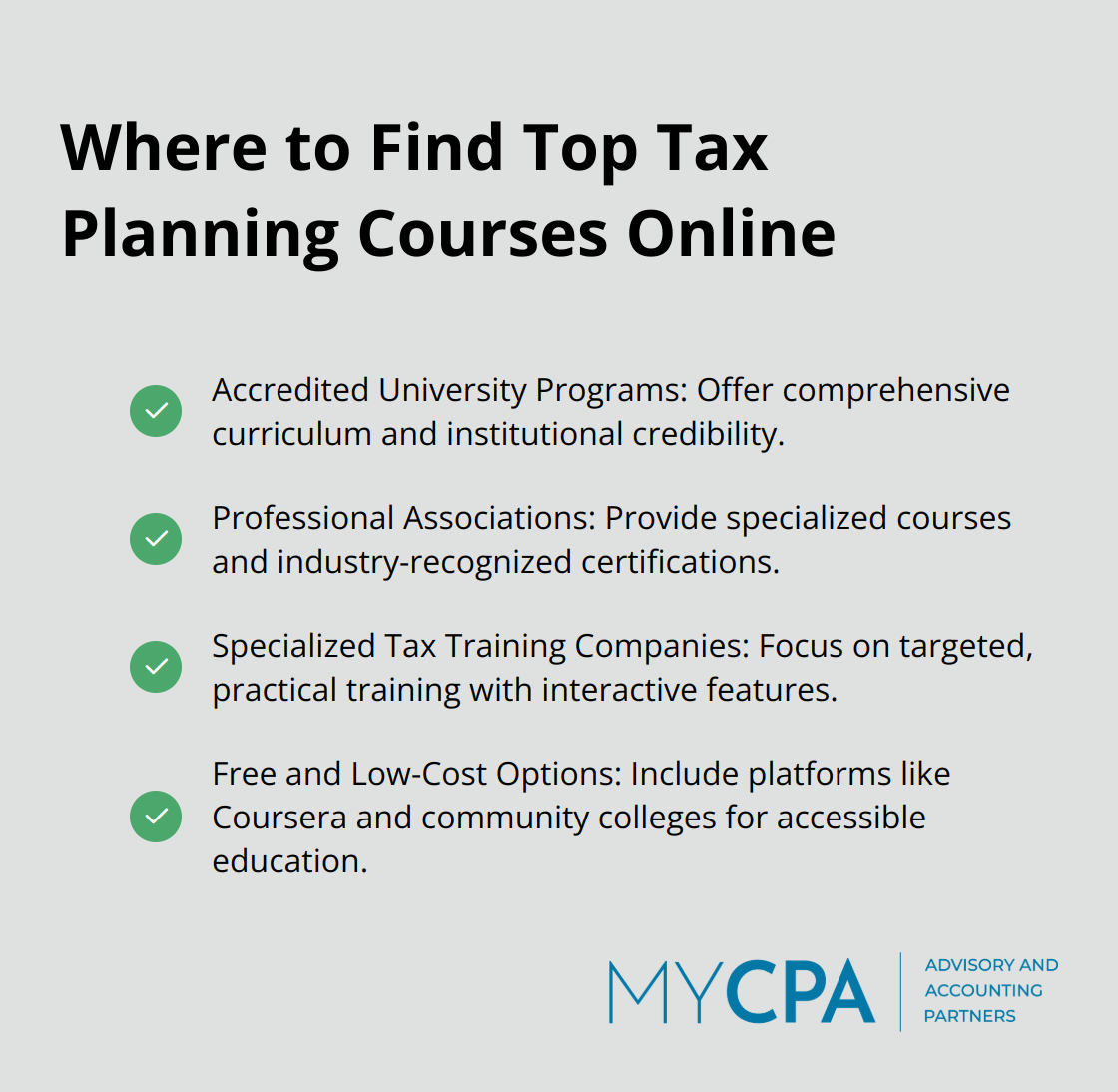

Prestigious universities now offer online tax planning courses. The University of Illinois Urbana-Champaign’s “U.S. Federal Taxation” course stands out with a 4.8-star rating (from nearly 1,000 reviews). These programs provide a comprehensive curriculum and the credibility of a recognized institution.

Organizations like the American Institute of CPAs (AICPA) offer specialized tax planning courses. The TPCP® Program from The American College of Financial Services deserves special attention. This program can be completed in 12 months or less through their e-learning experience. It’s ideal for those seeking a focused, industry-recognized certification.

Several companies focus exclusively on tax education. These platforms often provide more targeted, practical training. These specialized courses often include interactive features like discussion forums and live Q&A sessions, which enhance the learning experience.

For those on a budget, numerous free and low-cost options exist. Coursera offers a free trial for many tax courses, allowing you to explore the material before committing. Some platforms even offer free introductory classes, enabling you to assess your interest before making a financial commitment. Local community colleges increasingly offer affordable online tax planning courses, making quality education accessible to more people.

When choosing a platform, consider factors like course content, instructor expertise, and learner feedback. The right course can significantly enhance your career prospects.

Now that we’ve explored where to find top-notch tax planning education online, let’s examine how to evaluate these courses to ensure you’re making the best choice for your professional development.

A thorough examination of the course syllabus will reveal the comprehensiveness of the tax topics covered. Look for essential subjects such as tax authorities, research, and basic principles of tax planning. Select a course that aligns with your learning objectives and fills any knowledge gaps in your tax planning skills.

The instructor’s background significantly impacts your learning experience. Research the credentials and real-world experience of the course instructors. Role-playing exercises can provide a safe environment for students to simulate real-world experiences without associated risks. Prioritize courses led by instructors with practical tax planning experience, as they offer knowledge beyond textbook theory.

Student reviews provide valuable insights into a course’s effectiveness. Many platforms display ratings and reviews from past students. Focus on comments about the course’s practical applicability and its impact on career advancement.

Evaluate the time commitment required for each course and ensure it fits your schedule. Many online tax courses allow for flexible learning. Consider the financial aspect as well. Some platforms offer free trials or introductory classes, while others have specific costs. Weigh these factors against the potential career benefits and salary increases that may result from enhanced tax planning skills.

Tax laws change frequently, so choose a course that stays current. Try to find programs that explicitly state they update their content to reflect the latest tax code changes. This approach ensures you learn the most relevant and applicable information for your tax planning practice. When evaluating courses, you might also consider QuickBooks consulting services to complement your tax planning skills with efficient financial management tools.

Selecting the right tax planning courses online will advance your career and keep you ahead in taxation. The key factors include comprehensive coverage of tax laws, practical application exercises, regular updates, and instruction from experienced professionals. These elements create a powerful learning experience that translates directly to real-world success.

The importance of continuous learning in tax planning cannot be overstated. With tax laws and regulations constantly evolving, staying current is essential. Your investment in professional development through quality tax planning courses will enhance your skills and position you as a valuable asset in the financial industry.

At My CPA Advisory and Accounting Partners, we understand the value of ongoing education in tax planning. We offer a range of services tailored to your needs to complement your tax planning education. Our support extends from tax optimization to accounting and business advisory, all aimed at fostering your financial success.

Privacy Policy | Terms & Conditions | Powered by Cajabra