At My CPA Advisory and Accounting Partners, we know that a well-crafted accounting services engagement agreement is the foundation of a successful client relationship. This document outlines the terms, expectations, and responsibilities for both parties involved in accounting services.

Our guide will walk you through the key components, legal considerations, and customization options for different types of accounting services agreements. We’ll also share best practices for implementation and the importance of regular reviews to keep your agreements up-to-date and effective.

An effective accounting services engagement agreement forms the foundation of a successful client relationship. This document outlines the terms, expectations, and responsibilities for both parties involved in accounting services. Let’s explore the essential components that every accounting engagement agreement should include.

The scope of services section stands as the most important part of your agreement. It outlines exactly what you’ll do for your client-and what you won’t. Specificity is key. Instead of a vague “tax preparation” description, specify “preparation of federal and state income tax returns for the 2024 tax year.” This clarity prevents scope creep and ensures both parties understand the extent of the services.

Transparency in fees and payment terms is essential. Your agreement should specify your rates (whether hourly or flat fee), billing frequency, payment due dates, and accepted payment methods. Include details on late payment penalties and any early payment discounts. A survey indicates that 69% of accountants use technology for data entry and processing, which can impact fee structures (and should be reflected in your agreement).

Clients play a vital role in the success of accounting engagements. Your agreement should clearly outline what you expect from them, such as:

This section helps manage client expectations and ensures smoother collaboration throughout the engagement.

In today’s digital landscape, this section holds paramount importance. Detail how you’ll protect client information, including any specific software or security measures you use. Reference relevant regulations like GDPR or CCPA if applicable. This reassures clients and demonstrates your commitment to data security.

Your agreement should clearly state what the client can expect to receive (e.g., financial statements, tax returns, advisory reports) and when. Include specific deadlines or timeframes for each deliverable. This helps set realistic expectations and provides a framework for project management.

A well-crafted engagement agreement serves as a powerful tool for setting the stage for a successful accounting engagement. By addressing these key components, you’ll build trust with your clients and protect your practice from potential disputes. As we move forward, let’s examine the legal considerations that should be incorporated into your engagement agreements to further safeguard your practice and your clients.

At My CPA Advisory and Accounting Partners, we understand the importance of robust legal protections in accounting engagement agreements. These safeguards protect your practice and provide clarity and confidence to your clients.

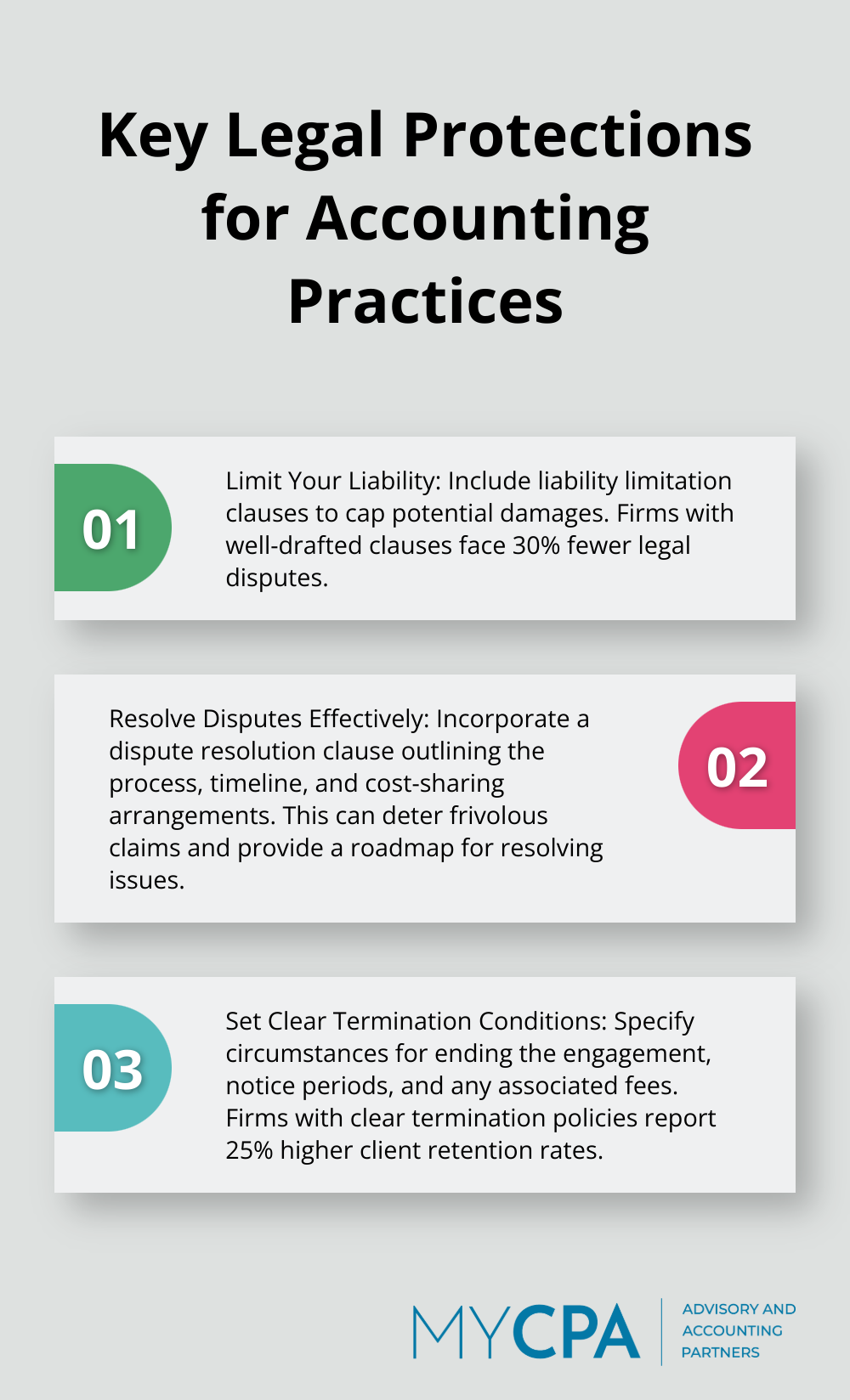

Liability limitation clauses are essential in accounting engagement agreements. These clauses cap the amount of damages a client can claim against your firm. You might limit liability to the fees paid for the specific service in question. A study by the American Institute of CPAs (AICPA) found that firms with well-drafted liability clauses faced 30% fewer legal disputes.

Be aware that some jurisdictions restrict the extent to which you can limit your liability. Always consult with a local attorney to ensure your clause is enforceable in your area.

Include a dispute resolution clause to save time, money, and stress if disagreements arise. The ICC Commission on Arbitration and ADR has reported on leveraging technology for fair, effective, and efficient international arbitration proceedings.

Your clause should outline the process, timeline, and cost-sharing arrangements for dispute resolution. This clarity can deter frivolous claims and provide a roadmap for resolving genuine issues.

Clear termination conditions protect both you and your client. Specify circumstances under which either party can end the engagement, such as non-payment, breach of agreement, or illegal activities. Include notice periods and any fees associated with early termination.

For ongoing engagements, consider an auto-renewal clause with an opt-out option. This can help retain clients while still providing flexibility. According to a survey by Accounting Today, firms with clear termination policies reported 25% higher client retention rates.

State your commitment to professional standards in your agreement to demonstrate your integrity and protect you legally. Reference specific standards you adhere to, such as those set by the AICPA or your state board of accountancy.

Include a clause that allows you to withdraw from the engagement if you believe continuing would violate professional standards. This protects your reputation and provides a clear exit strategy if ethical concerns arise.

These legal considerations will strengthen your practice’s legal position and build trust with clients. As we move forward, let’s explore how to customize your engagement agreements for different types of accounting services to ensure comprehensive coverage across all your offerings.

Privacy policy considerations are also crucial in protecting your accounting practice legally. Ensuring the confidentiality of your clients’ information is a key aspect of maintaining trust and complying with professional standards.

Tax preparation agreements must define specific tax years and return types covered. We specify whether we prepare individual, business, or specialized returns. The agreement includes the client’s duty to provide accurate, complete information. The Journal of Accountancy reports that 87% of tax-related disputes result from miscommunication about information requirements.

We address tax notice and audit handling. The agreement clarifies if we represent the client during an audit and any associated costs. We include a clause about client record retention and duration.

For bookkeeping services, we detail reconciliation and report frequency. The agreement specifies if we provide monthly, quarterly, or annual financial statements. We state the accounting standards we follow (e.g., GAAP or IFRS).

We include clauses about the client’s responsibility to review and approve financial statements. The American Institute of CPAs notes that 62% of bookkeeping engagement disputes stem from unclear approval processes. We address how we handle errors discovered after statement issuance.

Audit engagements require robust agreements due to their high-stakes nature. We clearly state the audit’s purpose and scope, specifying if it’s a full financial statement audit, a review, or a compilation. We define materiality thresholds and sampling methods.

The agreement includes language about management’s responsibility for internal controls and financial statement preparation. We address the audit process’s limitations. The Public Company Accounting Oversight Board found that 73% of audit-related lawsuits originated from misunderstandings about audit scope and limitations.

Advisory service agreements outline the specific problem or opportunity we address. We define deliverables clearly (e.g., written report, presentation, or ongoing advice).

The agreement includes clauses about recommendation implementation. We clarify if we’re responsible for implementation or if it falls to the client. We address intellectual property rights for any frameworks or methodologies developed during the engagement.

We at My CPA Advisory and Accounting Partners tailor our agreements to specific service types. This approach creates clarity and sets appropriate expectations. It protects our practice and enhances client satisfaction by aligning understanding from the outset.

To draft an agreement for accounting services effectively, follow step-by-step guidance to ensure your business transactions are seamless and well-documented.

A well-crafted accounting services engagement agreement forms the cornerstone of successful client relationships and protects your practice. Each agreement must be tailored to the specific services provided, ensuring both parties understand the scope of work and deliverables. Clear communication proves paramount when presenting engagement agreements to clients, fostering trust and demonstrating commitment to transparency.

Regular reviews and updates of your engagement agreements are essential as your practice evolves and regulations change. Technology can streamline the management of engagement agreements through digital signature tools and document management systems. Engagement agreements should evolve with your client relationships, accommodating changes in service offerings or client needs.

At My CPA Advisory and Accounting Partners, we help you navigate the complexities of accounting services engagement agreements. Our expertise ensures that your agreements are comprehensive, legally sound, and tailored to your specific practice needs. Prioritizing well-drafted engagement agreements sets the stage for enduring client relationships built on clarity, trust, and mutual understanding.

Privacy Policy | Terms & Conditions | Powered by Cajabra